Report Overview

Middle East and Africa Highlights

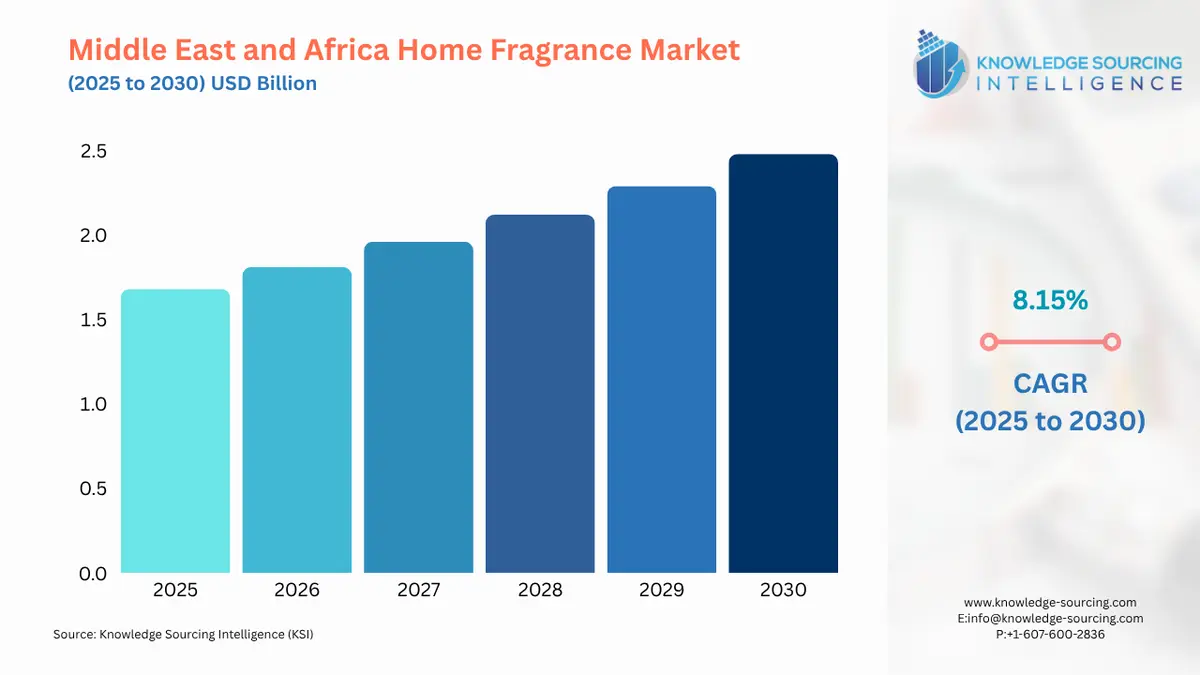

Middle East and Africa Home Fragrance Market Size:

The Middle East and Africa Home Fragrance Market is likely to reach USD 2.481 billion in 2030, up from USD 1.677 billion in 2025, progressing at a CAGR of 8.15%.

The Middle East and Africa home fragrance market is experiencing strong growth. This trend is sustained by a combination of factors such as deep-rooted cultural preference for aromatic products, increasing disposable incomes, and the widespread adoption of a premium lifestyle in both the GCC and African markets.

Government interventions to encourage local production, along with various compliance requirements from IFRA, SASO, ESMA, and SABS, are the main factors that define product standards and the market structure. In Africa, the growth of middle-class discretionary expenditure, the rising availability of premium products, and the improvement of the retail sector are the main factors that have driven the category to achieve a deep market penetration despite challenges such as higher import duties and the prevalence of counterfeit goods. In general, the market is growing continuously over time, supported by factors such as a strong cultural resonance, the trend towards premiumization, the expansion of distribution channels, and the increasing use of fragrances in hospitality, real estate, and everyday lifestyle experiences.

Middle East and Africa Home Fragrance Market Overview & Scope

The Middle East and African home fragrance market is growing, and this trend is expected to continue for a while. The major reasons driving market expansion are consumers' preference for luxurious aromas, the use of scents as a means of communication, and the rapid urban lifestyle spreading in major countries like the UAE, Saudi Arabia, and South Africa. To keep up with the demand, producers are progressively taking the initiative to release more options in the market. These products include scented candles, diffusers, incense sticks, room sprays, wax melts, and electric aroma diffusers, among which both traditional oriental scent profiles and contemporary Western-inspired blends are available.

Standards and safety adherence in the home fragrance sector in the Middle East and Africa are influenced by several layers of regulatory bodies at both the international and national levels. As a result, manufacturers are required to meet IFRA (International Fragrance Association) norms for the safety of fragrance ingredients, SASO (Saudi Standards, Metrology and Quality Organization) regulations for the product composition and labelling, and ESMA (Emirates Authority for Standardization and Metrology) regulations for the safety of consumer products in the UAE. In Africa, regulatory frameworks such as SABS (South African Bureau of Standards) oversee quality and fire-safety standards for candles and diffusers. Additionally, the continent has chemical safety standards inspired by global REACH standards that regulate the disclosure of ingredients and the limitation of VOCs in different markets.

A combination of long-standing regional perfumery houses and international fragrance companies dominate the Middle East and Africa home fragrance market. A Saudi Arabian business, Almajed for Oud, that specializes in producing and marketing high-end oud and fragrance products, saw growth in perfume revenues. Perfume revenues increased from SAR 255 million (57.5% of total revenues) in FY21 to SAR 491 million (64.0% of total revenues) in FY23, according to the company. Volumes increased from 2.9 million in FY21 to 4.7 million in FY23. AlMajed products can be found in both widely used and luxurious fragrances, hence it appeals to the Saudi masses and classes as per the October 2024 report.

The key players influencing the Middle East and Africa home fragrance market are regional perfumery houses like Ajmal Perfumes, Swiss Arabian Perfumes, Nabeel Perfumes, Arabian Oud, Al Haramain Perfumes, Rasasi Perfumes, Lootah Perfumes, and Khadlaj Perfumes. They are individually recognized for their long-standing heritage, vast retail network, and oud, bakhoor, and oriental scent expertise. Additionally, international fragrance formulation companies like Givaudan, Firmenich, and Eurofragance are instrumental in providing high-quality aroma chemicals, essential oils, and innovative scent compositions to both local manufacturers and luxury home fragrance brands in the region.

The Middle East and Africa home fragrance market is segmented by:

- Fragrance: The Middle East and Africa home fragrance market is anticipated to be led by the floral sector. The market is led by floral scents because of their adaptability, appeal, and connection to positive feelings like femininity and beauty. Diverse tastes are catered to by the flower category's extensive selection of fragrances, which range from subtle floral notes to strong and vivid floral-based perfumes. The industry is also fueled by the popularity of aromatherapy and the need for fragrances with a wellness theme, which frequently include floral notes.

- Product Type: The market is separated into many segments based on product type, candles, sprays, diffusers, essential oils, incense sticks, plug-in devices, potpourri and sachets, wax melts, and others. The market for home fragrances is anticipated to be led by the spray category. The growing use of the product to give living areas a pleasant scent is predicted to drive significant growth in the sprays segment over the next several years. Additionally, new items are being introduced by several well-known market participants.

- Distribution Channel: The market is divided into Specialty stores, online stores, hypermarkets and supermarkets, and others based on the distribution. The availability of a wide range of products on supermarket shelves allowed hypermarkets and supermarkets to dominate the market. This enables customers to know their alternatives and purchase a specific product or combination of products based on their requirements.

- Region: By country, the market is segmented into Saudi Arabia, UAE, and others. Saudi Arabia is expected to maintain the largest share of the Middle East and Africa home fragrance market. The reason for this can be attributed to a number of important factors. For one, the nation has a high cultural preference for fragrances that is firmly embedded in historical practices such as the utilization of bakhoor (incense) and oud (agarwood), which are used interchangeably in homes for both everyday and special occasions. The increased demand for luxury and premium home fragrance products among Saudi consumers further boosts the growth of the market, with special focus on traditional fragrances in new formats such as scented candles, diffusers, and sprays.

Top Trends Shaping the Middle East and Africa Home Fragrance Market

- Cultural Affinity and Premiumization

Fragrance holds a deep-rooted cultural significance in the MEA region, symbolizing luxury, hospitality, and spirituality. In countries like Saudi Arabia and the UAE, traditional practices such as the use of bakhoor and oud are integral to daily life. This cultural affinity has led to a high demand for premium and luxury home fragrance products, with consumers seeking both traditional scents and modern formats like diffusers and scented candles.

- Technological Advancements and Smart Diffusers

The adoption of smart home technologies is influencing the home fragrance market. Smart diffusers, which allow users to control fragrance intensity and schedule diffusion times via mobile apps, are gaining popularity. These devices offer a personalized and high-tech experience, aligning with the region's increasing tech-savviness and desire for convenience.

Middle East and Africa Home Fragrance Market Growth Drivers vs. Challenges

Drivers:

- Increased Government and Corporate Funding: Personal care with a focus on hair care is increasing, which is significantly contributing to product sales. Manufacturers of hair care products are effectively solving several hair issues, such as dandruff, thinning of hair, sebum secretion, and excessive hair loss, through the launch of anti-hair fall and anti-dandruff Middle East and Africa Home Fragrance. Product sales will continue to increase even further due to the remarkable growth of this trend. To diversify their portfolios, some prominent companies are introducing new products.

- Expanding Industry Applications: More industry participants are shifting towards customization to cater to a host of customer choices and hair care needs. Key players in the market are testing new ingredients that may enhance the quality of their products. The global market for protein- and vitamin-based products with numerous health benefits is increasing, and ingredients such as biotin, probiotics, and fruit vitamins are being researched. Personalization and the introduction of new products by large players will thus likely increase the growth of the global Middle East and Africa Home Fragrance market.

- Growth of E-Commerce and Omnichannel Distribution: One of the major factors that has led to the change in consumer behavior in the Middle East and Africa home fragrance market is the rise of e-commerce and omnichannel distribution. This has allowed people to have easy access to both premium and mass-market products and to purchase them at their convenience. More consumers have been empowered to discover and purchase fragrances online without visiting physical stores through increased internet penetration, growing smartphone usage, and the development of digital payment systems. The EZDubai report revealed that the e-commerce market size in the UAE totaled AED 27.5 billion in 2023 and is anticipated to exceed AED 48.8 billion in 2028, according to the Government of Dubai Media Office.

The top marketplaces like Amazon, Noon, Jumia, and local specialty platforms are giving home fragrance brands wide access to the market. At the same time, brand-owned e-commerce portals enable companies to communicate directly with consumers, provide them with personalized recommendations, and offer exclusive online collections. Omnichannel tactics, which merge the customer's interaction at the physical store with the digital experience, are being increasingly employed by brands as they combine in-store experiences, social media advertising, and online ordering with home delivery or click-and-collect services.

Challenges:

- Qubit Stability and Error Rates: One of the biggest challenges facing the growth of the global market is counterfeit hair care products, such as Middle East and Africa Home Fragrances, conditioners, and hair oils. Consumer trust in the market is undermined by counterfeit products because they raise questions about the authenticity and quality of hair care products. Consumers who encounter fake or sub-standard products might lose confidence, reducing their faith in buying the same. Genuine brands are often copied by illegal or counterfeit hair products, damaging the reputation of the original brand.

Middle East and Africa Home Fragrance Market Segment Analysis

- Distribution Channel: Online Stores

Based on distribution channel, the Middle East and Africa home fragrance market is segmented into hypermarkets/ supermarkets, specialty stores, online stores, and others. The growing technological shift in the Middle East and African region has provided a new approach to consumers for purchasing goods, and with the implementation of policies such as “Oman Vision 2040,” which aims to digitize the economy, the transition towards digital platforms is gaining traction. This transition, coupled with constant growth in urban population, especially in major MEA nations, has escalated the consumer preference for online stores and shopping platforms over traditional retail establishments.

Moreover, smart network deployment and investments in 5G expansion are gaining traction in key Middle East and African region economies. For instance, in May 2024, Zain Saudi Arabia announced an investment of SAR 1.6 billion aimed at expanding its 5G network and digital services across Saudi Arabia. The investment forms a key part of the company’s strategy to improve the overall digital experience across 122 cities, including Makkah.

Similarly, the smartphone penetration is also accelerating in the MEA economies. For instance, according to the GSMA’s research study “The Mobile Economy Middle East & North Africa 2024", the smartphone penetration in GCC (Gulf Cooperation Council) Arab states is expected to reach 91% by 2030, thereby showing a steady growth compared to the adoption rate of 88% in 2023. Additionally, the same research study further specified that for the same timeframe, the percentage of 5G network penetration is anticipated to grow from 26% to 95%.

The growing work culture is an additional driving factor for online channels, as people prefer digital platforms to purchase various consumer goods, including fragrance products for homes, as such platforms offer both time and cost utility. Moreover, the extensive product varieties available, followed by discount offers, have further improved the appeal of buying home fragrance products through online platforms.

Middle East and Africa Home Fragrance Market Regional Analysis

- UAE: The UAE home fragrance market is witnessing high growth due to a combination of cultural heritage, economic success, and shifting consumer behavior. The long-standing cultural traditions in the UAE, including the burning of oud and bakhoor, have placed great significance on the role of fragrances in daily life, resulting in high demand for home fragrance products. This cultural connection is augmented by increasing disposable incomes and a greater focus on luxury and wellness, with consumers spending on high-end home fragrance products such as scented candles and diffusers. The market's growth is also augmented by the growing awareness of the benefits of aromatherapy, stimulating the use of scents to add ambiance to the home and to improve individual health. Moreover, the rise of e-commerce websites and specialty retail stores has increased the availability and accessibility of various kinds of home fragrance products for consumers in the UAE.

- Saudi Arabia: Being one of the leading economies in the Middle East region, the Kingdom of Saudi Arabia holds high growth potential for the home fragrance market, fuelled by constant economic growth and increasing urban population, which is driving demand for various grooming products. According to the General Statistics Authority, in Q3 2025, the country’s real GDP grew by 5% compared to Q3 2024, which resulted from the growth of main economic activities.

Likewise, according to the World Bank, in 2024, the percentage share of the urban population was 85% of the overall population and has been growing at a rate of 4.9%. Additionally, the constant improvement in living standards, followed by a growth in the home-ownership rate, has also impacted the demand for home fragrance products.

For instance, according to the “Annual Report 2024” issued under the Housing Program, it was stated that the home ownership rate under the program reached 65.4%, demonstrating a positive uplift in comparison to the home ownership rate recorded in 2023. The report also stated that nearly 122,000 people benefited from the program, and 21,000 were able to own their houses due to the housing support. Hence, the Housing Program aims to increase home ownership up to 70% by 2030.

The growing home personalization trends, followed by cultural affinity, have provided new growth prospects for the use of fragrance products that add to the overall physical appeal of a house. Hence, the ongoing product innovations further impacted by digital influences are an additional driving factor for the overall market expansion.

Middle East and Africa Home Fragrance Market Competitive Landscape

The Middle East and Africa Home Fragrance market is competitive, with a mix of established players and specialized innovators driving its growth.

- Product Launch: In September 2024, Emirates continues to enhance and elevate the fly better experience for its customers, this time unveiling a new collaboration with the Irish brand renowned for spearheading organic luxury – VOYA.

Middle East and Africa Home Fragrance Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 1.677 billion |

| Total Market Size in 2031 | USD 2.481 billion |

| Growth Rate | 8.15% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Fragrance, Product Type, Distribution Channel, Country |

| Geographical Segmentation | Saudi Arabia, UAE, Others |

| Companies |

|

Middle East and Africa Home Fragrance Market Segmentation:

- By Fragrance

- Floral

- Fresh/Citrus

- Woody

- Oriental/Spicy

- Herbal

- Fruity

- Sweet/Gourmand

- Oceanic

- Others

- By Product Type

- Candles

- Sprays

- Diffusers

- Essential Oils

- Incense Sticks

- Plug-in Devices

- Potpourri and Sachets

- Wax Melts

- Others

- By Distribution Channel

- Hypermarkets/Supermarkets

- Specialty Stores

- Online Stores

- Others

- By Country

- Saudi Arabia

- UAE

- Others