Report Overview

Nanotechnology Market Size, Share, Highlights

Nanotechnology Market Size:

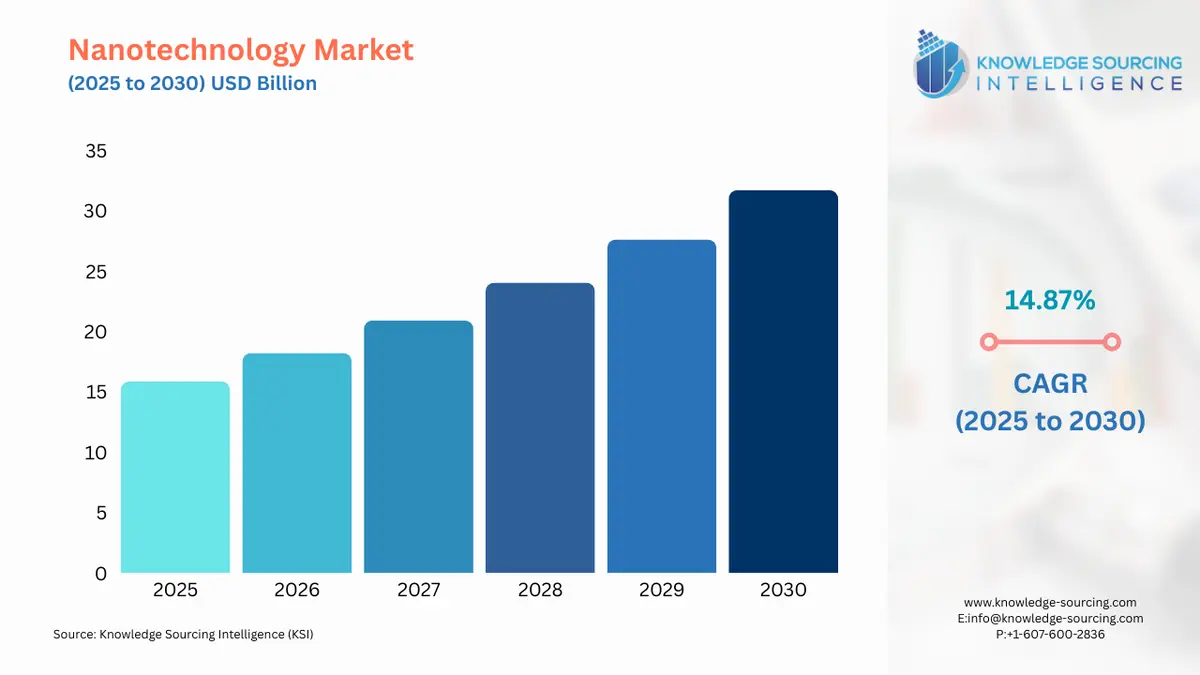

The Nanotechnology Market is expected to grow at a CAGR of 14.87%, reaching USD 31.728 billion in 2030 from USD 15.864 billion in 2025.

The nanotechnology market is characterized by its foundational role in enabling advancements across disparate industries. This is a market not defined by a single product, but by an enabling technology that manipulates matter at the atomic and molecular scale to create materials and devices with novel properties. The demand for these nanotechnologies is not an isolated phenomenon; it is a direct consequence of a global imperative for smaller, more efficient, and more effective solutions in fields ranging from medicine to electronics.

Nanotechnology Market Analysis

Growth Drivers

- Enhanced Performance and Miniaturization: The demand for nanotechnology is fundamentally propelled by the imperative for enhanced performance and miniaturization across critical industrial sectors. In the electronics and semiconductor industry, continuous node migration, such as the push toward 3 nm chips, directly creates demand for novel nanomaterials. These materials are essential for overcoming the physical limitations of conventional silicon-based components, enabling the fabrication of faster, more powerful, and more energy-efficient devices. Graphene and carbon nanotubes (CNTs) are critical examples, providing superior electrical conductivity and mechanical strength for next-generation transistors, flexible displays, and quantum nanowires. The healthcare and pharmaceutical sector is another potent demand driver. The increasing need for targeted drug delivery systems, advanced diagnostics, and regenerative medicine directly fuels the demand for nanomedicine. Nanoparticles can be engineered to deliver therapeutic agents directly to cancer cells, minimizing damage to healthy tissue and thereby increasing the efficacy of treatments. Similarly, nanosensors and nanobiosensors are in high demand for their ability to provide early and precise disease detection, offering a compelling upgrade over traditional diagnostic methods.

- Energy Sector Efficiency and Sustainability: The energy sector’s drive for efficiency and sustainability also generates significant demand. The development of next-generation solar cells, high-density batteries, and efficient hydrogen storage systems requires materials with unique nanoscale properties. Nanomaterials are used to improve the absorption and conversion of solar energy, enhance the capacity of energy storage devices, and create lighter, more durable components for wind turbines and fuel cells. This intersection of performance requirements and sustainability goals is a powerful catalyst for nanotechnology adoption.

Challenges and Opportunities

- Regulatory and Ethical Challenges: The nanotechnology market confronts several challenges that act as headwinds to widespread commercialization, primarily centered on environmental, health, and safety risks. The potential for engineered nanoparticles to pose unknown toxicological properties and environmental hazards creates regulatory uncertainty. This lack of a standardized global regulatory framework for nanomaterials introduces a significant barrier to market entry and a challenge for manufacturers seeking to comply with disparate national and regional rules. The high capital expenditure associated with advanced manufacturing processes, such as atomic-layer-deposition reactors, also constrains the market, particularly for small and medium-sized enterprises (SMEs) that lack the financial capacity to scale up production. This high cost can limit market penetration in price-sensitive applications.

- Sustainable and Personalized Medicine Opportunities: However, these challenges simultaneously present significant opportunities. The demand for sustainable and "green" nanotechnology offers a new market trajectory. Nanomaterials capable of purifying water, filtering air pollutants, and creating biodegradable composites present a direct opportunity to address global environmental challenges while generating commercial value. The market can also capitalize on the rising demand for personalized medicine. Nanotechnology enables the creation of tailored diagnostic and therapeutic solutions, directly addressing a patient’s unique genetic and biological profile. As healthcare systems globally shift towards precision treatments, the demand for nano-enabled drug delivery and diagnostic tools will expand. Furthermore, the development of self-powered nanodevices is a notable opportunity, as it addresses the logistical constraint of power supply for implantable biosensors and environmental monitors. These innovations directly create a new segment of demand for low-maintenance, high-efficiency products.

Raw Material and Pricing Analysis

The nanotechnology market, being a physical product market, is highly sensitive to the supply chain and pricing of its raw materials. The cost and availability of feedstocks for nanomaterials, such as precious metals like gold, silver, and platinum for nanoparticles, introduce significant pricing volatility. Geopolitical tensions and supply chain disruptions can cause spot prices for these precursors to fluctuate by as much as 30%, which directly impacts the production costs for downstream manufacturers. This price instability can lead to production pauses and ripples through the device roadmaps of companies that lack the financial strength to hedge their forward exposures. Conversely, the market for carbon-based nanomaterials like carbon nanotubes and graphene is benefiting from production scale-ups. Advances in manufacturing techniques, such as continuous floating-catalyst reactors, have intensified cost-down learning curves, making these materials more economically viable for a broader range of industrial applications. While the unit production costs for nanomaterials remain five to ten times higher than conventional bulk fillers, the increasing maturity of production routes, such as spray-dry and flame-pyrolysis for nanoparticles, is gradually lowering per-kilogram costs, which will stimulate greater demand.

Supply Chain Analysis

The global nanotechnology supply chain is complex and geographically distributed, with key production hubs located across North America, Europe, and the Asia-Pacific. The United States and China are central to the upstream segment, with a heavy focus on fundamental research and the production of advanced nanomaterials and nanodevices. The supply chain for advanced electronics and medical devices, for example, often involves a highly specialized network. A company in North America may design a nano-enabled sensor, but the high-purity raw materials might be sourced from a specialty chemical producer in Europe, with final component fabrication occurring in a high-tech manufacturing hub in Asia. Logistical complexities arise from the need to transport highly sensitive or regulated nanomaterials under specific conditions. Dependencies exist on a limited number of specialized suppliers for ultra-high-purity precursors and for the advanced equipment needed for synthesis and characterization. This creates a supply chain that is both highly efficient for specialized components but also vulnerable to single-point failures or disruptions.

Government Regulations

- United States: Environmental Protection Agency (EPA), Food and Drug Administration (FDA), Toxic Substances Control Act (TSCA): The EPA and FDA regulate products on a case-by-case basis. The TSCA provides a framework for new chemical substances, but its application to all nanomaterials is a source of debate. The lack of a unified, nanotechnology-specific regulatory body can create market uncertainty, as manufacturers must navigate multiple agencies, which can slow product approval and commercialization.

- European Union: Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) Regulation: REACH mandates the registration and safety assessment of chemical substances, including nanomaterials. This comprehensive framework, while providing clear guidelines, can also create a high compliance burden for companies, particularly SMEs. The regulation's strict precautionary principle can slow the introduction of new nano-enabled products to the market.

- Japan: Pharmaceuticals and Medical Devices Agency (PMDA): The PMDA has specific guidelines for nanomedicines, including liposome drugs and nucleic acid-loaded products. This targeted regulatory approach provides a clear pathway for pharmaceutical and medical device companies, which directly supports and accelerates the development and commercialization of nanomedicine applications in Japan.

- China: National Center for Nanoscience and Technology (NCNST): China has heavily invested in nanotechnology through strategic programs, and its regulations often aim to facilitate industrial growth. The NCNST coordinates research and development, and while specific regulations are evolving, the government's support for applied research and commercial-scale production creates a favorable environment that drives domestic demand and innovation.

- India: Department of Biotechnology (DBT), Department of Science and Technology (DST): India’s regulatory landscape for nanotechnology is still developing. While agencies like the DBT and DST have funded research, a comprehensive and dedicated regulatory framework for nanomaterials is in its nascent stages. This regulatory ambiguity can present both challenges for safety compliance and opportunities for rapid, less-regulated market entry for certain applications.

Nanotechnology Market Segment Analysis:

- By Application: Healthcare & Pharmaceuticals

The healthcare and pharmaceuticals segment is a central engine of demand for the nanotechnology market. This is driven by an unremitting global demand for more precise, less invasive, and more effective medical solutions. Nanotechnology’s ability to manipulate matter at the molecular level allows for the creation of targeted drug delivery systems that can encapsulate and transport therapeutic agents directly to diseased cells, such as those in a tumor. This precision directly reduces the systemic side effects associated with conventional chemotherapy, thereby improving patient outcomes and quality of life. The increasing incidence of chronic diseases and the aging global population create a structural demand for these advanced treatments. Furthermore, the use of nanotechnology in diagnostics is transforming early disease detection. Nanoscale biosensors can detect minute quantities of disease biomarkers in blood or saliva, providing rapid and highly sensitive diagnostic results. The need for these tools is growing in a healthcare environment that places a premium on early intervention and personalized medicine. Nanotechnology also addresses the logistical challenges in vaccine development and storage, where nanoparticles are used as carriers to improve stability and efficacy. The market for nano-enabled products in this sector is therefore directly tied to the commercial imperative to solve persistent and costly healthcare problems.

- By End-User: Electronics & Semiconductor

The electronics and semiconductor industry represents another critical end-user segment, with demand primarily driven by the relentless pursuit of miniaturization and enhanced performance. The industry's adherence to Moore's Law, which dictates a doubling of transistors on a microchip approximately every two years, has reached a point where conventional materials are nearing their physical limits. Nanotechnology provides a solution by enabling the development of nanoscale transistors and interconnections. The demand for nanomaterials like graphene and carbon nanotubes is escalating because they offer superior thermal and electrical conductivity compared to silicon. This allows for the production of smaller, faster, and more energy-efficient integrated circuits. The rise of flexible electronics, smart wearables, and the Internet of Things (IoT) also directly increases demand for nanotechnology. Nanomaterials are essential for creating flexible, durable, and lightweight components, such as transparent conductive films for flexible displays and nano-enabled sensors for wearable health monitors. The industry's continuous investment in research and development to push the boundaries of computing power and device functionality directly translates into a sustained and growing demand for nanotechnology-enabled components and tools.

Nanotechnology Market Geographical Analysis:

- US Market Analysis: The United States market is a dominant force in the nanotechnology sector, anchored by robust government funding and a deep-seated culture of innovation. The National Nanotechnology Initiative (NNI), a multi-agency federal R&D program, has been a foundational pillar, directly supporting both academic research and private-sector commercialization. This sustained investment creates a pipeline of intellectual property and a skilled workforce, which in turn fuels the demand for advanced nanodevices and materials. The U.S. market’s growth profile is characterized by a strong focus on high-value applications in defense, aerospace, and medical technology. The presence of major pharmaceutical and technology companies drives a significant portion of the demand for nanomedicine and nanoelectronics. The market for nanotechnology in the U.S. is not a generic one; it is highly specialized, with demand concentrated in solving complex, high-stakes problems in these specific industries.

- Brazil Market Analysis: Brazil’s nanotechnology market is primarily driven by its application in the energy and agriculture sectors. As a major producer of renewable energy and a global leader in agricultural output, Brazil’s demand for nanotechnology is closely tied to these industries. Nanotechnology is being adopted to enhance the efficiency of solar and biofuel energy production. In agriculture, nano-enabled fertilizers and pesticides are in demand for their ability to deliver nutrients and active ingredients more efficiently, thereby increasing crop yield and reducing environmental impact. The Brazilian government's investment in scientific research and its focus on industrial innovation are key demand-side factors. The market is also seeing an increase in the use of nanomaterials for water purification and environmental remediation, reflecting a broader national imperative for sustainability.

- UK Market Analysis: The UK nanotechnology market is driven by a strong academic and research base, with demand primarily stemming from the healthcare and life sciences sectors. The country's National Health Service (NHS) and a network of universities and research institutes are key players. This ecosystem creates a consistent demand for nanomedicine, diagnostic tools, and regenerative medicine applications. The UK market is also experiencing demand for nanotechnology in advanced manufacturing and materials science, particularly in the aerospace and automotive industries, where lightweight and high-strength nanomaterials are a competitive necessity. Government grants and funding for research bodies, such as the Engineering and Physical Sciences Research Council (EPSRC), directly support the R&D that underpins this demand.

- Saudi Arabia Market Analysis: The Saudi Arabian nanotechnology market is closely tied to the country’s economic diversification efforts, as outlined in Saudi Vision 2030. The primary demand drivers are found in the energy, water, and healthcare sectors. As a leading oil producer, Saudi Arabia is investing in nanotechnology to improve oil and gas extraction processes and to enhance renewable energy technologies. The severe water scarcity issues in the region create a strong demand for nanotechnology-enabled water purification and desalination systems, which utilize nano-membranes and filters for more efficient and cost-effective treatment. Furthermore, government initiatives to modernize the healthcare system are spurring demand for nanomedicine and diagnostic equipment. This demand is strategic, aimed at building a knowledge-based economy and reducing the nation’s reliance on oil.

- China Market Analysis: China is a dominant player in the nanotechnology market, with its demand profile defined by a combination of massive government investment, rapid industrialization, and a focus on domestic innovation. The government’s long-term strategic plans and significant funding for nanotechnology have positioned the country as a global leader in the number of scientific papers and patents. The market’s growth is particularly strong in the electronics, automotive, and advanced materials sectors. The domestic electronics industry, with its push to produce smaller, more sophisticated devices, is a voracious consumer of nano-enabled components and materials. The automotive industry’s shift towards electric vehicles (EVs) and lightweighting also fuels demand for nanocomposites and high-efficiency batteries. China's market is a prime example of demand being created and sustained by top-down, state-driven strategic initiatives aimed at achieving technological and economic leadership.

List of Top Nanotechnology Companies:

The competitive landscape of the nanotechnology market is a blend of large, diversified technology and chemical corporations and a growing ecosystem of specialized startups. The market is defined by continuous innovation, with companies competing on intellectual property, product performance, and the ability to scale up production. Key players often pursue strategic acquisitions to expand their technological capabilities and market reach.

- Thermo Fisher Scientific Inc.: As a global leader in scientific instrumentation and services, Thermo Fisher's strategic positioning in nanotechnology is centered on providing the foundational tools for research and development. Their portfolio includes high-resolution microscopes, such as electron and ion microscopes, which are essential for nanoscale characterization and manipulation. The company’s products are critical enablers for academic institutions and corporate R&D labs, directly influencing the pace of innovation and discovery in the market. Thermo Fisher's strength lies in its comprehensive product line that supports the entire workflow, from sample preparation to data analysis.

- Bruker Corporation: Bruker is a major competitor in the analytical instruments segment of the market. The company specializes in providing scientific instruments and solutions for molecular and materials research. Bruker's strategic focus is on delivering high-performance, specialized tools that enable customers to analyze and characterize materials at the atomic level. This includes atomic force microscopes and X-ray diffraction systems. Bruker’s products are highly sought after by research-intensive organizations in the academic, government, and industrial sectors, where precise material characterization is a prerequisite for product development and quality control.

- Nano Dimension Ltd.: Nano Dimension is a key player in the digital manufacturing and additive electronics space. The company's strategic positioning is focused on providing 3D-printed electronics and other advanced manufacturing solutions using nano-inks and other nanomaterials. Their flagship DragonFly system allows for the rapid prototyping and production of High-Performance Electronic Devices (Hi-PEDs). Nano Dimension's business model addresses a direct market need for agile, on-demand manufacturing in the electronics and defense industries, which reduces lead times and supports complex, customized product designs.

Nanotechnology Market Recent Developments:

- April 2025: Nano Dimension Completes Acquisition of Desktop Metal: Nano Dimension announced the completion of its acquisition of Desktop Metal, Inc. The transaction, finalized after regulatory approvals, consolidates two leaders in digital manufacturing. The combined company's expanded portfolio is expected to offer a comprehensive suite of advanced manufacturing solutions, including capital equipment, materials, and software, to the electronics, medical, and mechanical industries. This acquisition directly impacts the competitive landscape by creating a more formidable entity with a broader technological and intellectual property base.

- November 2024: Nawah Inaugurates Carbon Nanotube Facility in France: Nawah inaugurated a new carbon nanotube production facility in Rousset, France. This expansion significantly increases the company’s annual production capacity of 3D nanocarbons. The move is a direct response to the growing industrial demand for advanced nanomaterials and is expected to strengthen the supply chain by enhancing the availability of high-performance materials for various industrial applications.

- October 2024: OCSiAl Opens TUBALL Nanotube Facility in Serbia: OCSiAl inaugurated its first European TUBALL nanotube facility in Serbia. The facility commenced operations with a nameplate capacity of 60 tons per year. This development is aimed at enhancing the supply chain and meeting the increasing demand for advanced materials, particularly in the European market.

Nanotechnology Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Nanotechnology Market Size in 2025 | USD 15.864 billion |

| Nanotechnology Market Size in 2030 | USD 31.728 billion |

| Growth Rate | CAGR of 14.87% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Nanotechnology Market |

|

| Customization Scope | Free report customization with purchase |

Nanotechnology Market Segmentation:

- By Technology

- Nanodevices

- Nanomanipulators

- Nanomechanical Test Instruments

- Nanoscale Infrared Spectrometers

- Others

- Nanosensors

- Optical Nanosensors

- Biological Nanosensors

- Chemical Nanosensors

- Physical Nanosensors

- Others

- Nanotools

- Nanomaterials

- Fullerenes

- Nanoparticles

- Nanoshells

- Carbon-based Nanotubes

- Nanocomposites

- Graphene

- Quantum Dots

- Nanocomposites

- Other Nanotechnologies

- Nanodevices

- By Application

- Aerospace & Defense

- Energy

- Electronics

- Chemical Manufacturing

- Healthcare & Pharmaceuticals

- Automobiles

- Biotechnology

- IT & Telecom

- Textile

- Others

- By End-User

- Electronics

- Cosmetics

- Pharmaceutical

- Biotechnology

- Others

- By Geography

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa