Report Overview

Netherlands Commercial Greenhouse Market Highlights

Netherlands Commercial Greenhouse Market Size:

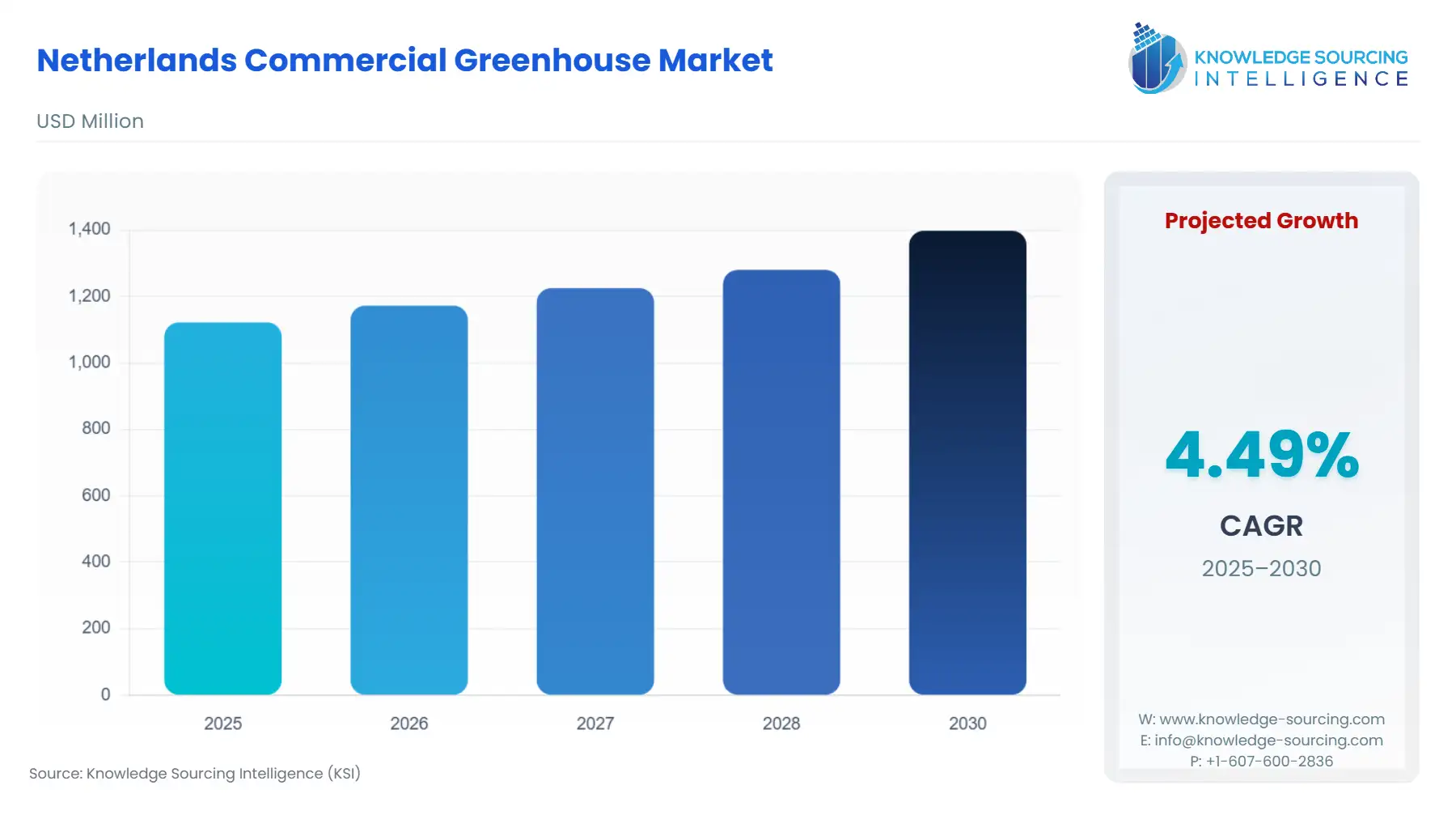

The Netherlands commercial greenhouse market is projected to grow at a CAGR of 4.49%, reaching a market size of US$1,398.095 million by 2030, up from US$1,122.249 million in 2025.

Netherlands Commercial Greenhouse Market Trends:

The Netherlands has a global leading position in agricultural technology. According to the World Bank, 53.9 percent of the land area is agricultural in the Netherlands. Despite being small in size and having a rainy climate, the Netherlands has learned to utilize its land and production systems effectively and creatively to maximize yields. Due to this, the Netherlands now has a particularly high concentration of specialist greenhouse businesses.

According to the official data provided by the Government of the Netherlands, over 90 square kilometers of greenhouses are available in the country. Based on the surface area, this is nearly 3.5 times larger than the greenhouses in Canada. Further, the Government’s efficient land regulation policies and initiatives with other countries to encourage agriculture are driving the commercial greenhouse market.

The Netherlands' commercial greenhouse market is expanding exponentially, owing to technological advancements, scarcity of arable land, growing urbanization, changing weather patterns, and high yields compared to traditional methods. Furthermore, the government policies and subsidies, and the increasing demand for year-round fresh produce are leading to market growth. The country’s long history of innovation in agricultural technologies, investment in research and development is the major factor driving market growth. The market is export-oriented and is at the forefront of sustainable agricultural practices and modern greenhouse technologies.

The Netherlands is known for its high-class technology, which sets it as a standard of greenhouse technology, driving the export of these products to other regions. Its long history of innovation, advanced technologies such as climate control systems, use of AI and robotics in precision farming, emphasis on energy efficiency, all these backed up by government R&D incentives and public-private partnerships, set it as a global standard. Simultaneously, increasing advancements in automation and controlled environment technologies are improving efficiency, giving a significant boost to demand for the Netherlands’ greenhouses, both for domestic consumption and for international markets.

Netherlands Commercial Greenhouse Market Overview:

The commercial greenhouse market in the Netherlands is primarily driven by its leadership in horticultural exports and the country's focus on high-value crops such as tomatoes, cucumbers, peppers, and flowers. The Netherlands has witnessed an increase in its agricultural growth in recent years. In horticulture, the nation's exports accounted for 11.5 billion euros in 2023, whereas the fruits and vegetables groups accounted for about 7.7 billion euros and 8.7 billion euros, respectively. This acts as a major driver for the commercial greenhouse industry’s expansion in the Netherlands.

According to CBS, in 2023, in the Netherlands, four primary greenhouse vegetables together occupied about the same area as the municipality of Amstelveen. Most of this area (over 43 percent) was used for tomatoes and nearly 38 percent for peppers, followed by cucumbers and aubergines.

Technological innovation is another key to market growth. Dutch greenhouses lead in controlled-environment agriculture (CEA) by using climate-controlled systems, hydroponics, automated lighting, AI crop monitoring, and energy-efficient materials like polycarbonate panels. These advancements allow growers to use resources more effectively, reduce energy and water use, and increase their yield per square meter.

In line with this, Koppert Cress introduced an innovation in greenhouse climate management with its Direct Air Capture (DAC) technology in April 2025. This makes it the first horticultural company in the world to use this method at scale. The system, developed with Dutch startup Carbyon and research organization TNO, captures CO? directly from the atmosphere and uses it to improve plant growth inside the greenhouse. This sustainable solution removes the need for CO? derived from fossil fuels, significantly reducing carbon emissions and supporting a closed-loop model for climate-neutral cultivation. This innovation shows the Dutch horticulture sector's commitment to sustainability, energy efficiency, and advanced environmental control.

Sustainability and energy efficiency are also important factors. The Netherlands is under pressure to lower greenhouse gas emissions and reduce its reliance on natural gas. In response, greenhouse operators are adopting circular practices such as recycling water, integrating renewable energy sources like geothermal and solar, and using environmentally certified production methods. VB Greenhouses, for instance, is helping with greenhouse sustainability by working with Aardwarmte Polanen, a geothermal energy project focused on reducing carbon emissions in horticulture in the Netherlands. The project uses geothermal heat from deep underground to provide a stable and renewable energy source, greatly decreasing the use of natural gas. This clean heat warms greenhouses in an eco-friendly way, allowing growers to lower their carbon footprint while maintaining optimal growing conditions. The initiative shows a wider change in Dutch horticulture toward sustainable energy practices and long-term commitment to the environment. Moreover, under the Dutch Climate Act, the Netherlands is trying to reduce its greenhouse gas emissions by 55% by 2030, compared to 1990 levels. These trends are helping the Netherlands' greenhouse industry grow stronger, more stable, and more competitive worldwide.

In terms of the competitive landscape, the market is moderately fragmented with a blend of specialized players and major players. Companies operate across different and distinct segments, including greenhouse structure manufacturing, climate control automation, irrigation systems, and horticultural lighting. Leading players such as Certhon, DutchGreenhouses, Havecon, Dalsem, and Richel Group provide comprehensive turnkey greenhouse solutions, while firms such as Priva and Hoogendoorn Growth Management dominate the software and environmental control niches.

Market players are increasingly focusing on technological innovation to leverage these capabilities to position themselves in the market. They are collaborating with research institutes or Universities for developing more innovative solutions with higher efficiency and sustainability. At the same time, the market is experiencing a trend towards consolidation, such as the acquisition of Certhon by Denso.

The Netherlands' commercial greenhouse market presents a significant export opportunity driven by its technological supremacy, engineering excellence, and integrated smart farming capabilities. Thus, the market offers a robust platform for long-term growth opportunities in overseas markets such as the Middle East, Asia, Eastern Europe, and North America, including the USA and Canada.

Netherlands Commercial Greenhouse Market Growth Drivers:

High demand for premium quality, year-round fruits, vegetables, and flowers

The strong demand for high-quality, year-round vegetables, fruits, and flowers has become a key factor in the growth and innovation of the Netherlands' commercial greenhouse market. As consumers focus more on freshness, nutrition, and sustainability, the Dutch greenhouse sector faces constant pressure to maintain a steady supply throughout the year, regardless of seasonal challenges. This demand has turned greenhouses from simple growing spaces into highly controlled, high-tech production environments that can ensure consistent quality and availability throughout the year.

To meet these year-round expectations, growers are investing heavily in technologies like controlled-environment agriculture (CEA), artificial lighting, hydroponics, and climate automation systems. These tools help producers control every part of the growing environment, from light and temperature to humidity and CO? levels, leading to higher yields and better-quality crops. The use of AI and data analytics further improves precision, allowing growers to optimize resources and predict crop performance more accurately. This technological advancement not only increases productivity but also boosts sustainability by lowering water, energy, and chemical use.

The demand for high-quality products also reinforces the Netherlands’ status as a global leader in horticultural exports. With most of the greenhouse produce sent abroad, maintaining premium quality is crucial for meeting strict international standards, particularly within Europe. The ability to provide a reliable year-round supply of vegetables, fruits, and flowers enables Dutch growers to secure long-term contracts with retailers, food service providers, and wholesalers. It also strengthens the Netherlands’ reputation as a leader in innovative, sustainable agriculture. According to CBI, the Netherlands has the largest number of Fairtrade-certified traders in Europe, with 26 fresh fruit traders and 9 fresh vegetable traders.

Furthermore, in response to the growing demand, growers are diversifying their crop offerings. They are increasingly cultivating exotic herbs, edible flowers, microgreens, and specialty vegetables to target niche markets and high-end food sectors. For instance, as of 2023/24, 199,000 MT of apples were produced in the

Netherlands. This diversification encourages investment in flexible infrastructure and modular systems that can support a variety of crops.

Comprehensively, the strong demand for high-quality, year-round produce is driving the modernization of greenhouse operations and strengthening the Netherlands’ strategic role in food security and agricultural innovation.

Netherlands Commercial Greenhouse Market Restraints:

The Netherlands has a cold climate, and the need for gas and energy is essential for the operations of greenhouses. Russia’s invasion of Ukraine in February, followed by economic sanctions from Europe along with other nations, has resulted in a shortage of gas and energy in the global market. The Netherlands is a vital part of Europe and is no different. This has led to an increase in gas and electricity prices.

Greenhouses play an important role in the Netherlands. This was made possible due to the cheap gas. However, with increasing prices, farmers are restricting their areas of production in the greenhouses to cut down costs. As per Statistics Netherlands, the industry’s gas usage plunged 23% in the year leading up to June. Further, according to the business association Glastuinbouw Nederland, up to 40% of its 3,000 members are struggling financially. With the country’s Climate change policies, the usage of wood for heating is also not a sustainable option for heating greenhouses. This indicated fewer installations of commercial greenhouses throughout the Netherlands.

Netherlands Commercial Greenhouse Market Segmentation Analysis:

The fruits & vegetables segment is growing significantly

By crop type, the Netherlands commercial greenhouse market is segmented into fruits & vegetables, flowers & ornamentals, and nursery crops. Agricultural technology is progressing in the Netherlands with the objective of meeting increasing demand for food fueled by the constant population growth. Furthermore, the dynamic climatic conditions in the country have also accelerated the need to adopt modern agricultural concepts with less reliance on soil and water, which has led to the development of varied commercial greenhouses in the country, especially for fruits & vegetables.

For instance, in November 2024, Hazera launched its high-tech R&D greenhouse in the Netherlands, marking a significant milestone in the company’s ambition to develop various tomato varieties with rich flavor and strong disease resistance. The 5-hectare facility further expands the Netherlands’ scale of high-tech tomato production.

Likewise, key market players, namely Netafim, have invested in the Dutch market to expand their presence in the country’s growing agri-tech sector with the acquisition of domestic greenhouse companies, enabling them to improve the overall local food production for communities. Moreover, the demand for organic produce is also growing in the Netherlands, followed by growing health awareness among consumers, which has further impacted the demand for commercial greenhouses.

The nation is aiming to reduce reliance on vegetable exports from major economies such as the USA and provide fresh vegetables produced domestically. According to the International Fresh Produce Association, in 2023, the Netherlands imported US$89.388 million worth of fresh vegetables from the USA, representing a 13% growth over the volume imported in 2022.

The Netherlands is a leader in horticulture and greenhouse building, and Invest International's funding helps to further this cause by highlighting the enormous potential that Dutch greenhouse technology holds for improving food security and jobs in emerging markets.

Netherlands Commercial Greenhouse Market Key Development:

Hazera Launches High-Tech R&D Greenhouse: In November 2024, Hazera opened a nearly 5-hectare high-tech greenhouse in Made, Netherlands, dedicated to advancing tomato variety research and development.

DENSO Acquires Certhon Group: In September 2023, DENSO Corporation acquired full ownership of Certhon Group, a Netherlands-based horticultural facility operator, to expand its global greenhouse technology solutions.

Netherlands Commercial Greenhouse Market Companies:

DutchGreenhouses B.V.

Havecon Horticulture Projects B.V.

LOGIQS B.V.

Certhon Group (Denso Corporation)

Dalsem B.V.

Netherlands Commercial Greenhouse Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 1,122.249 million |

| Total Market Size in 2030 | USD 1,398.095 million |

| Forecast Unit | Million |

| Growth Rate | 4.49% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Type, Material Type, Component, Crop Type |

| Companies |

|

Netherlands Commercial Greenhouse Market Segmentation:

By Type

Gutter Connected

Free Standing

By Material Type

Plastic

Glass

By Component

High-Tech Commercial Greenhouse

Heating System

Cooling System

Medium-Tech Commercial Greenhouse

Heaters

Cooling Pads

Thermostats

Exhaust Fans

Others

Low-Tech Commercial Greenhouse

By Crop Type

Fruits & Vegetables

Flowers & Ornamental Crops

Nursery Crops

By Region

North

South

East

West