Report Overview

Network Virtualization Market - Highlights

Network Virtualization Market Size:

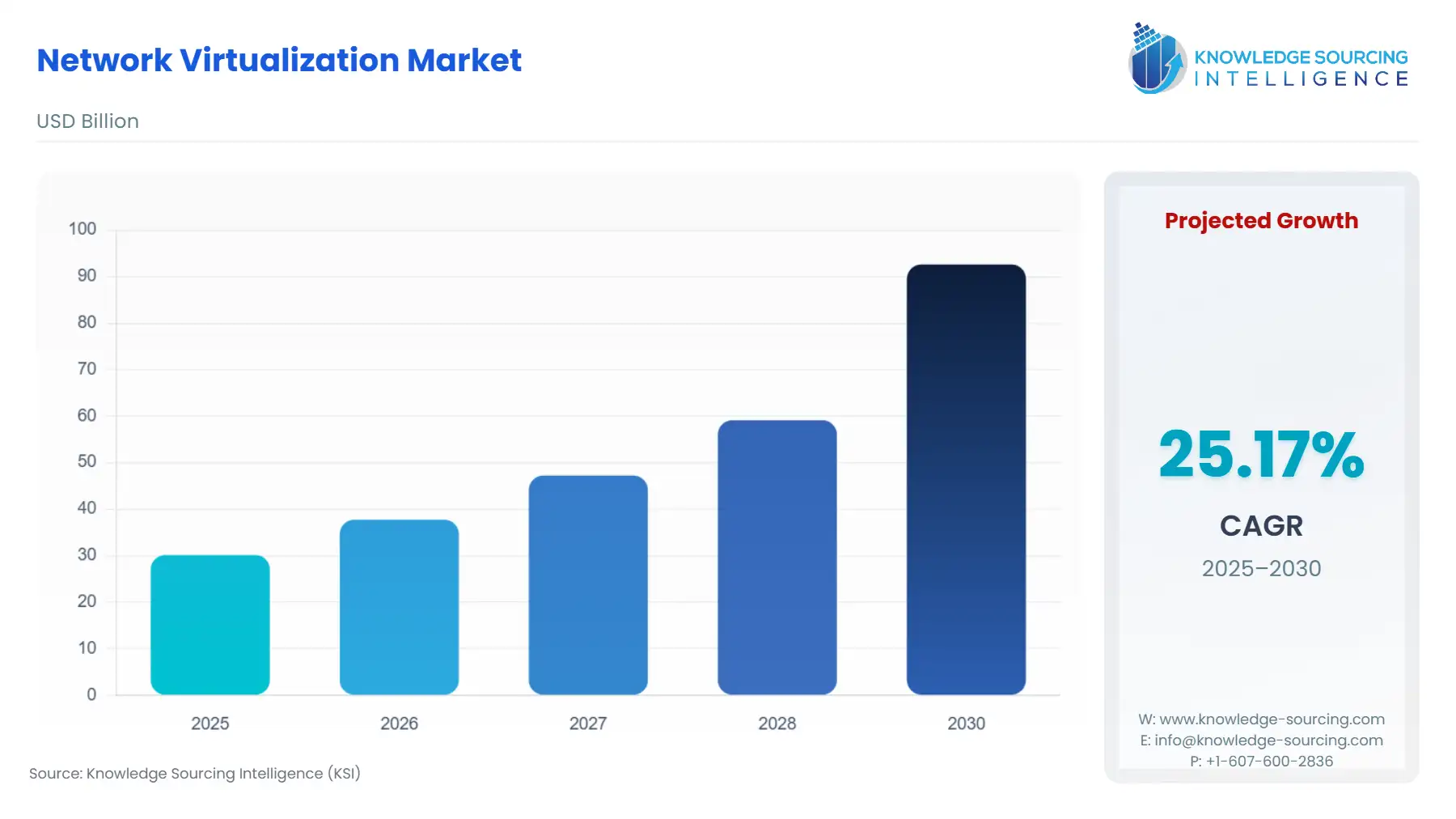

Network Virtualization Market, with a 24.41% CAGR, is forecasted to expand from USD 30.151 billion in 2025 to USD 111.824 billion in 2031.

Network Virtualization Market Trends:

Network virtualization is a technology that allows for the creation of isolated virtual networks on top of a physical network infrastructure. This allows multiple logical networks to share the same physical resources, which can improve efficiency and scalability. Network virtualization is used in a variety of applications including data center virtualization, cloud computing, software-defined networking, and many others. The rise of cloud computing and the growing need for security coupled with the increasing use of IoT devices have emerged as a significant driving force behind the substantial growth of the network virtualization industry.

Network Virtualization Market Growth Drivers:

Growing demand for cyber security solutions bolsters the network virtualization market growth.

By creating virtual networks that operate independently of the underlying physical infrastructure, network virtualization enhances security measures through the implementation of isolated environments, ensuring that potential breaches in one virtual network do not compromise the entire system. With the rising frequency and sophistication of cyber threats, organizations across various industries are recognizing the importance of implementing comprehensive security solutions, and network virtualization provides an effective framework for achieving this. For instance, as per the data maintained by the National Cyber Crime Reporting Portal, more than 16 lakh cyber-crime incidents have been reported and more than 32 thousand FIRs have been registered from January 2020 to December 2022 in India.

The rise in cloud computing drives the network virtualization market growth.

Network virtualization plays a crucial role in facilitating the efficient operation of cloud computing environments. It helps create virtual networks that can be easily adjusted and expanded to support the needs of different cloud-based programs and services. By separating network functions from the physical equipment, network virtualization makes it simpler to manage and scale the networks, ensuring that cloud-based applications can run efficiently and effectively. With the increasing adoption of cloud-based services and solutions across industries, organizations are increasingly relying on network virtualization technologies to support their cloud infrastructure and enable efficient resource management and allocation. The scalability, flexibility, and cost-effectiveness offered by network virtualization align closely with the requirements of cloud computing, making it an essential enabler for the seamless operation and expansion of cloud-based applications and services.

The increasing use of IoT devices drives the network virtualization market expansion.

Network virtualization plays a critical role in managing the complex network requirements brought about by the increasing use of IoT (Internet of Things) devices. By creating virtual networks that can handle the diverse communication needs of IoT devices, network virtualization enables efficient data transfer, seamless connectivity, and effective resource allocation. With the increasing use of IoT devices across various industries, there is a heightened demand for network virtualization solutions that can efficiently manage the complex network requirements and data traffic generated by these devices. As organizations aim to use IoT for improved operational efficiency and data-driven decision-making, the need for scalable network infrastructure supported by network virtualization technologies becomes increasingly essential.

Network Virtualization Market Geographical Outlook:

North America is expected to dominate the market.

North America is projected to account for a major share of the network virtualization market owing to the increasing adoption of advanced technologies such as 5G networks, and IoT devices in countries like the United States and Canada coupled with government initiatives that stimulate the network virtualization demand. For instance, in October 2020, The Federal Communication Commission (FCC) established the 5G Fund for Rural America to aid carriers in implementing advanced 5G mobile wireless services in rural areas, including a provision of up to $680 million for deployment on Tribal lands. Also, North America's projected dominance in the network virtualization market is reinforced by the concentration of key network virtualization providers such as Cisco, IBM, Hewlett Packard Enterprise, VMware, and Juniper Networks.

Network Virtualization Market Challenges:

Lack of skills will restrain the network virtualization market growth.

The network virtualization industry growth may be restrained by the lack of specialized expertise required to effectively implement and manage these technologies. The field requires a comprehensive understanding of virtualization concepts, network architecture, cloud computing, and software-defined infrastructures, among other specialized skills. The shortage of such skilled professionals can impede the successful implementation and optimization of network virtualization solutions, leading to delays in deployment, increased operational costs, and reduced overall efficiency. Initiatives such as specialized educational programs, certification courses, and industry collaborations to cultivate a proficient workforce may be required to gain expertise in network virtualization.

List of Top Network Virtualization Companies:

VMware NSX: VMware NSX enables the creation of a sophisticated cloud network, ensuring uniform policy enforcement, streamlined operations, and automated processes across various cloud environments. It supports rapid service delivery with a scalable, automated platform for networking, security, and load balancing at every layer. Additionally, it provides robust protection against cybersecurity threats, employing advanced technologies such as IDS/IPS, Sandboxing, and NTA/NDR to minimize false positives and expedite remediation.

Network Functions Virtualization: Cisco's NFVI accelerates service deployment, ensuring superior user experiences and seamless scalability to adapt to unpredictable traffic patterns. With NVF, functions can be efficiently executed on versatile hardware, allowing for easy scalability and automated service delivery via orchestration. It also automates service delivery across various vendors, aligning business models with procurement practices.

Nuage Networks Virtualized Network Services: Nokia's Nuage VNS leverages SDN to establish a cohesive WAN linking data centers to businesses, irrespective of their locations. It can be integrated into an existing infrastructure or acquired through a managed service from service providers. Built on an overlay model, Nuage Networks VNS utilizes any IP network for inter-site connectivity, allowing for optimal flexibility and support for various access technologies such as copper, fiber, or mobile broadband.

Network Virtualization Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Network Virtualization Market Size in 2025 | USD 30.151 billion |

Network Virtualization Market Size in 2030 | USD 92.640 billion |

Growth Rate | CAGR of 25.17% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Network Virtualization Market |

|

Customization Scope | Free report customization with purchase |

Network Virtualization Market Segmentation

By Component

Hardware

Software

Services

By Type

Internal Network Virtualization

External Network Virtualization

By Technology

Software-Defined Networking (SDN)

Network Function Virtualization

By Enterprise Size

Small

Medium

Large

By End-User

BFSI

IT & Telecommunication

Manufacturing

Retail

Healthcare

Others

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others