Report Overview

Non-Woven Adhesive Tape Market Highlights

Non-Woven Adhesive Tape Market Size:

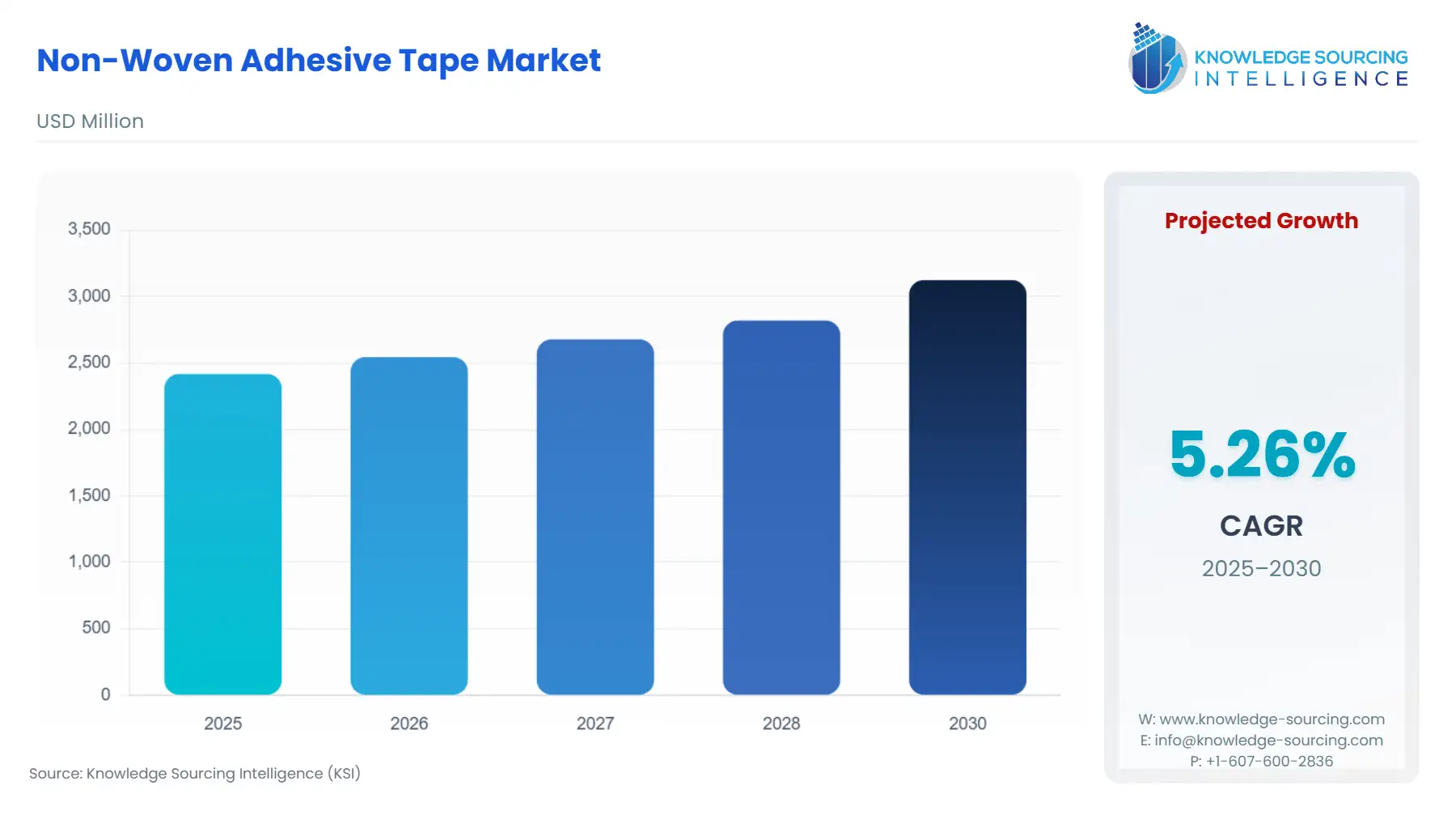

The Non-Woven Adhesive Tape Market will reach US$3,124.230 million in 2030 from US$2,417.373 million in 2025 at a CAGR of 5.26% during the forecast period.

Non-Woven Adhesive Tape Market Trends:

Non-woven tapes are formed by the mechanical, thermal, or chemical interlocking of natural or synthetic fibres, allowing for the use of materials such as nylon, cotton, and polyester, as well as acrylic or rubber-based additives. Stretchability, water and flame resistance, recyclability, and other features are all available with these tapes. The expanding use of these tapes across industrial verticals, particularly in the sectors of construction and healthcare, will drive demand for them throughout the forecast period.

The main cause of the nonwoven adhesive tape market growth is the growing urban population and their use of hygiene goods. The non-woven adhesives market will see profitable growth opportunities as the key players increase their investment in product innovation. The need for nonwoven adhesives will continue to rise as a result of rapid industrialization, low production costs, and waste minimization characteristics. Higher demand for non-woven adhesives as medical products and equipment, as well as improvements in the healthcare sector, will drive expansion in the non-woven adhesives market value. Increased awareness of nonwoven adhesives, combined with an ageing population and a rising birth rate, would provide the lucrative potential for this industry.

However, fluctuating raw material prices would pose a significant obstacle to the nonwoven adhesives market's growth pace. The market's intense rivalry will further limit the market's growth potential for nonwoven adhesives. The latest coronavirus outbreak has also slowed the rate of expansion.

The silicone-based nonwoven adhesive tape segment is predicted to expand at the highest CAGR in terms of value, according to adhesive type. Silicone adhesives have a wide temperature range of adhesion and may stick to even the toughest surfaces. The silicone-based non-woven tape has a lower overall adhesive strength than other non-woven tapes. Silicone-based nonwoven tapes, on the other hand, are more expensive than acrylic and rubber-based adhesive tapes.

The paper segment is predicted to expand at the fastest CAGR throughout the projection period, based on the backing material. Paper is a recyclable and environmentally beneficial material. Saturation, which is a technique in which paper gets treated with latex to enhance its chemical and physical qualities so that it can be utilized as a supporting substrate in adhesive tape, improves the properties of paper.

Due to an ageing population, rising chronic diseases, and increased personal and hygiene care globally, the medical and hygiene category is predicted to grow at the greatest CAGR in terms of volume during the forecast timeframe.

Due to the highly established healthcare sectors in China, India, and South Korea, as well as ongoing investments in the region to advance the medical technology and automotive industries throughout time, Asia-Pacific is likely to dominate the overall market. Furthermore, the automotive and transportation industries have been gradually increasing their need for nonwoven tapes. In automobiles, these tapes are used for roof linings, headliners, and leather and textile supporters.

The global non-woven adhesive tape market report provides an in-depth analysis of the industry landscape, delivering strategic and executive-level insights backed by data-driven forecasts and analysis. This regularly updated report equips decision-makers with actionable intelligence on current market trends, emerging opportunities, and competitive dynamics. It examines demand across various non-woven adhesive tape type, such as acrylic and rubber adhesives, while exploring end-user segments. The report also investigates technological advancements, key government policies, regulations, and macroeconomic factors, offering a comprehensive view of the market.

Non-Woven Adhesive Tape Market Segmentations:

Non-Woven Adhesive Tape Market Segmentation by adhesive type:

The market is analyzed by adhesive type into the following:

- Acrylic

- Rubber

- Silicone

- Others

Non-Woven Adhesive Tape Market Segmentation by material

The report analyzes the market by material as below:

- Polypropylene (PP)

- Paper

- Polyvinyl Chloride (PVC)

- Others

Non-Woven Adhesive Tape Market Segmentation by end-users industry:

The report analyzes the market by end-users industry as below:

- Packaging, Consumer, and Office

- Healthcare

- Automotive

- Electrical and Electronics

- Building and Construction

- Others

Non-Woven Adhesive Tape Market Segmentation by regions:

The study also analysed the Non-Woven Adhesive Tape Market into the following regions, with country level forecasts and analysis as below:

- North America (US, Canada, and Mexico)

- South America (Brazil, Argentina, and Others)

- Europe (Germany, UK, France, Spain, and Others

- Middle East and Africa (Saudi Arabia, UAE, and Others)

- Asia Pacific (China, Japan, India, South Korea, Thailand, Indonesia, and Others)

Non-Woven Adhesive Tape Market Competitive Landscape:

The Non-Woven Adhesive Tape Market features key players such as 3M, Nitto Denko Corporation, Tesa SE, Avery Dennison Corporation, Intertape Polymer Group Inc., LINTEC Corporation, Berry Global Group, Inc., Scapa Group plc, Lohmann GmbH & Co.KG, and Rogers Corporation, among others.

Non-Woven Adhesive Tape Market Report Coverage:

This report provides extensive coverage as explained in the points below:

- Market size, forecasts, and trends by different adhesive types, with historical revenue data and analysis focusing on key factors driving adoption, current challenges faced by key players, and major growth areas.

- Market size, forecasts, and trends by material, with historical revenue data and analysis.

- Market size, forecasts, and trends by end-users industry, with historical revenue data and analysis across various segments.

- Non-Woven Adhesive Tape Market is also analysed across different regions, with historical data, regional share, attractiveness, and opportunity of these solutions in different countries. The growth prospects and key players operating in these markets. The section also dwells on the macro factors, economic scenario and other complementing factors aiding in market growth.

- Market dynamics: The section details the market growth factors, restraints, and opportunities in the market. The segment also presents complete market scenario with the help of Porter’s five forces model.

- Competitive Intelligence: A thorough investigation on the competitive structure of the market presented through proprietary vendor matrix model, market share analysis of key players, insights on strategies of key players and recent major developments undertaken by the companies to gain competitive edge.

- Research methodology: The assumptions and sources which were considered to arrive at the final market estimates. Additionally, how our model is refined to ensure most significant factors are taken into consideration with the proper hypothesis and bottom-up and top-down approaches enhance the reliability of forecasts further strengthening the trustworthiness of the numbers being presented.

How this report is helpful to you and reasons for purchase?

- The report provides a strategic outlook of the non-woven adhesive tape market to the decision-makers, analysts and other stakeholders in the easy-to-read format for taking informed decisions.

- The charts, tables and figures make it easy for the executives to gain valuable insights while skimming the report.

- Analyst support through calls and email for timely clarification and incorporating additional requests.

- Option of presentation or doc format with the estimates file to take care of diverse requirements.

- 15% FREE customization with all our reports help cater additional requirements with significant cost-savings.

- Option of purchasing specific segments of the study, including opting for summary reports or just the estimates file.

Non-Woven Adhesive Tape Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 2,417.373 million |

| Total Market Size in 2031 | USD 3,124.230 million |

| Growth Rate | 5.26% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Adhesive Type, Material, End-User Industry, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

| Report Metric | Details |

| Non-Woven Adhesive Tape Market Size in 2025 | US$2,417.373 million |

| Non-Woven Adhesive Tape Market Size in 2030 | US$3,124.230 million |

| Growth Rate | CAGR of 5.26% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Non-Woven Adhesive Tape Market |

|

| Customization Scope | Free report customization with purchase |