Report Overview

North America Home Fragrance Highlights

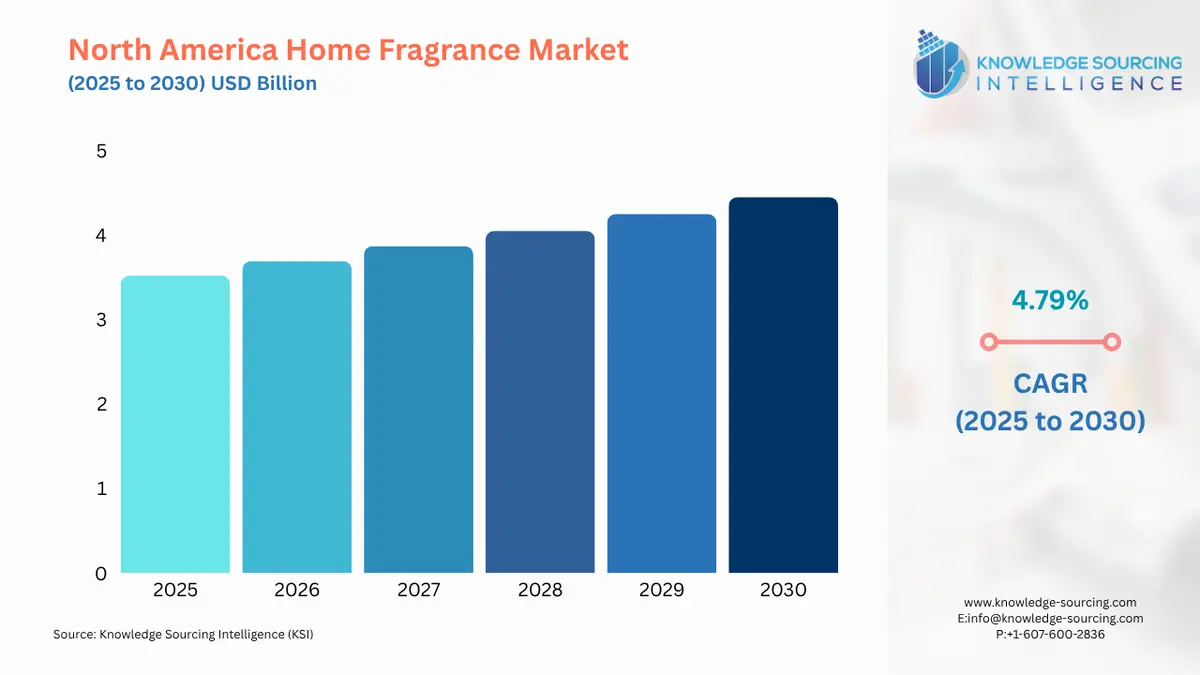

North America Home Fragrance Market Size:

The North America Home Fragrance Market is expected to grow at a CAGR of 4.79%, reaching USD 4.451 billion in 2030 from USD 3.522 billion in 2025.

North America is anticipated to hold the largest market share in the home fragrance industry. This is mostly because home aesthetics and décor are highly valued. The United States has a sizable consumer base with comparatively high disposable incomes, which permits more spending on luxuries like house scents. This region's cultural emphasis on comfort and home décor makes house fragrances even more significant as vital lifestyle components. Demand for a wide variety of home fragrance items, such as scented candles, diffusers, and room sprays, is driven by Canadian consumer's interest in wellness and improving living areas.

North America Home Fragrance Market Overview & Scope:

The North America home fragrance market is segmented by:

- Fragrance: The North American home fragrance market is anticipated to be led by the fresh/citrus sector. This is mostly because these fragrances are so widely accessible and well-liked. Essential oils made from the peels and fruits of different citrus trees, such as colorful limes, tart lemons, sweet oranges, sour grapefruits, and fragrant bergamot, are used to create fresh and citrusy scents. These fragrances are popular not only for their revitalizing properties but also for their many advantages, which include mood-boosting, aromatherapy applications, smell blending, and other uses that promote general well-being.

- Product Type: The market is separated into many segments based on product type, candles, sprays, diffusers, essential oils, incense sticks, plug-in devices, potpourri and sachets, wax melts, and others. The market for home fragrances is anticipated to be led by the candles category. This is mostly because scented candles are becoming more and more popular. Customers can choose fragrances that suit their emotions due to the wide variety of fragrance options available in scented candles, which range from fruity and floral to spicy and earthy. The segment is also supported by the growing appeal of scented candles as a gift option. During the holiday season, these candles are becoming more and more popular. They frequently function as considerate hostess presents, housewarming gifts, or expressions of gratitude. Additionally, these candles are used for a variety of festivities.

- Distribution Channel: The market is divided into Specialty stores, online stores, hypermarkets and supermarkets, and others based on the distribution. The availability of a wide range of products on supermarket shelves allowed hypermarkets and supermarkets to dominate the market. This enables customers to know their alternatives and purchase a specific product or combination of products based on their requirements.

Top Trends Shaping the North America Home Fragrance Market:

- Integration of Aromatherapy and Wellness

Home scents are becoming a popular part of consumer wellness regimens. The ability of products like scented candles and diffusers to improve mood and reduce stress has made them popular. - Integration of AI in the Fragrance Sector

The growing desire from consumers for personalized products is the main factor driving the growth of the fragrance sector. Consumers demand perfumes that genuinely reflect their individual identities and tastes, not just a simple fragrance. A development in artificial intelligence (AI) solutions specifically designed for the fragrance industry is being sparked by this notable change in customer behavior, which is forcing firms to reconsider conventional marketing strategies. By carefully examining consumer data, such as browsing patterns, previous purchases, and personal fragrance preferences, AI algorithms are transforming the market.

North America Home Fragrance Market Growth Drivers vs. Challenges:

Opportunities:

- Growing Interest in Organic Products: The market for home fragrances is growing due to consumer growing desire for organic products. Many people are gravitating toward natural and eco-friendly perfumes because of increased awareness of environmental sustainability. Sustainability-focused firms can capitalize on the growing demand for natural and organic home fragrance solutions. By creating novel product formats, such as smart diffusers that enable controlled aroma release or customized fragrance experiences based on personal preferences, businesses can draw in new clients. The product can be further improved by extending product lines to include wellness-promoting items like essential oil-based products and aromatherapy mixtures.

- Growing Customer Interest in Wellness and Home Ambience: The increased consumer focus on emotional well-being, self-care, and designing cozy living spaces is one of the main factors propelling the North American home fragrance industry. Customers now see their houses as places that should encourage rest, emotional stability, and mental clarity in addition to being useful places.

Challenges:

- Environmental and Health Issues: The adoption of house fragrances is constrained by several issues, despite the quickly rising interest in these products. Some fragrances, especially those with potent odors and artificial ingredients, are linked to health issues. Overuse of several fragrances increases the chance of sensitivities or allergic responses. Several synthetic perfumes result in customers worrying about the environment. Furthermore, the cost of high-end home fragrance products, which are frequently created using better components, restricts the market's expansion. Changing laws governing the components of scent goods may have an impact on market dynamics and require manufacturers to comply.

North America Home Fragrance Market Competitive Landscape:

The market is moderately fragmented, with many key players including Newell Brands, Bath & Body Works, S.C. Johnson & Son, Inc., Scentsy Inc., and Apotheke.

- Product Innovation: In April 2025, Harry Slatkin, a specialist in home scent, and Sir Elton John collaborated to introduce the Spring Woodside Collection under Slatkin's HomeWorx brand. The collection features scents including Ginger Mango, Ivy's Rose Garden, English Lavender, Rhubarb Strawberry Crumble, Spring Rain, and Apple Mint Tea.

- Sustainable product launch: In July 2024, in its Home Scents line, LOEWE debuted a fragrance with a wasabi theme. The fragrance, which comes in scented candles, ornamental wax candleholders, and room sprays, has spicy undertones that are balanced by lemongrass and basmati rice.

North America Home Fragrance Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 3.522 billion |

| Total Market Size in 2031 | USD 4.451 billion |

| Growth Rate | 4.79% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Fragrance, Product Type, Distribution Channel, Geography |

| Geographical Segmentation | USA, Mexico, Canada, Others |

| Companies |

|

North America Home Fragrance Market Segmentation:

- By Fragrance

- Floral

- Fresh/Citrus

- Woody

- Oriental/Spicy

- Herbal

- Fruity

- Sweet/Gourmand

- Oceanic

- Others

- By Product Type

- Candles

- Sprays

- Diffusers

- Essential Oils

- Incense Sticks

- Plug-in Devices

- Potpourri and Sachets

- Wax Melts

- Others

- By Distribution Channel

- Hypermarkets/Supermarkets

- Specialty Stores

- Online Stores

- Others

- By Region

- USA

- Mexico

- Canada

- Others