Report Overview

O-RAN Market - Strategic Highlights

O-RAN Market Size:

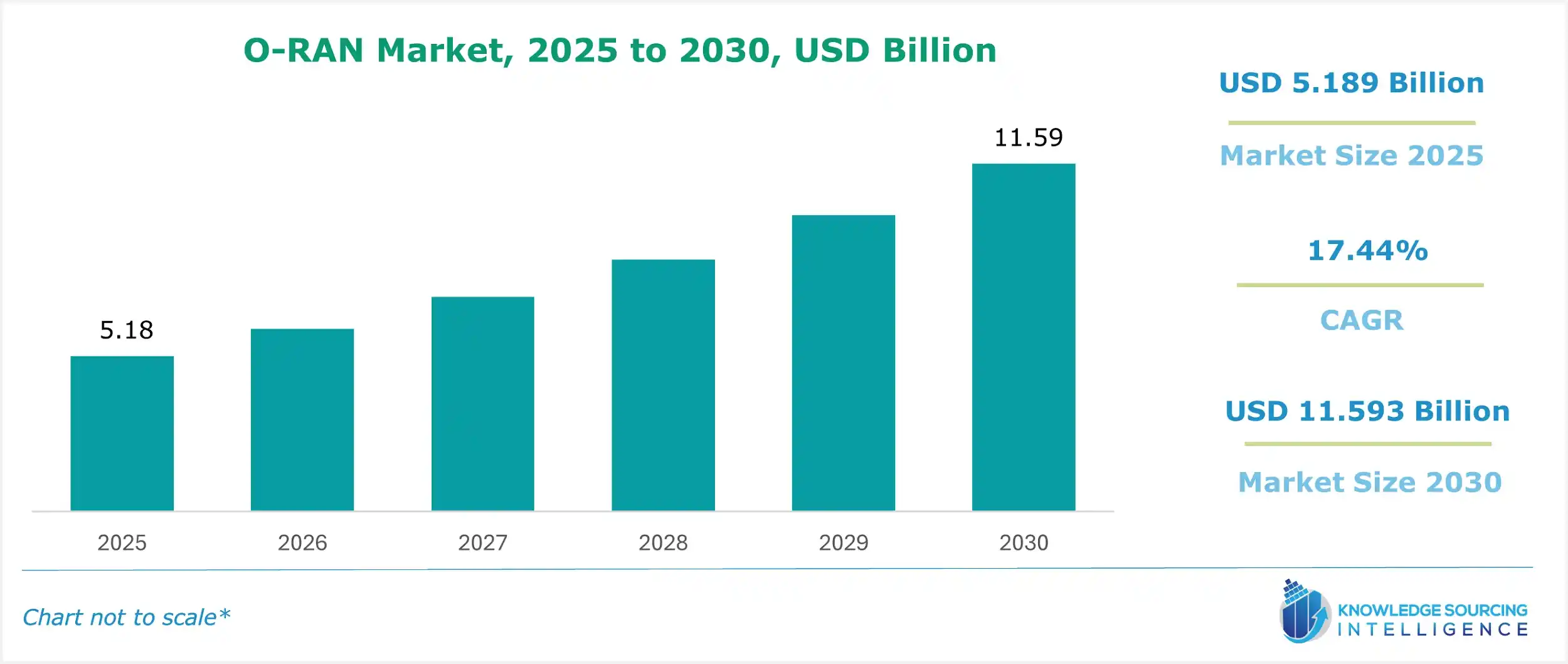

The O-RAN market is estimated to expand at a CAGR of 17.44% over the forecast period, increasing from US$5.189 billion in 2025 to US$11.593 billion by 2030.

O-RAN Market Overview:

The O-RAN market is revolutionizing telecommunications through Open RAN (O-RAN), enabling flexible, multi-vendor networks via Disaggregated RAN. Cloud RAN (C-RAN) and Virtual RAN (vRAN) leverage Software-Defined Networking (SDN) for RAN and Network Function Virtualization (NFV) for RAN, optimizing resource allocation and scalability. The O-RAN Architecture, featuring Open Fronthaul, supports interoperable interfaces, while the RAN Intelligent Controller (RIC) enhances automation with rApps for non-real-time and xApps for near-real-time optimization, driving AI-powered network management. This market fosters innovation, cost-efficiency, and scalability, reshaping global telecom infrastructure.

The deployment of 5G technology has unfolded new paths for expanding network capacity and customer experience at a reasonable cost. Open RAN enhances 5G deployments by establishing a direct link between the main network and the user’s devices, thereby providing subscriber information and location. This increased use of the 5G technology has grabbed different sectors including defense to make use of the Open RAN for the 5G deployment. In October 2024, Airspan Networks Holdings LLC announced the strategic Memorandum of Understanding (MoU) with Pavo Group, a global provider of security and defense solutions. Airspan Networks Holdings LLC is the leading developer of 4G and 5G Open RAN solutions.

This partnership would give the combined expertise of both companies. It would use the deployment of mobile telecommunications for defense, security, and critical infrastructure networks. The MoU will focus on integrating 4G and 5G into robust, secure networks, supporting the needs of military, law enforcement, and utility providers in high-demand, high-security environments. This integration would enhance real-time communication and data sharing, strengthening awareness, decision-making, and operational effectiveness.

O-RAN Market Trends:

The O-RAN market is advancing with Network Slicing O-RAN, enabling tailored 5G services for diverse applications. Automated Network Operations enhance efficiency through AI-driven management, while Predictive Maintenance RAN minimizes downtime with real-time analytics. Rural Broadband Deployment leverages O-RAN’s cost-effective, open architecture to bridge connectivity gaps. Industrial 5G applications, supported by O-RAN, drive automation in manufacturing and logistics. Smart City Connectivity integrates O-RAN for seamless, scalable urban networks, supporting IoT and public services. These trends highlight the market’s focus on flexibility, automation, and inclusivity, positioning O-RAN as a transformative force in 5G deployment and next-generation telecom infrastructure.

O-RAN Market Growth Drivers:

- The rising demand for convenience and healthy foods is predicted to promote the O-RAN market expansion.

The growing deployment of 5G has boosted the demand for the Open RAN. It is a complementary framework to 5G that provides the infrastructure to support 5G's advancements. The O-RAN provides the faster deployment of 5G networks. In December 2024, Liberty announced the collaboration with Samsung Networks Latin America to test Samsung’s O-RAN-compliant virtualized Radio Access Network (vRAN) and radios in its mobile network in Puerto Rico.

Liberty would be the first telecom operator in Puerto Rico and Latin America to introduce 5G vRAN and Open RAN technologies. This collaboration would allow Liberty to expand its 5G mobile network more easily with less hardware equipment. This new introduction of technology would be a significant addition to the Puerto Rico population with 5G coverage, although Liberty's 5G population coverage reached 97.5% in Puerto Rico.

Moreover, the coverage for 5G has been increasing around the world, with 18% population under the 5G coverage in 2021, increased to 31% of the population in 2022, and reaching 38% in 2023. However, this increased distribution is very remained uneven with Europe boasting the most extensive 5G coverage, with 68% of the population covered, followed by the Americas region with 59% and the Asia-Pacific region with 42%. However, only 12% population in the Arab States region, 8% in the CIS region, and 6% in the African region are within the 5G network.

The growing use of the O-RAN technology will provide a new and agile architecture, and reliable mobile connectivity, driving innovation in commercial networks and further bolstering 5G capabilities worldwide.

- The increase in massive MIMO technology is anticipated to boost the O-RAN market expansion.

Massive MIMO is predicted to account for a major market share due to the growing company investment in this technology and investments in 5G network coverage. Massive MIMO is a technology that uses multiple antennas at the base station to improve the throughput of a network and its capacity. The systems are based on spatial diversity, spatial multiplexing, and beamforming. Spatial diversity is when the radio signal is transmitted at several antennae, where each antenna transmits an altered version of the signal. This is very effective for ensuring the quality of the transmitted signal, as it spatially separates the receiving antennas from each other.

Another highlight of Massive MIMO is Beamforming. It works along with Massive MIMO to direct focus of the wireless signal, hence causing less interference between beams that are pointing in different directions. This implies that larger antenna arrays can be installed and boost the throughput and capacity of a network. Above everything, massive MIMO systems potentially indicate a more effective and efficient way of transmitting and receiving wireless signals.

Massive MIMO is expected to propel over the next coming years by mass commercialization of the world's 5G networks, relying on high data rates, low latencies, and huge connectivity. This 5G technology is consequently driving the demand higher. According to GSMA Intelligence data of February 2024, over half of mobile connections (51%) will be 5G by 2029 and 56% will be 5G at the end of the decade. Further, the report added that by the end of 2023, the 5G momentum with 1.6 billion connections worldwide is expected to reach 5.5 billion by 2030.

Furthermore, with expansion in 5G networks, larger antenna arrays would become more mainstream for the Massive MIMO to evolve. Technology will well advance along with the 3GPP specifications that then allow such antenna arrays to be feasible. mmWave is an important component of 5G performance and capacity which simply means that huge MIMO arrays would be mainstream during the forecasted years.

Following this, the increased number of 5G Base Transceiver Stations (BTS) makes a substantial contribution to Massive MIMO technology within the O-RAN market. Individual BTS with massive MIMO are likely to increase signal quality, reduce interference, and improve energy efficiency. Apart from AI/ML integration for 5G BTS, which optimizes Massive MIMO performance, including dynamic beamforming and user scheduling. There is a continuous increase in the number of 5G BTS deployed in India, as reflected in a Department of Telecommunication report, from 4,57,179 stations in September 2024 to the value of 4,62,854 stations in the country by November 2024. Growth in 5G BTS is one significant driving factor for the expansion of Massive MIMO technology in the O-RAN market.

O-RAN Market Geographical Outlook:

Based on geography, the O-RAN market is segmented into the Americas, Europe Middle East and Africa, and the Asia Pacific. The Open Radio Access Network (Open RAN) market in the United States is experiencing significant growth. One of the primary drivers of Open RAN adoption is the increasing demand for flexible and cost-effective network solutions. Traditional radio access networks often involve proprietary hardware and software, which can lead to vendor lock-in and high operational costs. Open RAN, by contrast, allows for multi-vendor integration, enabling telecom operators to mix and match components from different suppliers, thereby reducing costs and enhancing operational efficiency23. Major players like AT&T and Verizon are actively investing in Open RAN technologies to diversify their network infrastructure and improve service delivery.

The U.S. government has recognized the strategic importance of Open RAN in enhancing network security and reducing dependency on foreign technology suppliers, particularly from countries like China. Initiatives such as the Open RAN Policy Coalition have been established to promote this technology as part of a broader effort to bolster domestic telecommunications capabilities. This regulatory backing not only fosters competition among local vendors but also encourages innovation within the industry.

Open RAN enhances 5G deployments by establishing a direct link between the main network and the user’s devices, thereby providing subscriber information and location. Hence, various partnerships, demonstrations & trials, and investments are being implemented to complement the 5G deployment. For instance, In February 2022, Juniper Networks formed a collaboration with Parallel Universe and Vodafone both of which are pioneers in O-RAN solutions. The collaboration aimed to conduct a multi-vendor RAN Intelligent Controller trial thereby addressing business challenges faced by mobile operators around viable revenue generation, personalized user experience, and reduction in OPEX and CAPEX for 5G & 4G services. The trial emphasized developing open and agile mobile data delivery in any software-driven O-RAN environment. Furthermore, a few more key developments are imperative in driving the growth of the market. For instance in February 2024. MaxLiner Inc. launched “MXL17xxx” which is a highly integrated SoC optimized for 5G Open Radio Network and supports major Radio Units applications inclusive of massive MIMO, all-in-one small cell, and traditional macro.

In February 2022, Qualcomm Technologies formed a collaboration with Fujitsu to commercialize next-generation 5G mmWave DUs and RUs and further drive the transition towards modern 5 G mobile infrastructure. The collaboration was done under NTT Docomo’s “5G OREC Initiative,” which aimed to streamline modern network deployment and reduce the total cost by offering virtualized, O-RAN complaint, and cloud-native 5G solutions.

O-RAN Market Recent Developments:

- In February 2025, O-RAN Global PlugFest, Spring 2025: O-RAN ALLIANCE announced the launch of its Global PlugFest in Spring 2025, which offers a participation opportunity for members to collaborate on integration and interoperability testing from 18 labs globally.

- In March 2025, O-RAN Alliance announced the Strategic Agenda at MWC Barcelona 2025: At Mobile World Congress (MWC) Barcelona, the O-RAN Alliance laid out its plans for more widespread uptake, RIC integration, and alignment with 6G for the first time, which establishes a major commitment in the industry.

- In July 2025, O-RAN Alliance has published new technical documents: Since March 2025, O-RAN WORK GROUPS and FOCUS GROUPS have delivered 60 new or updated technical documents - further expanding the specification library and reducing deployment friction.

List of Top O-RAN Companies:

- Qualcomm Technologies

- Mavenir

- Cisco Systems, Inc.

- NEC Corporation

- Airspan Networks

O-RAN Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| O-RAN Market Size in 2025 | US$5.189 billion |

| O-RAN Market Size in 2030 | US$11.593 billion |

| Growth Rate | CAGR of 17.44% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in O-RAN Market |

|

| Customization Scope | Free report customization with purchase |

The O-RAN market is analyzed into the following segments:

- By Technology

- Massive MIMO

- Non-Massive MIMO

- By Spectrum Band

- Sub-6-Ghz

- mmWave

- By Architecture

- CU

- DU

- RU

- Others

- By Geography

- Americas

- United States

- Others

- Europe Middle East and Africa

- Germany

- UK

- Others

- Asia Pacific

- China

- Japan

- South Korea

- Others

- Americas

Our Best-Performing Industry Reports:

Navigation

- O-RAN Market Size:

- O-RAN Market Key Highlights:

- O-RAN Market Overview:

- O-RAN Market Trends:

- O-RAN Market Growth Drivers:

- O-RAN Market Geographical Outlook:

- O-RAN Market Recent Developments:

- List of Top O-RAN Companies:

- O-RAN Market Scope:

Page last updated on: September 22, 2025