Report Overview

Orange Terpenes Market - Highlights

Orange Terpenes Market Size:

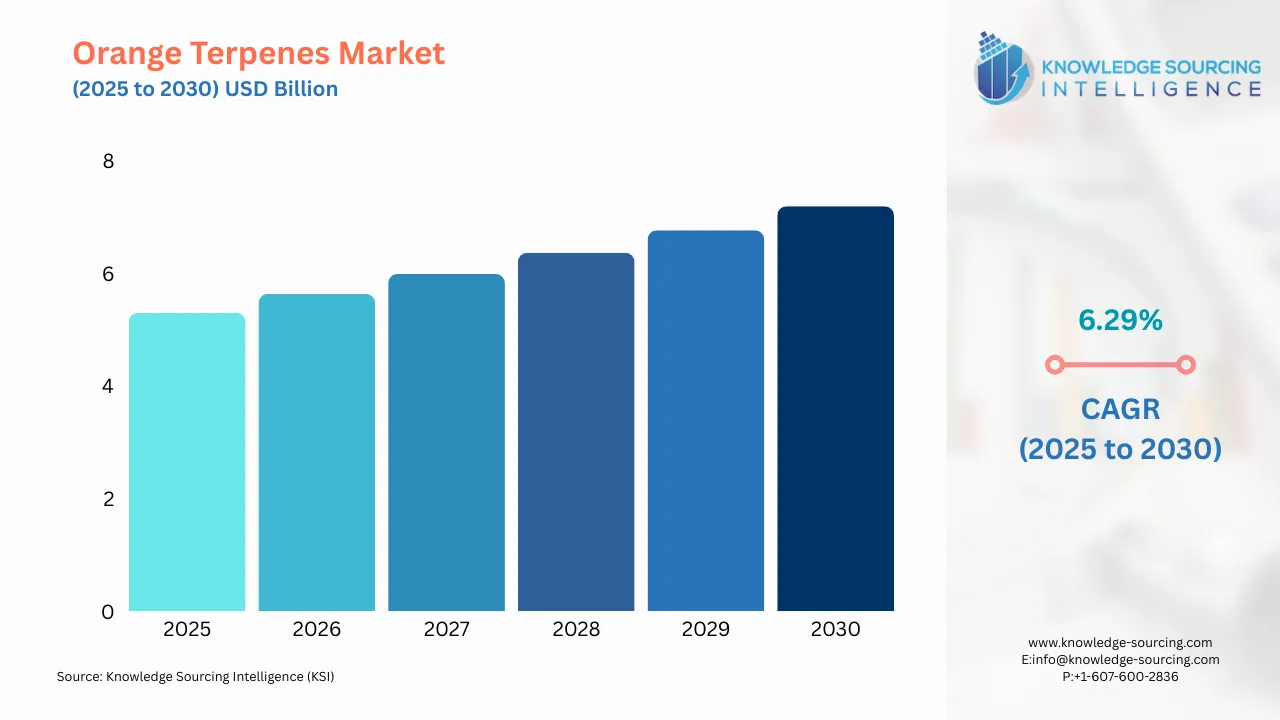

The Orange Terpenes Market is expected to grow at a CAGR of 6.29%, reaching a market size of US$7.190 billion in 2030 from US$5.299 billion in 2025.

Orange Terpenes are organic compounds that are naturally occurring and extracted from orange peels during the production of orange essential oil. D-limonene is the primary component of orange terpenes. It is produced through high vacuum fractional distillation of orange oils, where its odor, purity, moisture, and color are carefully controlled for a consistent product.

Orange terpenes are widely used across various industries due to several properties. It is used in the food and beverage industry as a natural flavoring agent, and in cosmetics and personal care products like perfumes, lotions, etc., for its fragrance. It is widely used as a cleansing product in households and industries for its excellent solvency and degreasing properties. It has applications in pharmaceuticals, agriculture, and other industries. It is also used as a solvent for paints & coatings and in lubricants industries. Its benefits over many other solvents, as well as its biodegradability, are driving its market growth.

The market growth of orange terpenes is driven by its increasing demand for end-use applications like cosmetics, food & beverage, personal care products, etc. At the same time, the ever-increasing health and environmental-conscious population's rising preference for natural and sustainable ingredients is driving its market growth.

Orange Terpenes Market Growth Drivers:

- Rising consumer preference for organic and natural products

The growing global trend toward a healthier and more sustainable way of life is driving the demand for organic food. People are becoming increasingly aware of the negative health effects of chemical or synthetic products on their personal and environmental health, leading to the rising demand for organic and natural products. People worldwide are increasingly prioritizing health and environmental sustainability in their food choices, leading to the demand for orange terpenes as the natural flavoring product in foods and beverages and as additives. Additionally, the sustainable production process of orange terpenes is driving its market growth.

- Growing demand for bio-based chemicals is driving its demand for cleansing products

Orange terpenes possess natural antibacterial as well as antifungal properties. It is also an excellent solvent with degreasing properties, making it ideal for bio-based cleansers. The increasing focus on sustainability and environment-friendly products is driving the need for orange terpenes. Orange terpenes are sustainable and eco-friendly, and demand is increasing as people seek bio-based products over petroleum-based ones. The health impacts of chemical-based cleansing products are shifting people's preference towards bio-based cleansing products, leading to the orange terpenes market expansion.

Orange Terpenes Market Restraints:

- Raw material availability poses a major challenge, leading to supply chain issue

Orange terpenes are extracted from the peels of orange; thus, the volatility in raw material leads to supply chain challenges in the orange terpenes market. Diseases, climate, natural disasters, etc., impact orange crops. As per the data by USDA, the bearing acreage of Florida, one of the major oranges producing states, has declined at an average rate of 3% per year since 2004. The volatility in the availability of raw materials leads to significant issues like price fluctuation of oranges impacting the cost of orange terpenes. The increased cost makes the orange terpenes market vulnerable to its other citrus-based products, posing market restraint.

Orange Terpenes Market Segment Analysis:

- The industrial segment will continue dominating the orange terpenes market by application, while the pharmaceutical segment will emerge with new opportunities

Orange terpenes have a wide variety of uses in the industrial sector. It is used as a solvent for paints, coatings, and lubricants. It is also used as an industrial cleanser for removing grease, resin, oils, and paints. It has applications such as cleansing electronic assemblies and high-voltage electronic parts. Thus, orange terpenes are widely demanded in the industrial sector for their cleansing and solvency properties. This segment is anticipated to continue to dominate the market.

During the forecast period, new opportunities will be rising in the pharmaceutical segment. It is increasingly being formulated for delivering the strain-specific profile. It is being demanded for its anti-inflammatory and antioxidant properties. It is also being used for antimicrobial and antiviral properties. Expanding research in natural remedies and the push for sustainability make orange terpenes a promising ingredient for various pharmaceutical uses, and the forecast period is anticipated to witness growth in the pharmaceutical segment.

Orange Terpenes Market Geographical Outlook:

- North America will hold the largest market share during the forecast period

Based on Geography, North America is estimated to hold a significant share of the orange terpenes market. The demand for organic flavoring agents and additives is growing among the health-conscious population of North American countries. The overall demand for organic and natural foods is driving the orange terpenes market. As per the Organic Trade Association, U.S. sales of certified organic products approached $70 billion in 2023, 3.4% higher than in 2022, reflecting the rising consumer preference for organic and natural food. The demand for orange terpenes as a bio-based cleansing product is also driving its market growth. Furthermore, the strong presence of the key regional market players is meeting the demand for orange terpenes.

Europe also holds a significant share of the orange terpenes market due to its growing demand in the cosmetic, food & beverage industries and the need for organic and eco-friendly products.

On the other hand, the Asia Pacific region will experience significant market expansion during the forecast period due to growing awareness of natural and organic products. The need for orange terpenes in the food and beverage industry, along with its increased demand in cosmetic industries with the presence and growth of a middle-class health-conscious population, is propelling its market growth.

List of Top Orange Terpenes Companies:

- Firmenich

- The Lebermuth Company Inc.

- Citrus and Allied Essence Ltd.

- Florida Chemical Company

- Berje Inc.

Orange Terpenes Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Orange Terpenes Market Size in 2025 | US$5.299 billion |

| Orange Terpenes Market Size in 2030 | US$7.190 billion |

| Growth Rate | CAGR of 6.29% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Orange Terpenes Market |

|

| Customization Scope | Free report customization with purchase |

Orange Terpenes Market is analyzed into the following segments:

- By Limonene Concentration

- >95%

- >98%

- >99%

- By Form

- Pure Form

- Blended Form

- By Application

- Homecare

- Industrial

- Food & Beverage

- Pharmaceutical

- Cosmetic and Personal Care

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- Australia

- India

- Indonesia

- Thailand

- Others

- North America

Our Best-Performing Industry Reports:

Navigation

- Orange Terpenes Market Size:

- Orange Terpenes Market Key Highlights:

- Orange Terpenes Market Growth Drivers:

- Orange Terpenes Market Restraints:

- Orange Terpenes Market Segment Analysis:

- Orange Terpenes Market Geographical Outlook:

- List of Top Orange Terpenes Companies:

- Orange Terpenes Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 11, 2025