Report Overview

Pipeline Security Market - Highlights

Pipeline Security Market Size:

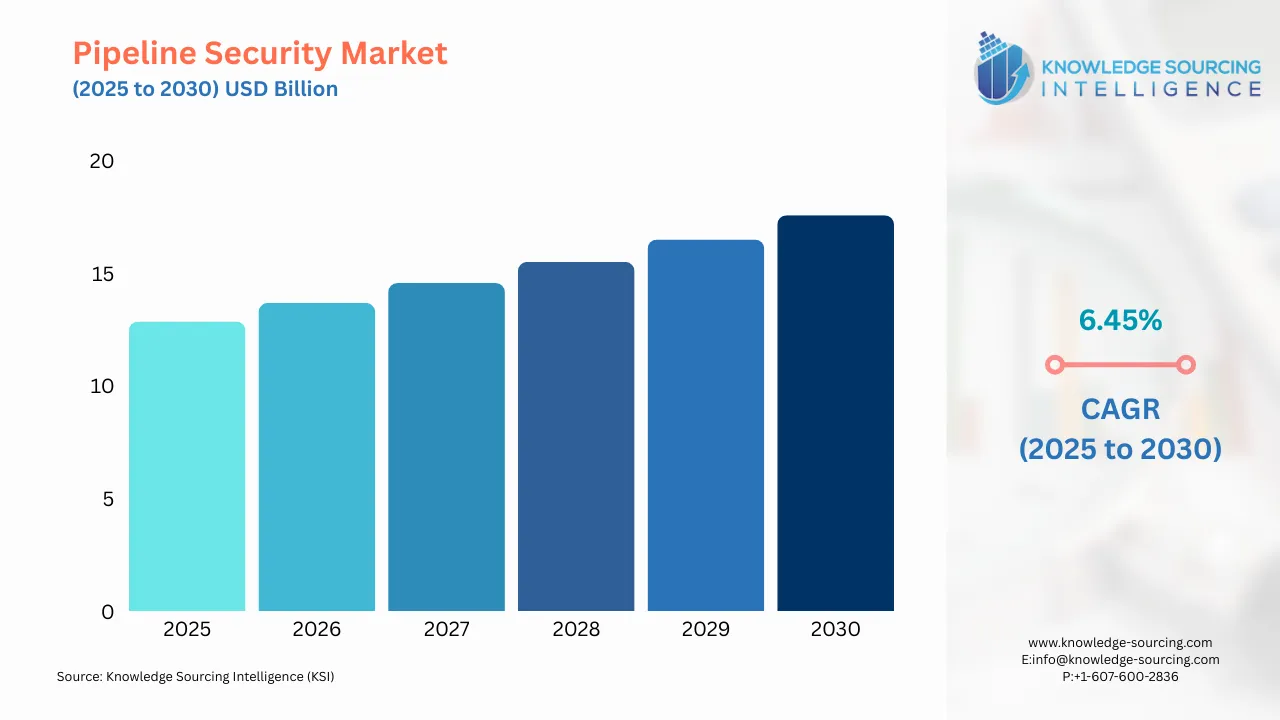

The pipeline security market is valued at US$12.850 billion in 2025 and is projected to grow at a CAGR of 6.45% to reach US$17.565 billion in 2030.

Pipeline Security Market Highlights:

AI and machine learning enhance real-time threat detection and predictive maintenance.

Pipeline Security Market Overview:

Pipeline security is the protection of land-based pipelines against sabotage, illegal tapping, and terrorist activities involving the pipelines. Global pipeline security solutions are gaining importance across the globe owing to increased terrorist attacks and cybersecurity threats worldwide. Another key driver of the market is the increasing demand for pipeline security solutions, coupled with increasing investments in these solutions.

The growing global demand for natural gas across transportation and power generation sectors is significantly driving the need for advanced pipeline security solutions. As energy consumption rises, particularly in developing nations requiring expanded extraction and distribution infrastructure, the market for these protective measures continues to expand. Government agencies worldwide are increasingly adopting specialized security systems to counter rising threats, with many nations allocating substantial funds to safeguard critical pipeline networks against both cyber threats and physical attacks. This heightened security focus, combined with the current lack of integrated platforms capable of addressing both physical and cyber vulnerabilities, is creating strong market growth opportunities.

North America currently dominates the pipeline security market, a position reinforced by ongoing shale gas exploration activities across the region. The substantial increase in natural gas production directly correlates with greater demand for comprehensive safety solutions, as expanded infrastructure requires corresponding security measures. This trend is expected to persist, with market analysts projecting continued growth as energy producers prioritize protecting their increasingly valuable pipeline assets against evolving threats in the coming years.

Pipeline Security Market Trends:

The pipeline security market is undergoing a transformative phase, driven by the critical need to protect vital energy infrastructure amid evolving physical and cyber threats. As pipelines remain the backbone of global energy transportation, carrying oil, natural gas, and refined products across vast distances, securing these assets has become a priority for governments, energy companies, and technology providers. The integration of advanced technologies such as artificial intelligence (AI), Internet of Things (IoT), and advanced sensors, coupled with heightened regulatory scrutiny, is reshaping the landscape of pipeline security.

Integration of AI and Machine Learning for Threat Detection: The adoption of AI and machine learning (ML) is revolutionizing pipeline security by enabling proactive threat detection and predictive maintenance. AI-powered systems analyze vast datasets from sensors, cameras, and IoT devices to identify anomalies, such as potential leaks or unauthorized access, in real time.

Rise of Distributed Fiber Optic Sensing: Distributed fiber optic sensing (DFOS) is gaining traction as a cutting-edge solution for pipeline monitoring. By using fiber optic cables as sensors, DFOS systems detect vibrations, temperature changes, and acoustic signals along pipelines, pinpointing potential threats like sabotage or leaks with high precision.

Convergence of Physical and Cybersecurity: The growing interconnectivity of pipeline systems through IoT and Supervisory Control and Data Acquisition (SCADA) systems has expanded the attack surface for cyber threats. As a result, the pipeline security market is witnessing a convergence of physical and cybersecurity solutions.

Adoption of Drones and Autonomous Systems: Drones and autonomous systems are becoming integral to pipeline security, offering cost-effective and scalable solutions for monitoring vast pipeline networks.

Pipeline Security Market Growth Drivers:

Increasing Threats to Energy Infrastructure: The pipeline security market is experiencing significant growth due to escalating physical and cyber threats targeting critical energy infrastructure.

Regulatory Compliance and Safety Mandates: Governments worldwide are implementing stringent regulations to protect critical infrastructure, driving demand for advanced pipeline security systems.

Global Energy Demand and Infrastructure Expansion: The rising global demand for energy, coupled with the expansion of pipeline networks to support emerging energy sources like hydrogen, is a key driver of the pipeline security market.

Pipeline Security Market Segmentation Analysis:

Pipeline Security Market Segmentation Analysis by Product Type:

Access Control Systems: Restrict unauthorized access to pipeline facilities, enhancing physical security.

Intrusion Detection Systems: Detect unauthorized activities or breaches along pipeline routes using sensors and analytics.

Video Surveillance Systems: Provide real-time monitoring and recording to deter and respond to security incidents.

Leak Detection Systems: Identify and locate leaks to prevent environmental damage and operational losses.

SCADA (Supervisory Control and Data Acquisition) Systems: Enable centralized monitoring and control of pipeline operations, integrating with security solutions.

Others: Include advanced technologies like drone-based surveillance and AI-driven analytics for comprehensive security.

Pipeline Security Market Segmentation Analysis by Deployment Type:

On-premise: Offers robust control and security for critical infrastructure, preferred for high-risk environments.

Cloud: Provides scalability and remote access, suitable for modern, interconnected systems.

Hybrid: Combines on-premise and cloud solutions for flexibility and enhanced security.

Pipeline Security Market Segmentation Analysis by End-Use Sector:

Oil & Gas: Dominates due to extensive pipeline networks and high vulnerability to physical and cyber threats.

Water & Wastewater: Requires security to protect critical water supply infrastructure.

Chemical & Petrochemical: Demands advanced security to prevent sabotage and ensure operational safety.

Energy & Utilities: Focuses on securing energy distribution networks against disruptions.

Others: Includes emerging applications like hydrogen pipelines, requiring tailored security solutions.

Pipeline Security Market Geographical Outlook:

The Pipeline Security market report analyzes growth factors across the following regions:

North America: Dominates due to extensive pipeline infrastructure and stringent regulatory mandates, particularly in the US.

South America: Growing demand driven by expanding energy infrastructure in countries like Brazil and Argentina.

Europe: Strong focus on energy security and regulatory compliance, with growth in Germany, UK, and France.

Middle East and Africa: High growth potential due to critical energy infrastructure and geopolitical risks in Saudi Arabia and UAE.

Asia Pacific: Rapid infrastructure expansion and energy demand drive growth in China, India, and South Korea.

Pipeline Security Market Competitive Landscape:

Honeywell International Inc.: Offers integrated security solutions combining SCADA systems and AI-driven analytics for pipeline protection.

Siemens AG: Provides advanced automation and cybersecurity solutions for pipeline security.

OptaSense Ltd.: Specializes in distributed fiber optic sensing for precise pipeline monitoring.

These companies are driving innovation through advanced technologies and strategic partnerships, enhancing market competitiveness.

Pipeline Security Market Latest Developments:

April 2025: Indian Oil Corporation Limited (IOCL) introduced LEAKSENSE, India’s first AI-powered Pipeline Intrusion and Detection Warning System, at Startup Mahakumbh.

January 2025: OptaSense, a QinetiQ company, advanced its distributed fiber optic sensing (DFOS) technology, improving detection accuracy for long-distance pipelines.

March 2024: Sonatrach, in collaboration with Huawei, presented an AI-driven smart pipeline inspection solution at MWC Barcelona.

Pipeline Security Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 12.850 billion |

| Total Market Size in 2030 | USD 17.565 billion |

| Forecast Unit | Billion |

| Growth Rate | 6.45% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Product Type, Deployment Type, End-Use Sector, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Pipeline Security Market Segmentation:

By Product Type

Access Control Systems

Intrusion Detection Systems

Video Surveillance Systems

Leak Detection Systems

SCADA (Supervisory Control and Data Acquisition) Systems

Others

By Deployment Type

On-premise

Cloud

Hybrid

By End-Use Sector

Oil & Gas

Water & Wastewater

Chemical & Petrochemical

Energy & Utilities

Others

By Region

North America

US

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

India

South Korea

Thailand

Indonesia

Others