Report Overview

Probe Card Market - Highlights

Probe Card Market Size:

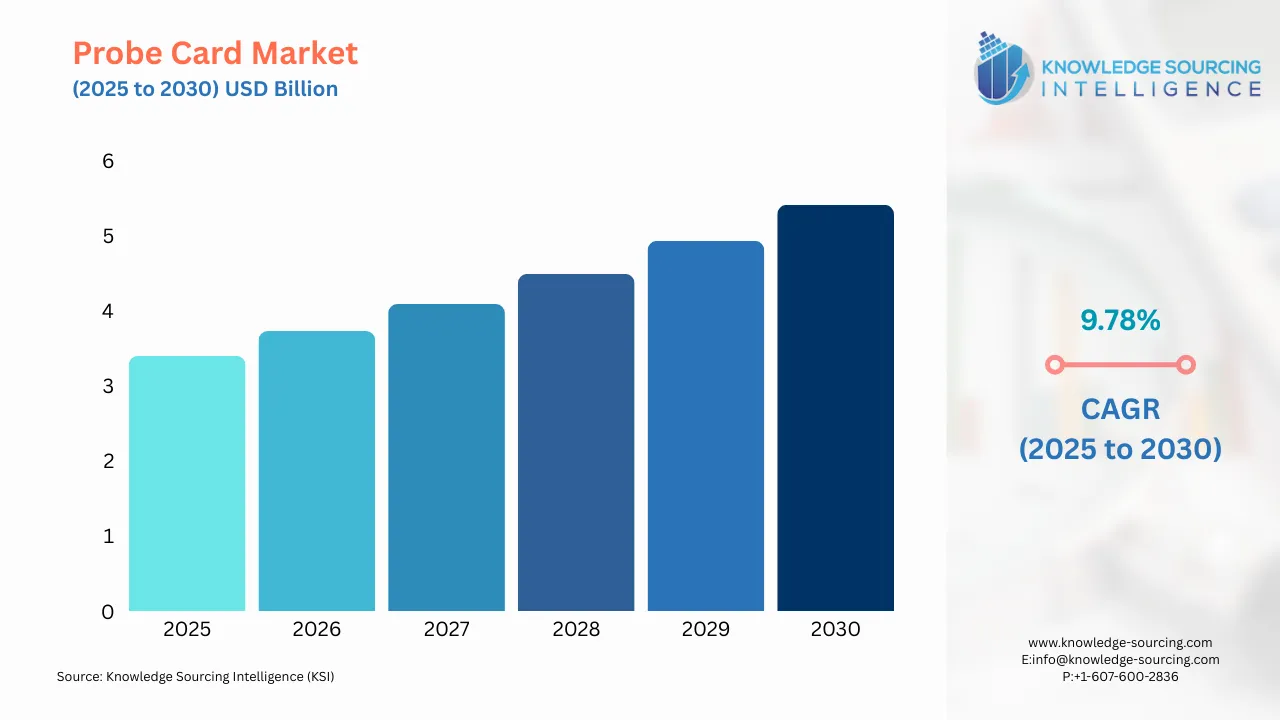

The probe card market is projected to grow from US$3.395 billion in 2025 to US$5.413 billion by 2030 at a CAGR of 9.78% during the forecasted period.

Probe Card Market Trends:

A probe card is a specialized testing equipment utilized in the semiconductor manufacturing process for enhancing electrical testing by checking the performance, quality, and functionality of the integrated circuit and other semiconductor products. The market for probe cards is witnessing growth due to diverse growth drivers such as the improvement in the complexity of semiconductor design, inclusive of integrated circuits and microchips, which are utilized in consumer electronics, automotive, and other industries. Additionally, the favorable collaboration between market players along with innovative product launches in this market is also predicted to directly promote the market expansion in the coming years.

Probe Card Market Overview & Scope:

The probe card market is segmented by:

- Probe Type: By probe type, the probe card market is segmented into advanced probe cards and standard probe cards. The advanced probe card is growing with the changing industrial requirements. The increasing complexity of semiconductor devices has boosted the need for precise and reliable testing solutions, which has positively impacted the market demand. The rise in demand for advanced technologies like 5G, AI, and IoT, which require higher-performance chips that need thorough validation with advanced probe cards, is further propelling the market expansion.

- Technology Type: By technology type, the probe card market is segmented into vertical, MEMS, cantilever, specialty, and others. The vertical is predicted to hold major market share. Rising demand for testing advanced semiconductors is driving the adoption of vertical probe cards. Meanwhile, MEMS probe cards are gaining traction due to their accuracy in testing fine-pitch and high-density ICs.

- Wafer Size: By wafer size, the probe card market is segmented into up to 5 inches, 5 to 8 inches, and greater than 8 inches. The 5 to 8 inches segment is the fastest-growing market share, this is due to the wide application in semiconductor manufacturing along with the cost effectiveness and scalability

- Material: By material, the probe card market is segmented into silicon, tungsten, and others. The silicon segment is rapidly expanding in the material segment. Silicon-based probe cards are compatible with smaller and advanced nodes in semiconductor manufacturing. The utilization of silicon material in probe cards ensures the device's high electrical performance, promoting the growth of the segment.

- Application: By application, the probe card market is segmented into DRAM, parametric, foundry & logic, and others. The DRAM segment is expected to have a significant market share in this segment.

- Region: The Asia Pacific is poised to hold a prominent position in the probe card market, particularly due to its increasing domestic semiconductor industry and presence of regional players. Additionally, the increase in miniaturization in electronics demands testing equipment like probe cards is propelling the regional market.

________________________________________

Top Trends Shaping the Probe Card Market:

1. Increase Advanced Prode Card Integration

- The rising demand for advanced probe cards is expected to increase owing to the increasing complexity of integrated circuits and chips. This rising trend is witnessed as chip manufacturers work with smaller nodes and higher-density designs; there has been an increase in reliance on high-precision probe cards for accurate testing and quality assurance.

2. Rising Adoption of Artificial Intelligence (AI) and Automation

- There is a rise in the adoption trend of AI and automation in the probe cards for increasing the accuracy and efficiency of the product., This is integrated in the automated probe card solutions to meet the high-throughput application requirement for the semiconductor sector.

________________________________________

Probe Card Market Growth Drivers vs. Challenges:

Drivers:

- Growth in Semiconductor Sector: The rise in semiconductor sales, which indicates an increase in semiconductor production, leads to propelling this market, as probe cards are a critical solution in testing for the performance and functionality of the wafer during manufacturing. As per data from the Semiconductor Industry Association (SIA) of February 2025, the semiconductor industry stood at US$526.8 billion in 2024, which is an increase of 19.1 percent from 2023 sales, which were valued at US$ 526.8 billion. Majorly semiconductor annual sales in 2024 were highest in the Americas, which was 44.8 percent, followed by China at 18.3 percent.

Moreover, the increased consumer demand for semiconductors has propelled the overall sales, for instance, according to World Semiconductor Trade Statistics, in 2024, the estimated global semiconductor sales stood at US$626.869 billion, which witnessed a growth of 18.97% over the preceding year’s sales volume. Additionally, the same source also mentions major regions such as Asia Pacific also witnessed 17.5% growth in 2024 and will experience 10.4% growth in 2025.

- Growing Complexity of Semiconductors: The growing complexity and advancement in the semiconductors, which are utilized in diverse applications, primarily in consumer electronics, automotives, and data centres, require a reliable semiconductor-level testing, which is promoting the market demand for probe cards. Semiconductors are transitioning into utilization for 5G, artificial intelligence (AI), Internet of Things (IoT) devices, and other high-performance computing. This is growing the development of these chips for managing the complex signal processing, along with supporting the high frequency transmission and providing quicker data transmission with reduced delay.

These complex semiconductor developments lead to a requirement for precision testing to ensure the performance, reliability, and functionality of these advanced chips, which boosts the demand for probe cards globally. Additionally, with the increasing production volume of advanced semiconductors is witnessed with proficient utilization is witnessed in ADAS in automotives, consumer electronics, and data centers, which will lead to efficient and high-performance testing equipment where probe card becomes a critical tool, boosting their market demand.

According to the Japan Electronics and Information Technology Industries Association (JEITA) data, the production value of consumer electronics accounted for 62,648 million yen as of February 2025, which is an increase of 101.5 percent from the previous year. This growing production will positively increase the semiconductor demand, propelling the probe card utilization for testing across the region.

- Rising Government Investments: Major semiconductor manufacturers, namely Taiwan Semiconductor Manufacturing Company (TSMC), are showing interest in expanding their operations in diverse regions, mainly in Japan and the United States, which has further provided new growth opportunities for semiconductor technologies. As per the March 2025 press release, TMSC announced it to invest US$100 billion to expand its advanced semiconductor manufacturing in the United States. Moreover, government initiatives such as the “CHIPS and Science Act” are also acting as additional driving factors for the growth in this market.

- Increase in Vertical Probe Card Demand: Vertical probe cards are widely used in semiconductor testing due to their ability to handle high parallel testing and advanced wafer nodes efficiently. Their demand is rising as chip manufacturers increasingly adopt complex and high-density IC designs, especially in sectors like 5G, AI, and data centres.

The growing need for faster, more reliable semiconductor testing, combined with advancements in chip packaging, continues to push the adoption of vertical probe cards. According to Semiconductor Equipment and Materials International, the semiconductor manufacturing equipment market showed steady growth, with global revenues rising from US$106.3 billion in 2023 to US$117.1 billion in 2024, supporting this upward trend.

Challenges:

- High Investment Cost: The high cost of investment for the setup and maintenance of probe cards, particularly advanced probe cards, can be financially pressuring for smaller manufacturers, which could limit their adoption, leading to hamper the market.

________________________________________

Probe Card Market Regional Analysis:

- North America: The end-users' demand for semiconductors in the United States is poised for a positive expansion fueled by the bolstering growth in smart electronics, automotives, and automation applications, all of which require semiconductor usage. The improved demand has made the nation invest in its semiconductor technologies and improve its overall capacity, leading to growth in the market.

According to the Semiconductor Association (SIA), the United States constitutes a 50.7% share of global semiconductor sales, and from 2001 to 2024, the country’s semiconductor sector has invested nearly 20% of its revenue in R&D operations. Likewise, the same source also dictates that SIA members are engaging in private investment of nearly US$540 billion to bolster US semiconductor manufacturing, with future goals to increase the country’s share in wafer fabrication by 203% and advance logic capacity to 28% by 2032.

Probe Card Market Competitive Landscape:

The market is fragmented, with many notable players, including Japan Electronic Materials Corporation, Micronics Japan Co., Ltd, Korea Instruments Co., Ltd, FormFactor, Feinmetall, Nidec SV Probe, TSE Co., Ltd., Willtechnology, Suzhou Silicon Test System Co., Ltd., Technoprobe S.p A, MPI Corporation, and Wentworth Laboratories, Inc., among others.

- Collaboration: In February 2025, Advent Corporation announced a strategic collaboration with Micronics Japan, a global probe card manufacturer, to offer innovative and reliable semiconductor test solutions. This collaboration focuses on meeting the future market with the rise in advancement and complexity of semiconductors. They work to align their expertise to advance the customer's test process and the cost of chip testing.

Probe Card Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Probe Card Market Size in 2025 | US$3.395 billion |

| Probe Card Market Size in 2030 | US$5.413 billion |

| Growth Rate | CAGR of 9.78% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Probe Card Market |

|

| Customization Scope | Free report customization with purchase |

________________________________________

Probe Card Market Segmentation:

By Probe Type

- Advanced Probe Card

- Standard Probe Card

By Technology Type

- Vertical

- MEMS

- Cantilever

- Specialty

- Others

By Wafer Size

- Up to 5 Inches

- 5 to 8 Inches

- Greater than 8 Inches

By Material

- Silicon

- Tungsten

- Others

By Application

- DRAM

- Parametric

- Foundry & Logic

- Others

By Region

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

Our Best-Performing Industry Reports:

Navigation:

- Probe Card Market Size:

- Probe Card Market Key Highlights:

- Probe Card Market Trends:

- Probe Card Market Overview & Scope:

- Top Trends Shaping the Probe Card Market:

- Probe Card Market Growth Drivers vs. Challenges:

- Probe Card Market Regional Analysis:

- Probe Card Market Competitive Landscape:

- Probe Card Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 30, 2025