Report Overview

Prunes Market Size, Share, Highlights

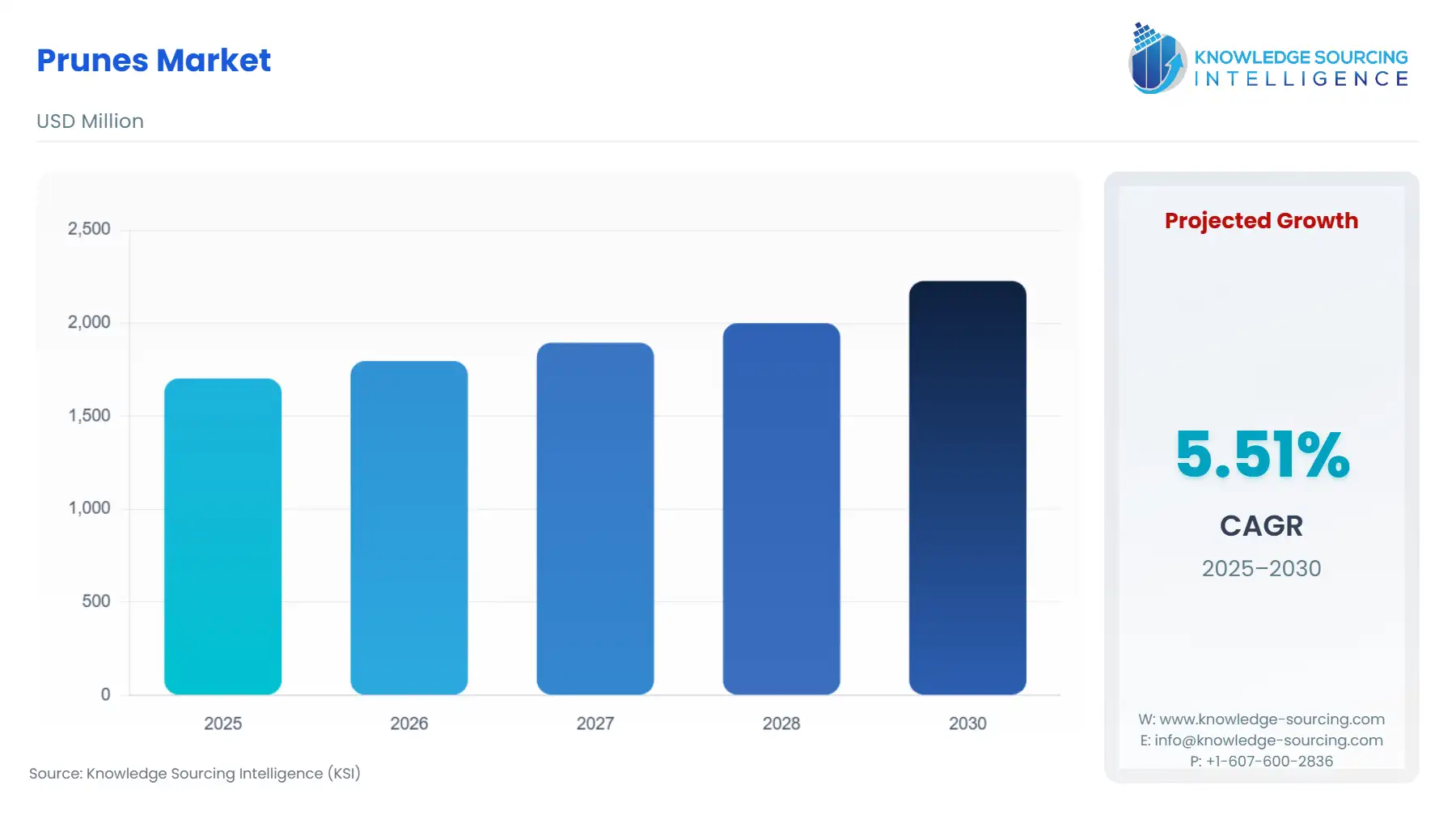

Prunes Market Size:

The Prunes Market is anticipated to climb from USD 1,702.595 million in 2025 to USD 2,226.542 million by 2030, registering a 5.51% CAGR.

The global prunes market is transitioning from a commodity-driven segment, historically tied to traditional laxative applications, to a sophisticated component of the functional food and nutraceutical value chain. This shift is predicated on a convergence of robust scientific validation of prunes' health benefits and demographic tailwinds, primarily the aging populations in developed economies seeking natural solutions for digestive and bone health. The market structure is characterized by a high degree of geographic concentration in production—namely, the US (California) and Chile—which introduces significant supply chain volatility linked to regional climate variations. This supply constraint, coupled with escalating demand from emerging economies, particularly within the Asia-Pacific, is putting upward pressure on bulk pricing and accelerating the pivot toward value-added prune products such as purées, concentrates, and powders for industrial use. This structural market tension between concentrated supply and diversifying global demand defines the current investment landscape for industry experts.

Prunes Market Analysis:

- Growth Drivers

The primary factor propelling demand is the scientifically validated role of prunes as a functional food. Academic studies underscore prunes' efficacy, noting their superiority to certain fiber-based laxatives for improving bowel movements and their significant sorbitol and phenolic compound content, which provide digestive benefits without the rapid glycemic response often associated with other dried fruits. This evidence directly increases demand by repositioning prunes in the consumer mind as a daily dietary staple for overall health, moving beyond a sporadic-use remedy. A secondary driver is the pronounced demographic aging trend in major consumption regions, including Europe and North America. As the population aged 60 and older expands, the market for products addressing age-related issues, specifically bone density maintenance and chronic constipation, expands correspondingly. Studies reinforce that consuming 50 to 100 grams of prunes daily helps postmenopausal women retain bone mineral density, a finding that generates direct, sustained demand from the nutraceutical and dietary supplement sectors targeting this demographic.

- Challenges and Opportunities

The key challenge facing the market is the inherent volatility of the raw material supply, tied almost exclusively to climate-sensitive prune plum cultivation in regions like California and Chile. Periods of drought, unseasonal frost, or intense heat directly impact crop yield, creating immediate price spikes and forcing processors and industrial buyers to manage inventory risk actively. This supply risk constrains market expansion and limits the predictability required for large-scale industrial incorporation. Conversely, a significant opportunity lies in the burgeoning Asian-Pacific consumer base, exemplified by the surge in Chinese import volume. This explosive growth is driven by rising middle-class disposable income and a growing preference for Western "superfoods." This emerging demand allows exporters to diversify their market dependency away from mature European and North American markets, opening a high-volume, premium-priced channel for value-added prune products.

- Government Regulations

Key governmental and supra-governmental regulatory actions significantly impact the market by enforcing quality standards and funding demand-side research. For instance, the USDA Marketing Order for Dried Prunes Produced in California implemented a final rule in April 2023, increasing the assessment rate to $0.33 per ton. This action directly funds the California Prune Board’s marketing, research, and inspection activities, strengthening the premium branding of California prunes and supporting long-term demand-building research.

Prunes Market In-Depth Segment Analysis:

- By Application: Food and Beverages

The Food and Beverages segment represents the largest and most dynamic application channel, driven by prunes' dual functionality as a natural sweetener and a moisture-retention agent. Manufacturers are increasingly substituting refined sugars and artificial additives with prune purée and paste in bakery, confectionery, and meat products to achieve "clean label" formulations. The demand creation is explicit: Prune paste's capacity to extend the shelf life of baked goods and naturally enhance their texture directly reduces the reliance on less desirable chemical humectants. The inherent fiber and nutrient density of the purée also allow food companies to make favorable nutritional claims, which is a core demand catalyst in the modern consumer-packaged goods market. The incorporation into gluten-free products, a high-growth niche, further accelerates demand in this segment as manufacturers seek natural, high-fiber alternatives to traditional grain binders.

- By Distribution Channel: Online Retail

The Online Retail segment is experiencing an accelerated demand trajectory, capitalizing on its ability to bypass traditional retail limitations and target niche, health-focused consumers. This channel is uniquely positioned to handle the proliferation of specialized prune products, such as organic, single-origin, or proprietary-branded prune powders and dietary supplements, which are often unavailable in conventional supermarkets. The demand is amplified by direct-to-consumer digital marketing that leverages the scientific research on prunes’ health benefits, such as those related to cardiovascular and bone health. Furthermore, the subscription model prevalent in e-commerce ensures recurring demand for products categorized as daily health supplements. The platform's logistical capability to deliver small, high-value orders efficiently, bypassing the centralized institutional sale channels, directly drives sales among younger, health-conscious consumers who may have historically avoided prunes due to their traditional market association.

Prunes Market Geographical Analysis:

- US Market Analysis (North America): The US market acts as both a major producer and a significant consumer, necessitating substantial imports, particularly from Chile, to meet domestic demand. The demand driver is fundamentally bifurcated: a steady institutional consumption (e.g., hospitals, schools) and a rapidly expanding premium retail segment. The presence of the California Prune Board, which actively funds nutrition research and marketing, generates consumer demand by creating an association between the product and verified health benefits, specifically bone protection in postmenopausal women, directly supporting the Nutraceuticals and Dietary Supplements segment.

- Brazil Market Analysis (South America): Brazil represents a high-potential market characterized by a growing middle class and increasing urbanization, leading to higher rates of Westernized diets and associated digestive issues. Demand is primarily driven by consumer awareness campaigns emphasizing the product's natural laxative properties, targeting a population increasingly seeking functional foods. Local factors, including the proximity to major South American producers (Chile, Argentina), often translate into more favorable import logistics and pricing compared to other global markets, accelerating the adoption of prunes in bakery and confectionery applications as a cost-effective ingredient.

- France Market Analysis (Europe): France is a historically significant market, being both a major consumer and the largest European producer and re-exporter of prunes, particularly the Pruneau d’Agen. The local demand is rooted in tradition, with prunes viewed as a high-quality agricultural product integrated into regional cuisine. The premium perception of the locally-produced d’Agen prune sustains high retail pricing and demand for whole, pitted prunes in specialty stores. Furthermore, France acts as a central hub for re-exporting processed prune derivatives, like prune paste, to other European industrial food manufacturers, maintaining a consistent demand for raw material imports.

- South Africa Market Analysis (Middle East & Africa): The South African market, a key entry point for the broader African continent, exhibits an emerging demand profile where prunes are positioned more as a niche health or "specialty dried fruit" item. Demand is catalyzed by the increasing prevalence of Western-style supermarket chains and specialty health stores, particularly in urban centers. Local factors impacting demand include relatively high import tariffs and logistical complexity, which make prunes a premium-priced item. However, the product’s long shelf life makes it suitable for local distribution chains, driving institutional interest from the foodservice sector.

- China Market Analysis (Asia-Pacific): China is the critical growth epicenter, evidenced by the dramatic 69.3% import surge in 2023. Demand is intensely focused on the functional health attributes of prunes, with consumers linking them to bone health and digestive wellness, aligning with traditional Chinese medicine's focus on food-based remedies. The demand creation strategy revolves around direct imports, primarily from Chile and the U.S., which leverage their established high-quality, clean-label reputations. The rapid expansion of e-commerce platforms and digital payment systems facilitates the market penetration of imported, branded prune products, targeting the affluent, health-conscious urban consumer.

Prunes Market Competitive Analysis:

The Prunes Market is moderately concentrated, dominated by a few large vertically integrated grower-processors and global food ingredient suppliers. The competitive structure is defined by raw material control, global distribution networks, and investment in nutrition research to create demand. Major players compete not solely on price, but increasingly on the verified quality, clean-label attributes, and health messaging surrounding their product lines.

Prunes Market Company Profiles:

- Sunsweet Growers Inc.: Sunsweet Growers, a cooperative based in California, maintains a strategic position as the world’s largest handler of dried fruits, predominantly prunes. Their competitive advantage stems from their direct control over a significant portion of the California prune crop, providing substantial supply security.

- Mariani Packing Company, Inc.: Mariani is another significant US-based competitor, operating primarily as a dried fruit packer and distributor. Their strategic positioning involves a broad product portfolio and robust retail distribution partnerships. The company focuses on product diversification within the dried fruit category, leveraging its extensive retail shelf space to drive sales of its whole and pitted prunes.

Recent Market Developments:

- June 2023: Sunsweet Growers unveiled three new products aimed at health-conscious consumers, which are Sierra Trail Bites, Probiotic+ Prunes, and Amaz!n Prune with Lemonade. Probiotic+ Prunes add BC30 probiotics to deliver digestive and immune benefits; and Amaz!n Prune with Lemonade is a low-sugar drink that retains prune juice’s fiber and offers vitamin C.

Prunes Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 1,702.595 million |

| Total Market Size in 2031 | USD 2,226.542 million |

| Growth Rate | 5.51% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Distribution Channel, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Prunes Market Segmentation:

- BY PRODUCT TYPE

- Whole Prunes

- Chopped Prunes

- Prune Juice and Concentrates

- Prune Paste

- Dried Prune Powder

- BY APPLICATION

- Food and Beverages

- Nutraceuticals and Dietary Supplements

- Pharmaceuticals

- Cosmetics and Personal Care

- BY DISTRIBUTION CHANNEL

- Offline

- Supermarkets & Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Foodservice & Institutional Sales

- Offline

- BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America