Report Overview

Remote Sensing Services Market Highlights

Remote Sensing Services Market Size:

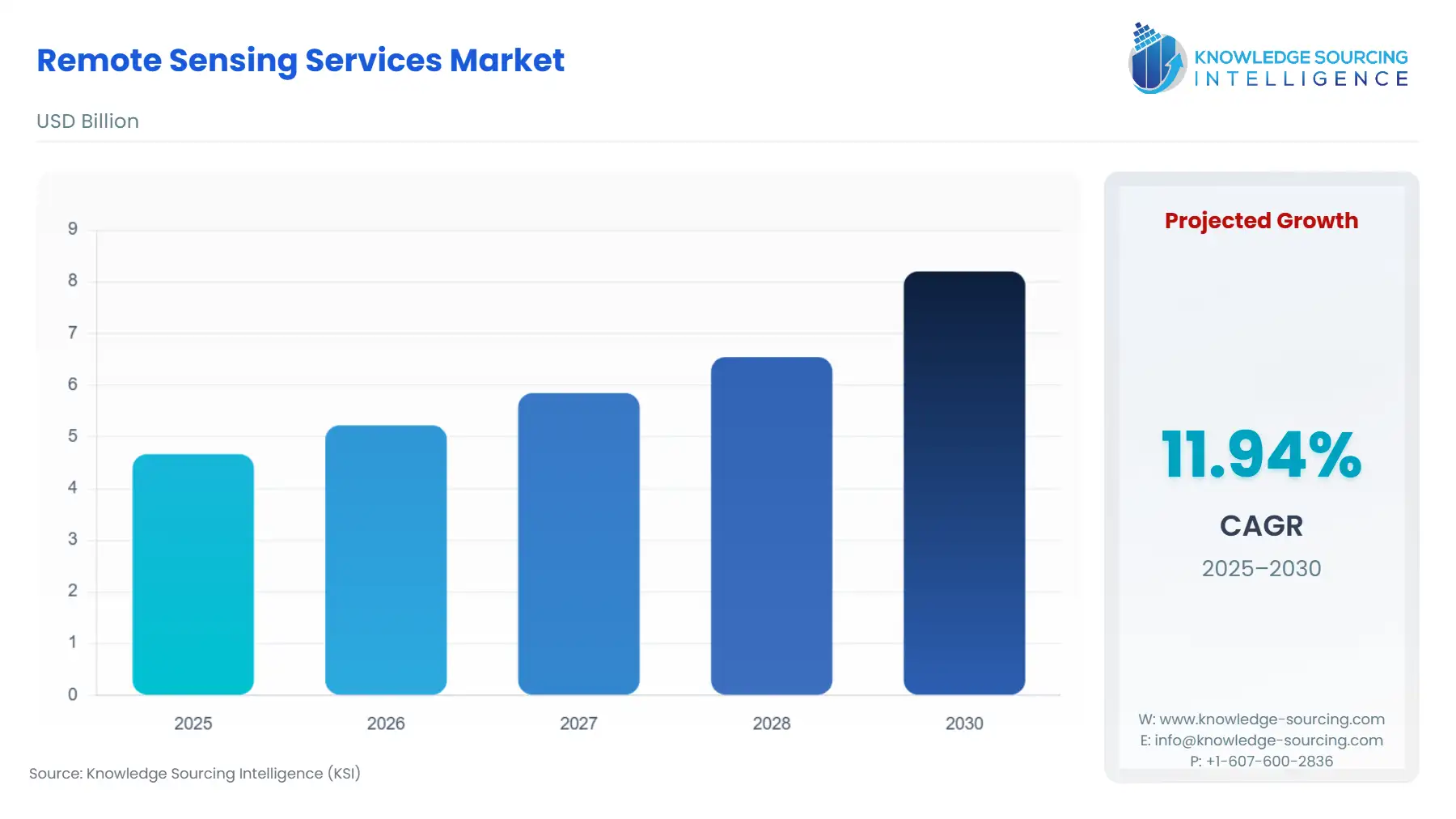

The Remote Sensing Services Market is projected to grow at a CAGR of 11.94% from 2025 to 2030, reaching US$8.201 billion in 2030 from US$4.666 billion in 2025.

The growing demand for geospatial data for a variety of industries, from agriculture to environmental monitoring to infrastructure development, is the key factor driving the market. The growing commercialization of space, such as the growing expansion of private companies like SpaceX is reducing the launch cost and making remote sensing services more accessible and affordable, giving a major boost to the market. Additionally, the high demand from traditional users like the defense for national security and increasing demand by the governments for disaster management, climate monitoring and urban planning is propelling the market. The advancement in technology and integration with advanced technologies like AI, machine learning, predictive modelling and others are another key factor that is enhancing the accuracy and resolution, making the demand grow across industries.

Remote Sensing Services Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

& Scope:

The Remote Sensing Services Market is segmented by:

- Platform: By platform, the market includes satellites, UAVs/drones, manned aircraft, and ground-based systems. Satellites are the dominant while there is a growing traction in UAVs/Drones due to their flexibility and cost-effectiveness with a very localized approach.

- Technology: In terms of technology, the market is categorized into active and passive remote sensing. Active comprises of LiDAR, SAR and RADAR, while passive systems rely on external lights.

- Application: By application, remote sensing services are widely used in defense & security, agriculture, environmental monitoring, and other sectors, including urban planning, transportation & logistics, maritime, and energy and power. Among these, defense and agriculture are major revenue contributors, while environmental monitoring is emerging due to increasing focus on meeting climate goals.

- End-User: The end-user segmentation includes military and defense, commercial, and government entities. Military and defense remain the largest end-user segment, while the commercial sector is growing at the fastest rate for various needs such as precision farming, infrastructure development, mining, and disaster risk management.

- Region: The market is segmented into five major geographic regions, namely North America, South America, Europe, the Middle East and Africa and Asia-Pacific. Asia-Pacific is expected to witness the fastest growth, while North America will constitute a major and dominant share of the market.

Top Trends Shaping the Remote Sensing Services Market:

1. Advancement in technologies and growing integration with other technologies

- The remote sensing technology has made huge development in recent years. There are growing advancements in tools and methods for gathering data. Satellites are continuing to evolve, while there are improvements in sensors and high-resolution imagery. There is a growing use of microsatellites and CubeSats, allowing cost-effective Earth observation missions.

- Apart from advancement in remote sensing technology, it is also increasingly combined with other technologies like GIS, Internet of Things, cloud computing platforms and integration with advanced algorithms for predictive modelling and analytics, shaping the future. For instance, GIS is merged with remote sensing data for powerful visualisation. Also, machine learning and AI for enhance the capabilities of data collection and real-time analysis to improve forecasting for weather or natural disasters. One of the key examples is Esri’s remote sensing solution. Its ArcGIS that integrates pretrained deep learning models, leverages artificial intelligence (GeoAI) to automate tasks like feature extraction, pattern recognition, and predictive analysis.

2. Shift to Subscription-Based and SaaS Models

- One of the key trends can be seen in how companies are aligning with the market. Many companies or players are moving towards subscription-based models or SaaS platforms from one-off data sales. This helps them in offering continuos access to imagery and analytics to the clients, leading to higher adoption for small businesses as well as startups. For instance, BlackSky's Spectra Platform operates on the subscription model, lowering the barriers to entry. In February 2025, the company won a multi-year contract with geospatial intelligence fusion company EMDYN. It will offer Gen-2 imagery and AI-driven analytics through the BlackSky Spectra® platform.

Remote Sensing Services Market Growth Drivers vs. Challenges:

Opportunities:

- Rapid demand for geospatial data from commercial sectors: There is increasing demand for geospatial data in the commercial sector, which is becoming a key driver for the market growth. The rapid adoption of drones in commercial sectors such as agriculture, construction, logistics, energy, telecommunications, power and utilities is leading the remote sensing services market to grow. The increasing demand for geospatial data for agriculture, for instance, to manage and monitor crops, crop mapping, disease and pest detection, soil analysis and crop analysis is leading the remote sensing market to grow.

- Rising demand from environmental monitoring: There is an increasing use of remote sensing services for monitoring air pollutants, infectious disease epidemics, HABS, climate change and more. As the technology is advancing, it is offering higher-resolution imagery, leading to more growth in environmental monitoring. For instance, in many cases across the United States and around the world, remote sensing is a critical tool for monitoring HABs, offering a holistic, big-picture view than data available using discrete surface sensors. Also, for example, the FAO is developing new tools to use satellite imagery for agricultural mapping and crop assessment. Applications like Bhuvan, provide a platform to create, visualize, share, and analyze Geospatial data products and services towards Spatial Mashups.

Challenges:

- Data Reliability and Accessibility Issues: The reliability of data becomes one of the major challenges that limit the growth potential. As different kind of remote sensing offers different data, it becomes hard to rely on one data. At the same time, the interpretation of data is also not easy, making distortions. Thus, making key challenges for the market limiting its adoption and growth potential.

Remote Sensing Services Market Regional Analysis:

- North America: The North American region will dominate the market due to being the early adopter of remote sensing technology. Besides, the high volume of satellite launches and increasing private involvement in commercial space launches, are key driver for the market. Additionally, the demand from the commercial sector and defense is leading to higher adoption. At the same time, the growing emphasis on climate change is expanding remote sensing services to environmental monitoring.

- Asia-Pacific: Asia-Pacific is the fastest-growing market, as countries like China are increasingly spreading their dominance in UAVs. Also, the growing investment by countries like India, China and Japan in remote sensing by satellite launches or offering platforms for geospatial data. The increasing demand from the commercial sector as well as the military and defense sector is leading the market to grow. The high population and increasing adoption of remote sensing for urban planning is also propelling the market.

Remote Sensing Services Market Competitive Landscape:

The remote sensing services market is moderately fragmented, with many players operating in the market, from global leaders like Maxar Technologies to Airbus SE to regional players like Antrix. There are key niche players as well, such as ICEYE, offering SAR imagery. The market includes data providers such as Planet Labs, Analytics firms like Esri or Hexagon and end-to-end provider firms like Airbus. Some key players like Satellogic are aligning with an increasing trend in AI.

- Satellite Launch: In January 2025, Pixxel launched three Firefly satellites, Pixxel’s flagship hyperspectral imaging satellite constellation, on SpaceX Transport-12. It is designed to offer climate and Earth insights in a precise manner. Its advanced spectral capabilities with spatial resolution of 5 meters in 150+ spectral bands in a spectral range of 450-900 nm, offering real-time data collection in a wide range of applications.

- Acquisition: In November 2024, ARKA Group L.P. acquired Maxar’s Radar and Sensor Technology (RST) group. It becomes part of ARKA’s Advanced Communications and Mission Applications business unit.

Remote Sensing Services Market Segmentation:

By Platform

- Satellites

- UAVs /Drones

- Manned Aircraft

- Ground-based Systems

By Technology

- Active Remote Sensing

- Passive Remote Sensing

By Application

By End-User

- Military and Defense

- Commercial

- Government

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Others