Report Overview

Satellite Propulsion System Market Highlights

Satellite Propulsion System Market Size:

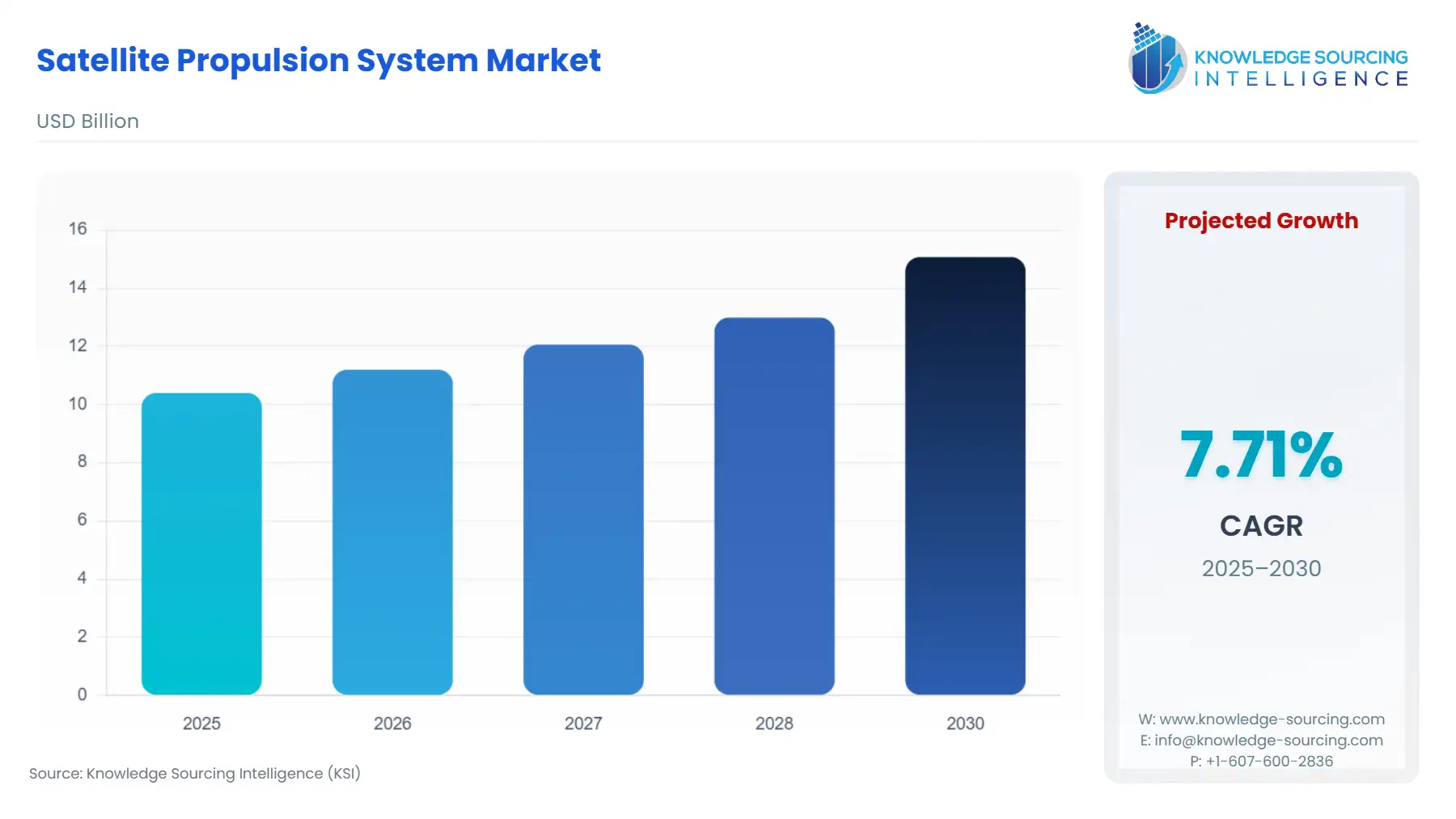

The Satellite Propulsion System Market is projected to grow at a CAGR of 7.71% from 2025 to 2030, reaching a market size of US$15.074 billion by 2030 from US$10.396 billion in 2025.

The growing demand for satellite services such as satellite-based communication, navigation, Earth observation, and others is driving the demand for satellites, which is increasing the demand for satellite propulsion systems. Surge in commercial satellite launches, increasing private sector investment in space exploration and satellite services, rising government initiatives for defense and national security, and rising demand for earth observation for environmental purposes are some of the key factors driving the deployment of satellites and spacecraft, thereby propelling the growth of satellite propulsion system, which is a key component in many satellite markets. Additionally, the advancement in propulsion technologies, such as electric propulsion systems and miniaturized propulsion systems, is also driving the market. With expansion in space programs and increasing deployment of small satellites, the demand for lightweight and efficient propulsion systems is growing.

Satellite Propulsion System Market Overview & Scope:

The Satellite Propulsion System Market is segmented by:

- Propulsion Type: The market is segmented into chemical propulsion, electric propulsion, hybrid propulsion systems, solar propulsion, and others (e.g., nuclear, green propulsion). Electric propulsion is the fastest-growing due to increasing demand from LEO and deep-space explorations

- Satellite Type: Based on the type of satellite, the market is categorized into LEO and MEO Satellites, GEO Satellites, HEO Satellites, and SmallSats / CubeSats / NanoSats. LEO satellites dominate the market due to increasing commercial launches for broadband and connectivity, while SmallSats/CubeSats are growing rapidly.

- Component: The market is segmented by component into thrusters, propellant tanks, valves and regulators, power processing units (PPUs), and controllers and software. Thrusters led the market.

- Application: In terms of application, the market is divided into communication, earth observation and remote sensing, navigation and surveillance, space exploration and scientific research, and defense and security. Communication will be the key and leading driver for the market.

- By End-User: The end-user segmentation includes commercial space organizations, government and military space agencies, research institutions, and space agencies.

Commercial players are gaining significant traction due to increasing investment and satellite deployment.

- Region: The market is segmented into five major geographic regions, namely North America, South America, Europe, the Middle East and Africa, and Asia-Pacific. North America has a key position in the market due to strong private players and strong governmental space programs. On the other hand, the Asia-Pacific region is growing at the fastest rate.

Top Trends Shaping the Satellite Propulsion System Market:

1. Increasing demand for electric propulsion systems

- The market is witnessing an increasing shift towards electric propulsion systems from traditional propulsion systems like chemical propulsion. The demand is driven by the higher efficiency and lower fuel needs compared to chemical propulsion. A report by Dawn Aerospace suggests that electric propulsion have Isp values typically around 1,600 seconds or even higher, making it incredible fuel-efficient. Thus, the electric propulsion offers high specific impulse, supporting longer missions and increased payload capacity.

- At the same time, electric propulsion is also demanded for its fine pointing manoeuvres, while traditional chemical propulsion typically produces high thrust. This makes electric propulsion a favoured option in modern satellites and space mission design.

- This drives its demand, particularly in low Earth Orbit propulsion market. The report by the European Space Agency highlights that Electric propulsion is currently considered by all space actors as a key and revolutionary technology for the new generations of commercial and scientific satellites.

2. High Growth Potential in Smallsats, CubeSats, and Nanosats

- As the demand for Earth observation, connectivity and broadband is growing, it is significantly increasing the deployment of SmallSats, CubeSats and Nanosats. The data from NASA highlights that in 2023, out of 2,938 total spacecraft launched, 68% had a mass less than 600 kg, and 27% were under 200 kg. The 17% increase in total spacecraft launches compared to 2022 is largely driven by the rise of next-generation SmallSat constellations.

- In the coming years, Smallsats, CubeSats, and Nanosats represent one of the highest growth potential areas in the satellite propulsion market, particularly for electric propulsion (EP) and innovative micro-propulsion systems.

- As there are growing trajectories in these types of satellites, it will also increase the demand for compact and cost-effective propulsion systems.

Satellite Propulsion System Market Growth Drivers vs. Challenges:

Opportunities:

- Surge in commercial space activities: The rapid growth of commercial space activities in space exploration and the increasing number of satellites launched by the commercial sector are major factors driving the satellite propulsion system market. The rise in investment by the commercial sector has increased the demand for advanced propulsion technologies. For instance, SpaceX’s achievements, as well as efforts by Boeing, Blue Origin and Virgin Galactic, are marking a new chapter of spaceflight led by the private firms offering a major boost to the Satellite Propulsion System Market. Companies such as SpaceX (Starlink), and OneWeb are deploying thousands of satellites, driving demand for propulsion systems.

Challenges:

- Technological constraints: As propulsion engines must endure extreme conditions such as high temperature, pressure and radiation, fabricating such materials involves huge cost and is very complex in manufacturing. Also, as there is an increasing demand for miniaturized propulsion systems, it poses a significant challenge as compressing the size of the propulsion system without compromising the efficiency is met with complexity.

- Geopolitical constraints: One other challenge for the propulsion system market is meeting the regulations set by different governments, as well as problems arising due to space sovereignty.

Satellite Propulsion System Market Regional Analysis:

- North America: The North American region will dominate the market due to a rise in public and private investment, governments' support for investment, and the presence of major space agencies of the world, which fund propulsion systems for missions and satellites.

The space economy accounted for $131.8 billion, or 0.5 per cent, of total U.S. GDP in 2022 (Bureau of Economic Analysis, USA, June 2024 Report), highlighting growth in propulsion subsystems as well. As per the NovaEspace Report, out of the US$596 billion global space economy, North America constitutes US$86 billion in 2024, the highest share, highlighting the dominant market share of the region in the overall space economy, which significantly impacts the propulsion system as well.

- Asia-Pacific: The same report by Novaspace estimated a US$45 billion, i.e., 7.55% market share of Asia-Pacific in the Space Economy in 2024. Thus, though currently it has a smaller share in the market, the Asia-Pacific is estimated to be growing at the fastest rate during the forecast period. The growth is driven by the increasing expenditure by the government, the rising government space programs and increasing investment in space infrastructure. For instance, in February 2024, the Green propulsion system developed by DRDO’s Technology Development Fund demonstrated in-orbit functionality on a payload launched by the PSLV C-58 mission.

Satellite Propulsion System Market Competitive Landscape:

The Satellite Propulsion System Market is moderately consolidated, with some key players such as Safran S.A., Airbus Defense and Space S.A., IHI Corporation, The Boeing Company, Northrop Grumman Corporation, OHB SE, Thales Alenia Space, L3Harris Technologies Inc., Moog Inc., Exotrail S.A.S., and Accion Systems Inc.

- Product Expansion/New Contract Win: In March 2025, Ursa Major was awarded a contract for the delivery of integrated GEO propulsion systems. It provided a $10 to $15 million support for the development, manufacturing, assembly, integration, and testing of a full propulsion system capable of six degrees-of-freedom maneuverability. It will be carried out at the Ursa Major’s facility in Berthoud, Colorado, using advanced digital and additive manufacturing.

- Production Expansion: In August 2024, Safran Electronics & Defense is establishing a new production facility in Colorado to manufacture electric propulsion systems (EPS®X00) for small satellites. First deliveries are planned for Q1 2026. The EPS®X00 system, featuring the PPS®X00 thruster that offers up to 5,000 hours of thrust time, high specific impulse for efficient propulsion, versatility for a range of Low Earth Orbit (LEO) applications, and is designed for the cost-sensitive "New Space" market.

- Product Innovation: In March 2024, Benchmark Space Systems successfully deployed the Xantus electric propulsion system. Launched aboard the SpaceX Transporter-10 rideshare mission, it is going through subsystem health checks and operational verification on Orion Space Solutions’ 12U cubesat in low Earth orbit .The Xantus system uses molybdenum as its primary propellant, chosen for its efficient thrust generation, and has been validated in testing at NASA Glenn and Benchmark’s facilities. It is designed to support spacecraft from 5 to 1000 kg, and the company is scaling up the production with more than 50 Xantus thrusters scheduled for shipment in 2025.

Satellite Propulsion System Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 10.396 billion |

| Total Market Size in 2031 | USD 15.074 billion |

| Growth Rate | 7.71% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Propulsion Type, Satellite Type, Component, Application |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Satellite Propulsion System Market Segmentation:

By Propulsion Type

- Chemical Propulsion

- Electric Propulsion

- Hybrid Propulsion Systems

- Solar Propulsion

- Other

By Satellite Type

- LEO and MEO Satellites

- GEO Satellites

- HEO Satellites

- SmallSats / CubeSats / NanoSats

By Component

- Thrusters

- Propellant Tanks

- Valves and Regulators

- Power Processing Units

- Controllers and Software

By Application

- Communication

- Earth Observation and Remote Sensing

- Navigation and Surveillance

- Space Exploration and Scientific Research

By End-User

- Commercial

- Government and Military Space Agencies

- Research Institutions

- Space Agencies

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Others