Report Overview

Saudi Arabia Home Fragrance Highlights

Saudi Arabia Home Fragrance Market Size:

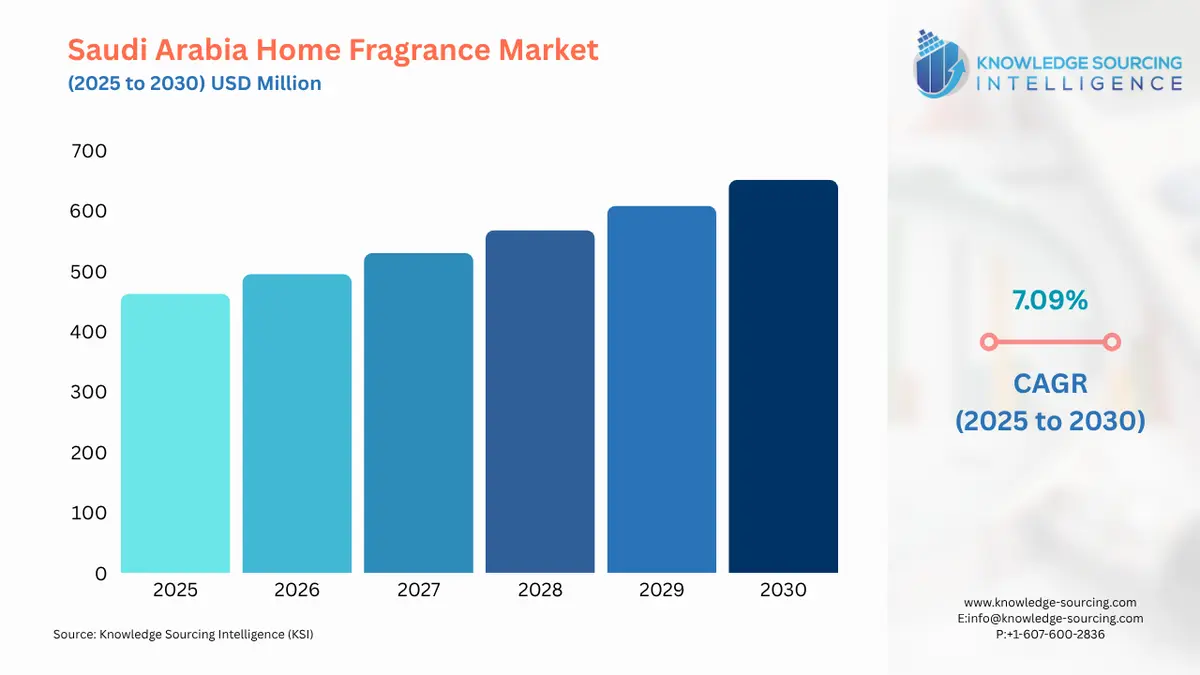

The Saudi Arabia Home Fragrance Market is set to register growth at a CAGR of 7.09%, reaching USD 651.494 million in 2030 from USD 462.596 million in 2025.

The market for home fragrances in Saudi Arabia is expanding rapidly due to a confluence of lifestyle, cultural, and economic factors. Pleasant fragrances have been important in Saudi households, symbolizing hospitality and personal attention. Premium home fragrance products like scented candles, diffusers, incense, and sprays are becoming more and more popular as disposable incomes rise and urban lives change. Aromatherapy and wellness-inspired fragrances that encourage calm and stress reduction are also becoming more popular among consumers. Fragrances are becoming a crucial component of home ambiance due to the rising popularity of interior design and home décor. Additionally, increased consumer access due to broader product availability through online and physical retail channels has fuelled additional market expansion across various demographics and groups.

Saudi Arabia Home Fragrance Market Overview & Scope:

The Saudi Arabia home fragrance market is segmented by:

- Fragrance: It is projected that the fresh/citrus industry will lead the Saudi Arabian home fragrance market. This is primarily due to how popular and easily available certain scents are. A variety of citrus trees, including colorful limes, tart lemons, sweet oranges, sour grapefruits, and fragrant bergamot, are used to make essential oils from their peels and fruits. In addition to their energizing qualities, these scents are well-liked for their many additional benefits, such as mood enhancement, aromatherapy applications, smell blending, and other uses that enhance overall wellbeing.

- Product Type: By product type, candles, sprays, diffusers, essential oils, incense sticks, plug-in devices, potpourri and sachets, wax melts, and other factors, the market is divided into numerous segments. It is projected that the candles category will lead the home fragrances industry. The main reason for this is the growing popularity of scented candles. With so many different fragrance possibilities available in scented candles—from fruity and floral to spicy and earthy—customers can select scents that align with their moods. Additionally, the increasing popularity of scented candles as a gift option is helping the segment. These candles are getting increasingly popular throughout the holidays. They often serve as thoughtful hostess presents, housewarming gifts, or tokens of appreciation.

- Distribution Channel: Based on distribution, the market is separated into categories such as supermarkets, hypermarkets, online retailers, and specialty shops. The commercial lead of supermarkets and hypermarkets was made possible by the abundance of products on store shelves. Customers can acquire a certain product or set of products based on their needs and are aware of their options.

Top Trends Shaping the Saudi Arabia Home Fragrance Market:

- Rise in Popularity of Electric Air Fresheners

In Saudi Arabia's home fragrances market, the popularity of electric air fresheners is on the rise due to changing customer tastes and technological developments. The need for reliable and practical fragrance experiences is met by these gadgets, which include plug-in diffusers and ultrasonic types. They provide continuous fragrance dissemination. The growing demand for items that improve indoor air quality and well-being is driving this trend. In addition, electric air fresheners' visual attractiveness and features like smart home system integration and changeable settings satisfy consumers increasing need for individualized and technologically advanced living spaces. A larger trend in Saudi Arabia toward high-end, eco-friendly, and health-conscious home scent options is reflected in the move toward electric air fresheners. - The Government's 2030 Vision and the Transformation of Retail

Significant retail modernization has resulted from Saudi Arabia's 2030 plan, which has supported local SMEs and expanded malls and e-commerce platforms. This has made a variety of home scent goods more easily accessible. Government subsidies and a growing interest in local manufacturing have contributed to the emergence of boutique perfumers and homegrown fragrance businesses. It is projected that 33.6 million Saudis will use the Internet for e-commerce (buying and selling) by 2024, a 42 percent rise from 2019, according to the International Trade Administration.

Saudi Arabia Home Fragrance Market Growth Drivers vs. Challenges:

Opportunities:

- Residential Sector Growth Throughout the Region: The market for home fragrance items has increased because of the housing sector growth, especially in urban areas, as people look to improve their living spaces. This need is fueled by a cultural focus on hospitality and keeping a cozy home atmosphere. Furthermore, scents are now a crucial component of interior design due to the increased desire for individualized and beautiful home décor. A large range of home fragrance goods is now more easily accessible because of the advent of e-commerce platforms, which has also fueled market expansion. In Saudi Arabia, the market for home fragrances is being driven by a combination of growing residential construction, cultural customs, and changing customer tastes.

- The Sacred Function of Fragrances in Everyday Life and Cultural Rituals: Saudi Arabians use fragrance for ceremonial and spiritual purposes in addition to aesthetic purposes. Oud (agarwood) and bakhoor (incense) are used in daily activities, from morning rituals to nighttime get-togethers. A spiritual and sensory custom that has been carried down through the ages is lighting bakhoor in homes, and even bedrooms. Since these customs are ritualized actions rather than passing trends, home scent goods are ingrained in the culture.

Challenges:

- Changing Raw Material Prices: A major obstacle faced by the Saudi Arabian home fragrances business is the volatility of raw material prices, which affect production costs and profit margins. Price volatility for key ingredients including essential oils, fragrance compounds, and natural extracts can be caused by supply chain interruptions, geopolitical tensions, and climate change. Negative weather or problems with the supply chain, for example, can impact the availability of plant-based components used in natural fragrance compounds, raising prices and possibly causing shortages. Furthermore, demand for these components has increased due to consumers growing preference for natural and organic scents, which further strains supply and raises prices.

- Young People Prefer Global Brands with Less Local Significance: Customers under 35 are particularly engaged on social media sites like Instagram, TikTok, and Snapchat. They are frequently attracted to premium brands, international trends, and attractive packaging. This results in a gap between the customary expectations of elder family members and that of young people.

Saudi Arabia Home Fragrance Market Competitive Landscape:

The market is moderately fragmented, with many key players including Rezaroma, Johnson and White Aromas, Reckitt Benckiser Group plc, and The Procter & Gamble Company.

- Product Expansion: In October 2024, Ahmed Perfume declared to open at least five new outlets in Saudi Arabia as part of their GCC growth. Ahmed Perfume, which is well-known for its Oriental and Western fragrances, such as Oud and Bukhoor, declared that it was moving away from word-of-mouth marketing and toward a more international, youth-focused approach. This included launching trendier items and improving its online visibility.

Saudi Arabia Home Fragrance Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 462.596 million |

| Total Market Size in 2031 | USD 651.494 million |

| Growth Rate | 7.09% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Fragrance, Product Type, Distribution Channel, Region |

| Geographical Segmentation | Riyadh, Makkah, Eastern Province, Madinah, Al Baha, Al Jawf, Others |

| Companies |

|

Saudi Arabia Home Fragrance Market Segmentation:

- By Fragrance

- Floral

- Fresh/Citrus

- Woody

- Oriental/Spicy

- Herbal

- Fruity

- Sweet/Gourmand

- Oceanic

- Others

- By Product Type

- Candles

- Sprays

- Diffusers

- Essential Oils

- Incense Sticks

- Plug-in Devices

- Potpourri and Sachets

- Wax Melts

- Others

- By Distribution Channel

- Hypermarkets/Supermarkets

- Specialty Stores

- Online Stores

- Others

- By Region

- Riyadh

- Makkah

- Eastern Province

- Madinah

- Al Baha

- Al Jawf

- Others