Report Overview

Global Smart Irrigation Market Highlights

Smart Irrigation Market Size:

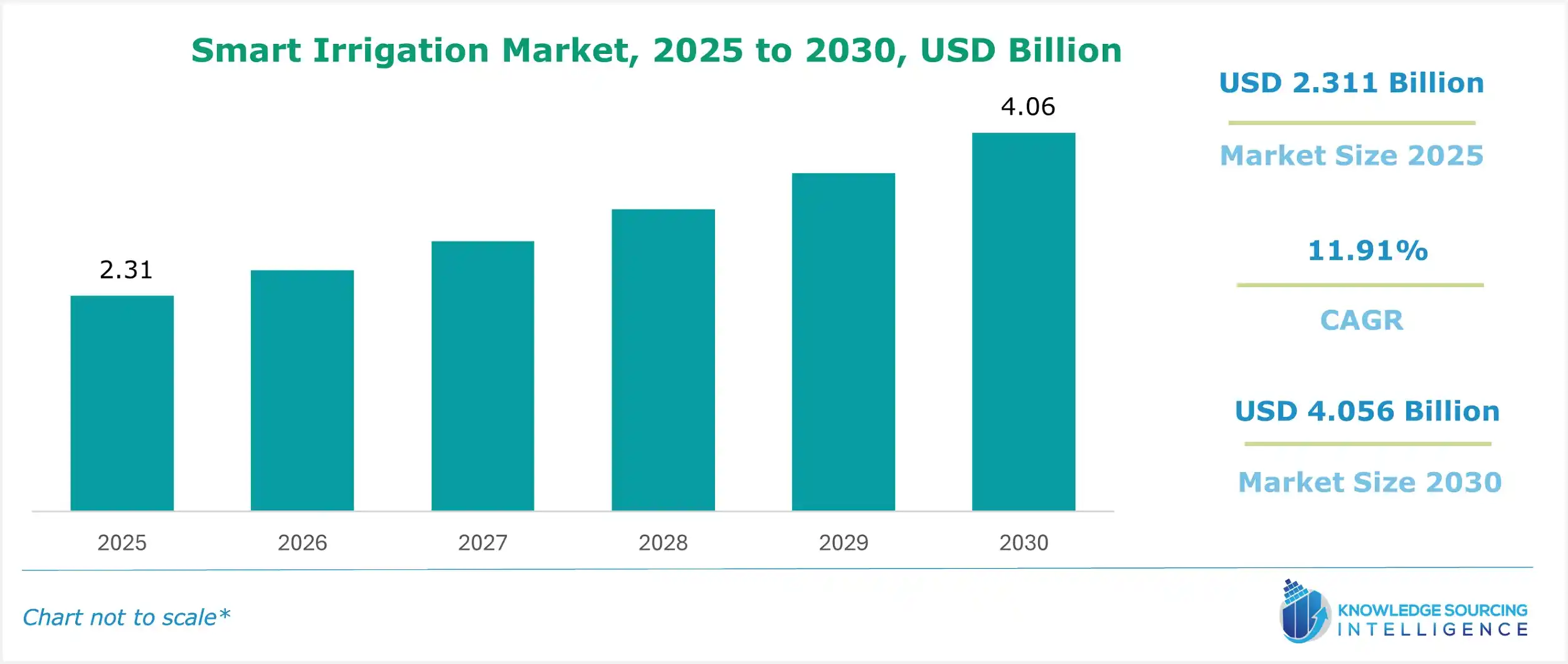

The Smart Irrigation Market is expected to grow from USD 2.311 billion in 2025 to USD 4.056 billion in 2030, at a CAGR of 11.91%.

Smart Irrigation Market Introduction:

The global smart irrigation market is transforming agriculture through advanced technologies, enhancing water-efficient agriculture, harnessing cutting-edge technologies to optimize water usage, boost crop productivity, and advance environmental sustainability. By integrating sensors, controllers, and advanced analytics, smart irrigation systems enable precise, automated watering tailored to real-time environmental factors such as soil moisture, weather conditions, and plant requirements. The market is propelled by escalating water scarcity and supportive government policies and is positioned for robust expansion.

As a key segment of the precision irrigation market, it leverages smart farming technology, integrating IoT agriculture and AI in agriculture to optimize water usage. Automated irrigation systems deliver precise water delivery, reducing waste and boosting crop yields. Climate-smart agriculture principles drive adoption, addressing water scarcity and climate variability. These systems, equipped with sensors and data analytics, enable real-time monitoring and adaptive irrigation strategies. The market is poised for growth as global demand for sustainable, efficient farming solutions intensifies in response to environmental challenges.

The Smart Irrigation Market is a vital enabler of sustainable agriculture and water management, driven by global water scarcity, supportive government policies, advancements in IoT and AI, and escalating food demand. Despite obstacles like high initial costs, technical skill gaps, and connectivity limitations, the market is witnessing robust growth, propelled by innovations in sensor-based controller systems, agricultural applications, and soil moisture sensors.

Asia-Pacific leads with its agricultural focus, North America excels in commercial applications and regulatory support, and Europe emphasizes sustainability. The sensor-based, agricultural, and soil moisture sensor segments are critical, addressing urgent water efficiency needs. Industry experts should prioritize technological innovation, policy alignment, and region-specific strategies to capitalize on the market’s transformative potential.

Smart Irrigation Market Overview:

Smart irrigation systems revolutionize traditional irrigation practices, which often result in water inefficiency due to imprecise application. These systems employ sensors to monitor soil moisture, rainfall, and flow rates, while controllers dynamically adjust irrigation schedules to minimize waste. Applications include agricultural fields for enhanced crop yields, residential landscapes for aesthetic maintenance, and commercial spaces such as parks and golf courses for operational efficiency. Weather-based systems leverage local climate data to fine-tune irrigation, whereas sensor-based systems respond directly to real-time soil and plant conditions. The integration of IoT, AI, and wireless technologies facilitates remote monitoring and data-driven decision-making, promoting water conservation and sustainability.

As of June 2025, the Smart Irrigation Market is witnessing significant growth, driven by the pressing need to address global water scarcity, impacting over 4 billion people annually (UNESCO, 2024). Industry leaders like Netafim, Rain Bird Corporation, and Jain Irrigation Systems are advancing the market through innovations in cost-effective sensors, cloud-based management platforms, and AI-powered analytics. The market’s expansion underscores its vital role in securing food supplies, mitigating environmental impact, and supporting urban green initiatives amid climate challenges.

Smart Irrigation Market Trends:

The global smart irrigation market is advancing with cutting-edge technologies. AI predictive irrigation and machine learning irrigation optimize water use through data-driven forecasts. 5G smart agriculture enhances connectivity for real-time system control. Drone irrigation and satellite imagery irrigation provide precise monitoring, improving resource efficiency. Variable rate irrigation (VRI) tailors water application to field variability, boosting yields. Irrigation as a service (IaaS) offers scalable, subscription-based solutions. Sustainable irrigation solutions prioritize eco-friendly practices, while digital twins in agriculture enable virtual modeling for optimized irrigation strategies. These trends reflect the industry’s shift toward precision, connectivity, and sustainability in addressing global water challenges.

Smart Irrigation Market Growth Drivers:

The Smart Irrigation Market is propelled by several key factors:

-

Global Water Scarcity Crisis: Agriculture consumes 70% of global freshwater, necessitating efficient irrigation solutions. The United Nations reports that 2.4 billion people face water stress, accelerating smart irrigation adoption (United Nations, 2024).

-

Government Support for Sustainable Agriculture: Policies like the EU’s Water Framework Directive and India’s Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) provide incentives for water-efficient technologies (European Commission, 2020; Ministry of Jal Shakti, 2024).

-

Advancements in IoT and AI Technologies: IoT sensors and AI analytics enable precise water management. In April 2024, Netafim introduced an AI-driven irrigation platform, achieving a 30% reduction in water use (Netafim Press Release, April 2024).

-

Increasing Global Food Demand: With the world population projected to reach 9.7 billion by 2050, agriculture faces pressure to boost yields sustainably, driving smart irrigation demand (UN Department of Economic and Social Affairs, 2022).

Smart Irrigation Market Restraints:

The market faces notable challenges:

-

High Upfront Investment: The cost of advanced sensors, controllers, and IoT infrastructure can deter adoption, particularly among small-scale farmers.

-

Limited Technical Knowledge: Many farmers in developing regions lack the expertise to implement and maintain smart irrigation systems effectively.

-

Connectivity Challenges in Rural Areas: IoT-based systems require reliable internet access, which is often unavailable in remote agricultural regions, limiting scalability.

Smart Irrigation Market Geographical Analysis:

- Asia Pacific

Asia Pacific is the dominant and fastest-growing region in the Smart Irrigation Market, fueled by its expansive agricultural sector, rapid urban development, and proactive government policies on water conservation. China leads with 70 million hectares of irrigated land, supported by the 2024 National Agricultural Modernization Plan, which invested $10 billion in smart irrigation technologies (China Ministry of Agriculture, 2024). India, where agriculture employs 42% of the workforce, drives demand for sensor-based systems, with 50 million farmers adopting micro-irrigation under PMKSY in 2024 (Ministry of Jal Shakti, 2024). The agricultural application segment is predominant, with soil moisture sensors widely utilized for crops like rice and wheat. Japan contributes through precision agriculture, with Kubota launching IoT-based irrigation systems in November 2023 (Kubota Press Release, November 2023). The sensor-based controller system segment is prominent, addressing water scarcity in arid regions.

China’s agricultural dominance and IoT infrastructure investments cement its leadership. In September 2024, Jain Irrigation Systems collaborated with Sher-e-Kashmir University to deploy smart irrigation in Jammu, India, supporting 10,000 farmers (Jain Irrigation Press Release, September 2024). India’s water-stressed states, such as Rajasthan, rely heavily on sensor-integrated drip irrigation. Japan and South Korea advance urban farming with high-tech irrigation, optimizing water use in controlled environments. The region’s growth is driven by its large population, government subsidies, and commitment to sustainable agriculture, making Asia-Pacific a global market leader.

- North America

North America commands a significant market share, underpinned by advanced farming techniques, a robust technology ecosystem, and stringent water conservation regulations. The U.S. leads with 55 million acres under irrigation, where 40% of farms employ smart irrigation systems, according to USDA data (USDA, 2024). California, a drought-prone state, drives the agricultural segment, achieving 30% water savings through smart irrigation (California Department of Water Resources, 2024). The commercial segment, including golf courses and public parks, is notable, with Rain Bird’s 2024 sensor-based system reducing water consumption by 25% (Rain Bird Press Release, March 2024). Canada supports urban applications, investing $200 million in smart landscaping in 2023 (Environment Canada, 2023). Mexico’s agricultural exports, valued at $5 billion in 2024, boost sensor adoption (Mexican Ministry of Agriculture, 2024). The weather-based controller system segment dominates, leveraging accurate climate data.

The U.S. thrives on its IoT infrastructure, with companies like HydroPoint and Toro pioneering cloud-based irrigation solutions. The EPA’s WaterSense program, saving 9 billion gallons of water daily, promotes smart irrigation adoption (EPA, 2023). Canada’s sustainable urban planning enhances residential and commercial applications, while Mexico’s agricultural trade with the U.S. drives technology uptake. North America’s market growth is supported by innovation, regulatory alignment, and heightened awareness of water conservation imperatives.

- Europe

Europe is a key player in the Smart Irrigation Market, driven by rigorous environmental policies, a focus on sustainable agriculture, and technological advancements. Germany leads with its precision farming sector, allocating €5 billion in 2024 for smart irrigation to support crops like barley (German Federal Ministry of Food and Agriculture, 2024). The agricultural application segment is central, with 60% of EU farms adopting smart irrigation under the Common Agricultural Policy (European Commission, 2023). France contributes through its vineyard sector, where IoT-based systems improved grape yields by 15% in 2024 (French Ministry of Agriculture, 2024). The UK’s commercial landscaping, backed by £1 billion in green infrastructure investment, drives weather-based controller demand (UK Department for Environment, 2024). The sensor-based controller system segment is significant, catering to varied soil types across the region.

Germany’s Industry 4.0 initiatives integrate IoT into irrigation, with 50% of farms using soil moisture sensors in 2024. The EU’s Water Framework Directive enforces efficient water use, spurring market growth (European Commission, 2020). France’s wine industry employs AI-driven irrigation for precision, while the UK focuses on urban green spaces. Challenges include high regulatory compliance costs and ecological constraints, highlighted by 2024 farmer protests (European Parliament, 2024). Europe’s market is shaped by sustainability goals, technological leadership, and a commitment to food security.

Smart Irrigation Market Segment Analysis:

- Sensor-Based Controller Systems

The sensor-based controller system segment is a primary growth driver, offering precise irrigation by responding to real-time data from soil moisture, rain, and flow sensors. These systems reduce water waste by tailoring irrigation to actual plant needs, achieving up to 43% water savings in agricultural trials, as seen in stone fruit studies (Afzaal et al., 2023). The segment’s expansion is propelled by the agricultural application, with 70% of smart irrigation systems in Asia-Pacific adopting this technology in 2024 (China Ministry of Agriculture, 2024). In March 2024, Toro unveiled a soil moisture sensor with 20% enhanced accuracy, targeting small-scale farmers (Toro Press Release, March 2024).

Sensor-based systems are ideal for water-scarce regions, providing detailed control and seamless IoT integration. They are critical for water-intensive crops like rice, which account for 40% of global irrigation water (FAO, 2024). The segment benefits from cost reductions in sensor technology and AI-driven insights, though high initial costs and technical complexity remain barriers. Its leadership is fueled by the demand for precision agriculture and sustainable landscaping, ensuring strong market traction.

- Agricultural Application

The agricultural application segment is the market’s largest, driven by the urgent need to enhance food production while conserving water resources. Smart irrigation systems improve crop yields and reduce water consumption, vital as agriculture consumes 70% of global freshwater (FAO, 2024). In June 2024, Netafim’s smart drip irrigation systems boosted potato yields by 26% in Indian farms (Netafim Press Release, June 2024). The segment’s growth is supported by government incentives, with India’s PMKSY allocating $2 billion for micro-irrigation in 2024 (Ministry of Jal Shakti, 2024). Asia-Pacific and North America dominate, with China and the U.S. leading adoption.

Smart irrigation is essential for staple crops like wheat and maize, which face climate-induced yield variability. Sensor-based systems, offering real-time soil monitoring, are widely adopted. The segment leverages IoT for large-scale farm management, though smallholder farmers face cost and connectivity challenges. Its critical role in ensuring food security and promoting sustainable farming practices drives its prominence in the market.

- Soil Moisture Sensors

The soil moisture sensor segment is a key contributor, enabling data-driven irrigation by measuring soil water content in real time. These sensors ensure watering occurs only when necessary, reducing waste. In December 2023, Delta-T Devices introduced a soil moisture sensor with 15% improved sensitivity, adopted by 10,000 U.S. farms (Delta-T Press Release, December 2023). The segment’s growth is driven by the agricultural application, with 60% of European smart irrigation systems incorporating soil moisture sensors in 2024 (European Commission, 2023). India deployed 5 million sensors in 2024, per government data (Ministry of Agriculture, 2024).

Soil moisture sensors achieve 30% water savings in crops like corn, enhancing yields and sustainability (FAO, 2024). Their IoT compatibility supports remote monitoring, ideal for large farms. Declining sensor costs fuel adoption, but calibration and maintenance complexities pose challenges. The segment’s growth is propelled by the need for precision in water-stressed regions, making it a foundational element of smart irrigation systems.

Smart Irrigation Market Key Developments:

- Netafim AI Platform Introduction: In April 2024, Netafim launched an AI-driven irrigation platform, reducing water use by 30% in field trials (Netafim Press Release, April 2024).

- Jain Irrigation University Collaboration: In September 2024, Jain Irrigation partnered with Sher-e-Kashmir University to deploy smart irrigation for 10,000 farmers in Jammu, India (Jain Irrigation Press Release, September 2024).

- Rain Bird Sensor-Based System: In March 2024, Rain Bird introduced a sensor-based irrigation system, cutting water use by 25% in commercial settings (Rain Bird Press Release, March 2024).

- Toro Enhanced Soil Sensor: In March 2024, Toro launched a soil moisture sensor with 20% greater accuracy, targeting small farms (Toro Press Release, March 2024).

- Delta-T Soil Sensor Launch: In December 2023, Delta-T Devices released a high-sensitivity soil moisture sensor, adopted by 10,000 U.S. farms (Delta-T Press Release, December 2023).

- India’s PMKSY Investment: In 2024, India invested $2 billion in micro-irrigation under PMKSY, boosting sensor adoption (Ministry of Jal Shakti, 2024).

- China’s Agricultural Modernization: In 2024, China allocated $10 billion for smart irrigation under its agricultural modernization plan (China Ministry of Agriculture, 2024).

Smart Irrigation Market Future Outlook:

The Smart Irrigation Market is poised for sustained growth, driven by intensifying water scarcity, population growth, and technological advancements. The integration of 5G and AI will enhance system precision and accessibility, enabling broader adoption. Asia-Pacific will maintain its leadership, fueled by China’s agricultural modernization and India’s government-backed initiatives. North America and Europe will experience steady growth, driven by commercial and agricultural applications. Emerging markets in South America and the Middle East and Africa will gain traction as infrastructure develops. Overcoming barriers such as high costs, limited technical expertise, and rural connectivity issues will be essential for market expansion. Industry experts should monitor evolving policies, technological breakthroughs, and regional water management challenges to seize market opportunities.

List of Top Smart Irrigation Companies:

- Telsco Industries, Inc.

- Rain Bird Corporation

- The Toro Company

- Hunter Industries

- Netafim

Smart Irrigation Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Smart Irrigation Market Size in 2025 | USD 2.311 billion |

| Smart Irrigation Market Size in 2030 | USD 4.056 billion |

| Growth Rate | CAGR of 11.91% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Smart Irrigation Market |

|

| Customization Scope | Free report customization with purchase |

Global Smart Irrigation Market Segmentation:

- By Component

- Hardware

- Software

- By System Type

- Weather-Based Controller System

- Soil Moisture Sensor System

- Others

- By Irrigation Type

- Drip Irrigation

- Sprinkler Irrigation

- Pivot Irrigation

- Others

- By Application

- Residential

- Commercial

- Agricultural Farms

- Sports Fields

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others

- North America

Our Best-Performing Industry Reports:

Navigation

- Smart Irrigation Market Size:

- Smart Irrigation Market Key Highlights:

- Smart Irrigation Market Introduction:

- Smart Irrigation Market Overview:

- Smart Irrigation Market Trends:

- Smart Irrigation Market Growth Drivers:

- Smart Irrigation Market Restraints:

- Smart Irrigation Market Geographical Analysis:

- Smart Irrigation Market Segment Analysis:

- Smart Irrigation Market Key Developments:

- Smart Irrigation Market Future Outlook:

- List of Top Smart Irrigation Companies:

- Smart Irrigation Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 25, 2025