Report Overview

South Africa Home Fragrance Highlights

South Africa Home Fragrance Market Size:

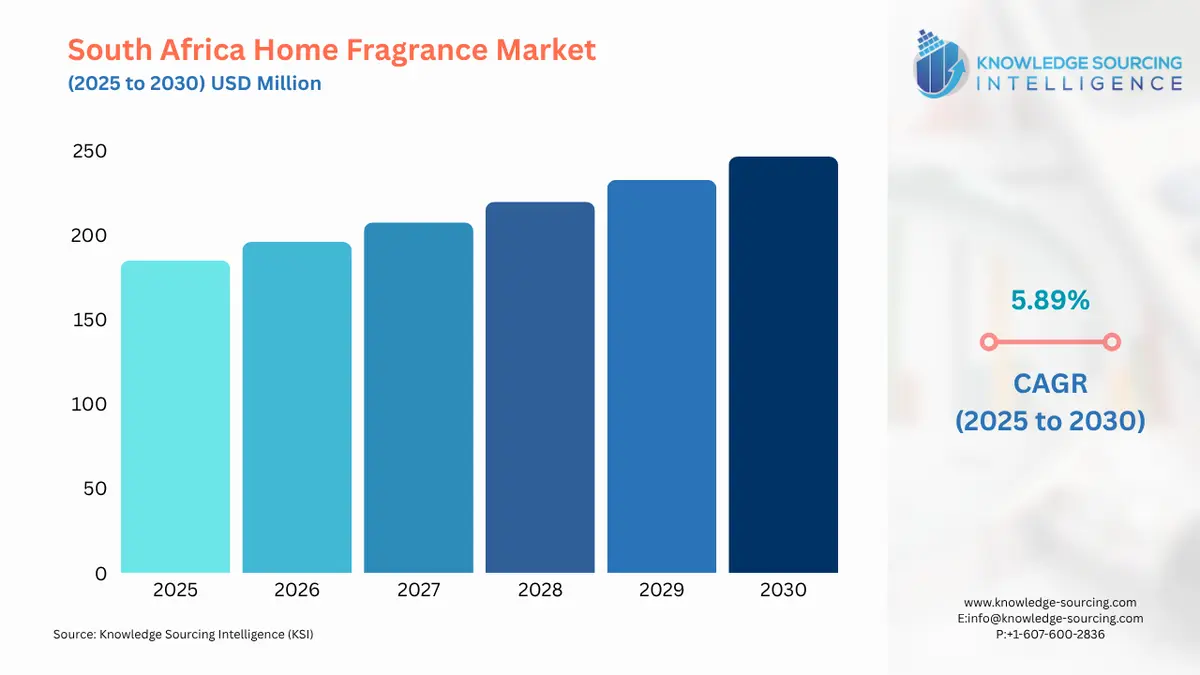

The South Africa Home Fragrance Market is forecasted to increase at a CAGR of 5.89%, climbing from USD 185.038 million in 2025 to USD 246.394 million in 2030.

Increasing consumer demand for wellness and aromatherapy products such as scented candles, essential oils, and diffusers in the growing urban population and middle-class South Africans is driving the market. In addition, the expanding e-commerce is enabling small and artisanal brands to scale up and reach broader audiences efficiently, offering a major boost to the market. As with growing urbanization, the hospitality sector is growing, driving an increasing demand for room fragrances. Further, the innovations in products and product diversification by the companies are expanding the options available to customers, propelling the market growth.

South Africa Home Fragrance Market Overview & Scope:

The South African Home Fragrance Market is segmented by:

- Fragrance Type: By fragrance type, the market offers a wide range of scents tailored to diverse consumer preferences. Popular categories include floral, fresh/citrus, woody, oriental/spicy, herbal, fruity, sweet/gourmand, and oceanic, along with a mix of other experimental or blended fragrances.

- Product Type: By product type, the market is segmented into candles, sprays, diffusers, essential oils, incense sticks, plug-in devices, potpourri and sachets, wax melts, and others. Candles and diffusers dominate the market, driven by their usage.

- Distribution Channel: By distribution channel, home fragrance products are primarily sold through hypermarkets/supermarkets, specialty stores, online stores, and other retail formats. The supermarkets and hypermarkets have a considerable share, while the online segment is on a growing trajectory.

- End-User: By end-user, the market is categorized into households, hospitality, offices and commercial spaces, wellness and spa centers, and religious and cultural establishments. The household segment remains dominant, with consumers using fragrances for daily ambience and self-care.

Top Trends Shaping the South Africa Home Fragrance Market:

- Demand for Natural, Eco-friendly and Wellness-Oriented Products

One of the key trends in the South African home fragrance market is increasing demand for natural and non-toxic ingredients like essential oils, soy waxes, and biodegradable packaging in home fragrance products. For instance, Yankee Candle by Newell Brands uses natural wax, which is a premium-grade paraffin. It also comes in a reusable glass apothecary jar for sustainable for eco-conscious homes. - High Demand for Incense Sticks

Incense sticks are a leading segment in the South African home fragrance market due to cultural and spiritual significance, and the presence of the middle class, who views incense sticks as an affordable luxury, priced lower than candles or diffusers. Within incense sticks, there is high demand for natural and eco-friendly sticks with traditional scents. For instance, companies like Saint d’Ici offer natural and handcrafted fragrances.

South Africa Home Fragrance Market Growth Drivers vs. Challenges:

Opportunities:

- Cultural Significance of Fragrances is Driving Market: In South Africa, fragrances are rooted in their social and spiritual culture. In many parts of South Africa, the use of fragrances like incense and essential oils is ritual and is used in homes. Now, with growing urbanization and increasing middle-class pollution, with greater product availability and accessibility through e-commerce expansion, there is a growing demand for home fragrances.

- Rising Urbanization and Middle-Class Demand for Affordable Luxury and Home Ambience: One of the other major factors for the market growth is the growing middle class. These growing middle-class populations are fueling demand for home fragrances as affordable luxury items to enhance home ambience. As per the data from the United Nations, the Republic of South Africa is one of the most urbanized countries in Africa. It's 67% of the population is living in urban areas, which is expected to increase to 80% by 2050. As per StatsSA Household Income and Expenditure Survey 2022 and 23, the average and median annual household income are R204 459 and R95 770 respectively. Income shares of black African-headed households increased from 38.8% in 2006 to 57.8% in 2023. In essence, rising urbanization and the growth of the middle-income population are increasing the consumer base; at the same time, it is changing the value proposition of home fragrances, where demand is being driven as a statement of lifestyle and self-expression.

Challenges:

- Counterfeit Products: Counterfeit products are one of the key challenges impacting the market. As a significant portion of consumers are price-sensitive, counterfeit products offer an attractive option for those who aspire to premium brands. The presence of these products dilutes the brand reputation of genuine brands. They also pose health and safety concerns.

- Limited Consumer Demand: Many consumers in South Africa are not aware of the different varieties of home fragrances, limiting their adoption of home fragrances beyond the basic air fresheners. Also, home fragrances are still considered a luxury rather than a wellness or lifestyle essential in many middle- and lower-income segments, limiting its demand.

South Africa Home Fragrance Market Competitive Landscape:

The market is fragmented, with the presence of some notable key players such as Saint d’Ici, S.C. Johnson & Son, Inc., The Procter & Gamble Company, Newell Brands, Inc., The Estée Lauder Companies Inc., Reckitt Benckiser Group plc, Natura & Co Holdings SA, Wild Olive Artisans (Pty) Ltd., Rain Natural Skincare, and L’Occitane International S.A.

- Saint d’Ici: Saint d’Ici is a local artisanal brand which is founded in Cape Town. It is a niche perfumery company that offers a handcrafted edition of natural perfumes. It offers home fragrance products like Parfum d’Ambience, which has a moist, earthy and green scent.

- S.C. Johnson & Son, Inc.: It is a global company with a key presence in South Africa. It has three facilities in South Africa with a total of 200 team members. It offers products through the brand Glade.

- Newell Brands, Inc.: Newell is a USA-based company, having a presence in the South African market. It offers products through Yankee Candle offering signature collection, classic collection, outdoor collection, car fragrances or small space fragrance, wax melts and diffusers.

- Product Launch: Cote Noire launched Cote Noire Reed Diffuser in a pink champagne with notes of strawberry, blackberry and pinot noir grape. It is also available in South Africa through various retailer websites.

South Africa Home Fragrance Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 185.038 million |

| Total Market Size in 2031 | USD 246.394 million |

| Growth Rate | 5.89% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Fragrance, Product Type, Distribution Channel, End-User |

| Companies |

|

South Africa Home Fragrance Market Segmentation:

- By Fragrance

- Floral

- Fresh/Citrus

- Woody

- Oriental/Spicy

- Herbal

- Fruity

- Sweet/Gourmand

- Oceanic

- Others

- By Product Type

- Candles

- Sprays

- Diffusers

- Essential Oils

- Incense Sticks

- Plug-in Devices

- Potpourri and Sachets

- Wax Melts

- Others

- By Distribution Channel

- Hypermarkets/Supermarkets

- Specialty Stores

- Online Stores

- Others

- By End-User

- Households

- Hospitality

- Offices & Commercial Spaces

- Wellness and Spa Centers

- Religious & Cultural