Report Overview

South America Travel Accessories Highlights

South America Travel Accessories Market Size:

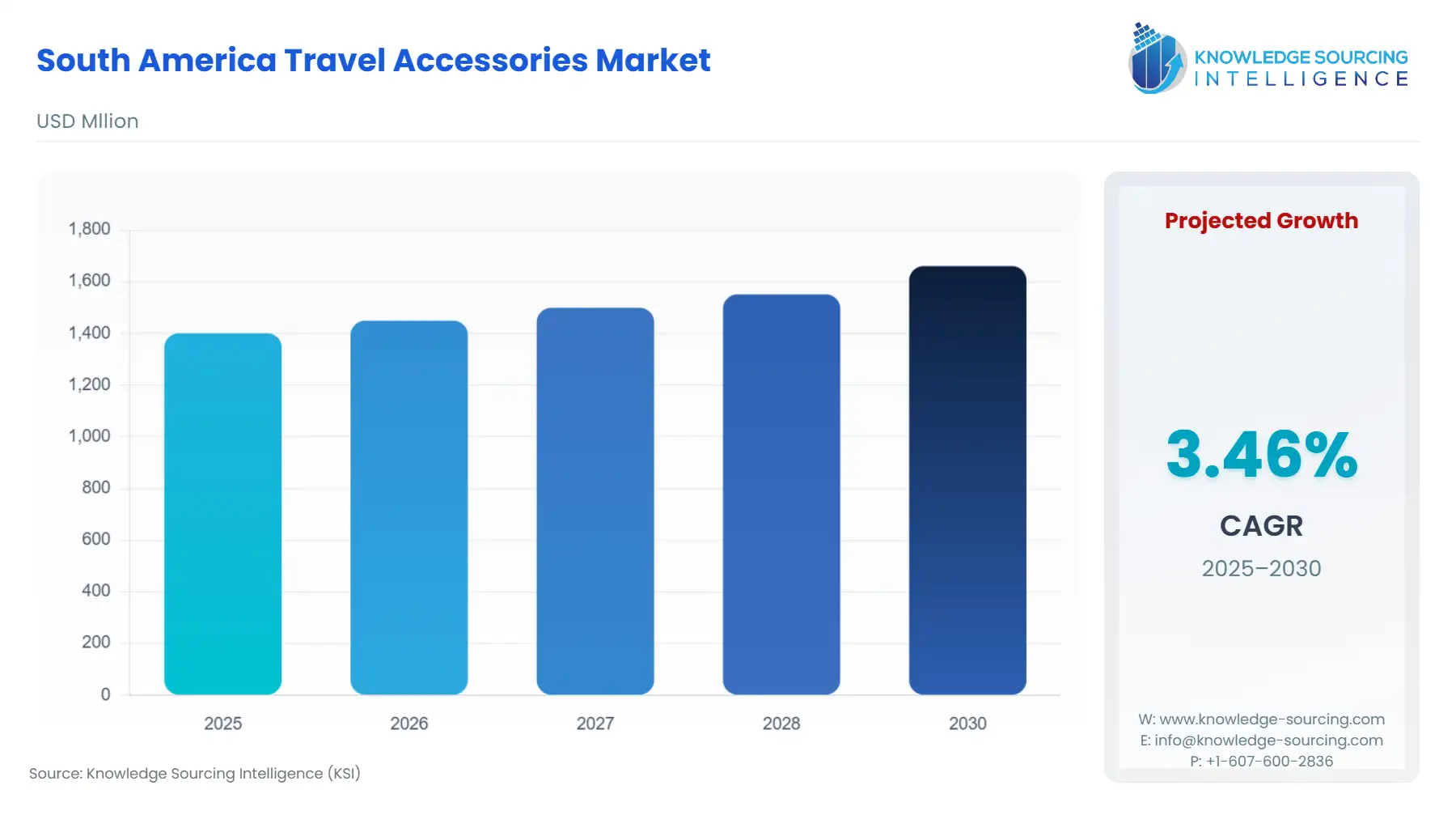

The South American travel accessories market is estimated to reach a market size of USD 1.661 billion by 2030, growing at a 3.46% CAGR from a valuation of USD 1.401 billion in 2025.

The market for South American travel accessories is experiencing significant growth, due to an increase in tourism, rising disposable incomes, and the evolution of consumer preferences. As more individuals in the region choose both domestic and international travel, the demand for diverse and functional travel accessories has increased. This growth is further pushed by the expansion in demand for e-commerce platforms, making travel accessories more accessible to a wider audience. Additionally, consumers are showing increasing interest in stylish, multifunctional, and tech-enabled products that enhance convenience and comfort during travel.

South America Travel Accessories Market Overview & Scope:

The South American travel accessories market is segmented by:

- Product Type: In the South American travel accessories market, travel bags and luggage hold a significant share.Whether for leisure or business, travel bags and luggage are non-negotiable essentials. Every traveler needs a reliable way to carry belongings, making this category consistently high in demand.With an increase in domestic tourism and short regional trips, there is a growing need for versatile, durable, and compact luggage solutions like duffle bags, trolleys, and backpacks.

- Distribution Channel: Offline channels has a significant share of the market, especially through supermarkets, health food stores, and specialty retailers, where consumers can physically check product quality. However, online sales are growing quickly, it is driven by the convenience of e-commerce platforms and direct-to-consumer brands. Increasing awareness and easy access to product information online are helping boost digital sales in the alternative protein space.

- End User: In the South American travel accessories market, leisure travelers hold a significant share.outh America has seen a steady rise in domestic and regional tourism, with popular destinations in Brazil, Argentina, Peru, and Colombia attracting leisure travelers year-round.s more people in the region gain access to middle-class spending power, leisure travel is becoming more common.

- Region: The Brazilian travel accessories market is experiencing robust growth, fueled by increasing tourism, rising disposable incomes, and evolving consumer preferences. As more individuals in the region engage in both domestic and international travel, the demand for diverse and functional travel accessories has surged in the region.

Top Trends Shaping the South America Travel Accessories Market

- Digital Retail Expansion Trend - Online platforms are becoming the primary shopping channel for travel accessories in South America. Consumers increasingly prefer digital purchases due to convenience, wider product choices, and attractive pricing.

- Multi-functional Products Trend - There is rising demand for travel accessories that combine style with utility. Young travellers, in particular, are drawn to trendy backpacks, compact luggage, and tech-integrated accessories like USB-charging bags.

South America Travel Accessories Market Growth Drivers vs. Challenges:

Drivers:

- Growth in Regional and International Tourism: An increase in both domestic and international travel across countries like Brazil, Argentina, and Colombia is a major driver. With more people exploring leisure and adventure tourism, the demand for travel essentials such as luggage, organisers, and comfort accessories is steadily rising. According to UN tourism, Argentina has emerged as a leading destination for international travellers in South America with 7.3 million visitors in 2023 which is a 98.5 percent recovery compared to pre-pandemic levels. In 2024, the country attracted reported 6.6 million tourists, reinforcing its position as a key gateway to South America for tourism.

- Rising disposable Income: Economic improvements and urbanisation have expanded the middle-class population across the region. With higher disposable incomes, consumers are spending more on quality, stylish, and convenient travel accessories, boosting overall market demand. According to EIA, Brazil’s disposable income per capita was projected to grow steadily from $11,919 in 2022 to $13,426 by 2050. While the growth is moderate, it reflects a gradual improvement in consumer purchasing power. Notable milestones include crossing $12,000 by 2035 and $13,000 by 2045, supporting long-term consumption trends.

Challenges:

- Price Sensitivity- Many South American countries, including Argentina and Brazil, face recurring economic instability, inflation, and currency fluctuations. This makes consumers more price-sensitive, often limiting spending on non-essential items like premium travel accessories. Brands must balance affordability with quality to remain competitive in such markets. In many parts of South America, especially rural or less-developed areas, access to a wide variety of travel accessories is limited. The retail landscape remains fragmented, and inconsistent logistics or a lack of e-commerce infrastructure in certain regions can hinder market growth and product reach.

South America Travel Accessories Market Regional Analysis:

- Argentina: The Argentine travel accessories market is experiencing growth, driven by increased international travel, evolving consumer preferences, and a growing demand for both functional and fashionable products. The rise in outbound tourism, particularly to destinations like the United States, has spurred demand for travel accessories that offer both functionality and style. Overall, the Argentine travel accessories market is poised for growth, supported by increasing travel activities and a consumer base that values both quality and style. Brands that can navigate the evolving market dynamics and cater to the preferences of Argentine travellers are likely to find success in this revitalized sector.

South America Travel Accessories Market Competitive Landscape

The market is fragmented, with many notable players, including Samsonite IP Holdings S.a.r.l., Delsey Paris, Monos, Travelpro, Izaan Export, LVMH Moët Hennessy Louis Vuitton SE, and Beis, among others.

- Leather Duffle Bag: Izaan Export stands out as a trusted name among leather duffle bags suppliers in Brazil, offering premium-quality bags crafted from genuine leather. Designed for durability and style, these bags are perfect for travellers and professionals seeking both functionality and elegance.

- Beis’ The Weekender: This duffle bag which is a product from Beis which is made to simplify weekend getaways or short trips. Its wide, easy-access opening allows for effortless packing and unpacking. A dedicated bottom compartment keeps shoes, toiletries, and other essentials separate and organised.

South America Travel Accessories Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| South America Travel Accessories Market Size in 2025 | US$1.401 billion |

| South America Travel Accessories Market Size in 2030 | US$1.661 billion |

| Growth Rate | CAGR of 3.46% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | Brazil, Argentina, Others |

| List of Major Companies in the South America Travel Accessories Market |

|

| Customization Scope | Free report customization with purchase |

South America Travel Accessories Market Segmentation:

By Product Type

- Travel Bags and Luggage

- Electronic Accessories

- Personal Care Accessories

- Others

By Distribution Channel

By End User

- Business Travelers

- Leisure Travelers

- Others

By Country