Report Overview

Spain Advanced Battery Market Highlights

Spain Advanced Battery Market Size:

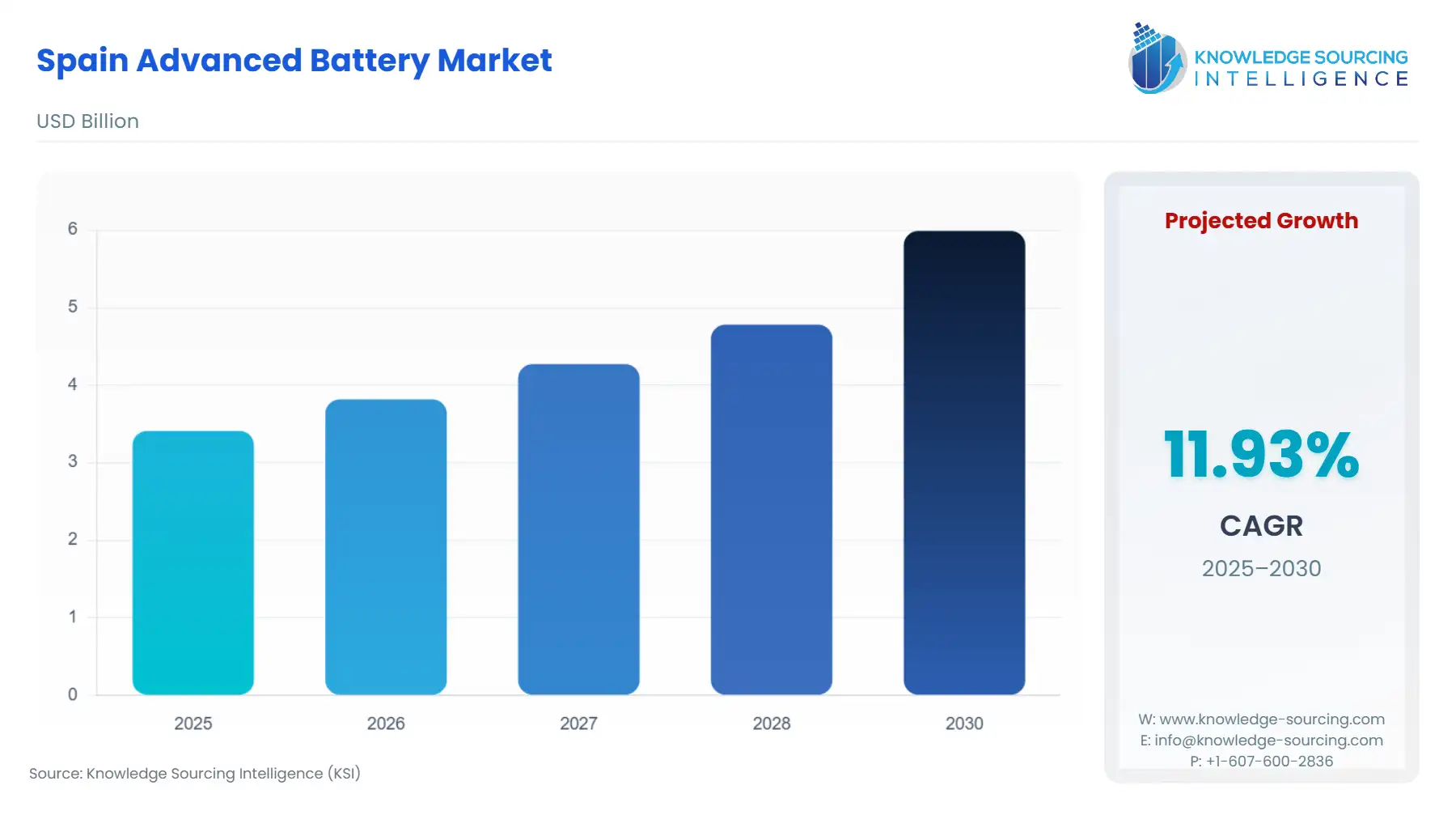

The Spain Advanced Battery Market is projected to expand at a CAGR of 11.93%, attaining USD 5.99 billion in 2030 from USD 3.41 billion in 2025.

The Spanish Advanced Battery Market is poised for rapid expansion, largely driven by the ongoing transition towards cleaner energy systems. Spain's renewable energy capacity, particularly in wind and solar power, has been growing at an unprecedented rate, driving demand for energy storage solutions. Furthermore, the growing adoption of electric vehicles (EVs) has added substantial momentum to the market, both as an end-user segment and as a catalyst for the need for advanced batteries. Regulatory frameworks from the European Union are also pushing for increased sustainability and the shift towards greener technologies, creating favorable conditions for the industry.

Spain Advanced Battery Market Drivers:

Several factors are driving the demand for advanced batteries in Spain. The most significant driver is the expansion of the electric vehicle (EV) market. As Spain aims to meet the EU’s ambitious carbon neutrality goals by 2050, the country has rolled out various incentives for EV adoption, ranging from subsidies for both individuals and fleet operators to favorable tax policies for manufacturers. As a result, the need for high-performance lithium-ion batteries is expected to grow rapidly in the automotive sector.

In addition, Spain’s commitment to renewable energy, particularly solar and wind, has created a growing need for energy storage systems. These systems enable the stabilization of the grid by storing excess energy generated during peak production periods, which is vital for meeting Spain's renewable energy targets. Consequently, there is an increasing demand for large-scale storage solutions, such as lithium-ion and flow batteries, which are essential for balancing the grid.

Government policies also play a pivotal role. Spain, as part of the European Union, is subject to regulations like the European Green Deal, which is designed to promote sustainable technologies, including advanced battery technologies. Additionally, the EU's Battery Directive mandates recycling and environmental sustainability, which is fostering innovation in battery design and manufacturing processes.

- Challenges and Opportunities:

Despite the promising growth prospects, the Spanish Advanced Battery Market faces several challenges. The most pressing challenge is the limited availability of key raw materials like lithium, cobalt, and nickel, which are critical for the production of high-performance batteries. Supply chain disruptions due to geopolitical tensions or natural resource depletion could increase the cost and decrease the availability of these essential materials.

Another challenge is the high upfront capital investment required for manufacturing advanced batteries. While Spain is positioning itself as a key manufacturing hub, the construction of gigafactories requires substantial investment, both from public and private sources. The financial sustainability of these projects depends on stable and growing demand for batteries, which may be jeopardized by external factors, such as global economic downturns.

On the flip side, the increasing focus on sustainable energy production and consumption presents significant opportunities. Spanish companies are leveraging technological advancements, particularly in solid-state and sodium-ion batteries, which offer higher energy densities, faster charging times, and enhanced safety over traditional lithium-ion batteries. These innovations present new market opportunities that could drive demand in both the automotive and energy storage sectors.

- Raw Material and Pricing Analysis:

As the Spanish Advanced Battery Market expands, the availability and cost of critical raw materials are becoming increasingly important. Lithium, cobalt, nickel, and graphite are among the primary materials required for manufacturing advanced batteries. The global supply chain for these materials is dominated by a few countries, which introduces volatility in prices and supply.

Lithium, for instance, is primarily sourced from countries like Australia, Chile, and Argentina. As the need for lithium-ion batteries surges due to EV adoption, Spain's ability to source lithium sustainably will directly impact the growth of its battery market. To mitigate these risks, several Spanish companies are exploring local lithium extraction projects, which may reduce reliance on imports in the future.

Cobalt, another key material for lithium-ion batteries, is primarily sourced from the Democratic Republic of Congo, which is politically unstable. This raises concerns about the reliability of supply and price volatility, which may hamper the growth of Spain's advanced battery industry. In response, there are ongoing efforts to develop cobalt-free battery technologies, such as solid-state and sodium-ion batteries, which could reduce dependency on cobalt.

- Supply Chain Analysis:

The supply chain for advanced batteries in Spain is globally interconnected, with significant dependencies on raw materials sourced from outside the European Union. While Spain has made strides in local production, particularly for lithium-ion batteries, it still relies heavily on imports of raw materials and finished goods. Companies like Inobat Auto Spain, LG Energy Solution, and Basquevolt are investing in local production capabilities to secure a more resilient and self-sustaining supply chain.

Spain is strategically located within Europe, benefiting from the EU’s single market and transportation infrastructure. This provides Spanish manufacturers with efficient access to raw materials from within the EU as well as key markets for battery sales, such as Germany and France. However, the global nature of battery supply chains still poses challenges. For instance, the reliance on Asian suppliers for battery components and the dependence on China for lithium processing create risks related to geopolitical instability and trade disruptions.

Government Regulations:

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| European Union | European Green Deal, EU Battery Directive | Strong regulatory push towards cleaner, sustainable batteries, with emphasis on recycling and sustainability in battery production. |

| Spain | Spanish National Energy and Climate Plan (NECP) | Accelerates EV adoption and energy storage deployment, thus increasing demand for advanced batteries. |

| Spain | Spanish Tax Incentives for Electric Vehicles | Directly boosts demand for EV batteries by making EVs more affordable for consumers. |

Spain Advanced Battery Market Segment Analysis:

- Automotive – Electric Vehicles (EVs): The EV segment is the leading growth driver for advanced batteries in Spain. Spain’s strategic commitment to achieving carbon neutrality by 2050 has prompted government incentives for EV adoption, which directly increases demand for high-performance lithium-ion batteries. The integration of electric vehicles into fleets, including both personal and commercial vehicles, further accelerates the need for reliable and efficient battery solutions. With car manufacturers like SEAT and multinational players investing heavily in EV production, the Spanish automotive sector is expected to play a key role in the growth of advanced battery demand.

- Energy Storage Systems – Utility-Scale: Spain’s renewable energy expansion is a key factor in driving the necessity for energy storage systems, particularly at the utility-scale level. The increased penetration of solar and wind energy requires reliable storage solutions to balance energy production and consumption. Batteries, particularly lithium-ion and flow batteries, are essential for stabilizing the grid and ensuring the availability of renewable energy even during non-peak production times. Spain’s renewable energy targets and EU regulations supporting green energy have made utility-scale energy storage a critical growth driver in the advanced battery market.

Spain Advanced Battery Market Competitive Analysis:

The competitive landscape in Spain’s advanced battery market is marked by a mix of local and international players. Key companies include Inobat Auto Spain, which focuses on high-performance lithium-ion batteries for the automotive sector, and Basquevolt, which is investing in the development of solid-state batteries. Both companies are benefiting from Spain’s favorable regulatory environment for electric mobility and energy storage.

International companies, such as LG Energy Solution Ltd. and BYD Company Limited, are also playing a significant role in the Spanish market. LG Energy Solution’s partnerships with European automakers and battery manufacturers strengthen its position in Spain. Meanwhile, BYD's diversified portfolio of battery technologies, including lithium iron phosphate (LFP) batteries, is positioning the company as a major player in both the automotive and energy storage sectors.

Spain Advanced Battery Market Developments:

- September 2025: Turbo Energy, a leading Spanish energy storage provider, announced a major 336 MWh contract with an unnamed construction industry group for commercial and industrial (C&I) battery systems. This deployment targets peak shaving and backup power, enhancing grid resilience post the April 2025 Iberian blackout. Valued at millions, it underscores Spain's push for localized storage solutions amid rising renewable integration, creating jobs and boosting domestic manufacturing.

- July 2025: Valencia-based Ionly unveiled the XYZ 5 kWh lithium-ion residential battery, featuring 90% European-sourced components for superior reparability and sustainability. Priced competitively, it integrates with solar setups for self-consumption optimization, supporting Spain's EU-mandated circular economy goals. Initial production hits 500 units monthly from September 2025, targeting 10,000 installations annually to cut household emissions by 20%.

Spain Advanced Battery Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 3.41 billion |

| Total Market Size in 2031 | USD 5.99 billion |

| Growth Rate | 11.93% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Technology, Capacity, Material, Sales Channel |

| Companies |

|

Spain Advanced Battery Market Segmentation:

- BY TECHNOLOGY

- Lithium-ion Batteries

- Lead-acid Batteries

- Solid-state Batteries

- Nickel-metal Hydride (NiMH) Batteries

- Flow Batteries

- Sodium-ion Batteries

- Others

- BY CAPACITY

- Low Capacity (<50 Ah)

- Medium Capacity (50-200 Ah)

- High Capacity (>200 Ah)

- BY MATERIAL

- Cathode Material

- Anode Material

- Others

- BY APPLICATION

- Automotive

- Electric Vehicles

- Hybrid Electric Vehicles

- Plug-in Hybrid Electric Vehicles

- Energy Storage Systems

- Residential

- Commercial & Industrial

- Utility-scale

- Consumer Electronics

- Industrial

- Motive Power

- Stationary

- Medical

- Aerospace

- Others

- Automotive

- BY SALES CHANNEL

- OEM

- Aftermarket