Report Overview

Electric Commercial Vehicles Market Highlights

Electric Commercial Vehicles Market Size:

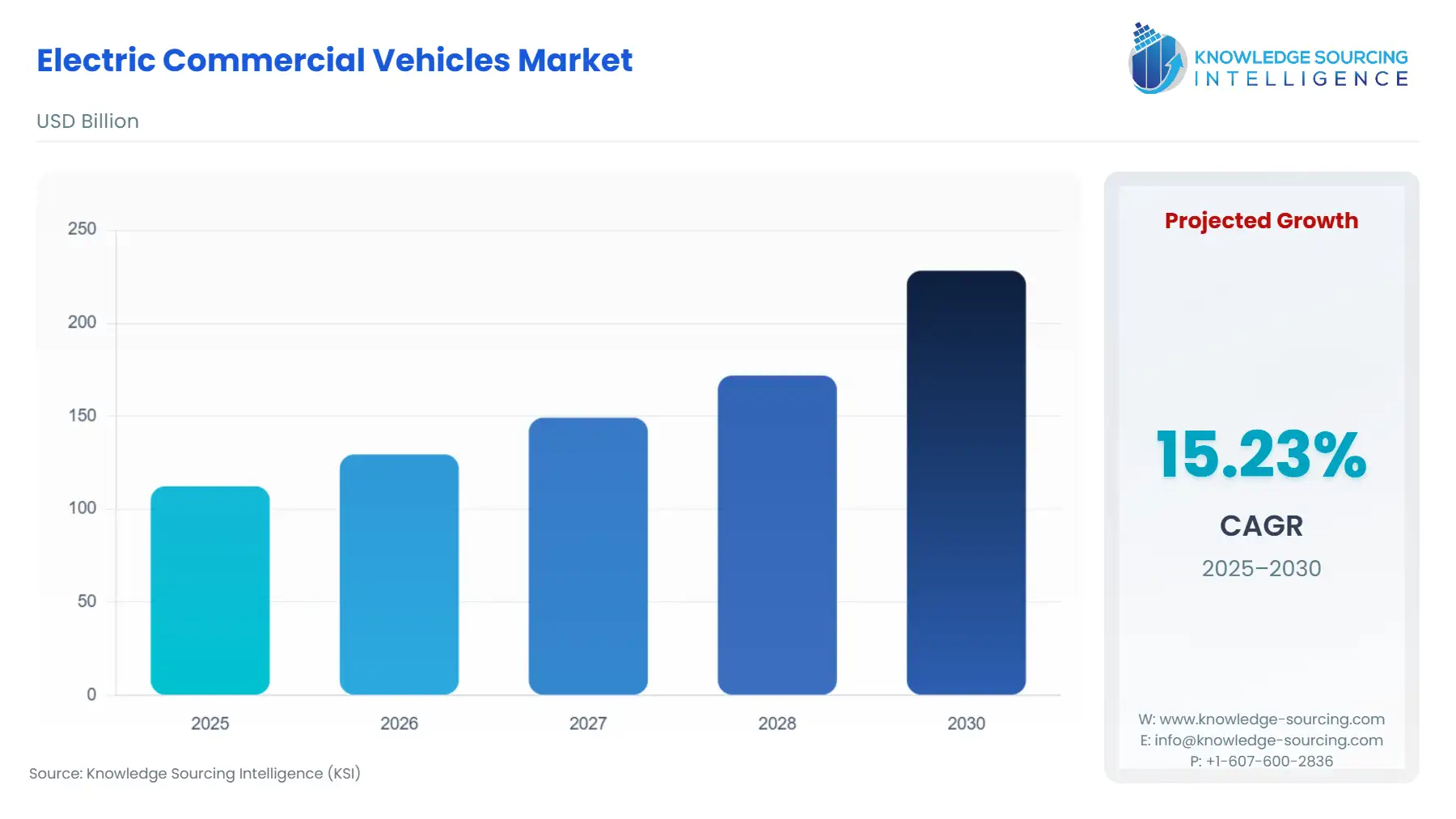

The Electric Commercial Vehicles Market is set to witness robust growth at a CAGR of 15.23% during the forecast period, to be worth US$228.202 billion in 2030 from US$112.337 billion in 2025.

Electric Commercial Vehicles Market Introduction:

The electric commercial vehicle market is reshaping transportation by focusing on sustainability and efficiency. Encompassing the electric trucks market, electric buses market, and electric vans market, it includes the eLCV market (light-duty electric vehicles), medium-duty electric vehicles, and heavy-duty electric vehicles. Zero-emission commercial vehicles are gaining traction as industries prioritize fleet electrification to meet stringent emissions regulations and reduce operational costs. Advancements in battery technology, charging infrastructure, and vehicle range are driving adoption across logistics, public transit, and delivery sectors. This market is pivotal for achieving decarbonization goals in global commercial transportation systems.

Electric Commercial Vehicles Market Trends:

The market for electric commercial vehicles is growing due to environmental concerns, lower costs, and technological advancements. Strict governmental emission regulations are being established worldwide to fight climate change because EVs deliver zero-emission capabilities. These automobiles present reduced maintenance costs and lower operating expenses due to their usage of less expensive electricity and lower maintenance intensity. The performance of electric commercial vehicles, a broader accessible charging network, enhanced battery technology, and electric drivetrain developments are becoming more attainable for these vehicles.

The electric commercial vehicle market is advancing with innovative technologies. EV battery technology improvements enhance range and durability, while fast charging commercial vehicles and megawatt charging systems (MCS) reduce downtime for heavy-duty fleets. Vehicle-to-grid (V2G) commercial solutions enable energy feedback, optimizing grid stability. AI fleet management and telematics for electric vehicles improve operational efficiency through predictive analytics and real-time monitoring. Autonomous electric trucks are emerging, streamlining logistics with enhanced safety. Modular EV platforms offer flexibility, enabling scalable designs for diverse applications. These trends underscore the industry’s focus on efficiency, sustainability, and technological integration in commercial transportation.

Electric Commercial Vehicles Market Growth Drivers:

- Stringent Regulatory Support and Environmental Policies: Governments worldwide enforce strict environmental rules that combine incentives and subsidies for Electric Vehicles to boost consumer demand for electric automobiles. The adoption of electric technology in commercial fleets is rising because companies are working to attract eco-conscious consumers and minimize their carbon emissions. In August 2024, India launched its BHARAT Zero Emission Trucking Policy to push zero-emission trucking projects while decreasing transportation sector emissions, targeting 100% sales penetration by 2050 as a part of the Net Zero 2070 commitment.

- Growing Technological Advancement: New EV battery technologies and improved EV charging technologies in the commercial sector allow drivers to operate vehicles with heavier load limits for longer distances. Fast-charging networks have helped remove range anxiety for electric commercial vehicle operators, thus making these vehicles more approachable for fleet operations. Fleet operators find electric commercial automobiles highly appealing as companies push forward their commercial EV portfolio investments. In November 2024, Mahindra Last Mile Mobility Limited achieved leadership status in sustainable transportation and commercial EV innovation by selling over 2,00,000 electric vehicles in India.

Electric Commercial Vehicles Market Segmentation Analysis By Vehicle Type:

- Buses and Coaches: Widespread adoption in city transportation systems drives the demand for electric buses and coaches because they provide lower costs for ownership and service. There is also broad governmental backing for zero-emission public transport.

- Trucks: The electric truck segment is growing significantly because logistics companies aim to lower environmental impact and operational costs. Established auto producers develop new vehicle models at expanded capacity while improving electrical range performance and fast refueling technology.

Electric Commercial Vehicles Market Segmentation Analysis By Propulsion:

- Battery Electric Vehicles (BEVs): The BEV segment holds the largest market share for electric commercial vehicles, by controlling extensive sales. The current increase in consumer demand for zero-emission vehicles drives manufacturers to create fully electric models for their product lines. Electric vehicle development experts are advancing lithium-ion batteries to increase the vehicle range while lowering prices.

- Plug-in Hybrid Electric Vehicles (PHEVs): Blending electric components with traditional combustion power into PHEVs provides businesses with flexible electric range capabilities despite limited charging options. Current electric models enable fleet operators to reduce their reliance on fossil fuels for city driving while they await the complete transition to electric vehicles.

Electric Commercial Vehicles Market Geographical Outlook:

The Electric Commercial Vehicles Market report analyzes growth factors across the following five regions:

- North America: Widespread interest in zero-emission vehicles, growing environmental awareness, and rising fuel prices are driving electric vehicle adoption across North America. Programs like California's Advanced Clean Trucks regulation and New York City's Clean Trucks Program are contributing to the regional market growth.

- South America: South American electric commercial vehicle adoption rates have risen quickly as Brazil and Chile emerge at the forefront of the market. Sustainable transportation development and pollution reduction form the core objectives of the present government programs. Insufficient charging infrastructure hinders market expansion; thus, government investments in renewable energy will be necessary for further development.

- Europe: European nations are making headway toward electric car adoption through solid regulatory systems and investments in charging stations. The EU's Green Deal envisions reducing emissions until they reach almost 55% of their previous levels by 2030, alongside Germany and the UK, among other countries operating as pioneers in infrastructure design.

- Middle East and Africa: Growing environmental awareness in urban areas in the Middle East and African region is increasing the exploration of EVs in South African markets. Proper charging infrastructure is critical, but insufficient policy support hinders the successful adoption of electric commercial vehicles.

- Asia-Pacific: Due to rapid urbanization, demand for efficient public transport solutions is surging across the Asia-Pacific region, where China and India are leading nations. China's BEV market success relies on government support through policies and monetary support, yet India advances the electric mobility drive through policies like FAME II.

List of Top Electric Commercial Vehicle Companies:

- Daimler Truck

- BYD Co., Ltd.

- Tesla, Inc.

- Volvo Trucks

Companies are securing stronger market standings through fresh product launches and strategic alliance formation as major vehicle producers collaborate with technology organizations to develop enhanced powertrain and charging infrastructure. New startup ventures continue to access this market by introducing revolutionary business concepts alongside unique technological approaches.

Electric Commercial Vehicles Market Latest Developments:

- In October 2024, Volvo announced that it plans to launch an FH Electric version with an increased range of 600 km on one full charge. This will allow transport businesses to cover long-range interstate runs and operate throughout an entire working day before needing to recharge. This long-range electric truck model is expected to become available during the second half of 2025.

- In April 2024, Daimler India Commercial Vehicles (DICV) under Daimler Truck AG unveiled the all-electric light-duty truck Next Generation eCanter for India's market while developing a sustainable, CO2-neutral propulsive strategy for future products through the battery-electric market entry.

Electric Commercial Vehicles Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Electric Commercial Vehicles Market Size in 2025 | US$112.337 billion |

| Electric Commercial Vehicles Market Size in 2030 | US$228.202 billion |

| Growth Rate | CAGR of 15.23% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Electric Commercial Vehicles Market |

|

| Customization Scope | Free report customization with purchase |

Electric Commercial Vehicles Market Segmentation:

- By Vehicle Type

- Buses and Coaches

- Trucks (Light-Duty Trucks, Medium-Duty Trucks, Heavy-Duty Trucks)

- Vans

- By Propulsion

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

- By Power Output

- Up to 150 kW

- 150-250 kW

- Above 250 kW

- By Application

- Logistics and Transportation

- Public Transportation

- Construction (Excavators, Loaders, Others)

- Mining

- Agriculture (Tractors, Harvesters, Others)

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Australia

- Others

- North America