Report Overview

Spain Home Fragrance Market Highlights

Spain Home Fragrance Market Size:

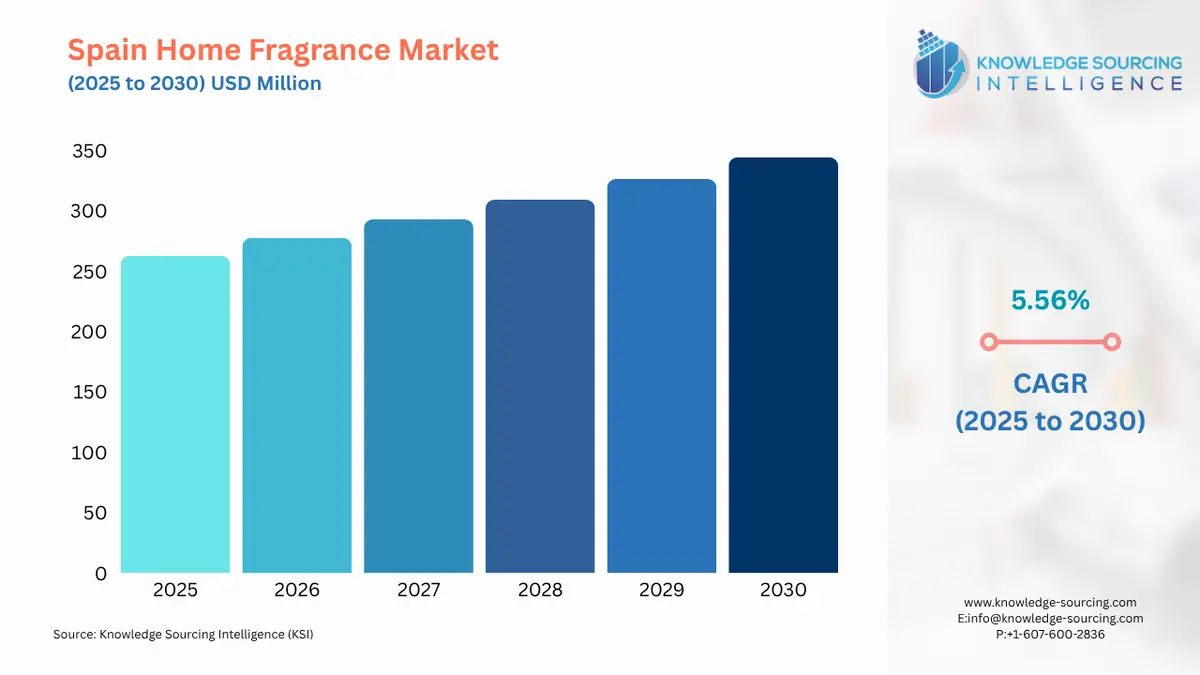

The Spain Home Fragrance Market is anticipated to grow at a CAGR of 5.56%, rising from USD 262.838 million in 2025 to USD 344.488 million by 2030.

Spain's home fragrance business is changing because of lifestyle trends and traditional sensitivities. Spanish customers consider house fragrances to be vital components that enhance a well-rounded living space. The market has grown to include many items like artisanal candles, botanical diffusers, incense, and ultrasonic aroma diffusers, all driven by a profound cultural respect for scent and the environment. Natural and organic components are becoming popular, which reflects Spain's larger trend toward wellness and sustainability. Customers who care about the environment are responding favorably to brands that combine ecological responsibility with olfactory artistry. Additionally, the market is being influenced by trends in home décor and lifestyle influencers, who promote self-care and everyday luxury.

Spain Home Fragrance Market Overview & Scope:

The Spain home fragrance market is segmented by:

- Fragrance: The Herbal industry is expected to lead the Spanish home fragrance market. Growing awareness of the negative effects of synthetic perfumes, increased disposable income, and customer desire for natural and organic products are driving the growth of the herbal fragrance market. The Centers for Disease Control and Prevention (CDC) reported in its 2023 National Health Interview Survey that 41% of adults used complementary health approaches, including aromatherapy, up from 36% in 2021.

- Product Type: The market is separated into many segments based on product type, candles, sprays, diffusers, essential oils, incense sticks, plug-in devices, potpourri and sachets, wax melts, and others. The Spain home fragrance market is presently dominated by the sprays segment. This is due to the fact that the sprays are more reasonably priced than other product types and are available in a range of fragrances, such as lavender, jasmine, and rose, along with various functions to accommodate the needs of various customers. For instance, the Godrej Aer Matic Spray is an an automatic spray that can be refilled and adjusted, allowing users to choose between four different scents in a matter of minutes.

- Distribution Channel: The market is divided into Specialty stores, online stores, hypermarkets and supermarkets, and others based on the distribution. The availability of a wide range of products on supermarket shelves allowed hypermarkets and supermarkets to dominate the market.

Top Trends Shaping the Spain Home Fragrance Market:

- Spanish Botanical Ingredients are Being Revived

Sustainable and locally produced native botanicals are becoming more popular in Spain's fragrance industry. Organic farms harvest Spanish lavender, citrus flower, myrtle, rosemary, and rockrose (Jara). Artisanal brands emphasize and encourage transparency by sharing the origin information of their ingredients. The use of herbal medicine and natural therapies that are based on Iberian ethnobotany is becoming common.

- Combining Spanish Wine and Food with Scents

Combining fragrance with local cuisine and wine is becoming a common trend that combines perfumery and gastronomy in immersive formats. Fragrance sets that are in line with local culture in terms of both cuisine and perfume and are inspired by D.O. (Denominación de Origen) zones. To develop scented napkins, menus, and atmosphere aromas for premium dining experiences, chefs and sommeliers collaborate.

Spain Home Fragrance Market Growth Drivers vs. Challenges:

Opportunities:

- The Dual Home Economy & Second Homes: Second-home ownership rates are among the highest in Europe, especially in coastal or rural areas of Spain (Costa Blanca, Asturias, Balearics). This creates demand in many ways. Customers choose completely different smell identities for their houses in the city and the country. While vacation homes utilize earthy, marine, or resinous notes, city residences prefer clean or lemony scents. Increased sales of "traveling fragrance kits" for second homes have been reported by retailers. Seasonal marketing is being adopted by an increasing number of brands, particularly during the summer and Semana Santa.

- Social Perception and Symbolic Cleanliness: In Spanish culture, a home that smells well is not merely a symbol of cleanliness but also of moral integrity and pride. When guests enter a house, they frequently remark on the perfume right away, and when their house "smells good," hosts feel socially acknowledged. Particularly in traditional or older homes, scent is associated with respectability, readiness, and dignity. A constant need for items that indicate social cleanliness, such as linen sprays, soap-scented candles, or lemon oil burners, is brought on by the pressure to preserve ambient smell.

Challenges:

- Competition from Multi-functional Household Goods: In Spain, multipurpose products like fabric softeners, air-freshening detergents, cleaning sprays with additional fragrances, and inexpensive plug-ins from supermarkets frequently compete with home fragrances.

- The Seasonal Variability of Fragrances: The Spain climate makes the usage of house scents quite seasonal. Strong fragrances can become overpowering or cloying during the hot summer months, particularly in southern Spain, which lowers consumption. Candles and diffusers become more popular during the cooler months, although this period is only from October to February.

Spain Home Fragrance Market Competitive Landscape:

The market is moderately fragmented, with many key players including Puig, Iberchem, Chemarome, Àuria Perfumes, Ambientair, and Cristalinas.

- Market Expansion: In May 2024, Puig Brands, S.A., a global leader in premium fragrance with a diverse presence across brands, product categories, and geographies, began trading as a listed company on the Barcelona, Madrid, Bilbao, and Valencia Stock Exchanges (the "Spanish Stock Exchanges").

Spain Home Fragrance Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 262.838 million |

| Total Market Size in 2031 | USD 344.488 million |

| Growth Rate | 5.56% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Fragrance, Product Type, Distribution Channel, Region |

| Geographical Segmentation | Andalusia, Catalonia, Galicia, Aragon, Navarre, Others |

| Companies |

|

Spain Home Fragrance Market Segmentation:

- By Fragrance

- Floral

- Fresh/Citrus

- Woody

- Oriental/Spicy

- Herbal

- Fruity

- Sweet/Gourmand

- Oceanic

- Others

- By Product Type

- Candles

- Sprays

- Diffusers

- Essential Oils

- Incense Sticks

- Plug-in Devices

- Potpourri and Sachets

- Wax Melts

- Others

- By Distribution Channel

- Hypermarkets/Supermarkets

- Specialty Stores

- Online Stores

- Others

- By Region

- Andalusia

- Catalonia

- Galicia

- Aragon

- Navarre

- Others