Report Overview

Surface Mount Technology (SMT) Highlights

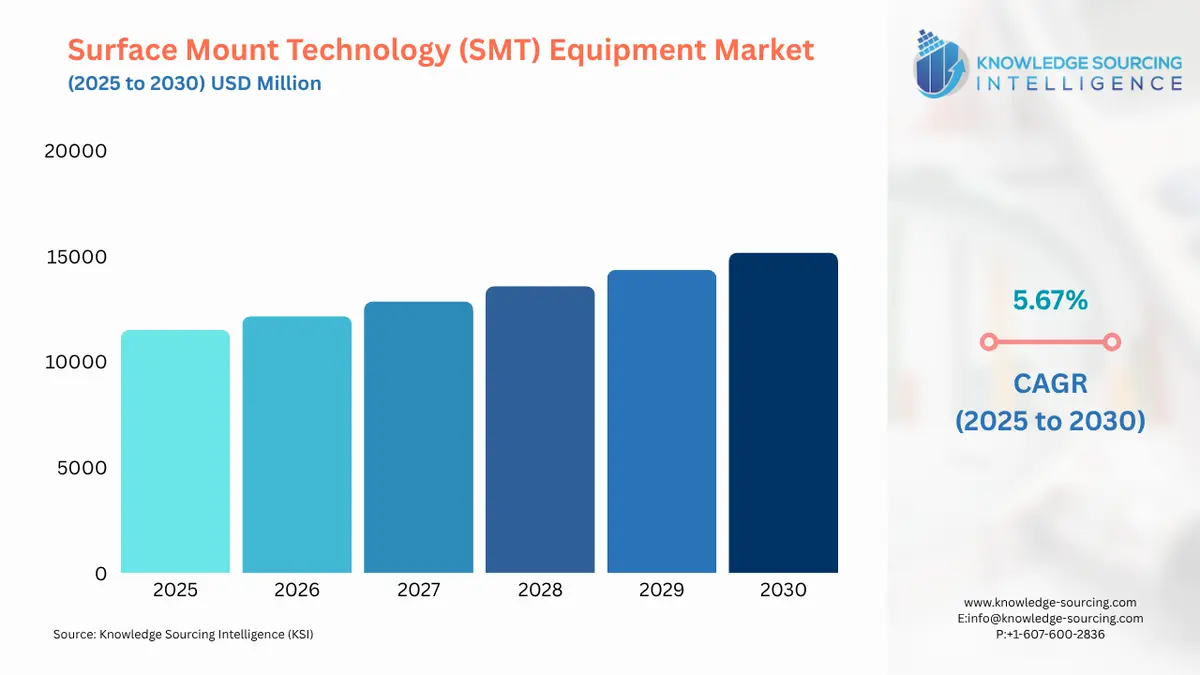

Surface Mount Technology (SMT) Equipment Market Size:

The Surface Mount Technology (SMT) Equipment market is expected to grow at a compound annual growth rate (CAGR) of 5.67% from US$11,508.443 million in 2025 to US$15,164.571 million in 2030.

Surface Mount Technology (SMT) Equipment Market Introduction:

Surface-mount technology, or SMT, is a type of component assembly technology mounted on the surface of the PCB or printed circuit board. The SMT offers maximum flexibility and improved reliability and performance. It also increases automation utilization and can integrate multiple components into smaller units. A major factor boosting the global SMT equipment market forward is the increasing demand for smartphones and telecommunication products worldwide. SMTs offer lighter and smaller footprints, which helps increase the performance of the devices. These systems also help in increasing the reliability of the smartphones. With the growing ownership of smartphones globally, the demand for SMTs in the telecommunications sector will increase significantly.

The GSM Association, in its report, stated that as of October 2023, about 54% of the global population, which is about 4.3 billion, owns smartphones. Similarly, mobile phone ownership also increased significantly. The International Telecommunication Union, in its report, stated that in 2023, the total ownership of mobile phones was recorded at 78%. In the global mobile phone ownership, the European region accounts for 93%, followed by 88% in the Americas region. The Arab States and the Asia Pacific region accounted for 82% and 75%, respectively.

With the growing demand for smartphones, manufacturers are increasingly resorting to SMT technology to create smaller, more efficient devices that match customer performance and portability standards. This tendency is accelerated by technological improvements such as 5G, which necessitate complex electronic components capable of managing faster data speeds and improved communication.

Furthermore, to offer devices with better cameras, longer battery life and robust processing capabilities, to meet the needs of consumers is essential for manufacturers to offer them at a reasonable price; hence, SMT technology becomes necessary. To satisfy the demand for increasingly smart devices and IoT, it also requires compact assemblies that SMT can successfully offer.

Surface Mount Technology (SMT) Equipment Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

:

SMT is a type of component assembly technology mounted on the surface of the PCB or printed circuit board. The SMT offers maximum flexibility and improved reliability and performance. It also increases automation utilization and can integrate multiple components into smaller units. SMT equipment encompasses a range of specialized machines and tools to achieve high precision, efficiency, and automation in electronics manufacturing.

SMT equipment forms the backbone of modern electronics manufacturing, playing a pivotal role in advancing digitalization, industrial automation, and high-quality production across sectors such as automotive, consumer electronics, industrial control, and medical devices. Rapid advancements in AI, IoT, and real-time data analytics are also reshaping the SMT landscape, driving demand for high-speed, high-precision, and highly flexible machines. Thus, the growing trend towards miniaturized products, the increasing adoption of advanced technologies such as 5G (forecasted to handle 80% share in global mobile traffic by 2030), and IoT are driving the SMT equipment demand.

SMT equipment is increasingly being tailored to meet the growing needs of next-gen applications such as smart homes, industrial automation, and intelligent wearables. Thus, a major factor boosting the global SMT equipment market is the increasing demand for smartphones. SMTs offer lighter and smaller footprints, which helps increase the performance of the devices. These systems also help in raising the reliability of the smartphones. With the growing ownership of smartphones globally, the demand for SMT equipment in the telecommunications sector will rise significantly. The GSM Association, in its report, stated that as of 2025, 80% of smartphone connections are anticipated to increase to 91% by 2030, directly fueling the demand for advanced SMT equipment due to the need for compact, high-performance, and reliable electronic components in smartphones.

Thus, the increasing applications in consumer electronics, automotive, telecommunications, healthcare, and other industries are propelling the market growth. According to the Electronics: Powering India’s Participation in Global Value Chains report, India’s electronics sector has experienced rapid growth, reaching USD 101 billion in FY23, doubling from USD 48 billion in FY17, highlighting the growing end-use industries driving the SMT equipment market.

For instance, in July 2025, Frank Elektronik, a German electronics service provider serving multiple sectors, such as industrial electronics, medical technology, automotive and e-mobility, railway, measurement technology, and lighting industries, added advanced SMT equipment, including AI-supported inspection systems and high-precision printing technology. The example highlights the growing demand for SMT equipment by electronics manufacturers.

Technological advancement remains a key growth catalyst for the SMT equipment market, driven by the increasing integration of AI for enhanced placement accuracy, the adoption of Industry 4.0 principles such as IoT connectivity, real-time data analytics, and cloud-based monitoring, along with the demand for high-speed, high-precision placement systems and advanced inspection technologies.

Surface Mount Technology (SMT) Equipment Market Drivers:

- Increasing demand for electric vehicles is projected to propel the Surface Mount Technology (SMT) Equipment market expansion.

The SMT equipment market’s growth is being driven primarily by the rise of automotive electronics and the electric vehicle (EV) sector. Advanced driver-assistance systems (ADAS), infotainment, powertrain control, battery management, and in-vehicle connection are a few of the vital functions that modern cars—especially electric and hybrid models—are depending more on complex electronic systems for. SMT methods are the most effective way to create the printed circuit boards (PCBs) needed for these systems, which must be small, dense, and extremely dependable.

There is a growing need for SMT equipment that can manage intricate component placement with exceptional accuracy, satisfy high-speed production needs, and guarantee long-term durability under challenging operating conditions as the automobile sector moves toward electrification and automation. To manage energy efficiency, safety, and performance, EVs also need a lot of control units and sensors, all of which depend on sturdy SMT-assembled PCBs. According to the International Energy Agency (IEA), in 2024, over 17 million electric cars were sold worldwide, accounting for more than 20% of total sales. Just the 3.5 million more electric vehicles sold in 2024 than the year before surpasses the global number of electric vehicles sold in 2020. It is anticipated that more than 20 million electric vehicles will be sold globally in 2025, making up more than 25% of all automobile sales. The first three months of 2025 saw a 35% increase in global sales of electric vehicles.

Upgrades and investments in SMT equipment are prompted by the drive toward completely driverless vehicles, which increases the demand for high-performance electronic assemblies. High-throughput, automated SMT lines are becoming more popular among OEMs and Tier 1 suppliers to grow production while upholding quality and traceability criteria. Furthermore, stricter safety and pollution regulations are pressuring automakers to incorporate additional electronics, like real-time monitoring modules and emission control sensors, which is increasing the use of SMTs. Nearly 250,000 premature deaths occur in Europe each year because of air pollution, and high concentrations of these pollutants are linked to a range of non-communicable diseases, including lung cancer, asthma, and cardiovascular issues.

- The expanding telecommunication sector is anticipated to fuel the SMT equipment market expansion.

The telecom sector has been expanding, and as the number of users has increased, so need for surface-mount technology equipment. Due to the introduction of new products, rapid production, and miniaturization, the expanding telecommunications industry has been driving the demand for SMT equipment globally. Moreover, due to the exponential growth in demand for mobile phones, 4G/5G networks, CFL and LED lighting units, LCD television sets, and other telecommunications, there is an immediate need for electronic devices that are both lightweight and long-lasting in their respective fields.

Further, the increasing use of the Internet globally is also raising the need for surface-mount technology equipment in the telecom industry. For instance, 4.9 million people, or 69% of the world's population, are active Internet users as of 2022. According to trends, the number of Internet users is increasing at a rate of 4% annually, which translates to about 196 million new users joining the Internet annually.

As technology such as 5G continues to advance, telecommunications become further advanced. As the complexity of data and connections grows, the demand for greater electronic components grows higher with it. Thus, these manufacturers have to spend big on advanced SMT equipment to be able to provide smaller and more complex boards that can fulfil all those new specifications. The trend continues to be amplified by smart devices, including IoT applications. These devices often require complicated electronic assemblies that rely extensively on SMT processes to manufacture efficiently. As more data traffic and connectivity requirements are built into the telecom company's infrastructure, they will continue to rely on SMT technology for their needs.

The inclusion of AI and machine learning in telecommunication also opens doors for SMT equipment manufacturers. These technologies require highly sophisticated electronics that can process large volumes of data in real-time, further increasing the demand for high-quality SMT solutions. In general, the interaction between telecommunications advancements and SMT technology will drive market growth to a huge extent in the coming years.

Surface Mount Technology (SMT) Equipment Market Segmentation Analysis:

- The consumer electronics sector is expected to lead the market growth

By industry vertical, the surface mount technology equipment market is segmented into telecommunication, consumer electronics, automotive, healthcare, and others. Due to the ongoing development and rising demand for small, multipurpose, high-performing electronic devices like smartphones, tablets, gaming consoles, wearable technology, and smart home goods, the consumer electronics industry is one of the major drivers of the SMT equipment market. As of FY 23, India's electronics industry is valued at USD 101 billion. This amount includes USD 15 billion in component manufacturing and USD 86 billion in final goods production. The PCBs used in these devices are lightweight, densely packed, and include many tiny components that are all effectively built utilizing SMT techniques.

Advanced SMT equipment that can insert components quickly and precisely is essential as consumer expectations push manufacturers to produce goods with rapid processing power, longer battery life, and sleeker form features. SMT technology is crucial to the high-volume production of consumer electronics because it enables electronics manufacturers to automate production lines, decrease human error, limit material waste, and guarantee uniformity in quality across enormous volumes.

Furthermore, the consumer electronics market's short product life cycles and quick rate of innovation necessitate flexible and adaptive SMT solutions that can manage a wide variety of component types and frequent design modifications. The complexity of PCB assemblies is also being increased by the spread of new technologies like augmented reality (AR), virtual reality (VR), and AI-enabled smart devices. This is driving up demand for next-generation SMT equipment like intelligent pick-and-place machines, automated optical inspection (AOI), and 3D solder paste inspection (SPI).

Consumer electronics are a key pillar in the steady growth of the SMT equipment market because major electronics manufacturers are increasing their production capacities in Asia-Pacific and other developing regions to meet global demand, and they are also investing more in cutting-edge SMT infrastructure. China, Taiwan, the United States, South Korea, Vietnam, and Malaysia control most of the USD 4.3 trillion global electronics market.

Surface Mount Technology (SMT) Equipment Market Geographical Outlooks:

Based on geography, the Surface Mount Technology (SMT) Equipment market is segmented into North America, South America, Europe, the Middle East and Africa, and the Asia Pacific. North America is anticipated to hold a substantial market share. The region's strong manufacturing base, highly qualified workforce, and pro-business government policies draw in multinational firms and encourage the expansion of regional electronics industries. The increasing demand for tablets, smartphones, and other electronic devices means that surface mount technology must be able to produce them efficiently and in large quantities.

Moreover, the market in the United States is changing as a result of the incorporation of cutting-edge technologies like artificial intelligence, the Internet of Things, and data analytics. These technologies put tech-driven businesses at the forefront by enabling increased product efficiency, customization, and user experience. In addition to enhancing competitive advantage, this emphasis on innovation opens up new growth prospects by satisfying a tech-savvy clientele.

Further, the demand for surface mount technology equipment is expected to increase during the forecast period due to the United States' significant share of the semiconductor industry and high R&D costs. For instance, the total R&D investment made by the semiconductor industry in the United States in 2023 was $59.3 billion. Spending on research and development increased by 0.9% in 2023 compared to 2022.

Moreover, key market players are pursuing several strategic initiatives, including mergers and acquisitions and new product launches, to strengthen their market position, capture a significant share, and improve profitability as a whole. For instance, in September 2023, Hyve Solutions Corporation, a prominent supplier of hyperscale digital infrastructures and a fully owned subsidiary of TD SYNNEX Corporation, introduced new Surface Mount Technology (SMT) lines that increase its capacity for manufacturing in the United States. Hyve's continued dedication to offering clients a Secure Supply Chain through locally optimized efficiencies and lead time reductions is strengthened by this expansion.

As competition heats up in the SMT equipment market, companies are focusing on sustainability initiatives to attract environmentally concerned customers. This trend towards more sustainable manufacturing processes is likely to affect industry advancements in the future. Firms that engage in environmentally friendly technologies and procedures can not only increase their market appeal but also contribute positively to global sustainability initiatives.

Surface Mount Technology (SMT) Equipment Market Key Developments:

- April 2025- Incap US invested USD 2 million in advanced SMT production equipment to expand its production capacity. It will boost Incap US’s production capacity by approximately 110%, a substantial increase for a facility focused on high-complexity, low-to-mid volume electronics manufacturing.

- June 2024- SMTO has partnered with Essemtec, a leading company in complex electronics assembly solutions, for a strategic presence in the Mexican market. This alliance seeks to leverage the fast-expanding electronics manufacturing sector of Mexico, which has experienced a 30% increase between 2020 and 2023. Combining Essemtec's advanced manufacturing tools with SMTO's commitment to service excellence, the partnership will prove to be an opportunity to offer a holistic solution with support to local manufacturers. Both companies are enthusiastic regarding the growth potential, strengthening their market penetration through service provision, and are ready for the shifting landscape of Mexico's electronics industry.

- March 2024- Hitachi High-Tech Corporation launched LS9300AD, a new system for inspecting the front and backside of non-patterned wafer surfaces for particles and defects. It supports high-quality wafers for downstream PCB assembly.

- January 2024- ASMTXTRA USA has joined up with Precision Tool Group as its representative from Virginia to Maine. This agreement is expected to improve the distribution of SMT products and solutions in the northeastern United States. SMTXTRA USA, an expert in surface mount technology, looks forward to leveraging Precision Tool Group's wide network and industry experience to better serve customers in the region. The agreement represents a common commitment to providing high-quality, cost-effective products that satisfy the changing needs of the electronics manufacturing industry. By combining their resources, both organisations hope to improve service delivery and extend their market presence. This strategic agreement is expected to improve manufacturers' access to modern SMT equipment and components, ultimately promoting enhanced efficiency.

Surface Mount Technology (SMT) Equipment Companies:

- Fuji Corporation

- Hitachi

- Juki Corporation

- Viscom AG

- Nordson Corporation

Surface Mount Technology (SMT) Equipment Market Scope:

| Report Metric | Details |

| Surface Mount Technology Equipment Market Size in 2025 | US$11,508.443 million |

| Surface Mount Technology Equipment Market Size in 2030 | US$15,164.571 million |

| Growth Rate | CAGR of 5.67% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Surface Mount Technology Equipment Market |

|

| Customization Scope | Free report customization with purchase |

Segmentation

- By Type

- Screen Print Equipment

- Soldering Equipment

- Inspection Equipment

- Placement Equipment

- Cleaning Equipment

- Repair & Rework Equipment

- By Industrial Vertical

- Telecommunication

- Consumer Electronics

- Automotive

- Healthcare

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America

Our Best-Performing Industry Reports:

Navigation

- Surface Mount Technology (SMT) Equipment Market Size:

- Surface Mount Technology (SMT) Equipment Market Highlights:

- Surface Mount Technology (SMT) Equipment Market Introduction:

- Surface Mount Technology (SMT) Equipment Market Drivers:

- Surface Mount Technology (SMT) Equipment Market Segmentation Analysis:

- Surface Mount Technology (SMT) Equipment Market Geographical Outlooks:

- Surface Mount Technology (SMT) Equipment Market Key Developments:

- Surface Mount Technology (SMT) Equipment Companies:

- Surface Mount Technology (SMT) Equipment Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 26, 2025