Report Overview

Sustainable Footwear Market - Highlights

Sustainable Footwear Market Size:

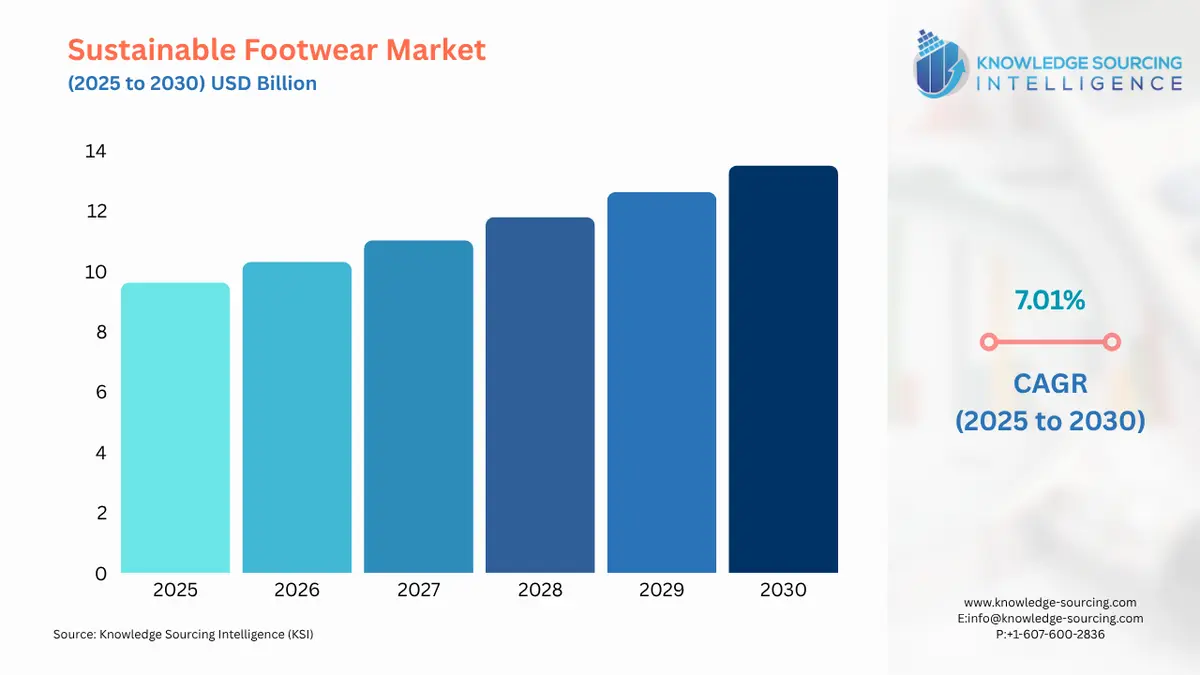

The Sustainable Footwear Market is expected to grow at a CAGR of 7.01%, reaching a market size of USD 13.513 billion in 2030 from USD 9.630 billion in 2025.

The global sustainable footwear market is a rapidly evolving segment of the broader apparel industry, distinguished by its focus on reducing the environmental and social impact of production. The market's growth is a direct response to a rising tide of consumer consciousness regarding the fashion industry's ecological footprint, prompting a fundamental re-evaluation of traditional manufacturing processes and materials. Historically, the footwear industry has been reliant on resource-intensive methods, including the use of petroleum-based synthetics and conventional leather, which have come under increasing scrutiny.

Sustainable Footwear Market Analysis

- Growth Drivers

The primary catalyst for the sustainable footwear market is a profound change in consumer behavior. A growing segment of the global consumer base is actively seeking products that align with their environmental and social values. This shift directly increases demand for footwear made from materials that are either recycled, bio-based, or ethically sourced. The need for products made from recycled plastics, for instance, is directly linked to consumer awareness of ocean plastic pollution and landfill waste. When brands successfully communicate that their products utilize materials like recycled PET from plastic bottles, it serves as a powerful purchasing incentive. This sentiment is particularly strong among millennials and Gen Z, who often view sustainability as a key purchasing factor.

Moreover, innovation in material science is creating new demand pathways. The development of plant-based leathers from materials such as pineapple leaves, mushrooms, and cactus provides a cruelty-free and lower-impact alternative to traditional animal leather. This directly caters to the growing segment of vegan and environmentally conscious consumers. Brands that adopt these materials differentiate their products and tap into a market segment that would otherwise be inaccessible. The rise of digital platforms and social media also fuels demand by enabling brands to transparently communicate their sustainability practices. This increased transparency builds consumer trust and allows smaller, mission-driven brands to compete with larger, legacy companies, thereby broadening the market's reach and accelerating its growth.

- Challenges and Opportunities

The sustainable footwear market navigates several inherent challenges that serve as significant constraints on its growth. The most prominent challenge is the higher production cost associated with sustainable materials and ethical manufacturing practices. Materials like organic cotton and bio-based alternatives are often more expensive to source and process than their conventional counterparts. This cost is compounded by the need for transparent, ethical supply chains, which require brands to invest in auditing and certification processes. These higher costs can result in a premium price point for the final product, which may deter price-sensitive consumers and limit mass-market adoption. Additionally, the limited availability of certain innovative materials and the nascent state of recycling infrastructure for footwear pose logistical and scalability challenges for brands.

Despite these obstacles, the market is rich with opportunities. The increasing demand for sustainable products presents a compelling incentive for brands to invest in research and development. This creates an opportunity for innovation in areas such as closed-loop recycling programs for end-of-life footwear. Companies that can develop scalable and economically viable methods to recycle shoes are poised to create a competitive moat. The opportunity also extends to collaborations. Strategic partnerships between footwear brands and material science companies or non-governmental organizations can accelerate the development and commercialization of new sustainable materials. For instance, partnerships focused on using ocean plastics or industrial waste can not only provide a new source of raw material but also enhance a brand's reputation. Finally, the growing consumer demand for transparency and ethical production practices creates an opportunity for brands to build deep consumer loyalty by authentically sharing their sustainability journey and impact.

- Raw Material and Pricing Analysis

The sustainable footwear market is distinguished by its departure from traditional, petroleum-based materials in favor of a diverse range of eco-friendly alternatives. The core raw materials include recycled plastics, such as PET bottles and ocean plastics, which are processed into yarns for uppers and recycled rubber for outsoles. Other key materials are natural fibers like organic cotton and hemp, which are cultivated with significantly less water and fewer pesticides than conventional cotton. Bio-based leathers, derived from sources like pineapple leaves (Pinatex) and mushroom mycelium, represent a high-value, innovative material segment.

The pricing dynamics of these materials are complex. Recycled and bio-based materials often command a premium over traditional synthetics and leather due to the higher costs of collection, sorting, and processing, as well as the nascent nature of their supply chains. The price of recycled PET, for example, is influenced by the efficiency of collection networks and the cost of the recycling process. Similarly, the cultivation and processing of bio-based materials require specialized infrastructure, which contributes to a higher cost basis. This raw material pricing structure directly impacts the final retail price of the footwear, often positioning sustainable products in a premium market segment.

- Supply Chain Analysis

The supply chain for sustainable footwear is inherently more complex and transparent than that of conventional footwear. It begins with the sourcing of sustainable raw materials, which requires a detailed understanding of their origin and production methods. For recycled materials, the supply chain involves the collection of post-consumer waste, its processing into raw material (e.g., plastic pellets or recycled yarn), and its subsequent delivery to the manufacturer. For bio-based materials, the chain involves farming or cultivating the base material, followed by processing into a usable textile or leather alternative.

Key production hubs for sustainable footwear are distributed globally, with notable concentrations in countries known for their ethical manufacturing practices and technological capabilities. European countries, for example, have a strong presence in high-end, bio-based footwear, while many brands utilize facilities in Asia that have adopted sustainable manufacturing practices. The logistical complexities are significant. Brands must ensure traceability across the entire supply chain, from raw material extraction to final assembly, to verify and communicate their sustainability claims. This requires partnerships with certified suppliers and a commitment to transparency, which contrasts with the more opaque, multi-tiered supply chains of traditional footwear. The supply chain is a critical element of a brand's sustainability story and is a key area of strategic focus.

- Government Regulations

Government regulations play an increasingly direct role in shaping the sustainable footwear market by setting standards and creating an environment that incentivizes eco-friendly practices. These regulations move beyond voluntary corporate commitments to mandatory requirements that influence product design, material sourcing, and end-of-life management.

Jurisdiction | Key Regulation / Agency | Market Impact Analysis

- India: Bureau of Indian Standards (BIS) Quality Control Orders (QCOs). The DPIIT has issued Quality Control Orders making BIS certification mandatory for footwear, including footwear made from rubber, polymeric materials, leather, and other materials. This regulation directly impacts the market by ensuring a baseline quality standard and formalizing the industry. For sustainable footwear manufacturers, this creates a uniform quality framework that their products must meet, thereby building consumer confidence and formalizing the market.

- European Union: EU Green Deal, Circular Economy Action Plan, and Ecolabel Regulations. The EU's policies mandate higher standards for product durability, recyclability, and the use of sustainable materials. The EU Ecolabel, for instance, provides a voluntary certification that influences consumer purchasing decisions. These regulations increase demand for products that meet stringent environmental criteria, compelling brands to innovate with sustainable materials and production processes to remain competitive in the European market.

- United States: Federal Trade Commission (FTC) Green Guides. The FTC Green Guides provide a framework for environmental marketing claims, prohibiting deceptive or unsubstantiated claims of sustainability. While not a direct regulation on materials, these guidelines have a profound market impact by requiring brands to be truthful and transparent about their sustainable practices. This rule directly increases consumer trust in certified sustainable products and penalizes brands that engage in "greenwashing," thereby bolstering the market for authentically sustainable footwear.

Sustainable Footwear Market Segment Analysis:

- By Material: Recycled Plastics

The use of recycled plastics has emerged as a transformative material segment within the sustainable footwear market. This necessity is a direct consequence of a global movement to address plastic waste, particularly in oceans and landfills. Brands leverage recycled polyethylene terephthalate (PET) from plastic bottles to create high-quality, durable yarns that are used for shoe uppers. This process directly diverts waste from the environment and reintroduces it into a valuable product. The demand for shoes made from recycled plastics is propelled by consumer preference for products with a clear, positive environmental story. For example, a consumer purchasing a pair of sneakers made from recycled plastic bottles understands the direct link between their purchase and waste reduction. This segment is characterized by rapid innovation, with companies continuously improving the performance and aesthetics of recycled materials to match or exceed those of virgin synthetics. The scalability of recycled PET production, driven by existing bottle recycling infrastructure, makes it a commercially viable and high-volume option for both athletic and lifestyle brands.

- By End-User: Women

The women's end-user segment is a primary driver of demand in the sustainable footwear market, with a strong preference for both style and ethical production. The market’s expansion is propelled by the growing influence of the "conscious consumer" movement, where women actively seek products that are stylish, comfortable, and align with their personal values. This segment is not only driven by environmental concerns but also by a heightened awareness of social issues, such as fair labor practices and supply chain transparency. Brands targeting this segment often emphasize the use of cruelty-free, vegan, and ethically sourced materials. The market profile is diverse, ranging from sustainable sneakers and flats for everyday wear to more specialized, high-fashion sustainable boots and sandals. Companies like Rothy's, which have built their brand identity around creating stylish shoes from recycled plastic bottles, are a testament to the success of this strategy. The women's segment also benefits from a high level of digital engagement, as consumers use social media and online platforms to discover new sustainable brands and share their product experiences.

Sustainable Footwear Market Geographical Analysis:

- US Market Analysis

The US sustainable footwear market is a leader in consumption and innovation. The market is driven by a large, affluent consumer base that is increasingly prioritizing environmental responsibility. The market is characterized by a high degree of brand awareness and a willingness to pay a premium for certified sustainable products. The US is a hub for startups and specialized sustainable brands that are challenging legacy companies with innovative materials and direct-to-consumer business models. This dynamic competitive environment, combined with the presence of major athletic and non-athletic footwear giants, drives constant product innovation. The necessity is not only for athletic and lifestyle shoes but also for a growing range of sustainable non-athletic footwear. While federal regulation is limited, state-level initiatives and the powerful influence of the Federal Trade Commission's Green Guides push brands toward verifiable and transparent sustainability claims, thereby strengthening consumer trust.

- Brazil Market Analysis

Brazil's sustainable footwear market is a growing segment within the country's large and established footwear industry. The market is propelled by a rising middle class and increasing domestic awareness of global environmental trends. Brazil possesses a unique competitive advantage as a major producer of natural and bio-based materials, such as rubber and certain plant-based fibers. This domestic material availability creates a localized supply chain that can be a key driver for sustainable production. The need for sustainable footwear is also influenced by local brands that are implementing circular economy initiatives and working with community cooperatives to source recycled materials. While the market is still developing, the strong domestic manufacturing base and the presence of innovative local and international brands create a fertile ground for future growth. The government's support for local industries and the country's significant role in global supply chains will be key factors in the market's trajectory.

- Germany Market Analysis

Germany’s sustainable footwear market is defined by a strong consumer preference for quality, durability, and a deep-seated commitment to environmental and ethical standards. The market’s expansion is driven by a well-informed consumer base that expects transparency and verifiable certifications. The German market places a high value on products that are not only made from sustainable materials but are also produced under fair labor conditions. The country is a major hub for technical textiles and advanced manufacturing, which supports the development of high-performance sustainable materials. The market profile is diverse, with strong segments for outdoor and athletic footwear, as well as for minimalist and eco-friendly casual shoes. Germany's stringent regulatory environment and the influence of the EU's Circular Economy Action Plan directly push brands to adopt more sustainable practices.

- Saudi Arabia Market Analysis

The sustainable footwear market in Saudi Arabia is an emerging segment, with demand driven by a young, urban, and tech-savvy population. While the overall footwear market is expanding rapidly due to increased disposable income and a growing focus on fashion, the sustainable segment is gaining traction as a result of global trends and a rising awareness of environmental issues. Market growth is primarily for fashionable, branded sneakers and lifestyle footwear that align with a modern, conscious consumer identity. The market is influenced by global brands and e-commerce platforms that are introducing sustainable product lines to the region. The Saudi government's Vision 2030, which includes a focus on economic diversification and quality of life, may indirectly support the growth of a more sustainable consumer culture and, in turn, the demand for sustainable products.

- Japan Market Analysis

Japan's sustainable footwear market is characterized by a strong emphasis on innovation, quality, and craftsmanship. The necessity is not simply for eco-friendly products but for those that seamlessly blend sustainability with superior design and performance. Japanese consumers are highly discerning and are driven by a culture of meticulous craftsmanship and attention to detail. This creates a market for high-quality, durable, sustainable footwear that is built to last, which in itself is a form of sustainability. The market is seeing a growing demand for athletic and performance-oriented sustainable footwear, as well as for elegant, non-athletic styles. The Japanese government's push for a circular economy and its focus on waste management influence consumer behavior and support the growth of brands that can offer a clear end-of-life solution for their products.

Sustainable Footwear Market Competitive Analysis:

The competitive landscape of the sustainable footwear market is dynamic, featuring a mix of specialized brands and legacy footwear giants. The market is driven by innovation in materials, transparent supply chains, and a compelling brand narrative.

- Adidas AG: A global athletic powerhouse, Adidas has strategically positioned itself as a leader in sustainable innovation by integrating recycled and bio-based materials into its core product lines. A key component of its strategy is the partnership with Parley for the Oceans, which uses recycled ocean plastic to create high-performance footwear. The brand's scale allows it to drive down the cost of sustainable materials and make them accessible to a mainstream audience, thereby directly increasing demand for recycled-content athletic shoes.

- Allbirds: Allbirds has built its entire brand identity around the use of natural and sustainable materials. The company's strategic positioning is centered on providing comfortable, minimalist, and eco-friendly footwear. Its use of materials like Merino wool, eucalyptus tree fiber, and sugarcane-based foams directly addresses consumer demand for natural alternatives to petroleum-based synthetics. Allbirds’ direct-to-consumer model and transparent communication about its carbon footprint have helped it cultivate a loyal customer base.

- Veja: Veja is a French brand that has gained global recognition for its commitment to ethical and transparent production. The company's strategic positioning is based on its use of a highly traceable supply chain and its sourcing of materials from small-scale producers. Veja's use of wild Amazonian rubber for its outsoles and its partnerships with organic cotton producers directly address consumer demand for ethically sourced and socially responsible products. The brand's focus on timeless, simple designs and its resistance to conventional advertising have created a unique and authentic market presence.

Sustainable Footwear Market Developments:

- September 2025: Evoco Ltd. was selected to participate in The Next Stride bio-sole initiative, advancing its FATES™ bio-foam as a sustainable midsole/ insole material alongside major global brands.

- September 2025: Fashion for Good initiated The Next Stride: Bio-Based Materials for Footwear Soles, a 12-month project with adidas, Target, and Zalando to validate scalable bio-based polymers for sustainable shoe soles.

- February 2025: Allbirds launched the M0.0NSHOT Zero, the world’s first net-zero carbon shoe, available beginning Feb 6, using regenerative materials to achieve a net-zero carbon footprint.

Sustainable Footwear Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Sustainable Footwear Market Size in 2025 | USD 9.630 billion |

| Sustainable Footwear Market Size in 2030 | USD 13.513 billion |

| Growth Rate | 7.01% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Sustainable Footwear Market |

|

| Customization Scope | Free report customization with purchase |

Sustainable Footwear Market Segmentation:

- By Material

- Recycled Plastics (e.g., PET)

- Natural Fibers (e.g., Organic Cotton, Hemp)

- Bio-based Materials (e.g., Pinatex, Mushroom Leather)

- Recycled Rubber

- Others

- By Type

- Athletic

- Non-Athletic

- By Distribution Channel

- Online Retail

- Offline Retail

- By End-User

- Men

- Women

- Children

- By Geography

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa