Report Overview

Tea Infuser Market - Highlights

Tea Infuser Market Size:

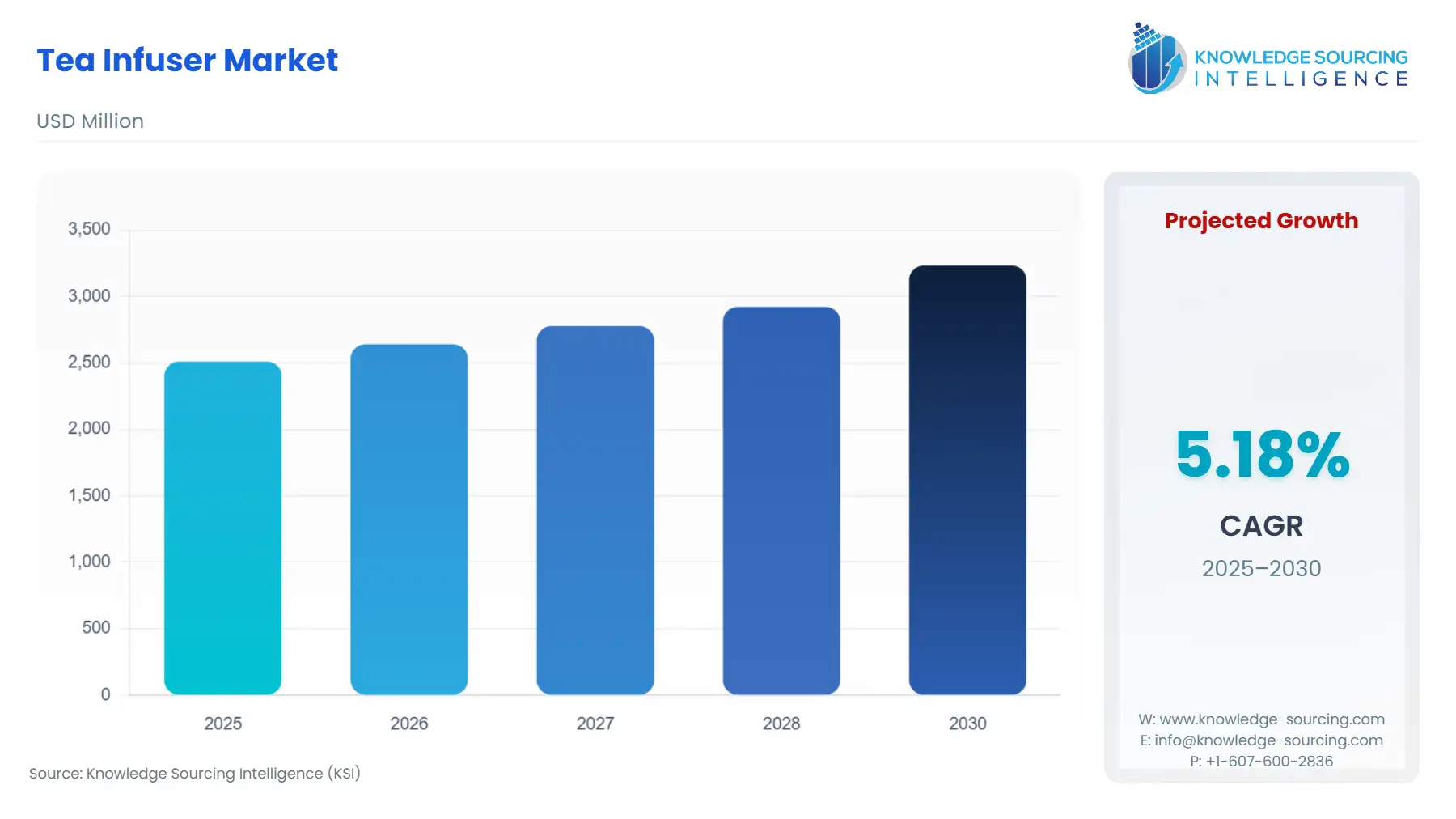

Tea Infuser Market, with a 5.03% CAGR, is forecasted to grow from USD 2.511 billion in 2025 to USD 3.372 billion in 2031.

A tea infuser is a small often mesh or perforated, device used to brew loose tea leaves or herbal blends. Placed inside a teapot, mug, or cup, the infuser allows water to flow through the tea leaves, extracting their flavours, aromas, and beneficial compounds, while preventing loose leaves from dispersing into the beverage. After steeping, the infuser is easily removed, leaving behind a flavorful and aromatic brewed tea ready for consumption.

Tea Infuser Market Trends:

The tea infuser market caters to the beverage and kitchenware industry, providing products that enhance the tea brewing experience for consumers. As the popularity of speciality and herbal teas continues to rise, coupled with a growing emphasis on convenience and customized tea experiences, the tea infuser market has expanded to offer diverse and innovative options that cater to tea enthusiasts' preferences and brewing needs.

Tea Infuser Market Growth Drivers:

Rising Tea Consumption: The increasing popularity of tea consumption worldwide is a significant driver for the tea infuser market. As more individuals explore and appreciate different tea varieties, the demand for convenient and efficient brewing methods like tea infusers grows.

Health and Wellness Trends: Growing awareness of the health benefits associated with tea, such as antioxidants and natural ingredients, drives the demand for loose-leaf tea and, consequently, tea infusers. Consumers seeking to extract the maximum nutritional value from their tea prefer infusing loose leaves rather than tea bags.

Customized Tea Blends: Tea enthusiasts are increasingly experimenting with custom tea blends by combining different herbs, flavours, and ingredients. Tea infusers provide a practical way to mix and brew personalized blends, contributing to their popularity.

Eco-Friendly Choices: With environmental consciousness on the rise, consumers opt for reusable and sustainable products. Tea infusers eliminate the need for single-use tea bags, aligning with eco-friendly lifestyles.

Innovative Designs and Materials: Manufacturers continuously introduce innovative tea infuser designs and materials, catering to various preferences and aesthetics. Creative and visually appealing infusers add an element of enjoyment and self-expression to the tea brewing process.

Rise in Artisanal Tea Culture: The emergence of artisanal and speciality tea culture encourages consumers to explore premium and unique tea offerings. Tea infusers complement this trend by providing an effective means to steep high-quality loose-leaf teas.

Convenience and Portability: Tea infusers offer portability and convenience, making it easy for individuals to brew loose-leaf tea at home, at work, or on the go. This factor appeals to busy lifestyles and those seeking a quick, flavorful tea experience.

Social Media Influence: The visual appeal of aesthetically pleasing tea infusers, often showcased on social media platforms, sparks interest and drives consumer desire to own and use these products as part of a stylish and trendy tea ritual.

Gifting and Personalization: Tea-related gifts and personalized items are popular choices for special occasions. Tea infusers, often available in charming and decorative designs, make thoughtful and customizable gifts, contributing to market growth.

Culinary Creativity: Tea infusers are not limited to traditional tea brewing. Culinary enthusiasts use them for infusing flavours into cooking and baking, such as infusing herbs into recipes or creating unique beverages, broadening the scope of their utility.

List of Top Tea Infuser Companies:

Stasher Tea Infuser by Stasher: This reusable silicone tea infuser is made from food-grade silicone and is dishwasher-safe. It is also BPA-free and phthalate-free. Stasher claims that their tea infuser can last for up to 10 years, which makes it a more sustainable option than disposable tea bags.

Moso Natural Bamboo Tea Infuser by Moso Natural: This bamboo tea infuser is made from 100% organic bamboo and is free of chemicals and toxins. It is also dishwasher-safe and biodegradable. Moso Natural claims that its bamboo tea infuser is a more sustainable option than plastic tea infusers.

Tea Infuser Market Segmentation Analysis:

Positive growth in the tea ball segment:

Tea balls, known for their simplicity and convenience, are gaining popularity among tea enthusiasts and casual drinkers alike. They offer an easy way to brew loose-leaf tea without the need for complex equipment, appealing to individuals seeking a hassle-free tea experience. Additionally, the compact and portable nature of tea balls makes them suitable for on-the-go brewing, aligning with modern lifestyles that value convenience and quality in tea preparation.

Tea Infuser Market Geographical Outlook:

The Asia Pacific region is expected to hold a significant share:

Asia Pacific is expected to dominate the tea infuser market share due to its rich tea culture and longstanding tradition of tea consumption. Countries like China, Japan, India, and Taiwan have deep-rooted tea-drinking customs, driving a strong demand for innovative and practical tea-brewing tools such as infusers. The region's affinity for diverse tea varieties, coupled with a growing preference for premium loose-leaf teas, positions Asia Pacific as a significant market influencer and leader in the tea infuser industry.

Tea Infuser Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Tea Infuser Market Size in 2025 | USD 2.511 billion |

Tea Infuser Market Size in 2030 | USD 3.233 billion |

Growth Rate | CAGR of 5.19% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Tea Infuser Market |

|

Customization Scope | Free report customization with purchase |

Tea Infuser Market Segmentation

By Material Type

Plastic

PET

PP

PE

PS

Metal

Aluminum

Stainless Steel

Silicone

Fiber

By Substrate

CPET-based

APET-based

PP-based

PVC-based

PE-based

Others

By Distribution Channel

Manufacturers

Distributors

Retailers

Hypermarket

Supermarket

Convenience Store

Specialty Stores

E-Commerce

By Product Type

Tea Ball

French Press

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others