Report Overview

South Africa 5G Fuel Highlights

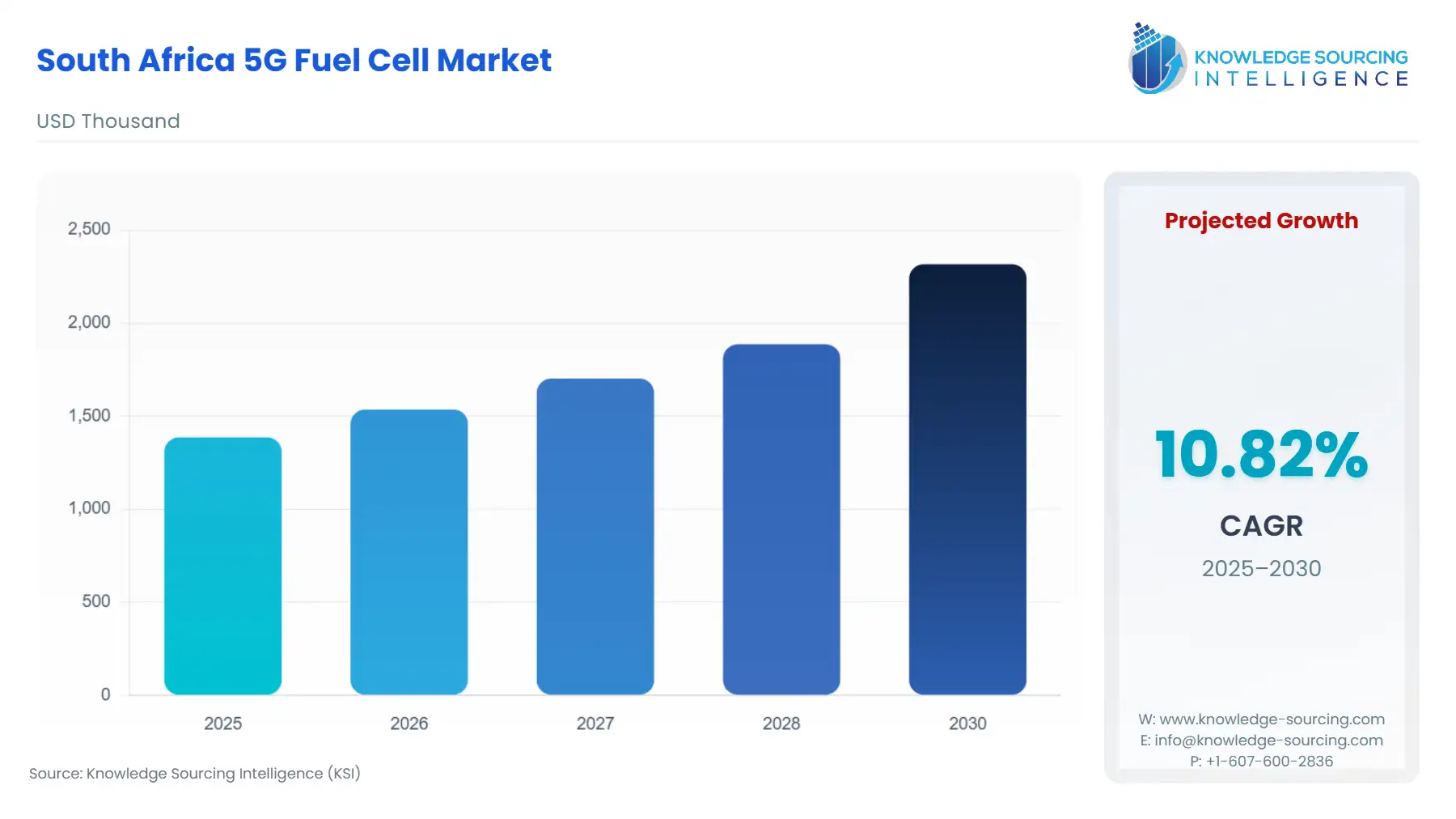

South Africa 5G Fuel Cell Market Size:

The South Africa 5G Fuel Cell Market is expected to grow at a CAGR of 10.83%, reaching USD 2.317 million in 2030 from USD 1.386 million in 2025.

The South African 5G Fuel Cell Market is undergoing a rapid, supply chain-driven transition, pivoting from opportunistic backup power installation to a structured, mission-critical infrastructure segment. The market’s evolution is uniquely dictated by the confluence of the national electricity crisis—which mandates uninterrupted power delivery for advanced telecommunications—and a supportive regulatory environment actively promoting independent, clean energy generation. This context places hydrogen and methanol fuel cells at the core of the 5G network resilience strategy, positioning them as superior alternatives to legacy diesel generator sets, particularly in remote or high-vandalism areas.

South Africa 5G Fuel Cell Market Analysis:

Growth Drivers

South Africa's systemic power capacity constraints serve as the primary catalyst propelling fuel cell market expansion. Load shedding necessitates guaranteed network uptime, and the move to 5G, which requires higher site power, makes traditional battery-only solutions insufficient for extended outages. This operational imperative directly increases the demand for long-duration Backup Power Solutions and Hybrid Energy Systems, driving procurement from major Telecom Operators seeking to de-risk their infrastructure investments. Furthermore, the push for cleaner energy by corporate environmental, social, and governance (ESG) mandates creates direct demand for zero-emission fuel cells to replace carbon-intensive diesel generators, supporting the image and compliance requirements of global network providers operating in the region.

Challenges and Opportunities

The primary constraint facing the South African 5G fuel cell market is the nascent state of the commercial hydrogen fueling infrastructure, which creates logistical complexity and higher initial CapEx compared to established diesel supply chains. This challenge dampens initial demand by forcing users toward localized Fuel Supply Solutions like methanol-based systems. The opportunity, however, resides in the country's strategic position as a platinum group metals (PGM) producer. Local entities are actively developing PGM-containing components, creating an incentive for vertically integrated, South African-sourced fuel cell manufacturing. This focus on local value-add, as exemplified by the initiatives of HyPlat and HySA, positions the country to mitigate import risk and ultimately lower the long-term cost of goods sold, substantially increasing the demand for domestically manufactured fuel cell stacks.

Raw Material and Pricing Analysis

The structural pricing dynamics of the South African 5G Fuel Cell Market are intrinsically linked to the supply of Platinum Group Metals (PGMs), specifically platinum, which is a key catalyst in Proton Exchange Membrane (PEM) fuel cell stacks. South Africa’s dominant global PGM production (approximately 80% of global platinum) presents a unique domestic advantage. While the global price of platinum (traded at approximately $1,659 per troy ounce as of October 2025) dictates a significant portion of the stack's cost, the local supply chain, bolstered by entities like HyPlat and Isondo Precious Metals, is focused on downstream beneficiation. This strategic national focus aims to move beyond simply exporting raw materials to manufacturing PGM catalysts and membrane electrode assemblies (MEAs) locally. Such vertical integration provides an inherent supply chain security and is poised to stabilize or lower the input cost for locally assembled fuel cell stacks, which in turn will propel end-user demand by improving the TCO competitiveness against imports.

Supply Chain Analysis

The global supply chain for 5G fuel cells is characterized by a complex, multi-national dependency, primarily for specialized components like the stack, which is the heart of the system. Production hubs for fuel cell stacks and core components are predominantly in North America, Europe, and parts of Asia. The South African market remains reliant on imported Fuel Cell Stacks & Components from companies such as GenCell and Plug Power. Logistical complexities stem from the secure, time-sensitive transport of these high-value components, often through air freight, adding significant cost and lead time. The local manufacturing efforts by CHEM Energy SA, which focuses on the final assembly of the G5 fuel cell system in Durban, represent a critical shift. This local assembly and distribution model mitigates the high import cost of the full Fuel Cell Systems and facilitates the integration of locally-sourced parts, like those from HyPlat, thereby enhancing regional supply resilience and directly addressing the demand for quick deployment.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| South Africa | Electricity Regulation Amendment Act (ERAA, fully effective January 2025) | This Act streamlines the licensing process for small-scale and backup power facilities. This regulatory simplification reduces bureaucratic hurdles and accelerates the timeline for Telecom Operators and Tower & Infrastructure Providers to install decentralized power sources, directly increasing the near-term demand for easily deployable fuel cell systems. |

| South Africa | Independent Communications Authority of South Africa (ICASA) Coverage and Roll-out Obligations | ICASA's mandate requires operators to meet specific coverage and roll-out obligations, especially in underserved and rural areas. Since these areas often lack stable grid connections or are highly susceptible to theft/vandalism (making diesel unattractive), the requirement drives demand for reliable, off-grid Fuel Cell Systems and Off-grid / Remote Power Solutions that are quieter and less prone to theft. |

| South Africa | Hydrogen South Africa (HySA) Programme | Although not a direct regulation, this government-led initiative promotes the commercialization of hydrogen and fuel cell technologies. It indirectly stimulates market demand by nurturing local IP (e.g., HyPlat's PGM component development) and creating a national ecosystem, which de-risks long-term procurement decisions for end-users like Telecom Operators who prefer secure, local supply chains. |

South Africa 5G Fuel Cell Market Segment Analysis:

By Technology: Fuel Cell Systems

The Fuel Cell Systems segment, encompassing the full operational unit (fuel cell, reformer, power electronics, and balance of plant), is the core consumption category within the South African 5G market. The shift to 5G requires a continuous power supply that exceeds the duration capability of traditional battery banks, specifically for High-capacity Solutions exceeding 50 kW during extended load shedding events. This creates a non-negotiable demand for complete systems that can operate autonomously for days, not hours. The preference leans heavily toward systems leveraging locally accessible fuel options, such as methanol reformers, which mitigate the challenge of the immature hydrogen distribution network. Companies offering turn-key solutions that include installation, remote monitoring, and comprehensive Service Level Agreements (SLAs)—eliminating the CapEx and management burden for Tower & Infrastructure Providers—are capturing the highest demand share. The decision matrix for large-scale procurement is based on TCO, reliability ratings (uptime), and ease of maintenance, favoring commercially proven, telecom-standard certified systems like the CHEM G5.

By End User: Tower & Infrastructure Providers

Tower & Infrastructure Providers represent the largest, most consolidated demand segment in the South African 5G Fuel Cell Market, acting as the primary point of procurement for backup power solutions. These providers, unlike Telecom Operators who focus on consumer services, are directly responsible for the asset uptime and operational expenditure (OpEx) of the physical tower network. Their core growth driver is the mitigation of power outage risk, which is a massive financial and reputational liability. The inherent characteristics of fuel cells—namely their zero-vandalism risk (no valuable diesel to steal), quiet operation in urban areas, and reduced maintenance schedule compared to diesel generators—directly address the provider's need for OpEx reduction and site security. The shift to 5G requires a densification of the network and higher average power draws at each site, ensuring that the demand for robust Backup Power Solutions and systems in the 5–50 kW range is structurally locked for the foreseeable future, as providers standardize on long-duration, high-resilience power platforms.

South Africa 5G Fuel Cell Market Competitive Environment and Analysis:

The competitive landscape is bifurcated between established international fuel cell manufacturers and localized partners, with a critical emphasis on regional support infrastructure. The primary competition for market share centers not only on the core technology but crucially on the capacity to provide reliable, national fueling, maintenance, and technical support. Local entities that integrate global technology with regional service depth gain a significant advantage in the Backup Power Solutions segment.

CHEM Energy SA (Pty) Ltd

CHEM Energy SA (Pty) Ltd operates as a key local manufacturer and solutions provider, anchoring the South African fuel cell supply chain. The company’s strategic positioning stems from the local manufacturing of its G5 Fuel Cell System at the Dube Tradeport SEZ in Durban, which provides a 5kWe, 48VDC output system scalable up to 10kWe. This localized manufacturing supports the national mandate for in-country value addition and provides a competitive advantage in lead times and local support. Its official partnership with 24 Solutions, which is the sales and service representative for SADC countries with a proven track record across Vodacom and MTN sites, directly addresses the end-user demand for guaranteed fuel and maintenance services. This focus on local assembly and a robust service network mitigates the primary market challenge of logistical risk.

GenCell Ltd

GenCell Ltd, a global player, specializes in hydrogen and ammonia-based fuel cell solutions, particularly its alkaline fuel cell (AFC) and ammonia-to-hydrogen technology (AHA). Although recent press releases confirm large-scale supply deals and strategic focus on substation backup and DC fast EV charging in North America and Europe, GenCell’s strategic positioning in South Africa is focused on leveraging its robust, long-duration Backup Power Solutions for mission-critical applications. Their technology’s ability to use a non-traditional fuel source like ammonia (via AHA), which has a higher energy density than compressed hydrogen, provides an alternative solution for Off-grid / Remote Power Solutions that require extended runtime without frequent refueling, appealing to Tower & Infrastructure Providers operating in highly isolated regions.

South Africa 5G Fuel Cell Market Recent Developments

- April 2025: The European Union announced a significant financial support package (part of a €4.7bn Global Gateway Investment Package) to aid South Africa in developing its green hydrogen and fuel cell value chain. This investment acts as a major acquisition of foreign capital and support for the local industry, bolstering future 5G site power resilience.

South Africa 5G Fuel Cell Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 1.386 million |

| Total Market Size in 2031 | USD 2.317 million |

| Growth Rate | 10.83% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Product Type, Deployment, Power Output Range, End-User |

| Companies |

|

South Africa 5G Fuel Cell Market Segmentation:

- BY PRODUCT TYPE

- Fuel Cell Systems

- Fuel Cell Stacks & Components

- Fuel Supply Solutions

- BY DEPLOYMENT

- Backup Power Solutions

- Off-grid / Remote Power Solutions

- Hybrid Energy Systems

- High-capacity Solutions

- BY POWER OUTPUT RANGE

- <5 kW

- 5–50 kW

- 50 kW

- BY END USER

- Telecom Operators

- Tower & Infrastructure Providers

- Government & Defense Communication Networks

- Enterprise 5G Networks