Report Overview

USA Home Fragrance Market Highlights

USA Home Fragrance Market Size:

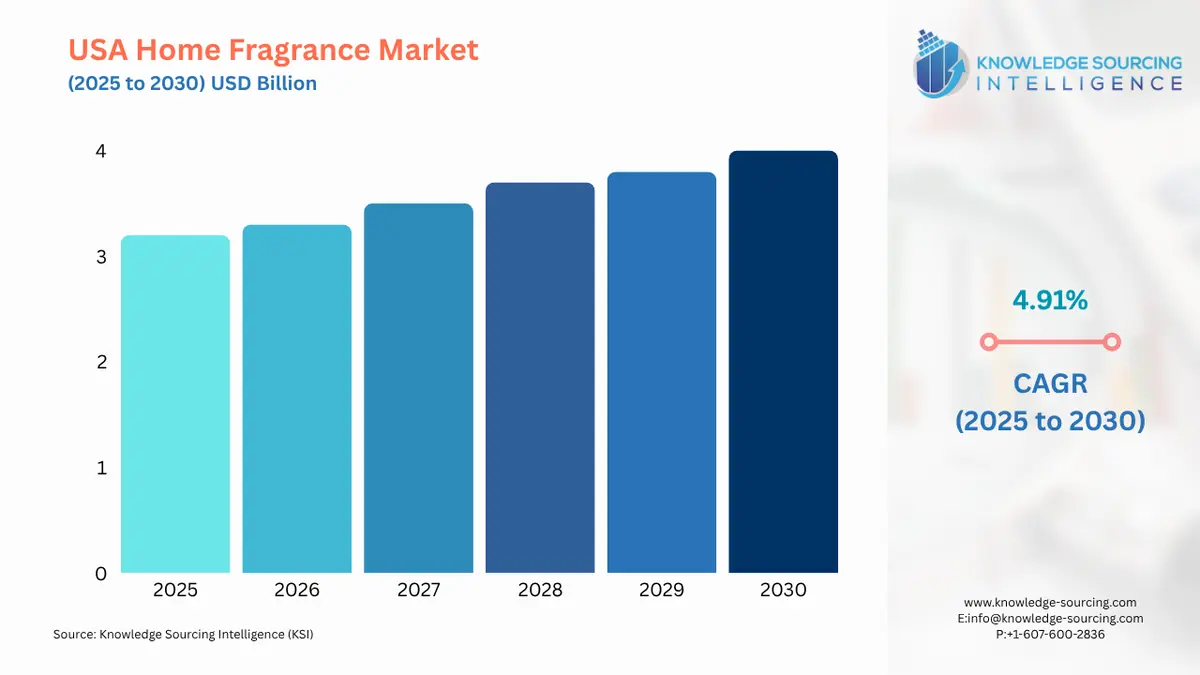

The USA Home Fragrance Market is anticipated to grow at a CAGR of 4.91%, moving from USD 3.170 billion in 2025 to USD 4.028 billion by 2030.

The increasing spending on home improvement and décor, and fragrances for emotional and wellness benefits are the key factors driving the market. As time spent at home is rising, there is an increasing demand for home fragrances. In addition, the gifting culture and premiumization of the USA home fragrance market towards high-end fragrance brand drives the market. Growth of online platforms and increasing product innovation and smart home integration are propelling the market towards specialty and niche brands. The market is witnessing increasing product innovation, growth of high-end fragrances, increasing demand for aesthetic-focused and wellness-driven fragrances, especially by Gen Z and a shift from aerosol sprays to diffusers, wax melts, essential oils and refillable formats.

USA Home Fragrance Market Overview & Scope:

The USA Home Fragrance Market is segmented by:

- Fragrance Type: By fragrance type, the market offers a wide range of scents tailored to diverse consumer preferences. Popular categories include floral, fresh/citrus, woody, oriental/spicy, herbal, fruity, sweet/gourmand, and oceanic, along with a mix of other experimental or blended fragrances.

- Product Type: By product type, the market is segmented into candles, sprays, diffusers, essential oils, incense sticks, plug-in devices, potpourri and sachets, wax melts, and others. Candles and diffusers dominate the market, driven by their usage.

- Distribution Channel: By distribution channel, home fragrance products are primarily sold through hypermarkets/supermarkets, specialty stores, online stores, and other retail formats. The supermarkets and hypermarkets have a considerable share, while the online segment is on a growing trajectory.

- End-User: By end-user, the market is categorized into households, hospitality, offices and commercial spaces, wellness and spa centers, and religious and cultural establishments. The household segment remains dominant, with consumers using fragrances for daily ambience and self-care.

Top Trends Shaping the USA Home Fragrance Market:

- Growing Product Innovation

One of the key trends in the USA home fragrance market is increasing product innovation and increasing product launches to align with changing consumer needs. There is an introduction of innovative products like smart diffusers and customizable scent systems, which integrate with home automation for enhanced user experience. Companies like Pura and ScentAir are introducing tech-driven solutions and unique fragrance blends. For instance, Pura LLC offers Pura 4, a smart home fragrance diffuser that uses innovative smart features with premium and clean scents. Its fragrance intensity, schedules and timers and many more can be adjusted in the Pura app. Companies are also using different technologies to make the fragrances more customized. For instance, Air Wick uses multi-layered fragrance technology for its Life Scents Room Mists collection, where each mist has three distinct scent notes experienced individually and together. The collection of scents includes Sunny Morning Linen, Paradise Retreat, Sweet Lavender Days, Fresh Sparkling Waterfall, Seaside Escape and First Day of Spring. - Growing Demand for Eco-Conscious and Sustainable Products

One of the major trends that is shaping the market is the increasing demand for eco-conscious and sustainable home fragrances. Growing environmental awareness has led to a surge in demand for sustainable, non-toxic, and natural-ingredient-based home fragrances, such as soy candles and biodegradable diffusers. There is also increasing demand for sustainable packaging, driving the demand for recyclable glass containers, refill pouches and plastic-free options. For instance, Aeron Lifestyle Technology launched Belle Aroma. It is a series of products based on eco-friendly scent solutions. It incorporated eco-friendliness at its core, incorporating practices like reducing waste by making products reusable, minimizing plastic in packaging, and using recyclable materials. Another company named ScentAir has introduced three new 100% sustainably produced fragrances in their sustainable line in April, 2025. This line of product use essential oils and sustainably sourced, naturally derived, and upcycled ingredients.

USA Home Fragrance Market Growth Drivers vs. Challenges:

Opportunities:

- Growing Consumer for Wellness and Ambience: Consumers are prioritizing home environments that promote relaxation and well-being, driving demand for premium and natural home fragrance products like scented candles, essential oil diffusers, and eco-friendly air fresheners. According to a Talker Research Survey, 78% of the respondents feel that a pleasant scent can transform a space's feeling, while only 24% consider it essential for a home gathering. This highlights the growing preference for home fragrances by consumers for making their home pleasant, and thus, driving the demand for home fragrances. This evolving consumer preference for home fragrance is leading companies to offer many new varieties of home fragrances. For instance, Reckitt Benckiser plc, under its brand, Air Wick, launched “The Spring Fete- lavender, gentle chamomile and precious woods fragrance”, “A Crisp Affair - Linen Scented Oil”, “The Sea-Scape Soiree- Deep Blue Sea and Beach Wood Scented oil” in the USA market.

- Growing Consumer Spending on Home Improvement and Décor: One of the other major factors for the market growth is the increasing spending on home improvement and home décor. Rising home-centric lifestyles and growing consumer preferences for non-toxic, plant-based, paraben-free, and phthalate-free formulations are driving the demand for high-quality home fragrances. Consumers are increasingly spending on home fragrances, driving the market to grow.

Challenges:

- Concern over Synthetic Ingredients: A significant portion of mass-market products contain synthetic ingredients such as volatile organic compounds (VOCs), phthalates, and synthetic fragrances. As there is growing health and environmental concern over these synthetic ingredients, consumers are being cautious or are avoiding such products, significantly impacting the market.

USA Home Fragrance Market Competitive Landscape:

The market is fragmented, with the presence of some notable key players such as S.C. Johnson & Son, Inc., The Procter & Gamble Company, Newell Brands, Inc., The Estée Lauder Companies Inc., Reckitt Benckiser Group plc, Voluspa, ScentAir Technologies, LLC, NEST Fragrances, P.F. Candle Co., Scentsy, Inc., Bridgewater Candle Company, Diptyque, Luna Sundara LLC, and Pura Scents Inc.

- Technological Innovation: In March 2025, Osmo launched the first digitize scent. It is powered by olafactory intelligence, which is a technology that turns data into scent. It uses exclusive ingredients, advanced formulation tools and market intelligence for creating fragrances with more precision and creativity. It is a AI-powered formulation tools with real-world precitive market intelligence.

- Product Launch: In January 2025, The Yankee Candle Company, Inc. launched Yankee Candle Well Living Collection, a lineup of wellness-inspired fragrances. It features a nature-inspired color palette, a square vessel shape and a natural rubberwood lid. The collection of home fragrances is made up of essential oils, coconut and soy wax blend, and natural fiber wicks.

- Business Strategy: In May 2024, Air Wick, a home fragrance brand of Reckitt, has teamed up with floral and gifting provider 1-800-Flowers.com to offer a limited-time collection of exclusive bouquets inspired by Air Wick's signature home fragrances. The Air Wick x 1-800-Flowers.com Collection includes Piece of Paradise Bouquet, Lovely Lily and Lavender Bouquet, and Petal Perfection Bouquet. Through this partnership, the company aims to expand its product into houses.

USA Home Fragrance Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 3.170 billion |

| Total Market Size in 2031 | USD 4.028 billion |

| Growth Rate | 4.91% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Fragrance, Product Type, Distribution Channel, End-User |

| Companies |

|

USA Home Fragrance Market Segmentation:

- By Fragrance

- Floral

- Fresh/Citrus

- Woody

- Oriental/Spicy

- Herbal

- Fruity

- Sweet/Gourmand

- Oceanic

- Others

- By Product Type

- Candles

- Sprays

- Diffusers

- Essential Oils

- Incense Sticks

- Plug-in Devices

- Potpourri and Sachets

- Wax Melts

- Others

- By Distribution Channel

- Hypermarkets/Supermarkets

- Specialty Stores

- Online Stores

- Others

- By End-User

- Households

- Hospitality

- Offices & Commercial Spaces

- Wellness and Spa Centers

- Religious & Cultural