Report Overview

Vietnam Probiotic Supplements Market Highlights

Vietnam Probiotic Supplements Market Size:

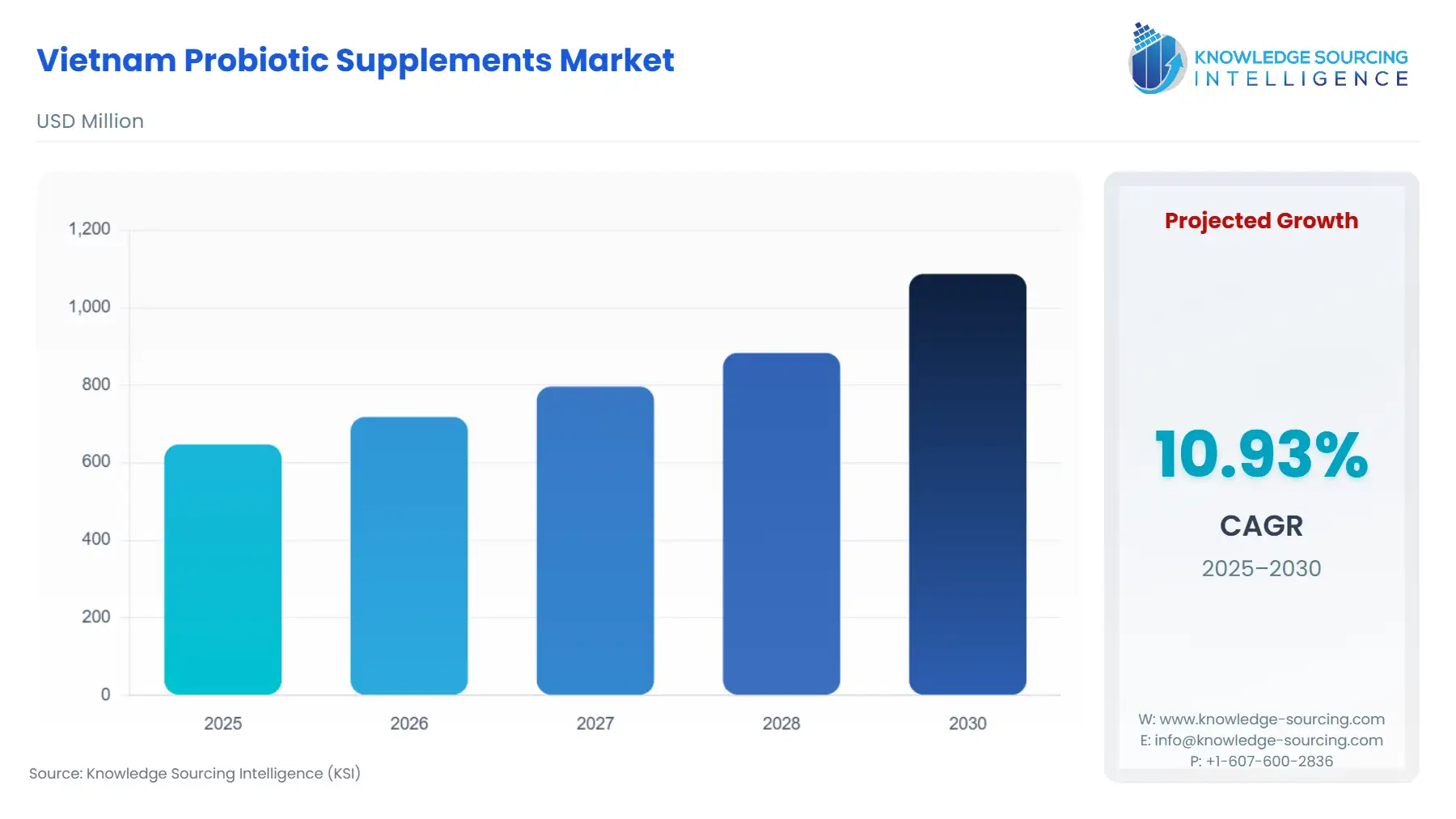

The Vietnam probiotic supplements market is estimated to grow at a CAGR of 10.93% from US$647.234 million in 2025 to US$1,087.158 million in 2030.

The Vietnamese probiotic supplements market continues to grow vigorously over a long period, as consumer awareness regarding gut health, immunity, and preventive wellness is significantly changing the nutritional landscape in the country. The demand is rapidly increasing not only in urban areas but also in semi-urban regions. Thus, lifestyle changes, the increasing number of digestive disorders, and the shift to science-backed functional ingredients are the main factors that have led to such a trend.

Despite the growing number of local health products, international brands still dominate the market through pharmacies, healthcare institutions, and e-commerce channels that are developing rapidly. The tightening of regulations by the Ministry of Health and the Vietnam Food Administration is raising the quality standards of products and facilitating openness in the labelling and claims. With a young population, an expanding middle class, and a growing preference for personalized nutrition, probiotic supplements are turning into a standard health category in the future.

Vietnam Probiotic Supplements Market Trends:

Probiotic supplements, which contain live microorganisms believed to promote gut health, are available in various forms, including capsules, gummies, powders, and pills. Despite the industry's growth, studies have shown that probiotic supplements can alter the gut microbiome's composition and reduce microbial diversity, potentially leading to health issues. However, probiotic supplements may benefit certain individuals, particularly those with gastrointestinal ailments.

Research has demonstrated their ability to alleviate symptoms of irritable bowel syndrome and inflammatory bowel disease, prevent traveler's diarrhea, and mitigate some side effects of antibiotic medications. Probiotics are also found in fermented foods and beverages, and their efficacy and safety for various health conditions continue to be actively investigated. While evidence supports the benefits of probiotics for specific conditions, it is crucial to note that their effects can vary depending on the species and strain, and labeling regulations for these products are limited. Therefore, consulting healthcare providers before consuming probiotic supplements, especially for individuals with weakened immune systems, is essential.

A major driver augmenting the demand for probiotic supplements in Vietnam is the growing urban population and GDP per capita growth rate. With the increasing urban population and GDP per capita, consumers are becoming more focused on the health aspects.

Another major factor is the increasing consumer awareness regarding health and wellness. It was observed by various organizations that consumers are moving towards a healthy lifestyle, which includes dietary restrictions and consuming vitamins & supplements, among others. This change in the trend has created optimum opportunities for probiotic supplement producers and suppliers to attract more consumers through new product launches coupled with rigorous marketing campaigns.

Vietnam Probiotic Supplements Market Overview

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

The Vietnamese probiotic supplements market is growing rapidly due to the consumer awareness regarding gut health, the number of people suffering from digestive disorders, and the general trend of preventive healthcare in the entire country. The process of urbanization, changes in people's diets, and the rising popularity of functional foods have all contributed to the increased consumption of probiotic supplements among the adult and children's population. Additionally, this market is witnessing the positive effects of Vietnam’s young population, the rise in disposable incomes, and a rapidly expanding retail pharmacy network that is making probiotic products available to consumers throughout the country.

The probiotic supplements market in Vietnam is a heavily regulated market. In addition to the Ministry of Health (MOH), the Vietnam Food Administration (VFA) has also been very active in enforcing requirements on product safety, labelling, and allowed probiotic strains. Enterprises are obligated to follow the provisions of Decree 15/2018/ND-CP concerning food supplements, which entails the necessity for the product to be supported by documented evidence of the strain source, stability, and clinical trials.

Moreover, inclination for microbiome-based health is also affecting the Vietnamese consumers who demand a scientific substantiation and clinical testing of probiotic strains for their immune system, digestive system, and general health. The proportion of Digestive for various countries in the Asia Pacific was Indonesia 1.5%, China 4.8%, Japan 6.5%, South Korea 8.0%, and Vietnam 16.9% in 2023, according to the International Probiotics Association (IPA).

Local biotech companies are becoming major players as they heavily invest in the development of local strains and adopt modern processes for production. Meanwhile, foreign brands are still penetrating the market through pharmacies, online channels, and healthcare practitioners. The government’s emphasis on raising the quality standards of food and supplements, together with the increasing medical tourism and digital health usage, are additional factors that reshape the market.

Essential global and regional players that influence the probiotic supplements market are BioGaia, a leader in clinically backed Lactobacillus reuteri formulations; Reckitt Benckiser and Amway, which use broad consumer-health portfolios to extend probiotic offerings; and Chr. Hansen, a major supplier of industry-wide high-quality microbial strains. The Asian giants, Yakult Honsha, Morinaga Nutritional Foods, and Vietnam's Vinamilk are powering the market through high-quality dairy-based probiotic products and strong distribution networks. On the other hand, the innovative Vietnamese biotech companies such as LiveSpo and HURO Biotech are progressing in spore-based and next-generation probiotic technologies to upgrade the country's domestic capabilities.

Vietnam Probiotic Supplements Market Growth Drivers:

- Increase in Vietnam’s urban population

In recent years, Vietnam witnessed a significant increase in its urban population. This increase created an increase in demand for the various products in the nation that were considered luxurious. Probiotic supplements are among those products, which witnessed significant growth in the past few years.

The urban population of the nation increased from 3,88,41,525 in 2022, with about 39.6%, to about 3,99,08,501 in 2023, with about 40.4%. This increase in the urban population makes the availability of the latest features like the internet and new shopping infrastructure, available to mass consumers. For instance, the introduction of new retail landscapes like hypermarkets and supermarkets provided the consumer with the choice of products, along with helping the consumer understand the supplement benefits.

The increasing urban population also makes the availability of the Internet and the introduction of e-commerce websites like Amazon and Shopee, to a mass consumer. According to Open Gov Asia, Vietnam had about 72.1 million internet users in 2022. Through the online shopping mode, the sellers offered the benefit of quick delivery along with the option to shop from anywhere, and also provided the consumer with various reviews, instructions, and FAQs to solve any queries that the consumer may have.

- Lack of Strong Local Players

The lack of strong local players in the probiotic supplements market has created opportunities for international companies to enter and expand their presence in Vietnam. This has led to a diverse range of products addressing numerous health concerns, catering to the growing demand for probiotic supplements in the country.

- Growing Online Culture

Vietnam has experienced significant growth in e-commerce, and this trend has extended to the sale of probiotic supplements. The increasing online culture has provided a platform for consumers to easily access and purchase probiotic products, contributing to the expansion of the market.

- Health and Wellness Awareness

There is an increasing awareness of health and wellness among the Vietnamese population, leading to a growing demand for nutritional supplements, including probiotics. This heightened awareness has been a major driver for the growth of the probiotic supplements market in Vietnam.

- Rising Disposable Incomes

The rising disposable incomes of the Vietnamese population have enabled more individuals to afford and invest in health and wellness products, including probiotic supplements. This increased purchasing power has contributed to the expansion of the market.

- Changing Lifestyle Preferences

Changes in lifestyle preferences, including a shift towards preventive healthcare, have led to an increased adoption of nutritional supplements, including probiotics. The emphasis on preventive healthcare has driven the demand for products that support overall well-being, thereby boosting the probiotic supplements market in Vietnam.

- Increasing Medical Endorsement and Clinical Validation

The rising medical endorsement and clinical validation largely influence Vietnam’s probiotic supplements market growth. As medical professionals increasingly acknowledge probiotics as the most viable solution to maintain gut health, immunity, and general health, the demand for such products continues to soar. Thus, specialists in child health, gastroenterology, and general medicine are writing more prescriptions to infants, children, and adults for probiotics, mainly to treat digestive disorders, side effects of antibiotic usage, and immunity support, which, in turn, enhances consumer confidence and usage.

The Vietnamese pharmaceutical sector is expected to expand significantly. This development will be mainly propelled by healthcare infrastructure. In 2023, revenue from prescription drug sales was 4.6 billion USD, and predictions expect an increase of up to 9.1 billion USD by 2033.

Moreover, involvement in community and regional clinical trials as well as following the Ministry of Health directives in terms of safety, labeling, and giving evidence-based claims, have contributed to the trustworthiness and the uptake of probiotic supplements. Increasing income and better healthcare infrastructure, such as 62,000 retail pharmacies and 5,000 wholesalers, are facilitating access.

The concerted effort of medical endorsement, clinical proof, and adherence to regulations is leading to the acceptance of probiotics as a normal, safe, and effective preventive and treatment source, thus being used more by all age groups in Vietnam.

Vietnam Probiotic Supplements Market Segment Analysis:

- Prominent growth in the tablets/capsules segment within the Vietnam probiotic supplements market

The tablets/capsules segment within the Vietnam probiotic supplements market has experienced remarkable growth. Tablets and capsules offer a convenient and accessible form of probiotic supplements, aligning with the fast-paced lifestyles of Vietnamese consumers. This convenience makes it a popular choice for incorporating probiotics into their daily routines.

A significant portion of the Vietnamese population reportedly suffers from gastritis, leading to a high demand for probiotic supplements in tablet and capsule form. These formats are considered convenient and effective in addressing digestive health concerns, contributing to their prominent growth in the market. Tablets and capsules are preferred by many consumers due to their ease of consumption and precise dosage control. This preference has driven the growth of this segment within the probiotic supplements market, aligning with the preferences and habits of the target consumer base in Vietnam.

- By End-user: Adults

The Vietnamese probiotics supplements market by end-user is segmented into adults and kids. The adult group, comprising the working-age population and the elderly, is likely to become the most considerable demographic segment in this market, driven by their emphasis on preventive healthcare, digestive health, and immunity in the midst of fast-paced urban living. The demand arises from a mixture of factors such as more socio-economic changes, emerging health trends, and better access to health products, with lifestyle supplements (like tablets and capsules) taking the bulk of demand due to their convenience and accurate dosing according to adults' needs. The way Vietnamese health and wellness are changing is the result of growing consumer awareness. The health supplements, including probiotics, are witnessing a positive impact influenced by this change in the Vietnamese market.

The Vietnamese adult population is increasing, focusing on gut health, immunity, and general wellness, leading them to seek wellness products. This shift is supported by gradual understanding of the advantages of probiotics, which include the healing of digestive diseases such as gastritis and IBS. A considerable portion of the adult population in the city suffers from these diseases. Furthermore, the growing presence of lifestyle-related diseases like stomach problems due to stress from long working hours has contributed to the trend of self-medication, thus positioning probiotics supplements as the first choice for a preventive measure for health issues.

Moreover, according to ITA's (International Trade Administration) data of January 2024, Vietnam's plan of improving its GDP per capita from USD 4,086 in 2022 to at least USD 18,000 by 2035, along with the disposable incomes in large urban locations, will be 4-5 times higher than the national average, and will have a notable positive effect on the adult consumers of probiotic supplements market in Vietnam. This effect will mainly be through the different dimensions of accessibility to, demand for, and consumption of these products since they belong to the growing consumer goods and services sectors that are mainly health and wellness-oriented.

- By Distribution Channel: Online

The sales of probiotic supplements through e-commerce have seen a drastic rise in Vietnam, and they have become a more common and easier way of purchasing products in the dietary supplement market. The rise in middle-class individuals who have money to spend on these kinds of products are driving this growth. High-quality probiotic supplements are increasingly purchased by Vietnamese people who prioritize their health. The probiotic supplement market in Vietnam, which is marketed as being healthy and natural, has received support from the country's addiction to herbal and traditional products, as the latter corresponds to the former.

Additionally, there has been a major increase in e-commerce sales of supplements, which is the direct consequence of the growing popularity of health products sold through web channels. It is assumed that the internet user base and the level of digital literacy will continue to increase, boosting market expansion. The figures released by the World Bank show that in 2020, 70% of Vietnam's total population was using the internet, and it increased by 14% by 2024, i.e., 84% in 2024.

E-commerce offers competitive pricing and provides customers with the advantages of a much wider product variety, the opportunity to read reviews, get answers to their questions through the frequently asked questions section, and receive personalized recommendations. All of these build trust and are appealing to younger consumers in the country who pay attention to gut health and immunity. Thus, market penetration is hastened by overcoming the urban-rural divide.

According to the World Bank, the urban population reached 40% by 2024, which is accompanied by higher GDP per capita and better access to modern retail infrastructure such as hypermarkets and e-commerce. This change in population distribution will rise with the increase in demand for health products that can be easily purchased online, with urban customers accounting for the largest share of the online health supplement market in the country.

Vietnamese Probiotic Supplements Market Key Companies:

- BioGaia Protectis Baby Drops is a probiotic dietary supplement containing the patented lactic acid bacterium L. reuteri Protectis (DSM 17938). It is a safe and effective way to support gut health in babies, infants, and toddlers.

- Amway offers Nutrilite Botanical Beverage Mix - Chicory Root Extract with Probiotics is a dietary supplement that combines the benefits of chicory root extract and probiotics to support digestive health and overall well-being.

Vietnamese Probiotic Supplements Market Segmentation:

By Ingredient

- Bacteria

- Lactobacilli

- Bifidobacterium

- Streptococcus Thermophilus

- Yeast

- Saccharomyces Boulardii

- Others

By Type

- Tablets/Capsules

- Sachet & Drops

By End-User

- Adults

- Kids

By Distribution Channel

- Online

- Offline

- Pharmacy

- Supermarkets

- Other Outlets