Driving the Future: SIC Wafers for Next-Generation Electric Vehicles

Silicon carbide semiconductors better known as SiC Wafers have a wide bandgap of silicon carbide which makes it perfectly compatible with high-power applications. SiC wafers are widely used in several industries due to their hardness, stability under heat and high voltage current, and wide bandgap. It was discovered in 1893 as an industrial abrasive for automotive brakes and grinding wheels. Also, the hardness of SiC provides stability under high voltage current and heat, this material is being widely used in several industries.

Global Production Trends

The production of SiC wafers has been steadily increasing over the years. The SiC wafers experience growth in the automotive industry as they need shorter charge times, longer ranges, and better performance. Also, it has benefits in various industries such as its high thermal conductivity, low switching losses, improved power density, increased bandwidth capabilities, and effective and efficient functioning at high temperatures. The production is predicted to rise with increasing applications of SiC wafers.

In recent years, there has been a notable increase in the production of SiC wafers in emerging economies with technological advancements in various fields. For instance, the SmartSiC technology from Soitec allows power electronics equipment to increase the energy economy of electric vehicles and work much better. SiC power semiconductor helps power modules become more energy-efficient and smaller.

As SiC power semiconductor has so many features and benefits, the demand for them has seen rapid growth in various industries such as usage in xEVs, railcars, and industrial machinery.

SiC Wafer Use Case

Renewable energy alternatives are a huge trend in the market these days as people are switching over to more sustainable options for responsible power generation and creating a sustainable future. Solar power is one of the fastest-growing renewable energy resources among users and industries. However, to use this energy resource, the precision and reliability should be very high. Therefore, with a rise in demand for solar energy a lot of research and development is done to harness its power efficiently. SiC devices can provide 98% efficiency with solar power systems and reduce the total cost of ownership and inverter size.

Furthermore, key players in the ecosystem industry provide SiC devices for solar power systems such as ON Semiconductor and WOLFSPEED INC. with a wide range of products such as SiC diodes and SiC MOSFETs. SiC diodes provide higher and superior switching performance reliability to silicon and SiC MOSFETs are designed to be rugged and fast and include system benefits from reduced system cost and size to high efficiency.

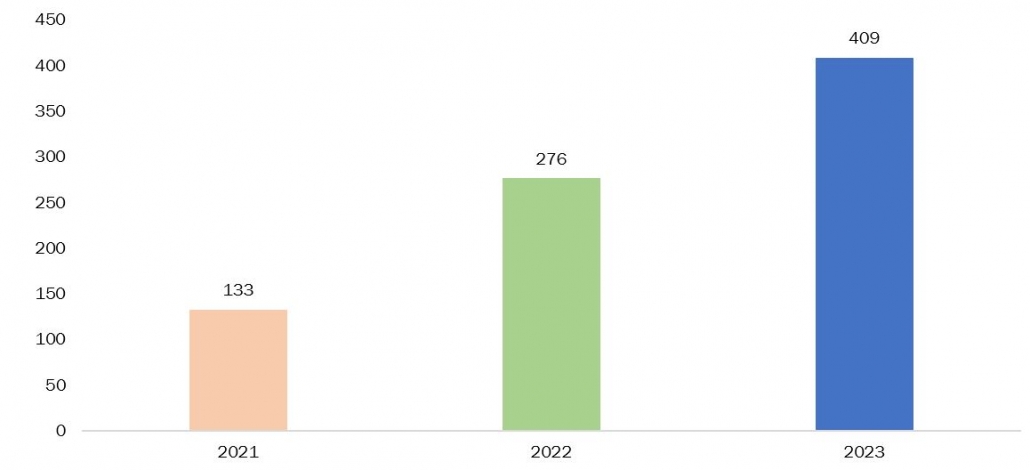

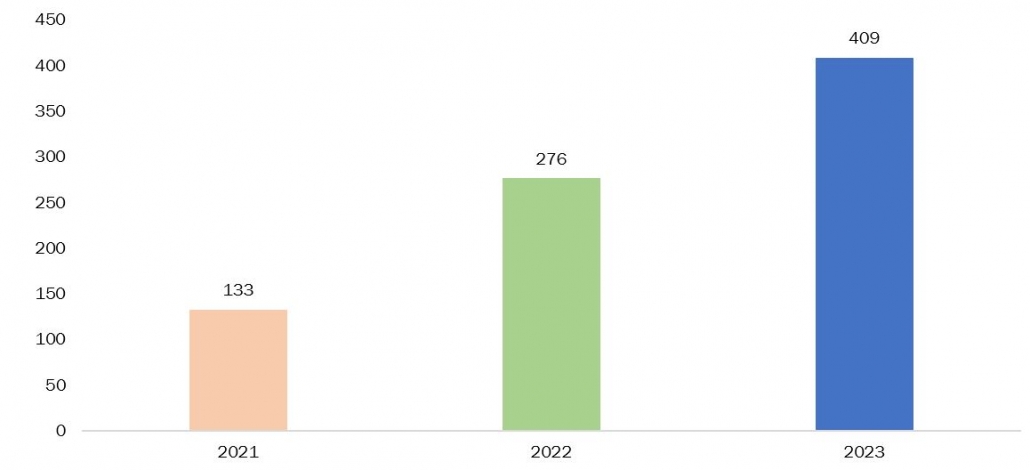

Wolfspeed Inc. is one of the global leaders in silicon carbide technology. They make a lot of power systems that contain SiC wafer technology. The company further supplies advanced high-quality silicon carbide materials in large quantities. They are power device manufacturer that can enable silicon carbide applications in a broad range of industries, such as electric vehicles, renewable energy and storage, charging infrastructure, industrial power supplies, variable speed drives, and traction.

Figure 1: Revenue Growth by Power Products of Wolfspeed Inc., in USD Millions, 2021-23

Source: Wolfspeed Inc. Annual Reports

Market Dynamics and Drivers

Several factors drive the SiC wafers market, including a rise in applications of SiC in renewable energy in recent times coupled with the rise in demand for EVs in the automotive industry has contributed significantly to boosting the overall SiC wafers market. So, with this rapid growth in electric vehicle technology and popularity, the need for SiC wafers is rising proportionally. SiC wafers are used to provide powerful electronic components capable of effective and efficient functioning at high temperatures. Therefore, with a rise in demand for these products in the market, the market is also predicted to grow.

The development and innovation in semiconductor technology across several industries is one of the growth factors in the SiC wafers market. The traditional silicon-based power semiconductors are outdated now and new SiC power semiconductors outperform them and are compatible with current industry standards. They help power modules become smaller and more energy-efficient. Most power semiconductor devices have 6-inch diameter but innovations are being made for 8-inch diameter power semiconductors. So, with these constant innovations and developments in SiC wafer technology, the market is anticipated to grow in the forecast period.

Challenges and Constraints

Despite the huge advantages and use cases of SiC wafers the companies that manufacture them require a lot of materials to build SiC wafers. This includes micropipes which are micro-sized holes found in crystals. Also, while manufacturing these semiconductors workers need to be very precise and highly concentrated because one mistake can ruin a whole set of manufacturing. They are prone to various defects such as stacking faults or dislocation. These factors are predicted to contribute to and affect the market negatively.

The expansion of applications of SiC is wide but with these continuous developments and innovations, the complexity and process to manufacture these SiC wafers are also getting high proportionally. The major challenge these manufacturers face is keeping the cost low while achieving better efficiency with a less complex structure. Also, the different applications of SiC wafers require different design complexity, therefore, hindering the market.

Emerging Opportunities and Innovations

The SiC wafers market presents numerous opportunities for innovation and growth. Also, the presence of major key players offering silicon carbide devices such as Toshiba Corporation from Japan, TanKeBlue Co. Ltd. From China, and Renesas Electronics Corporation from Japan which are making significant innovations in SiC wafers technology are anticipated to increase its demand in the market globally. Furthermore, the growing innovations in the automotive industry and the electric vehicle's popularity among people create various new opportunities for innovation in SiC wafer technology.

Key Developments

Source: Wolfspeed Inc. Annual Reports

Market Dynamics and Drivers

Several factors drive the SiC wafers market, including a rise in applications of SiC in renewable energy in recent times coupled with the rise in demand for EVs in the automotive industry has contributed significantly to boosting the overall SiC wafers market. So, with this rapid growth in electric vehicle technology and popularity, the need for SiC wafers is rising proportionally. SiC wafers are used to provide powerful electronic components capable of effective and efficient functioning at high temperatures. Therefore, with a rise in demand for these products in the market, the market is also predicted to grow.

The development and innovation in semiconductor technology across several industries is one of the growth factors in the SiC wafers market. The traditional silicon-based power semiconductors are outdated now and new SiC power semiconductors outperform them and are compatible with current industry standards. They help power modules become smaller and more energy-efficient. Most power semiconductor devices have 6-inch diameter but innovations are being made for 8-inch diameter power semiconductors. So, with these constant innovations and developments in SiC wafer technology, the market is anticipated to grow in the forecast period.

Challenges and Constraints

Despite the huge advantages and use cases of SiC wafers the companies that manufacture them require a lot of materials to build SiC wafers. This includes micropipes which are micro-sized holes found in crystals. Also, while manufacturing these semiconductors workers need to be very precise and highly concentrated because one mistake can ruin a whole set of manufacturing. They are prone to various defects such as stacking faults or dislocation. These factors are predicted to contribute to and affect the market negatively.

The expansion of applications of SiC is wide but with these continuous developments and innovations, the complexity and process to manufacture these SiC wafers are also getting high proportionally. The major challenge these manufacturers face is keeping the cost low while achieving better efficiency with a less complex structure. Also, the different applications of SiC wafers require different design complexity, therefore, hindering the market.

Emerging Opportunities and Innovations

The SiC wafers market presents numerous opportunities for innovation and growth. Also, the presence of major key players offering silicon carbide devices such as Toshiba Corporation from Japan, TanKeBlue Co. Ltd. From China, and Renesas Electronics Corporation from Japan which are making significant innovations in SiC wafers technology are anticipated to increase its demand in the market globally. Furthermore, the growing innovations in the automotive industry and the electric vehicle's popularity among people create various new opportunities for innovation in SiC wafer technology.

Key Developments

Source: Wolfspeed Inc. Annual Reports

Market Dynamics and Drivers

Several factors drive the SiC wafers market, including a rise in applications of SiC in renewable energy in recent times coupled with the rise in demand for EVs in the automotive industry has contributed significantly to boosting the overall SiC wafers market. So, with this rapid growth in electric vehicle technology and popularity, the need for SiC wafers is rising proportionally. SiC wafers are used to provide powerful electronic components capable of effective and efficient functioning at high temperatures. Therefore, with a rise in demand for these products in the market, the market is also predicted to grow.

The development and innovation in semiconductor technology across several industries is one of the growth factors in the SiC wafers market. The traditional silicon-based power semiconductors are outdated now and new SiC power semiconductors outperform them and are compatible with current industry standards. They help power modules become smaller and more energy-efficient. Most power semiconductor devices have 6-inch diameter but innovations are being made for 8-inch diameter power semiconductors. So, with these constant innovations and developments in SiC wafer technology, the market is anticipated to grow in the forecast period.

Challenges and Constraints

Despite the huge advantages and use cases of SiC wafers the companies that manufacture them require a lot of materials to build SiC wafers. This includes micropipes which are micro-sized holes found in crystals. Also, while manufacturing these semiconductors workers need to be very precise and highly concentrated because one mistake can ruin a whole set of manufacturing. They are prone to various defects such as stacking faults or dislocation. These factors are predicted to contribute to and affect the market negatively.

The expansion of applications of SiC is wide but with these continuous developments and innovations, the complexity and process to manufacture these SiC wafers are also getting high proportionally. The major challenge these manufacturers face is keeping the cost low while achieving better efficiency with a less complex structure. Also, the different applications of SiC wafers require different design complexity, therefore, hindering the market.

Emerging Opportunities and Innovations

The SiC wafers market presents numerous opportunities for innovation and growth. Also, the presence of major key players offering silicon carbide devices such as Toshiba Corporation from Japan, TanKeBlue Co. Ltd. From China, and Renesas Electronics Corporation from Japan which are making significant innovations in SiC wafers technology are anticipated to increase its demand in the market globally. Furthermore, the growing innovations in the automotive industry and the electric vehicle's popularity among people create various new opportunities for innovation in SiC wafer technology.

Key Developments

Source: Wolfspeed Inc. Annual Reports

Market Dynamics and Drivers

Several factors drive the SiC wafers market, including a rise in applications of SiC in renewable energy in recent times coupled with the rise in demand for EVs in the automotive industry has contributed significantly to boosting the overall SiC wafers market. So, with this rapid growth in electric vehicle technology and popularity, the need for SiC wafers is rising proportionally. SiC wafers are used to provide powerful electronic components capable of effective and efficient functioning at high temperatures. Therefore, with a rise in demand for these products in the market, the market is also predicted to grow.

The development and innovation in semiconductor technology across several industries is one of the growth factors in the SiC wafers market. The traditional silicon-based power semiconductors are outdated now and new SiC power semiconductors outperform them and are compatible with current industry standards. They help power modules become smaller and more energy-efficient. Most power semiconductor devices have 6-inch diameter but innovations are being made for 8-inch diameter power semiconductors. So, with these constant innovations and developments in SiC wafer technology, the market is anticipated to grow in the forecast period.

Challenges and Constraints

Despite the huge advantages and use cases of SiC wafers the companies that manufacture them require a lot of materials to build SiC wafers. This includes micropipes which are micro-sized holes found in crystals. Also, while manufacturing these semiconductors workers need to be very precise and highly concentrated because one mistake can ruin a whole set of manufacturing. They are prone to various defects such as stacking faults or dislocation. These factors are predicted to contribute to and affect the market negatively.

The expansion of applications of SiC is wide but with these continuous developments and innovations, the complexity and process to manufacture these SiC wafers are also getting high proportionally. The major challenge these manufacturers face is keeping the cost low while achieving better efficiency with a less complex structure. Also, the different applications of SiC wafers require different design complexity, therefore, hindering the market.

Emerging Opportunities and Innovations

The SiC wafers market presents numerous opportunities for innovation and growth. Also, the presence of major key players offering silicon carbide devices such as Toshiba Corporation from Japan, TanKeBlue Co. Ltd. From China, and Renesas Electronics Corporation from Japan which are making significant innovations in SiC wafers technology are anticipated to increase its demand in the market globally. Furthermore, the growing innovations in the automotive industry and the electric vehicle's popularity among people create various new opportunities for innovation in SiC wafer technology.

Key Developments

- In February 2024, Onsemi announced the availability of its 1200V SPM31 Intelligent Power Modules. It provides a smaller footprint, higher efficiency, and higher power density resulting in lower total system cost than other leading solutions on the market. Also, it has the latest generation Field Stop 7 (FS7) Insulated Gate Bipolar Transistor (IGBT) technology.

- In January 2024, Onsemi announced nine new EliteSiC Power Integrated Modules which will be used to enable bidirectional charging capabilities as they can charge electric vehicle batteries up to 80% in as little as 15 minutes for fast energy storage systems and electric vehicle chargers.

- In January 2024, Wolfspeed Inc. one of the global leaders in silicon carbide technology announced the expansion of an existing long-term silicon carbide wafer supply agreement with a leading global semiconductor company.

- In July 2023, Axcelis Technologies Inc. announced a shipment of a Purion H200™ SiC ion implant system to Wolfspeed. This was used to support the production of power devices for electric vehicle (EV) applications.

Get in Touch

Interested in this topic? Contact our analysts for more details.

Latest Thought Articles

Top OSAT Companies Driving Semiconductor Assembly and Test Services Worldwide

Recently

EV Charging Stations Market Outlook: Smart Charging, Fast Charging, and Regional Expansion

Recently

Future of Corporate Wellness: Global Trends and Regional Outlook

Recently

Regional Breakdown of the Mechanical Keyboard Market: Who Leads and Why?

Recently