Innovations in Eco-Friendly and Renewable Aseptic Packaging Materials

Aseptic packaging is a specialized manufacturing technique wherein pharmaceutical, food, and other products are sterilized independently of their packaging. After that, the components are sterilely added to the container. Food products that maintain their chemical and sensory qualities and can be kept without refrigeration for a minimum of six months are the goal of aseptic packaging. This method ensures that the product remains fresh and permits the avoidance of biological spoilage. This means that the aseptic packaging system does not rely on canning as the traditional way of preserving food.

The process of canning begins with food preparation, followed by filling. Desirable materials for aseptic packaging are glass, plastic, paperboard, or metal. These materials are often used in the manufacture of cans, receptacles, cartons, and other aseptic packaging. Paperboard is liked for use in aseptic packaging because it looks nice and can be recycled.

There is a great benefit of aseptic packaging to the global market due to its unique advantages such as longer shelf life, Eco-friendliness, maintaining good product quality and lacking preservatives. Regarding the aseptic packaging market, it is projected that the beverage sector will take up this technology fast while at the same time, there will be an increase in demand from the healthcare industry.

Global Production Trends

The growing demand for packaged foods, such as ready-to-eat meals, dairy goods, frozen meals, cake mixes, and snack foods, is expected to boost industry growth over the forecast period. Additionally, consumers who are "on the go" will find this type of packaging convenient as it does not require refrigeration. However, throughout the projection period, growth is likely to be constrained by the higher initial cost of the technology compared to conventional processes.

The aseptic packaging market statistics are mostly driven by the consumption of bottled water and other beverages. Additionally, the market is expanding due to the widespread use of single-serve and reusable packaging options, such as pouches for dairy products and fresh fruit juices. Because of these developments, packaged foods are now a staple in pantry stockpiles across the globe. In addition, the United States Department of Agriculture (USDA)'s Foreign Agriculture Service (FAS) released a report that showed that over the previous ten years, frozen food consumption, including frozen snacks, had been steadily increasing in Japan.

Further, the Coca-Cola Company is introducing Tetra Stelo Aseptic packaging in the Asia-Pacific area with this package. Additionally, in February 2023, SIG constructed its first aseptic carton plant in India, which is home to one of the biggest milk markets in the world as well as a significant juice producer.

Aseptic packaging recycling use case

The use of aseptic packaging in different industry verticals is a huge trend in the market these days due to the proliferation of pharmaceutical industries, and the rise in demand for aseptic packaging products. Due to significant government investments in enhancing healthcare infrastructure as well as rising demand for more sophisticated manufacturing systems, the healthcare sector is growing quickly in emerging market economies. The concentration of pharmaceutical companies in developing nations like China and India also helps to fuel the market's expansion.

The demand for aseptic packaging is due to the increased demand for cartons as aseptic cartons are made from paperboard, aluminium, and thin plastic layers. In addition, the growth of the dairy and dairy substitute industries as well as the construction of new beverage facilities are driving the market. SIG put up an aseptic carton plant in India in February 2023. The aseptic plant is situated in Ahmedabad, a city in Gujarat. It is the largest milk market globally and a significant juice producer. The purchase of modern aseptic carton pack manufacturing capabilities that conform to strict environment guidelines for printing and finishing was part of the costs.

One of the main factors propelling the market expansion in this sector is the growing plastic packaging industry. In addition, the market expansion for aseptic packaging in this segment is being driven by consumers' widespread use of retort pouches—which are composed of laminated aluminium and plastic and can withstand heat processing—instead of traditional cans for curries and sauces.

Market Dynamics and Drivers

Several factors drive the aseptic packaging recycling market like the increasing consumer awareness of environmental issues is driving the popularity of sustainable packaging alternatives that minimize waste generation and maximize resource utilization, which is driving the market growth. Amcor PLC, for example, declared that it wanted all of its aseptic products to be recyclable. Amcor has made headway toward its objective of having every variety recyclable, reusable, or compostable by 2025; currently, 74% of the company's total weight in production is made of recyclable materials. The aseptic packaging market is also being driven by the top manufacturers' increased emphasis on creating cutting-edge technologies for eco-friendly packaging alternatives. Huhtamäki Oyj, for instance, introduced a novel, recyclable ice cream packaging solution in October 2022 based on paper-based technology. 95% of the materials used to construct this packaging derivative are biobased and renewable. In the upcoming years, this innovation will help reduce packaging waste and environmental pollution.

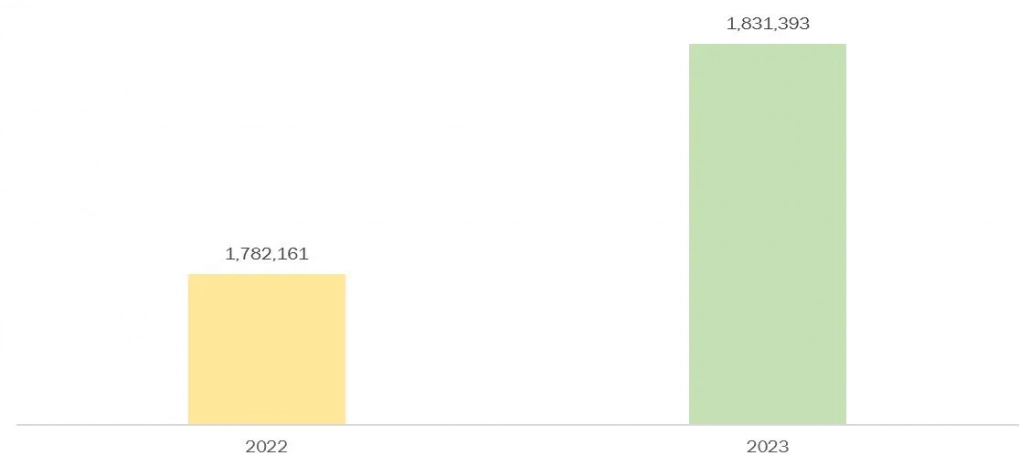

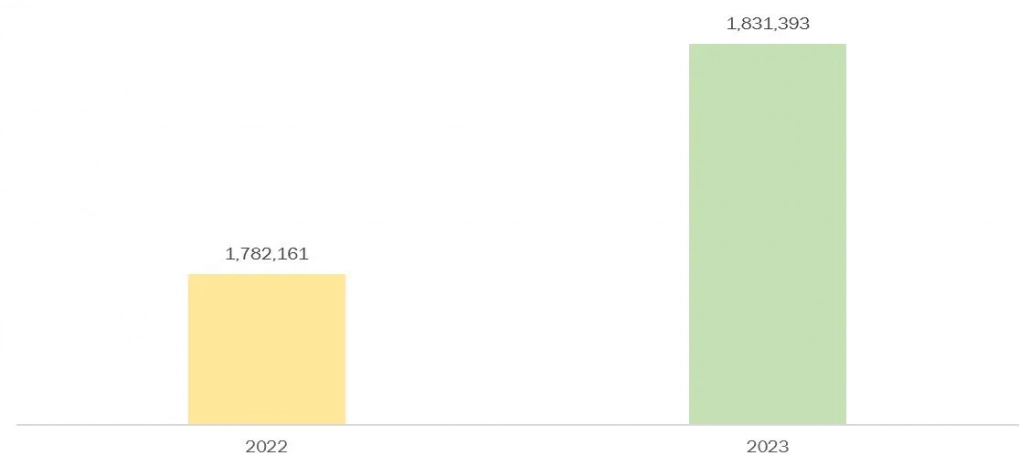

Moreover, throughout the forecast period, the aseptic packaging market is anticipated to benefit greatly from a slow but steady rise in global e-commerce sales as well as expansion prospects in emerging markets in developing nations. For instance, the projected total e-commerce sales for 2023 were $1,118.7 billion, up 7.6% from 2022. Moreover, 2023 saw a 2.1% (±0.4%) increase in total retail sales over 2022. In 2023, sales through e-commerce made up 15.4% of total sales. In 2022, sales through e-commerce made up 14.7% of total sales.

Figure 1: Estimated Quarterly Retail Sales, in Million Dollars, United Sales, 2020 to 2023

Source: Census.gov

Key Developments

Source: Census.gov

Key Developments

Source: Census.gov

Key Developments

Source: Census.gov

Key Developments

- In April 2023, SIG launched SIG Digital Printing for European-made aseptic carton packs. To meet specific customer demands with flexibility and agility, the printing solution provides full-colour digital printing without the need for cylinders or printing forms. SIG invested in this new digital printing technology to go along with its "extremely" effective and superior rotogravure printing system. One of Koenig & Bauer's RotaJET 168 digital printing machines is part of SIG Digital Printing's investment.

- In November 2023, Tetra Pak and Lactogal introduced an aseptic beverage carton with a paper-based barrier, following successful commercial consumer testing in 2022. This is a small portion of a larger technology validation project that is presently being carried out in Portugal and involves over 25 million packets. Comprising around 80% paperboard, the package boosts its renewable content to 90%, lowers its carbon impact by 33%, and has earned the Carbon TrustTM's Carbon Neutral certification.

- In January 2023, leading Chinese aseptic packaging company Shandong NewJF Technology Packaging Co., Ltd. (NEWJF) purchased a 28.22% share in Greatview Aseptic Packaging in January 2023, and the deal was finalized in October. The market for liquid product packaging has greatly increased NEWJF's profile as a result of this calculated move.

| Subscribe Us |

Get in Touch

Interested in this topic? Contact our analysts for more details.

Latest Thought Articles

Top OSAT Companies Driving Semiconductor Assembly and Test Services Worldwide

Recently

EV Charging Stations Market Outlook: Smart Charging, Fast Charging, and Regional Expansion

Recently

Future of Corporate Wellness: Global Trends and Regional Outlook

Recently

Regional Breakdown of the Mechanical Keyboard Market: Who Leads and Why?

Recently