Demand for Communications and Electronics to Fuel the Semiconductor Dry Etch Systems Market

Semiconductor dry etch systems are equipment used in the production of semiconductors, microprocessors, and other microelectronics. The technique is selectively removing or etching specific layers of material from a wafer, leaving behind the patterns and structures required for the device's operation.

Dry etching systems use a variety of processes to remove material from the wafer surface, including plasma etching, reactive ion etching, and deep reactive ion etching. Dry etching is an important stage in semiconductor production because it enables accurate patterning and the development of detailed patterns on the wafer's surface. These characteristics may include channels and trenches, which are key components of contemporary semiconductor devices. The capacity to create exact and consistent patterns is required to improve device performance, minimize size, and expand functionality.

The semiconductor dry etch systems market is being pushed by rising demand for improved semiconductor devices and high-resolution patterning capabilities. The drive for better processing speeds, smaller form factors, and more functionality is driving the development of more accurate patterning and etching capabilities. As a result, dry etching has become an important stage in the semiconductor production process.

In the 1980s, the US semiconductor industry lost more than half of its global market share. This was due to fierce competition from Japanese manufacturers, illegal "dumping," and a severe industrial slump in 1985–86. The sector lost 19 worldwide market share points, surrendering leadership to Japan's semiconductor industry.

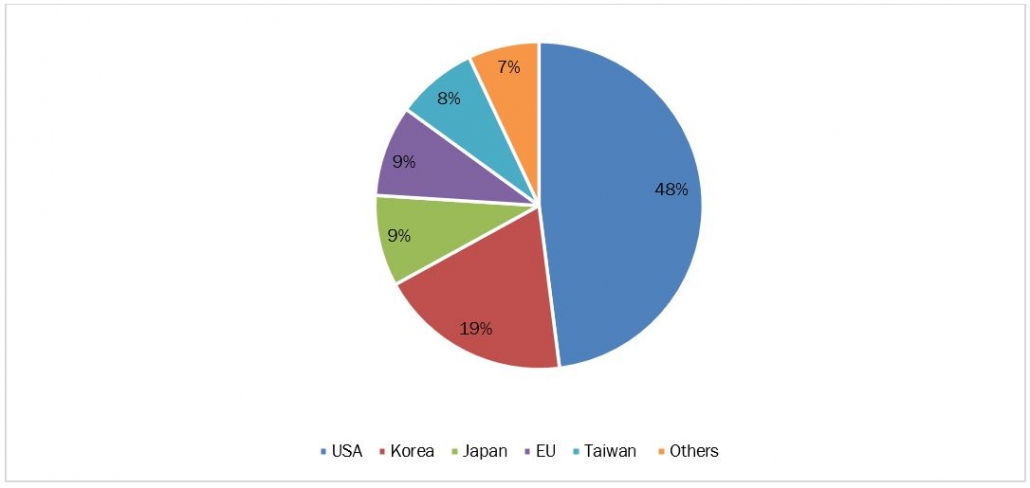

However, the company rebounded throughout the next decade, regaining its leading position and peaking at 50% global market share by 1997. US semiconductor companies maintain a competitive edge in microprocessors, R&D, design, and process technology, with a current market share of 48%, Korea 19%, Japan 9%, the EU 9%, Taiwan 8%, and other nations' industries accounting for 7–20% of global market share.

Figure 1: Semiconductor Industry Countries Market Share

Source: World Semiconductor Trade Statistics (WSTS), Omdia, and SIA Estimates

The demand for modern semiconductor and electronic equipment, such as microprocessors, memory chips, and sensors, as well as mobile devices, tablets, and laptops, is fast expanding due to the widespread use of digital technology in numerous industries. Higher processing speeds, smaller form factors, and greater functionality are increasing demand for more accurate patterning and etching capabilities.

Furthermore, technical improvements in semiconductor production, such as the development of novel materials, methods, and devices, are increasing demand for more sophisticated dry etch systems. For example, the developments of novel materials like silicon carbide and gallium nitride for high-power and high-frequency devices needs more accurate and uniform etching skills. Furthermore, the growing need for three-dimensional (3D) architecture in semiconductor devices drives the need for deep reactive ion etching (DRIE) equipment.

Consumer-purchased items, including laptops and cellphones, fuel most of the semiconductor demand. Consumer demand is growing in emerging markets such as Asia, Latin America, Eastern Europe, and Africa. Global semiconductor sales are generated by goods that are eventually purchased by customers.

Semiconductors are critical components in a wide range of consumer electronics and products, including smartphones, tablets, laptop computers, TVs, gaming consoles, digital cameras, smart home appliances, wearables, and automotive electronics, among others. These semiconductor chips, also known as integrated circuits (ICs), perform a variety of activities in electronic devices, including processing, memory storage, communication, display control, sensor input, and power management.

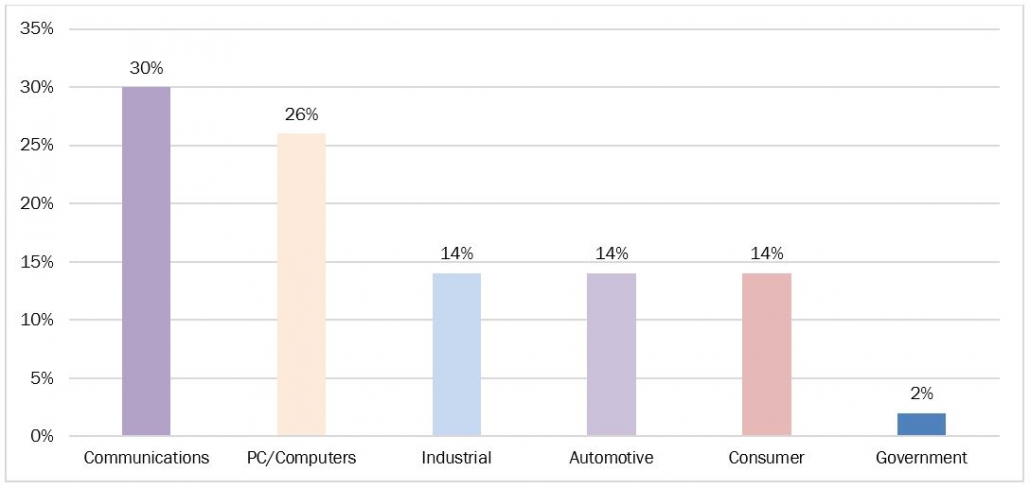

According to data from World Semiconductor Trade Statistics Communication sectors have the largest market share of 30% followed by PC/Computer devices that holds the et share of 26% followed by industrial, automotive, consumer sector holding market share of 14% each and government holding 2%.

Figure 2: Global Semiconductor Sales Share by End User

Source: World Semiconductor Trade Statistics (WSTS), Omdia, and SIA Estimates

The demand for modern semiconductor and electronic equipment, such as microprocessors, memory chips, and sensors, as well as mobile devices, tablets, and laptops, is fast expanding due to the widespread use of digital technology in numerous industries. Higher processing speeds, smaller form factors, and greater functionality are increasing demand for more accurate patterning and etching capabilities.

Furthermore, technical improvements in semiconductor production, such as the development of novel materials, methods, and devices, are increasing demand for more sophisticated dry etch systems. For example, the developments of novel materials like silicon carbide and gallium nitride for high-power and high-frequency devices needs more accurate and uniform etching skills. Furthermore, the growing need for three-dimensional (3D) architecture in semiconductor devices drives the need for deep reactive ion etching (DRIE) equipment.

Consumer-purchased items, including laptops and cellphones, fuel most of the semiconductor demand. Consumer demand is growing in emerging markets such as Asia, Latin America, Eastern Europe, and Africa. Global semiconductor sales are generated by goods that are eventually purchased by customers.

Semiconductors are critical components in a wide range of consumer electronics and products, including smartphones, tablets, laptop computers, TVs, gaming consoles, digital cameras, smart home appliances, wearables, and automotive electronics, among others. These semiconductor chips, also known as integrated circuits (ICs), perform a variety of activities in electronic devices, including processing, memory storage, communication, display control, sensor input, and power management.

According to data from World Semiconductor Trade Statistics Communication sectors have the largest market share of 30% followed by PC/Computer devices that holds the et share of 26% followed by industrial, automotive, consumer sector holding market share of 14% each and government holding 2%.

Figure 2: Global Semiconductor Sales Share by End User

Source: World Semiconductor Trade Statistics (WSTS)

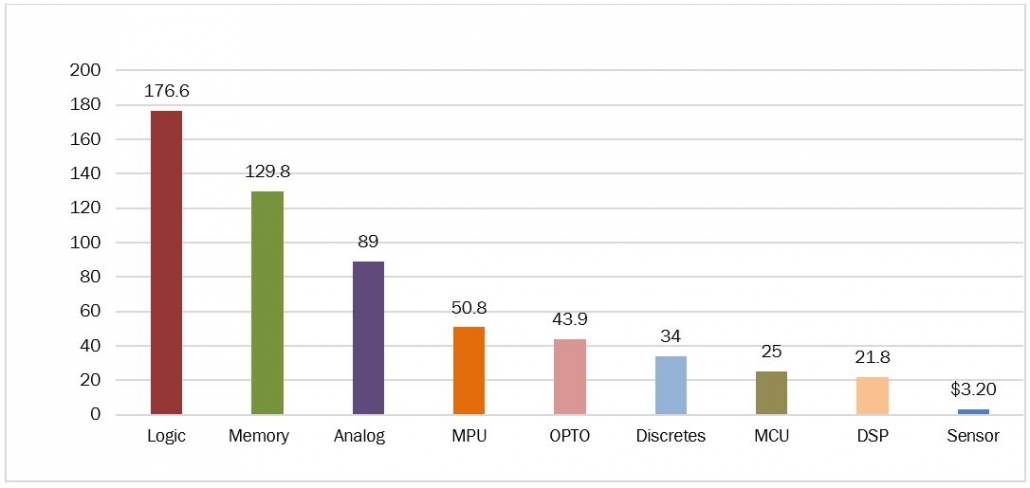

Semiconductor technology is continually evolving to meet the needs of many sectors through enhanced products and processes. Memory, logic, analog, and mpu have been the leading segments of the global semiconductor business in recent years. In 2022, these items represented 78% of semiconductor industry sales.

Figure 3: Worldwide Semiconductor Sales by Product Segment 2022

Source: World Semiconductor Trade Statistics (WSTS)

Semiconductor technology is continually evolving to meet the needs of many sectors through enhanced products and processes. Memory, logic, analog, and mpu have been the leading segments of the global semiconductor business in recent years. In 2022, these items represented 78% of semiconductor industry sales.

Figure 3: Worldwide Semiconductor Sales by Product Segment 2022

Source: World Semiconductor Trade Statistics (WSTS)

In conclusion, semiconductor dry etch systems are critical equipment in the semiconductor manufacturing industry for accurate material removal and patterning. They employ plasma, a state of matter made up of ionized gases, to remove material layers from wafers. Compared to wet etching procedures that employ liquid chemicals, this process provides more control, accuracy, and selectivity, making it excellent for generating delicate patterns and features on semiconductor devices.

Key Developments

Source: World Semiconductor Trade Statistics (WSTS)

In conclusion, semiconductor dry etch systems are critical equipment in the semiconductor manufacturing industry for accurate material removal and patterning. They employ plasma, a state of matter made up of ionized gases, to remove material layers from wafers. Compared to wet etching procedures that employ liquid chemicals, this process provides more control, accuracy, and selectivity, making it excellent for generating delicate patterns and features on semiconductor devices.

Key Developments

- February 2024: Toppan Photomask and IBM had entered a research and development collaboration for 2-nanometer logic semiconductor nodes utilizing extreme UV lithography. Beginning in the first quarter of 2024, the cooperation would focus on establishing photomask capacity at the albanyNanoTech Complex and Toppan Photomask's Asaka Planted, to provide commercial solutions for mass production of 2nm nodes and beyond semiconductors.

- December 2023: Tokyo Electron had announced Ulucus™ G, a wafer-thinning solution for 300-mm wafer production. The technology intended to improve silicon wafer flatness for improved patterning in semiconductor manufacturing while also reducing the amount of personnel necessary for mass production. It included a ground unit, a scrubbed cleaned unit, and a spin wet etch unit enabling in-system feedback and feedforward of process data. The technology had been completely tested in coating and development applications and projected to minimize mass production labor.

- May 2023: CVD Equipment Corporation had sold Tantaline CVD apS, a Danish subsidiary, with an earn-out provision based on expected net profits for the five years ended December 31, 2027. The firm anticipates a loss of around $250,000 in the quarter ended June 30, 2023. Tantaline's revenues and net income for the fiscal year ending December 31, 2022, and the three months ending March 31, 2023, were $1.7 million and $0.4 million, respectively.

- July 2022: Hitachi High-Tech Corporation ("Hitachi High-Tech") announced the development of a service to remotely assess the deterioration condition of on-board automobile lithium-ion batteries. The achievement of battery stability and efficiency was increasingly critical for the deployment of electric vehicles ("EVs"). Hitachi High-Tech would begin to offer this service to worldwide clients via various networks to helped built a circular society by resolving customer difficulties.

Get in Touch

Interested in this topic? Contact our analysts for more details.

Latest Thought Articles

Top OSAT Companies Driving Semiconductor Assembly and Test Services Worldwide

Recently

EV Charging Stations Market Outlook: Smart Charging, Fast Charging, and Regional Expansion

Recently

Future of Corporate Wellness: Global Trends and Regional Outlook

Recently

Regional Breakdown of the Mechanical Keyboard Market: Who Leads and Why?

Recently