Solar Panel Recycling Industry: Growth Path and Key Catalysts

Introduction

One???????? of the major changes brought about by the global energy transition has been the rapid expansion of solar energy, which has fundamentally altered how electricity is generated and distributed globally. Over twenty years, solar technology has been deployed at an almost exponential rate mainly due to its ever-decreasing costs, the implementation of policies favorable to it, and the urgent call for decarbonization of global energy systems. However, the impressive growth of solar energy carries with it the challenge of figuring out how to keep such energy sources sustainable, store them economically, and dispose of them in an environmentally friendly manner. The solar panel recycling sector, therefore, is becoming increasingly important as a viable solution to the renewable energy system with the continuous influx of millions of photovoltaic (PV) modules that are going to be ????????retired. Recycling???????? should not be considered an optional afterthought anymore; it is progressively becoming one of the main indispensable components of a circular economy in solar manufacturing. Recycling plants, by recycling valuable materials for both the industry and the environment such as silver, copper, aluminium, silicon, and top-quality glass, can energize local production, decrease the country’s dependence on foreign raw materials, and reduce the carbon emission of solar production.Market Overview of the Solar Panel Recycling Industry

- Rising Significance in the Clean Energy Ecosystem

- Why Solar Panel Recycling Has Become Essential

Growth Path of the Solar Panel Recycling Industry

The???????? growth of the solar panel recycling industry is essentially a journey through different stages that overlap with each other. Each phase has contributed to different technologies, regulations, and business models that together form the base of the industry's current ????????vigor.- Early Awareness and Pilot Activity

- Commercialization and Market Emergence

- Waste-management firms expanded their portfolios to include PV recycling.

- Manufacturers began supporting take-back programs and circular-economy initiatives.

- Pilot technologies were refined into commercially scalable processes.

- End-of-life collection networks began forming across regions.

- Large-Scale Industrialization

Source: European Commission

Source: European Commission

Technological Advancements Improving Recovery Rates

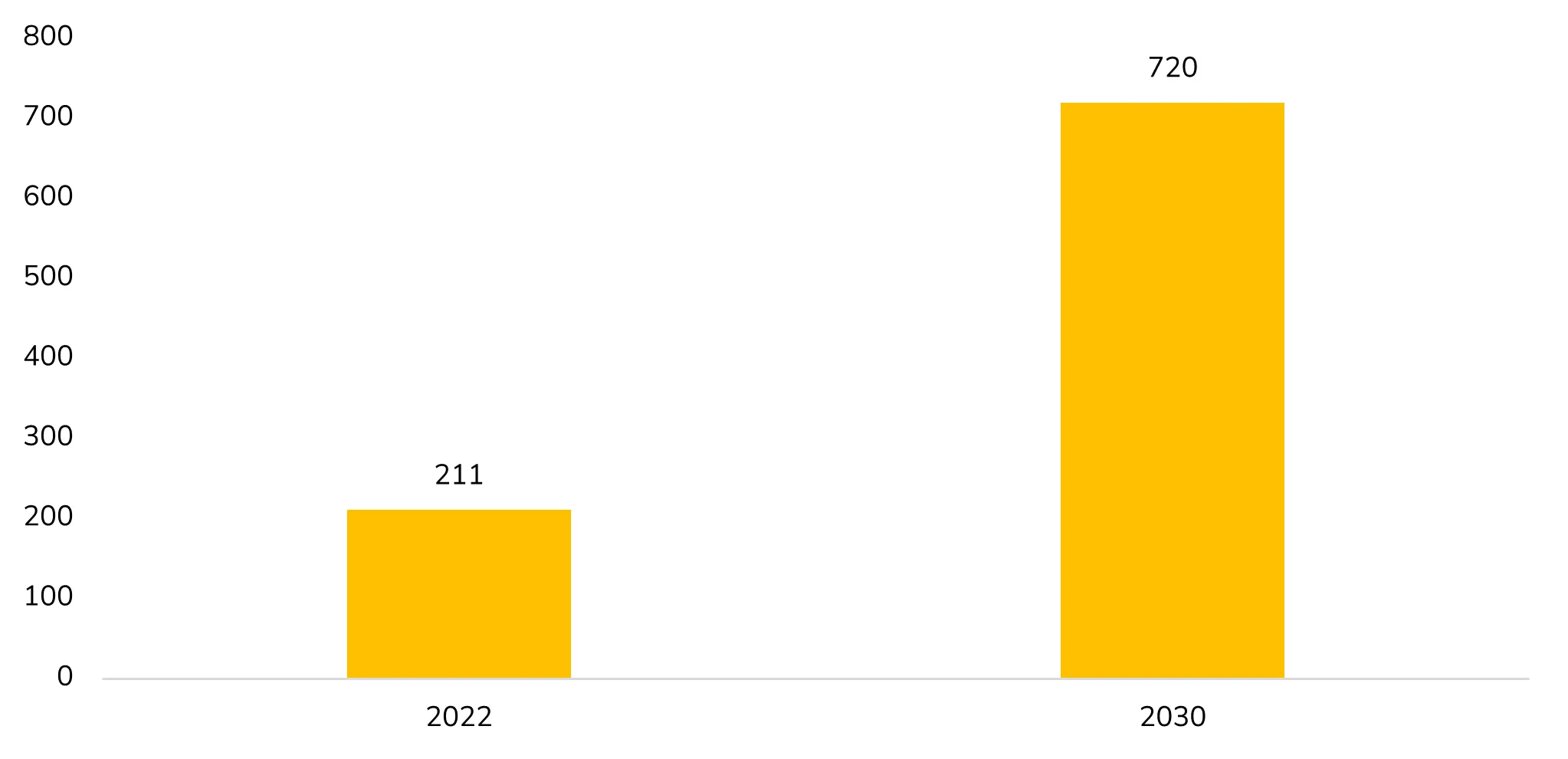

One???????? of the major changes leading to the rise of the solar panel recycling business has been the breakthroughs in technology. Today's recycling operations, in general, are quite efficient in recovering valuable materials like silver, silicon, copper, aluminium, and high-quality glass compared to those of the past. Several innovations are changing the way in which panels are taken apart and treated. The mechanical separation methods have been improved to the extent that the automated and robotic systems are able to detach the frames, junction boxes, and other components, thus working without causing any harm to the materials beneath. The thermal-delamination devices, in fact, enable the recyclers to separate the different layers of the panels after they are heated and the loosening of the encapsulants is done, thus permitting the free removal of the glass and silicon ????????wafers. Chemical???????? recovery methods are becoming more popular because they can dissolve the materials that bind the metals and isolate silver, for example, with a higher level of purity. There is even the introduction of advanced laser-based separation methods to separate silicon wafers more delicately and accurately than ever before. At the same time, better glass cleaning and reconditioning methods are enabling recyclers to produce high-quality glass that can be used both in solar and non-solar applications. These innovations, in aggregate, elevate the material recovery rates, largely make the plants more profitable, and lessen the environmental impact of the recycling ????????activities. As???????? research and development spending goes on, the sector is set to not only reach higher levels of efficiency but also open new ways of getting back materials that were considered unprofitable, thus positioning technology as a key factor for market growth in the ????????future. India's???????? installed solar power capacity of 66.7 GW (FY 2022-23) resulted in roughly 100,000 tonnes of solar waste in 2022-23, and the figure is forecasted to rise to 340,000 tonnes by 2030, i.e., more than thrice the present value. Out of this, approximately 10 kilotonnes (kt) of silicon, 12-18 tonnes of silver and 16 tonnes of cadmium and tellurium will be the elements that are central to India's mineral ????????security. Recorded???????? in March 2024, a new study unveils projections that sound the alarm about the amount of solar waste that India will be producing. By 2030, solar waste in India will be doubling to 600,000 tonnes, enough to fill 720 Olympic-size swimming pools; just 100,000 tonnes is the current part of the solar waste, which is a direct consequence of the rapid deployment of new solar plant ????????capacity.Competitive Landscape and Industry Participants

- Established Recycling Companies

- New Entrants and Startups

| Company | Core Activities in Solar Panel Recycling |

| First Solar, Inc. | Large-scale PV recycling; closed-loop recovery of CdTe thin-film materials. |

| Veolia Environment S.A. | EU-authorized PV recycling; mechanical and thermal recovery of glass, metals, and aluminum. |

| Recycling Technologies GmbH (RTG) | Advanced dismantling; silicon and metal separation technologies. |

| PV Cycle | Collection, take-back operations, and compliance under EPR rules across Europe. |

| SunPower Corporation | End-of-life management programs; partnerships for high-efficiency panel recycling. |

| Envaris GmbH | Diagnostic testing plus recycling for crystalline-silicon PV modules. |

| SiC Processing GmbH | Recovery and reprocessing of silicon slurry and kerf waste. |

| Metech Recycling | PV and e-waste recycling focus on precious metal extraction. |

| CleanTech Recycling Corp. | Chemical and laser-based recovery of silver, copper, and semiconductor-grade silicon. |

Opportunities, Challenges, and Future Outlook

Major Opportunities Ahead The solar panel recycling industry offers several significant opportunities:- Development of high-value markets for recovered silver and silicon.

- Integration of recycled materials into new solar manufacturing facilities.

- Creation of new jobs and industrial clusters focused on circular energy systems.

- Expansion of service-based business models such as take-back programs, leasing, and refurbishment.

- High initial costs for building and operating advanced recycling facilities.

- Lack of standardized panel designs, making disassembly more complex.

- Transport logistics and costs for collecting panels across remote sites.

- Need for regulatory harmonization across regions.

- Limited awareness among smaller project developers and installers.

The Future Outlook

Solar???????? panel recycling will be a vital clean-energy solution of the future, and its success remains interconnected with the worldwide climate goals. As the cubes of discarded materials swell and the technology gets better, the process will be less of a niche and more of a standard industrial sector. Improvements in efficiency, support from regulations, and the rising value of the recycled materials will pave the way for the expansion of this market in the long run. After ten years, the industry will be indispensable to the solar energy value chain, making it feasible to close the loop in a circular model and provide truly sustainable renewable energy ????????systems.Conclusion

The???????? solar panel recycling industry is at an important crossroads. The industry, which was originally a small-scale, environmentally friendly initiative, has developed into a quickly expanding industrial ecosystem that is indispensable for the future of clean energy. The industry is ready for considerable growth due to the increasing waste volumes, the advancement of recovery technologies, the tightening of regulations, and the rise in corporate sustainability goals. The global growth of solar power will be complemented by recycling, which will make the renewable energy revolution not only clean at the point of generation but also sustainable throughout the entire ????????lifecycle.Get in Touch

Interested in this topic? Contact our analysts for more details.

Latest Thought Articles

Top OSAT Companies Driving Semiconductor Assembly and Test Services Worldwide

Recently

EV Charging Stations Market Outlook: Smart Charging, Fast Charging, and Regional Expansion

Recently

Future of Corporate Wellness: Global Trends and Regional Outlook

Recently

Regional Breakdown of the Mechanical Keyboard Market: Who Leads and Why?

Recently