Unlocking Lithium Sources: Delving into the Top 5 Global Lithium-Producing Countries

Lithium is a widely expanding element in market demand among different end user industries. Here are the 5 countries that have significant lithium production.

1. Australia: Lithium plays a multifaceted role in both chemical and technical industries. It’s different variants, such as lithium carbonate, lithium hydroxide, and lithium chloride, are utilized across a spectrum of applications including lubricant greases, pharmaceuticals, catalysts, air treatment, and prominently, in batteries. These batteries span both non-rechargeable (primary) lithium metal batteries and rechargeable (secondary) lithium-ion batteries.

The rising global need for lithium-based power offers a significant yet time-sensitive opportunity for Australia's resources sector. As nations and corporations delineate their roles in the battery supply chain, present decisions are shaping the future dynamics of the global industry into the 2030s.

Additionally, Lithium-ion batteries are extensively utilized in mobile consumer electronics such as smartphones and laptops due to their exceptional energy density and efficiency, surpassing other energy storage solutions. They boast a favorable power-to-weight ratio, impressive high-temperature performance, prolonged lifespan, and minimal self-discharge. Although numerous components of lithium-ion batteries are recyclable, the industry faces a notable obstacle in managing the costs linked with material recovery, representing a substantial challenge.

The surging demand for lithium-based power mirrors the swift expansion of the electric vehicle (EV) market. Tesla's forecasts project a demand of approximately 1,000 kilotons of lithium carbonate equivalent (LCE) per year by 2030, representing a sixteenfold increase from 2022 and surpassing current global production levels by 30%. The passenger EV market, heavily reliant on lithium-based batteries, is expected to grow at a robust annual rate of 26% until 2030.

Source: Resources and Energy Quarterly (REQ)

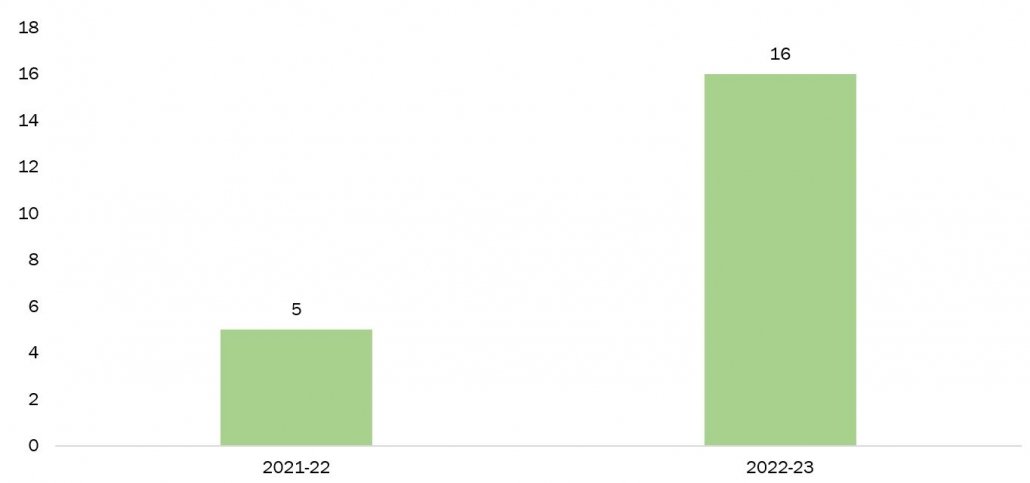

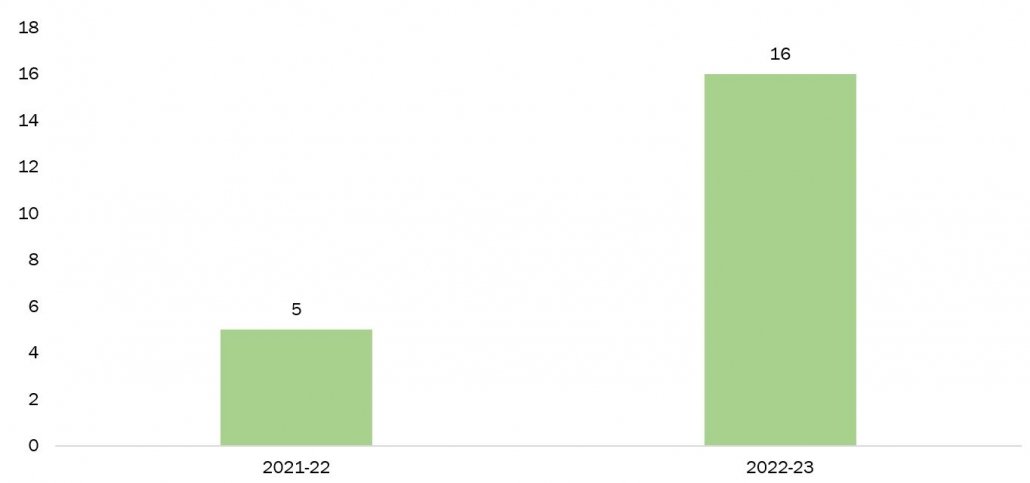

As per the December 2022 edition of the Resources and Energy Quarterly (REQ) by Australia’s Department of Industry, Science and Resources, it is projected that lithium export earnings will exceed $16 billion in 2022–23, experiencing substantial growth from $5 billion in the preceding year (2021–22). This expansion is anticipated to position lithium as Australia's sixth-largest resource and energy commodity export.

2. Chile: Chile is positioned within the Lithium Triangle alongside Bolivia and Argentina, featuring extensive salt flats in the Atacama Desert and nearby arid areas. Notable sites include Salar de Uyuni in Bolivia, Chile's Salar de Atacama, and Argentina's Salar del Hombre Muerto.

SQM and Albemarle presently hold sway over Chile's lithium production sector. Nonetheless, there's a looming potential transformation as Chile's announcement in April 2023 to nationalize its lithium industry has sparked considerable disruption within the market.

Source: Resources and Energy Quarterly (REQ)

As per the December 2022 edition of the Resources and Energy Quarterly (REQ) by Australia’s Department of Industry, Science and Resources, it is projected that lithium export earnings will exceed $16 billion in 2022–23, experiencing substantial growth from $5 billion in the preceding year (2021–22). This expansion is anticipated to position lithium as Australia's sixth-largest resource and energy commodity export.

2. Chile: Chile is positioned within the Lithium Triangle alongside Bolivia and Argentina, featuring extensive salt flats in the Atacama Desert and nearby arid areas. Notable sites include Salar de Uyuni in Bolivia, Chile's Salar de Atacama, and Argentina's Salar del Hombre Muerto.

SQM and Albemarle presently hold sway over Chile's lithium production sector. Nonetheless, there's a looming potential transformation as Chile's announcement in April 2023 to nationalize its lithium industry has sparked considerable disruption within the market.

Source: United States Geological Survey (USGS)

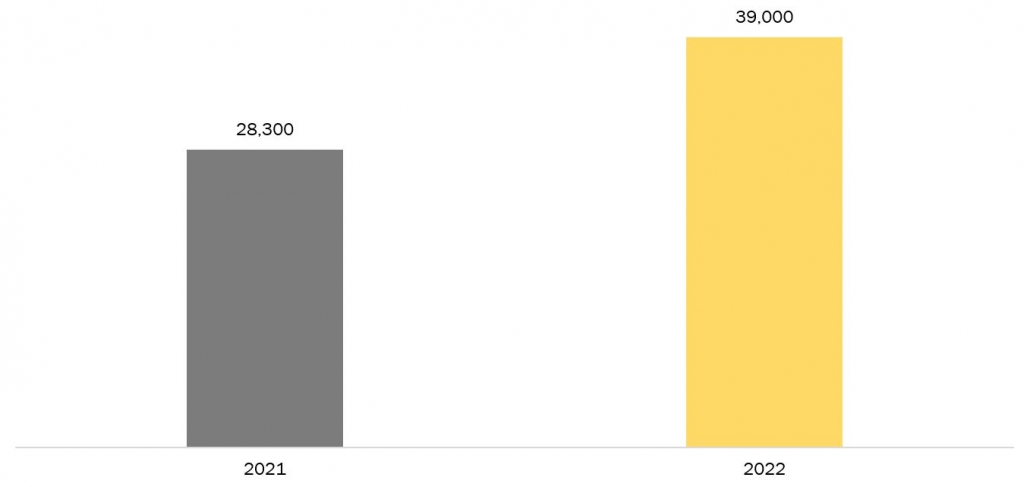

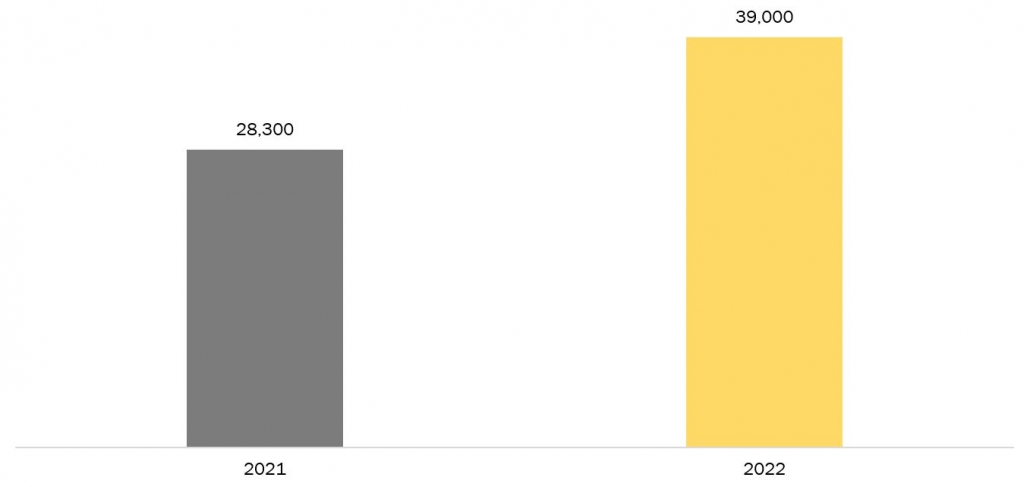

According to the US Geological Survey (USGS), Chile's lithium production surged from 28,300 metric tons (MT) of lithium content in 2021 to 39,000 MT in 2022. The majority of Chile's lithium is sourced from lithium brine deposits.

Additionally, Lithium Chile has significant ownership interests in the world's largest high-grade lithium reserves, covering 110,000 hectares in Chile and 20,800 hectares in Argentina. The company is currently advancing its Phase Two Exploration & Development Program in Arizaro, Argentina, with the goal of expanding the existing resource base of 3.32 million tonnes (LCE) as outlined in the 43-101 report. According to the Preliminary Economic Assessment (PEA), the project boasts an after-tax Net Present Value (NPV) of US $1.1 billion, alongside an impressive Internal Rate of Return (IRR) of 24%.

3. China: China, is one of the foremost global importer and processor of lithium, has positioned itself as a pivotal player in the worldwide lithium supply chain, significantly influencing the transition to cleaner energy sources. With more than half of its lithium sourced from international markets, China primarily supplies processed lithium to battery manufacturers, critical for the production of electric vehicles (EVs).

Recognizing lithium's strategic importance, China has designated it as a key mineral and is focused on enhancing domestic production in regions like Qinghai, Tibet, Sichuan, and Jiangxi. To ensure a secure and reliable supply, numerous Chinese firms have pursued overseas investments, particularly in African lithium mines and South American brine operations.

In China, the main regions with lithium ore reserves are Sichuan and Jiangxi provinces. In Yichun, Jiangxi, the substantial rise in lithium prices over the last two years sparked an increase in unregulated mining and trading of the metal. Consequently, many local ceramics firms redirected their production efforts towards manufacturing lithium mica.

Figure 3: Electric Car Sales in China, in Million Units

Source: United States Geological Survey (USGS)

According to the US Geological Survey (USGS), Chile's lithium production surged from 28,300 metric tons (MT) of lithium content in 2021 to 39,000 MT in 2022. The majority of Chile's lithium is sourced from lithium brine deposits.

Additionally, Lithium Chile has significant ownership interests in the world's largest high-grade lithium reserves, covering 110,000 hectares in Chile and 20,800 hectares in Argentina. The company is currently advancing its Phase Two Exploration & Development Program in Arizaro, Argentina, with the goal of expanding the existing resource base of 3.32 million tonnes (LCE) as outlined in the 43-101 report. According to the Preliminary Economic Assessment (PEA), the project boasts an after-tax Net Present Value (NPV) of US $1.1 billion, alongside an impressive Internal Rate of Return (IRR) of 24%.

3. China: China, is one of the foremost global importer and processor of lithium, has positioned itself as a pivotal player in the worldwide lithium supply chain, significantly influencing the transition to cleaner energy sources. With more than half of its lithium sourced from international markets, China primarily supplies processed lithium to battery manufacturers, critical for the production of electric vehicles (EVs).

Recognizing lithium's strategic importance, China has designated it as a key mineral and is focused on enhancing domestic production in regions like Qinghai, Tibet, Sichuan, and Jiangxi. To ensure a secure and reliable supply, numerous Chinese firms have pursued overseas investments, particularly in African lithium mines and South American brine operations.

In China, the main regions with lithium ore reserves are Sichuan and Jiangxi provinces. In Yichun, Jiangxi, the substantial rise in lithium prices over the last two years sparked an increase in unregulated mining and trading of the metal. Consequently, many local ceramics firms redirected their production efforts towards manufacturing lithium mica.

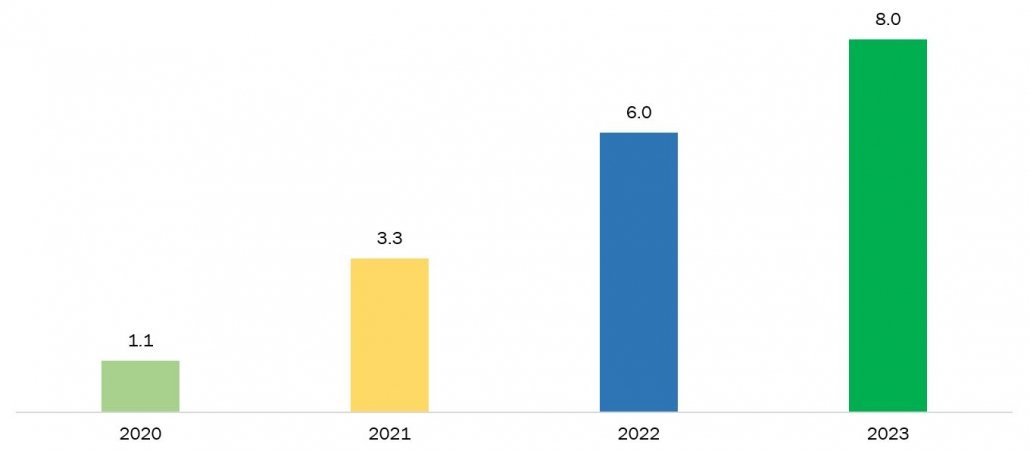

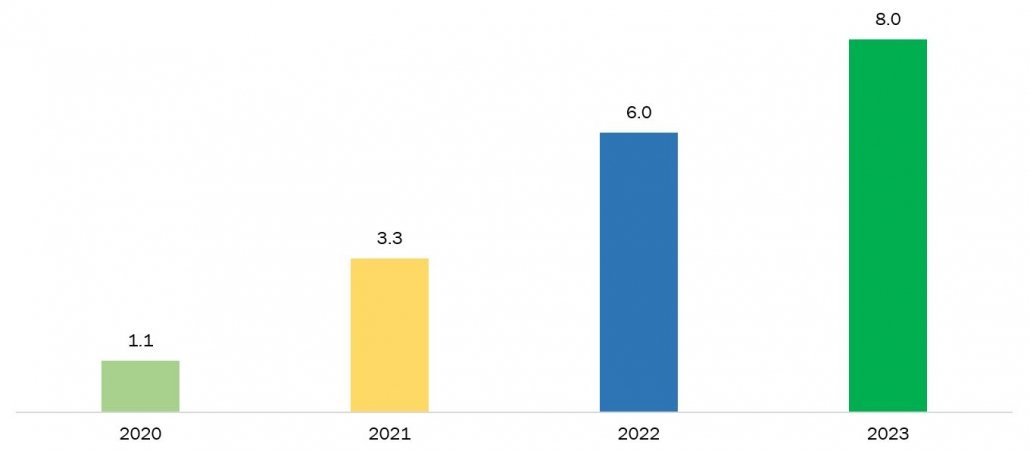

Figure 3: Electric Car Sales in China, in Million Units

Source: International Energy Agency

China's electric vehicle market witnessed a remarkable upswing, with sales escalating from 1.1 million units in 2020 to 3.3 million units in 2021. This positive trajectory persisted through 2022, as sales surged to 6.0 million units, followed by continued growth in 2023, reaching 8.0 million units. This trend highlights China's substantial advancement and dedication to the electric vehicle sector, driven by both rising consumer demand and governmental efforts to foster clean energy transportation initiatives.

4. Argentina: Argentina's lithium mining industry is rapidly expanding, signaling robust growth potential. Projections indicate that by 2030, Argentina could emerge as a leading lithium producer in Latin America, potentially rivaling or surpassing Chile.

This increased industry activity has attracted a competitive influx of global operators and investors aiming to secure their position in this lucrative market. The moniker "white gold" underscores lithium's substantial market value, underlining its pivotal role in the global transition to sustainable energy sources.

According to the International Energy Agency (IEA), Latin America accounts for approximately 35% of global lithium production, with Chile and Argentina being the primary contributors at 26% and 6%, respectively. Additionally, this region holds more than half of the world's lithium reserves, with Argentina and Chile jointly possessing 21% and 11% of the total reserves, respectively.

5. Brazil: Lithium production is on the rise in Brazil due to the growing demand for lithium-ion batteries. Furthermore, there has been a notable increase in the sales of electric vehicles (EVs) within the country. For example, EV sales surged from 3,970 units, constituting 0.16% of the total automotive industry in Brazil in 2018, to 67,047 units, in 2023, representing 3.85% of the total automotive sector in the country.

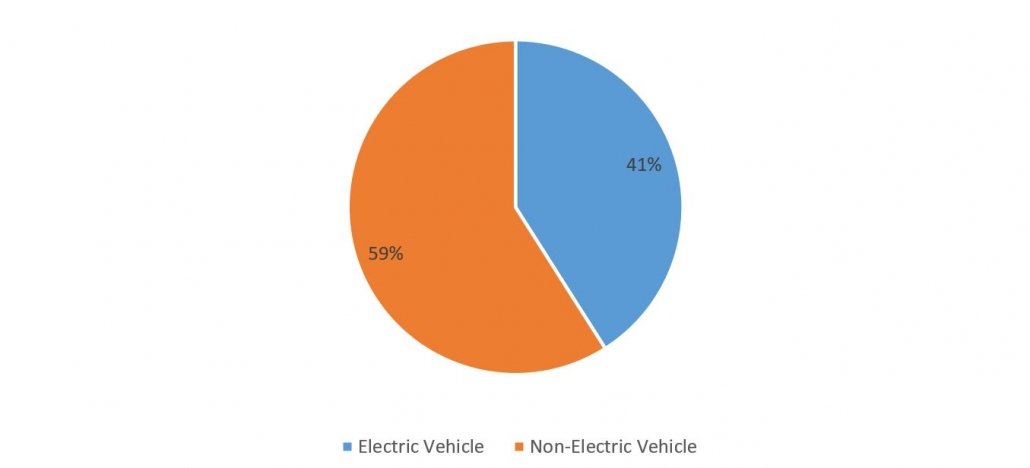

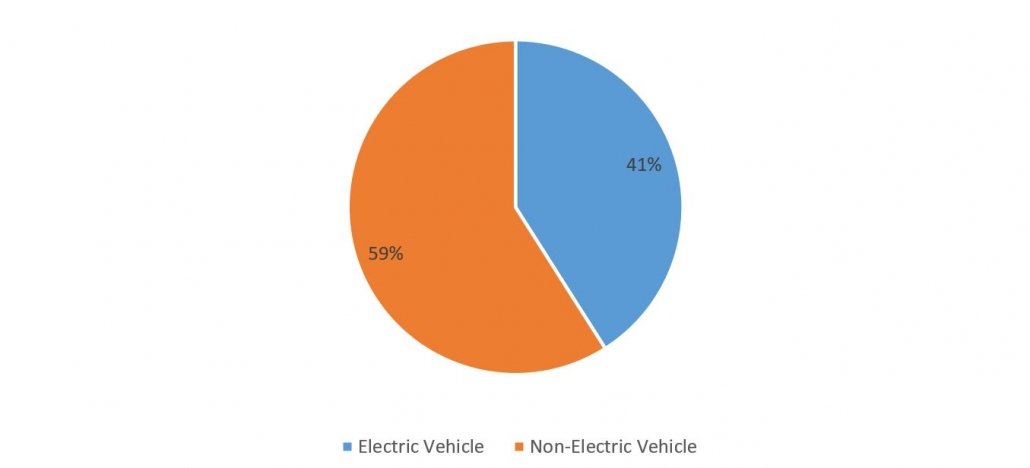

Figure 4: Brazil Electric and Non-Electric Vehicle Sales as a Percentage (%) of Total Sales, in 2022

Source: International Energy Agency

China's electric vehicle market witnessed a remarkable upswing, with sales escalating from 1.1 million units in 2020 to 3.3 million units in 2021. This positive trajectory persisted through 2022, as sales surged to 6.0 million units, followed by continued growth in 2023, reaching 8.0 million units. This trend highlights China's substantial advancement and dedication to the electric vehicle sector, driven by both rising consumer demand and governmental efforts to foster clean energy transportation initiatives.

4. Argentina: Argentina's lithium mining industry is rapidly expanding, signaling robust growth potential. Projections indicate that by 2030, Argentina could emerge as a leading lithium producer in Latin America, potentially rivaling or surpassing Chile.

This increased industry activity has attracted a competitive influx of global operators and investors aiming to secure their position in this lucrative market. The moniker "white gold" underscores lithium's substantial market value, underlining its pivotal role in the global transition to sustainable energy sources.

According to the International Energy Agency (IEA), Latin America accounts for approximately 35% of global lithium production, with Chile and Argentina being the primary contributors at 26% and 6%, respectively. Additionally, this region holds more than half of the world's lithium reserves, with Argentina and Chile jointly possessing 21% and 11% of the total reserves, respectively.

5. Brazil: Lithium production is on the rise in Brazil due to the growing demand for lithium-ion batteries. Furthermore, there has been a notable increase in the sales of electric vehicles (EVs) within the country. For example, EV sales surged from 3,970 units, constituting 0.16% of the total automotive industry in Brazil in 2018, to 67,047 units, in 2023, representing 3.85% of the total automotive sector in the country.

Figure 4: Brazil Electric and Non-Electric Vehicle Sales as a Percentage (%) of Total Sales, in 2022

Source: Brazilian Association of Electric Vehicles (ABVE)

The Brazilian Association of Electric Vehicles (ABVE) reports a significant surge in electric vehicle sales within the country. In 2022, electric vehicles accounted for 41% of total automotive production, while non-electric vehicles comprised 56%. With the escalating advantages of EVs, there is anticipated growth in demand in the forthcoming years.

In the country there are several acquisitions and mergers taking place, for the mineral rights which are further expected to boost the market in the projected period. For instance, in November 2023, Armada Metals Limited has announced the formalization of a Binding Term Sheet with Antares Minerais Estratégicos Ltda. (Antares Minerais), a Brazilian exploration entity. This agreement involves securing legal ownership and title rights to specific Exploration Permits and Applications for Exploration, encompassing a total expanse of 16,750.28 hectares in the eastern precinct of Minas Gerais State, Brazil.

The acquisition encompasses 14 mineral rights segmented into four blocks, notably including the Agua Boa Project, where pegmatite formations have been detected, alongside the Rio Doce Project, the Resplendor Project, and the Mendes Pimentel Project.

Find some of our related studies:

Source: Brazilian Association of Electric Vehicles (ABVE)

The Brazilian Association of Electric Vehicles (ABVE) reports a significant surge in electric vehicle sales within the country. In 2022, electric vehicles accounted for 41% of total automotive production, while non-electric vehicles comprised 56%. With the escalating advantages of EVs, there is anticipated growth in demand in the forthcoming years.

In the country there are several acquisitions and mergers taking place, for the mineral rights which are further expected to boost the market in the projected period. For instance, in November 2023, Armada Metals Limited has announced the formalization of a Binding Term Sheet with Antares Minerais Estratégicos Ltda. (Antares Minerais), a Brazilian exploration entity. This agreement involves securing legal ownership and title rights to specific Exploration Permits and Applications for Exploration, encompassing a total expanse of 16,750.28 hectares in the eastern precinct of Minas Gerais State, Brazil.

The acquisition encompasses 14 mineral rights segmented into four blocks, notably including the Agua Boa Project, where pegmatite formations have been detected, alongside the Rio Doce Project, the Resplendor Project, and the Mendes Pimentel Project.

Find some of our related studies:

Figure 1: Australia Forecasts Lithium Export Earnings, in US$ Million, in 2021-22, and 2022-23

Source: Resources and Energy Quarterly (REQ)

As per the December 2022 edition of the Resources and Energy Quarterly (REQ) by Australia’s Department of Industry, Science and Resources, it is projected that lithium export earnings will exceed $16 billion in 2022–23, experiencing substantial growth from $5 billion in the preceding year (2021–22). This expansion is anticipated to position lithium as Australia's sixth-largest resource and energy commodity export.

2. Chile: Chile is positioned within the Lithium Triangle alongside Bolivia and Argentina, featuring extensive salt flats in the Atacama Desert and nearby arid areas. Notable sites include Salar de Uyuni in Bolivia, Chile's Salar de Atacama, and Argentina's Salar del Hombre Muerto.

SQM and Albemarle presently hold sway over Chile's lithium production sector. Nonetheless, there's a looming potential transformation as Chile's announcement in April 2023 to nationalize its lithium industry has sparked considerable disruption within the market.

Source: Resources and Energy Quarterly (REQ)

As per the December 2022 edition of the Resources and Energy Quarterly (REQ) by Australia’s Department of Industry, Science and Resources, it is projected that lithium export earnings will exceed $16 billion in 2022–23, experiencing substantial growth from $5 billion in the preceding year (2021–22). This expansion is anticipated to position lithium as Australia's sixth-largest resource and energy commodity export.

2. Chile: Chile is positioned within the Lithium Triangle alongside Bolivia and Argentina, featuring extensive salt flats in the Atacama Desert and nearby arid areas. Notable sites include Salar de Uyuni in Bolivia, Chile's Salar de Atacama, and Argentina's Salar del Hombre Muerto.

SQM and Albemarle presently hold sway over Chile's lithium production sector. Nonetheless, there's a looming potential transformation as Chile's announcement in April 2023 to nationalize its lithium industry has sparked considerable disruption within the market.

Figure 2: Lithium Production in Chile, in Metric Tons (MT), in 2021, and 2022

Source: United States Geological Survey (USGS)

According to the US Geological Survey (USGS), Chile's lithium production surged from 28,300 metric tons (MT) of lithium content in 2021 to 39,000 MT in 2022. The majority of Chile's lithium is sourced from lithium brine deposits.

Additionally, Lithium Chile has significant ownership interests in the world's largest high-grade lithium reserves, covering 110,000 hectares in Chile and 20,800 hectares in Argentina. The company is currently advancing its Phase Two Exploration & Development Program in Arizaro, Argentina, with the goal of expanding the existing resource base of 3.32 million tonnes (LCE) as outlined in the 43-101 report. According to the Preliminary Economic Assessment (PEA), the project boasts an after-tax Net Present Value (NPV) of US $1.1 billion, alongside an impressive Internal Rate of Return (IRR) of 24%.

3. China: China, is one of the foremost global importer and processor of lithium, has positioned itself as a pivotal player in the worldwide lithium supply chain, significantly influencing the transition to cleaner energy sources. With more than half of its lithium sourced from international markets, China primarily supplies processed lithium to battery manufacturers, critical for the production of electric vehicles (EVs).

Recognizing lithium's strategic importance, China has designated it as a key mineral and is focused on enhancing domestic production in regions like Qinghai, Tibet, Sichuan, and Jiangxi. To ensure a secure and reliable supply, numerous Chinese firms have pursued overseas investments, particularly in African lithium mines and South American brine operations.

In China, the main regions with lithium ore reserves are Sichuan and Jiangxi provinces. In Yichun, Jiangxi, the substantial rise in lithium prices over the last two years sparked an increase in unregulated mining and trading of the metal. Consequently, many local ceramics firms redirected their production efforts towards manufacturing lithium mica.

Figure 3: Electric Car Sales in China, in Million Units

Source: United States Geological Survey (USGS)

According to the US Geological Survey (USGS), Chile's lithium production surged from 28,300 metric tons (MT) of lithium content in 2021 to 39,000 MT in 2022. The majority of Chile's lithium is sourced from lithium brine deposits.

Additionally, Lithium Chile has significant ownership interests in the world's largest high-grade lithium reserves, covering 110,000 hectares in Chile and 20,800 hectares in Argentina. The company is currently advancing its Phase Two Exploration & Development Program in Arizaro, Argentina, with the goal of expanding the existing resource base of 3.32 million tonnes (LCE) as outlined in the 43-101 report. According to the Preliminary Economic Assessment (PEA), the project boasts an after-tax Net Present Value (NPV) of US $1.1 billion, alongside an impressive Internal Rate of Return (IRR) of 24%.

3. China: China, is one of the foremost global importer and processor of lithium, has positioned itself as a pivotal player in the worldwide lithium supply chain, significantly influencing the transition to cleaner energy sources. With more than half of its lithium sourced from international markets, China primarily supplies processed lithium to battery manufacturers, critical for the production of electric vehicles (EVs).

Recognizing lithium's strategic importance, China has designated it as a key mineral and is focused on enhancing domestic production in regions like Qinghai, Tibet, Sichuan, and Jiangxi. To ensure a secure and reliable supply, numerous Chinese firms have pursued overseas investments, particularly in African lithium mines and South American brine operations.

In China, the main regions with lithium ore reserves are Sichuan and Jiangxi provinces. In Yichun, Jiangxi, the substantial rise in lithium prices over the last two years sparked an increase in unregulated mining and trading of the metal. Consequently, many local ceramics firms redirected their production efforts towards manufacturing lithium mica.

Figure 3: Electric Car Sales in China, in Million Units

Source: International Energy Agency

China's electric vehicle market witnessed a remarkable upswing, with sales escalating from 1.1 million units in 2020 to 3.3 million units in 2021. This positive trajectory persisted through 2022, as sales surged to 6.0 million units, followed by continued growth in 2023, reaching 8.0 million units. This trend highlights China's substantial advancement and dedication to the electric vehicle sector, driven by both rising consumer demand and governmental efforts to foster clean energy transportation initiatives.

4. Argentina: Argentina's lithium mining industry is rapidly expanding, signaling robust growth potential. Projections indicate that by 2030, Argentina could emerge as a leading lithium producer in Latin America, potentially rivaling or surpassing Chile.

This increased industry activity has attracted a competitive influx of global operators and investors aiming to secure their position in this lucrative market. The moniker "white gold" underscores lithium's substantial market value, underlining its pivotal role in the global transition to sustainable energy sources.

According to the International Energy Agency (IEA), Latin America accounts for approximately 35% of global lithium production, with Chile and Argentina being the primary contributors at 26% and 6%, respectively. Additionally, this region holds more than half of the world's lithium reserves, with Argentina and Chile jointly possessing 21% and 11% of the total reserves, respectively.

5. Brazil: Lithium production is on the rise in Brazil due to the growing demand for lithium-ion batteries. Furthermore, there has been a notable increase in the sales of electric vehicles (EVs) within the country. For example, EV sales surged from 3,970 units, constituting 0.16% of the total automotive industry in Brazil in 2018, to 67,047 units, in 2023, representing 3.85% of the total automotive sector in the country.

Figure 4: Brazil Electric and Non-Electric Vehicle Sales as a Percentage (%) of Total Sales, in 2022

Source: International Energy Agency

China's electric vehicle market witnessed a remarkable upswing, with sales escalating from 1.1 million units in 2020 to 3.3 million units in 2021. This positive trajectory persisted through 2022, as sales surged to 6.0 million units, followed by continued growth in 2023, reaching 8.0 million units. This trend highlights China's substantial advancement and dedication to the electric vehicle sector, driven by both rising consumer demand and governmental efforts to foster clean energy transportation initiatives.

4. Argentina: Argentina's lithium mining industry is rapidly expanding, signaling robust growth potential. Projections indicate that by 2030, Argentina could emerge as a leading lithium producer in Latin America, potentially rivaling or surpassing Chile.

This increased industry activity has attracted a competitive influx of global operators and investors aiming to secure their position in this lucrative market. The moniker "white gold" underscores lithium's substantial market value, underlining its pivotal role in the global transition to sustainable energy sources.

According to the International Energy Agency (IEA), Latin America accounts for approximately 35% of global lithium production, with Chile and Argentina being the primary contributors at 26% and 6%, respectively. Additionally, this region holds more than half of the world's lithium reserves, with Argentina and Chile jointly possessing 21% and 11% of the total reserves, respectively.

5. Brazil: Lithium production is on the rise in Brazil due to the growing demand for lithium-ion batteries. Furthermore, there has been a notable increase in the sales of electric vehicles (EVs) within the country. For example, EV sales surged from 3,970 units, constituting 0.16% of the total automotive industry in Brazil in 2018, to 67,047 units, in 2023, representing 3.85% of the total automotive sector in the country.

Figure 4: Brazil Electric and Non-Electric Vehicle Sales as a Percentage (%) of Total Sales, in 2022

Source: Brazilian Association of Electric Vehicles (ABVE)

The Brazilian Association of Electric Vehicles (ABVE) reports a significant surge in electric vehicle sales within the country. In 2022, electric vehicles accounted for 41% of total automotive production, while non-electric vehicles comprised 56%. With the escalating advantages of EVs, there is anticipated growth in demand in the forthcoming years.

In the country there are several acquisitions and mergers taking place, for the mineral rights which are further expected to boost the market in the projected period. For instance, in November 2023, Armada Metals Limited has announced the formalization of a Binding Term Sheet with Antares Minerais Estratégicos Ltda. (Antares Minerais), a Brazilian exploration entity. This agreement involves securing legal ownership and title rights to specific Exploration Permits and Applications for Exploration, encompassing a total expanse of 16,750.28 hectares in the eastern precinct of Minas Gerais State, Brazil.

The acquisition encompasses 14 mineral rights segmented into four blocks, notably including the Agua Boa Project, where pegmatite formations have been detected, alongside the Rio Doce Project, the Resplendor Project, and the Mendes Pimentel Project.

Find some of our related studies:

Source: Brazilian Association of Electric Vehicles (ABVE)

The Brazilian Association of Electric Vehicles (ABVE) reports a significant surge in electric vehicle sales within the country. In 2022, electric vehicles accounted for 41% of total automotive production, while non-electric vehicles comprised 56%. With the escalating advantages of EVs, there is anticipated growth in demand in the forthcoming years.

In the country there are several acquisitions and mergers taking place, for the mineral rights which are further expected to boost the market in the projected period. For instance, in November 2023, Armada Metals Limited has announced the formalization of a Binding Term Sheet with Antares Minerais Estratégicos Ltda. (Antares Minerais), a Brazilian exploration entity. This agreement involves securing legal ownership and title rights to specific Exploration Permits and Applications for Exploration, encompassing a total expanse of 16,750.28 hectares in the eastern precinct of Minas Gerais State, Brazil.

The acquisition encompasses 14 mineral rights segmented into four blocks, notably including the Agua Boa Project, where pegmatite formations have been detected, alongside the Rio Doce Project, the Resplendor Project, and the Mendes Pimentel Project.

Find some of our related studies:

- Battery Recycling Market: https://www.knowledge-sourcing.com/report/battery-recycling-market

- Global Electric Vehicle Battery Market: https://www.knowledge-sourcing.com/report/global-electric-vehicle-battery-market

- Lithium-Ion Battery Materials Market: https://www.knowledge-sourcing.com/report/lithium-ion-battery-materials-market

Get in Touch

Interested in this topic? Contact our analysts for more details.

Latest Thought Articles

Top OSAT Companies Driving Semiconductor Assembly and Test Services Worldwide

Recently

EV Charging Stations Market Outlook: Smart Charging, Fast Charging, and Regional Expansion

Recently

Future of Corporate Wellness: Global Trends and Regional Outlook

Recently

Regional Breakdown of the Mechanical Keyboard Market: Who Leads and Why?

Recently