Report Overview

5G Subscriber Data Management Highlights

5G Subscriber Data Management Market Size:

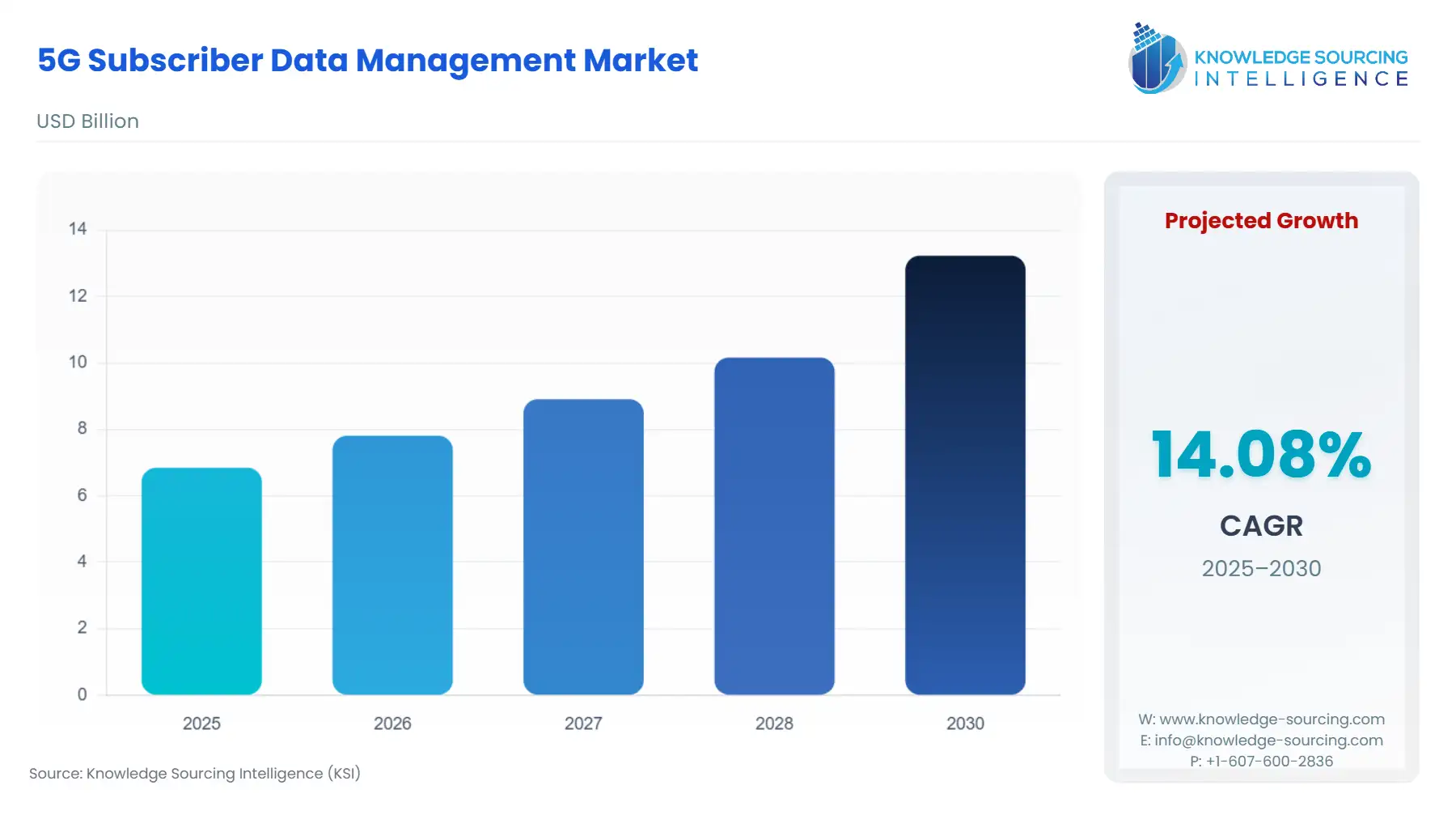

The 5G subscriber data management market will grow from USD 6.848 billion in 2025 to USD 13.232 billion in 2030 at a CAGR of 14.08%.

5G Subscriber Data Management Market Growth Drivers:

- Improved mobile connectivity coverage and mobile subscribers have bolstered the market growth.

The 5G service-based architecture (SBA) enables operators to secure their 5G investments by leveraging their relationship with subscribers, which also assists them in maintaining their competitive edge. Hence, the emphasis is on maintaining a robust, agile, and comprehensive solution for managing subscriber, device, and network function data. Key features of 5G data management solutions include service personalization, being cloud-native, offering high performance & security for the data layer, and supporting distributed data management. The ease of integration with other network applications and functions further bolsters the network coverage.

The boom in demand for high-performance wireless connectivity and led to various efforts to minimize the coverage gap of internet connectivity globally. With the growing 5G subscriber penetration, the demand for 5G subscriber data management is anticipated to grow positively. For instance, according to the GSM’s research report “Mobile Economy-2023”, the global 5G adoption is set to reach 54% by 2030. The same source stated that from 2017 to 2022, the mobile internet gap has narrowed from 50% to 41%. Such bolstering growth in subscriber strength indicates the user base expansion, which would further lead to 5G infrastructure development. This increases the network efficiency and scope of efficient data management, augmenting the overall 5G subscriber data management market expansion.

5G Subscriber Data Management Market Emerging Opportunities:

- Cloud and On-Premise Solutions

Based on deployment type, the 5G subscriber data management market is analyzed into cloud and on-premise, in which the former is set to show the quickest segment growth. The development of 5G service-based architecture (SBA) improves core network efficiency and further bolsters flexible data management for various data types, such as device, network function, applications, and subscriber data. The 5G data management solutions also support cloud-native & distributed technologies, which reduce operational costs, improve service personalization, and ease of integration with other network components.

The growing wireless connectivity has accelerated the pace of cloud computing to process and manage personalized and commercial data, thereby opening new doors for 5G subscriber data management.

For instance,

- In February 2024, Ericsson and Brazilian communication service provider TIM Brazil successfully implemented a cloud-native user database in the company’s 5G Core network powered by “Red Hat OpenShift”. The initiative bolstered TIM’s 5G evolution strategy that emphasized improving the 5G service agility and operational efficiency for the telecommunications sector.

- In March 2023, ZTE Corporation formed a strategic partnership with BCX at the “Mobile World Congress 2023”, which aimed to deploy digital solutions, inclusive of private 5G, data center infrastructures, and private clouds, among others, for various industrial sectors in South America. Likewise, in the same event, ZTE, along with other strategic partners such as China Mobile, initiated the “5G New Calling Industry Development Forum” to explore new opportunities for 5G services for various applications.

5G Subscriber Data Management Market Geographical Outlook:

Geographically, the 5G subscriber data management market comprises major countries undertaking various steps to secure their 5G network. Japan is expected to have a higher CAGR during the forecasted period. In addition, a few major countries include the USA, China, South Korea, the United Kingdom, and Germany. The nations are taking initiatives that have complemented the overall market growth. For instance,

- In June 2024, Hewlett-Packard Enterprise launched “HPE Aruba Networking Enterprise Private 5G” in the USA to assist customers in simplifying their private 5G network deployment that would provide wide area coverage across industrial environments and large campuses, thereby addressing complex network challenges.

- In February 2024, NEC Corporation, in collaboration with Clear Mobile Ltd., successfully deployed the former’s state-of-the-art “5G SA Cloud-Native Core Network” in the United Kingdom to accelerate the deployment of advanced 5G services. The collaboration would further serve Clear Mobile’s vision of setting up 5G service for B2B and B2C cases.

Additionally, other major nations, namely India, France, Spain, and Middle Eastern countries, have implemented various initiatives to bolster digital adoption, which has further increased the strength of their 5G adoption. For instance, according to Ericsson’s “Mobility Report”, 2023 India’s 5G subscription reached 130 million in 2023, and by 2029, the figure is anticipated to show a significant jump to 860 million.

List of Top 5G Subscriber Data Management Companies:

Some leading players in the market include Alepo Technologies Inc., Nokia, and Huawei Technologies Co., Ltd., among others. The product offerings of the major corporation include the following:

|

COMPANY NAME |

PRODUCT NAME |

DESCRIPTION |

|

Alepo Technologies Inc. |

Alepo Subscriber Data Management (SDM) |

Alepo’s converged “Subscriber Data Management” supports both 4G & 5G subscriptions and is based on the “Network Data Layer” approach, which interfaces with multiple applications, thereby preventing data duplication. The solution is highly scalable and robust, and provides services such as Enterprise IoT and 5G slicing. |

|

Nokia |

Nokia Subscriber Data Management (SDM) |

Nokia's Subscriber Data Management addresses the new demands associated with data storage and network latency raised by the gaining 5G momentum. Sitting at the heart of the core network, the SDM provides carrier-grade robustness and data consolidation, which assist in transforming cloud-native software applications. |

|

Huawei Technologies Co., Ltd. |

SDM Solution |

Huawei’s “SDM Solution” offers basic subscriber management functions such as service authorization, access authentication, and mobility management. It is based on a convergent and unified data center for managing subscriber data flexibility and also supports NEs hybrid deployment, including UDM, AUSF, and ENS, among others. |

5G Subscriber Data Management Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Market Size Value in 2025 | US$6.848 billion |

| Market Size Value in 2030 | US$13.232 billion |

| Growth Rate | CAGR of 14.08% from 2025 to 2030 |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segments Covered |

|

| Companies Covered |

|

| Regions Covered | Americas, Europe, Middle East and Africa, Asia Pacific |

| Customization Scope | Free report customization with purchase |

5G Subscriber Data Management Market Segmentation:

- By Solution

- Subscriber Data Repository

- Subscriber Policy Management

- Others

- By Deployment

- Cloud

- On-Premise

- By Geography

- Americas

- United States

- Others

- Europe, Middle East, and Africa

- Germany

- UK

- Others

- Asia Pacific

- China

- Japan

- South Korea

- Others

- Americas