Report Overview

Green Data Center Market Highlights

Green Data Center Market Size:

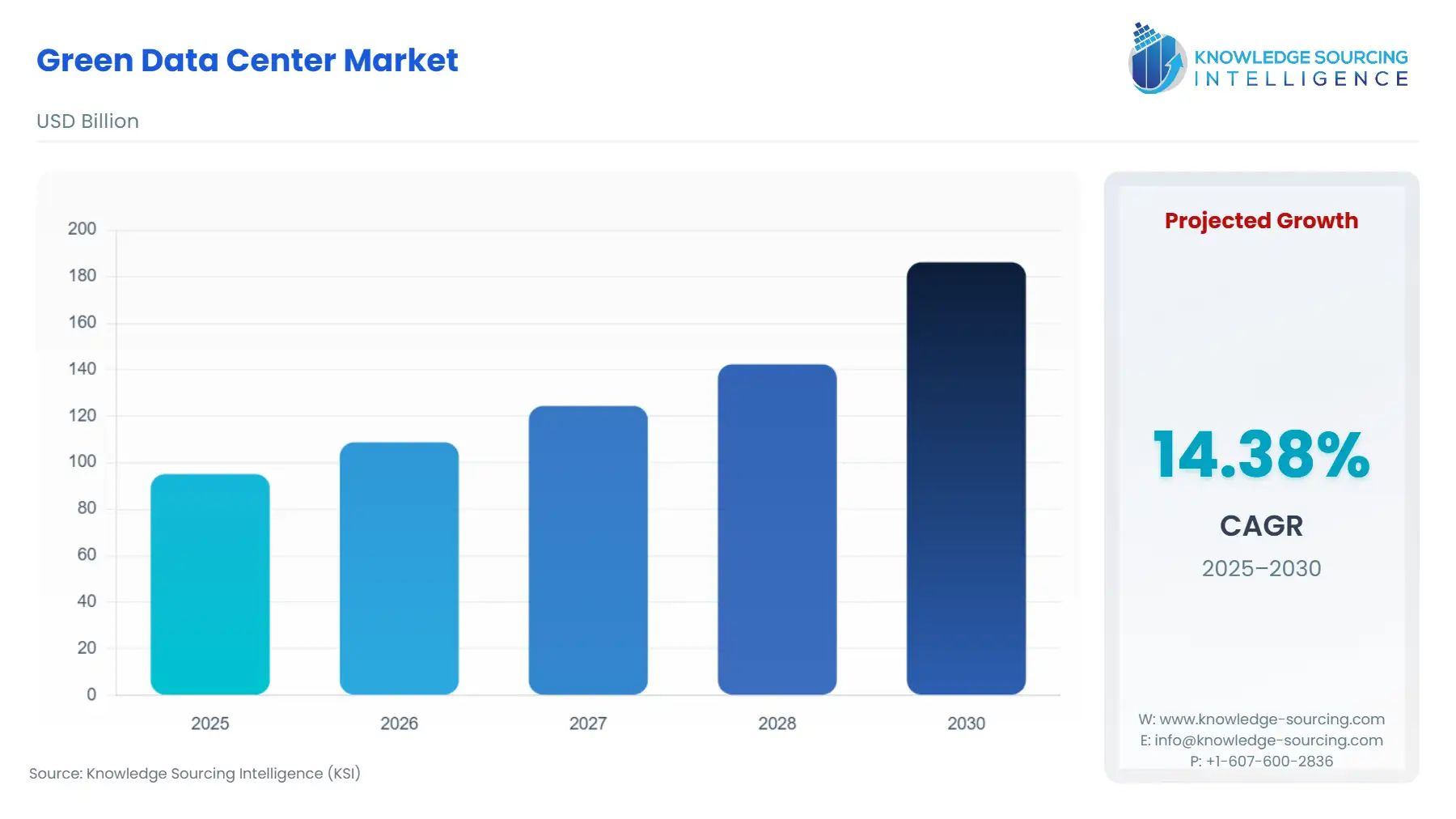

The green data center market is expected to grow at a CAGR of 14.37%, reaching a market size of US$186.191 billion in 2030 from US$95.093 billion in 2025.

Green Data Centers are computer facilities where data is stored, managed, and operated. They are designed to maximize energy efficiency and minimize environmental impact. These centers reduce operational costs and carbon footprint by using energy-efficient power supply systems, servers, LEDs, etc. Moreover, The majority of companies incorporate sustainability and Corporate Social Responsibility as crucial parts of their operations. One such approach is through green data centers which help businesses uphold these sustainability standards and better their name. Non-renewable fossil fuel dependence can be minimized by utilizing renewable sources of energy such as solar, wind or hydropower in green data centers. Using energy efficient systems this will ultimately assure data center owners large savings on resources. Thus, businesses will spend less in the long run by decreasing their power consumption.

Data has become a meaningful resource for any organization to serve its customers. Data Mining techniques have brought synergies in handling customers' data and then analyzing it to understand their purchasing patterns. These developments are being deployed excessively by companies such as Amazon, Flipkart, and Myntra, among others. With the developing trend of digitalization of processes across developing countries, the amount of data to be maintained is colossal. For that matter, the number of data storage facilities is rising, and the energy consumed in such processes is straining the environment by exploiting non-renewable energy resources. This leads to the demand for Green Data Centers, which stores the data more economically and efficiently. Government regulations focusing on more renewable means of energy utilization are augmenting this market’s growth.

Green Data Centre Market Growth Drivers:

- The growing volumes of customer data at the global level are elevating market growth in the forecast period.

Developing companies are adding more customers to the digital economy, owing to improvements in infrastructure facilities and an increment in disposable incomes. Hence, customers are spending more time and money on digital services such as making payments or storing files. Therefore, increasing the storage capacity of data centres is becoming a prime focus of companies with a rising number of Internet users. Companies with a far-sighted vision are investing in Green Data Centers despite high initial investments to reduce operational costs. Furthermore, cloud storage services that enable the storage of data in the servers’ memory without taking up any physical room hasten the evolution of eco-friendly central storage.

- Escalating demand for cost savings.

Green data centers are cherished because of their effective management. Their cutting-edge designs often prioritize energy efficiency in order to reduce operational costs and utility costs. Due to rising electricity prices all over the world, companies know they have to manage their budgets while still operating reliable data centers. There are many ways by which green data centers minimize costs. One method is through the use of advanced cooling technologies such as hot/cold aisle containment and also including free cooling to minimize the power for temperature regulation. To translate this into other terms, green data centers have among others solutions like wind turbines or solar panels that help save even more on electricity bills.

Green Data Centre Market Restraints:

- High investment cost.

Renewable energy data centers recoup initial high-cost returns even though it seems long-term. Building an energy-efficient green data center requires a larger upfront investment than constructing a conventional one. Businesses must make larger investments to modify the current infrastructure, which is a constraint.

Green Data Centre Market Geographical Outlook:

- North America is expected to hold a significant share of the green data centre market

Due to the abundance of service and software providers propelling the market forward, North America currently holds the largest share of the global market for green data centers. It is anticipated that the United States and Canada will lead the North American market in terms of high investments made by hyper-scale data center operators and colocation providers. Further, new buildings are now being developed as green data centers in North America, with an increasing need for economic and efficient power solutions. “Data centers consume 2% of America’s electricity,” U.S. Department of Energy estimates. The arrival of 5G calls for the expansion of cloud computing, big data analytics, mobile broadband, and hence, new data center infrastructures in this region. Network operators are striving to guarantee the quick deployment of 5G to foster greater innovation. Data center providers are environmentally conscious and can reduce power consumption through increased efficiency to reduce carbon emissions into the atmosphere.

Green Data Centre Market Key Developments:

- In November 2022, Volkswagen AG planned to make its data center operations carbon neutral by 2027. To accomplish this, the company partnered with Green Mountain and increased its processing capacity at the Norwegian operator of CO-neutral data centers. Volkswagen will be able to meet this goal due to its partnership with Green Mountain, as all of its servers run entirely on hydropower-generated renewable energy.

- In November 2022, SB Google and Energy Global collaborated to provide 942 MW of green energy to match Google's Texas data center usage. Under the terms of the agreement, four solar projects of SB Energy with a combined capacity of 1.2 gigawatts will provide 75% of the renewable energy generated, supporting Google's commitment to clean energy and its investment in Texas

Green Data Center Market Players and Products:

- HCL Technologies Green Data Center: Through the Certified Alliance Partnership Program (CAPP), HCL has partnered with suppliers to provide green data centers in environment-friendly buildings and adopted innovative technologies. This includes ultra-sonic humidification, high-density racks, variable frequency drives, and highly efficient harmonic mitigation transformers. This has enabled HCL to provide knowledgeable assistance, green data center solutions, and clean, affordable energy. Enterprises may expect facilities, management evaluation, technology, green procurement, new data center design, e-waste recycling programs, cooling, and power management, along with analysis, monitoring, and management, by choosing HCL's Next Gen Green Data Center Methodology.

- Fujitsu PRIMERGY System: FUJITSU Server PRIMERGY systems offer high energy efficiency. Highly effective components, modern cooling technology, and sophisticated power management technologies are used in the most recent PRIMERGY server generation. With Cool-safe Advanced Thermal Design, servers can operate at much broader temperature ranges, hence reducing the chances of experiencing heat-related downtimes. This can result in a Green data center with lower operational costs when combined with solutions like virtualization and consolidation.

Green Data Center Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Green Data Center Market Size in 2025 | US$95.093 billion |

| Green Data Center Market Size in 2030 | US$186.191 billion |

| Growth Rate | CAGR of 14.37% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Green Data Center Market |

|

| Customization Scope | Free report customization with purchase |

Green Data Center Market Segmentation:

- By Product

- Hardware

- Cooling Solutions

- Power Solutions

- Networking Solutions

- Others

- Software

- Services

- Consulting Services

- Design and System Integration

- Monitoring Services

- Hardware

- By End-User

- Colocation Service Providers

- Enterprises

- Cloud Service Providers

- By Enterprise Size

- Small Enterprises

- Medium Enterprises

- Large Enterprises

- By Industry Vertical

- Banking and Financial Services

- Communication and Technology

- Media and Entertainment

- Manufacturing

- Healthcare

- Energy

- Education

- Government

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America