Report Overview

Multi-Access Edge Computing Market Highlights

Multi-Access Edge Computing Market Size:

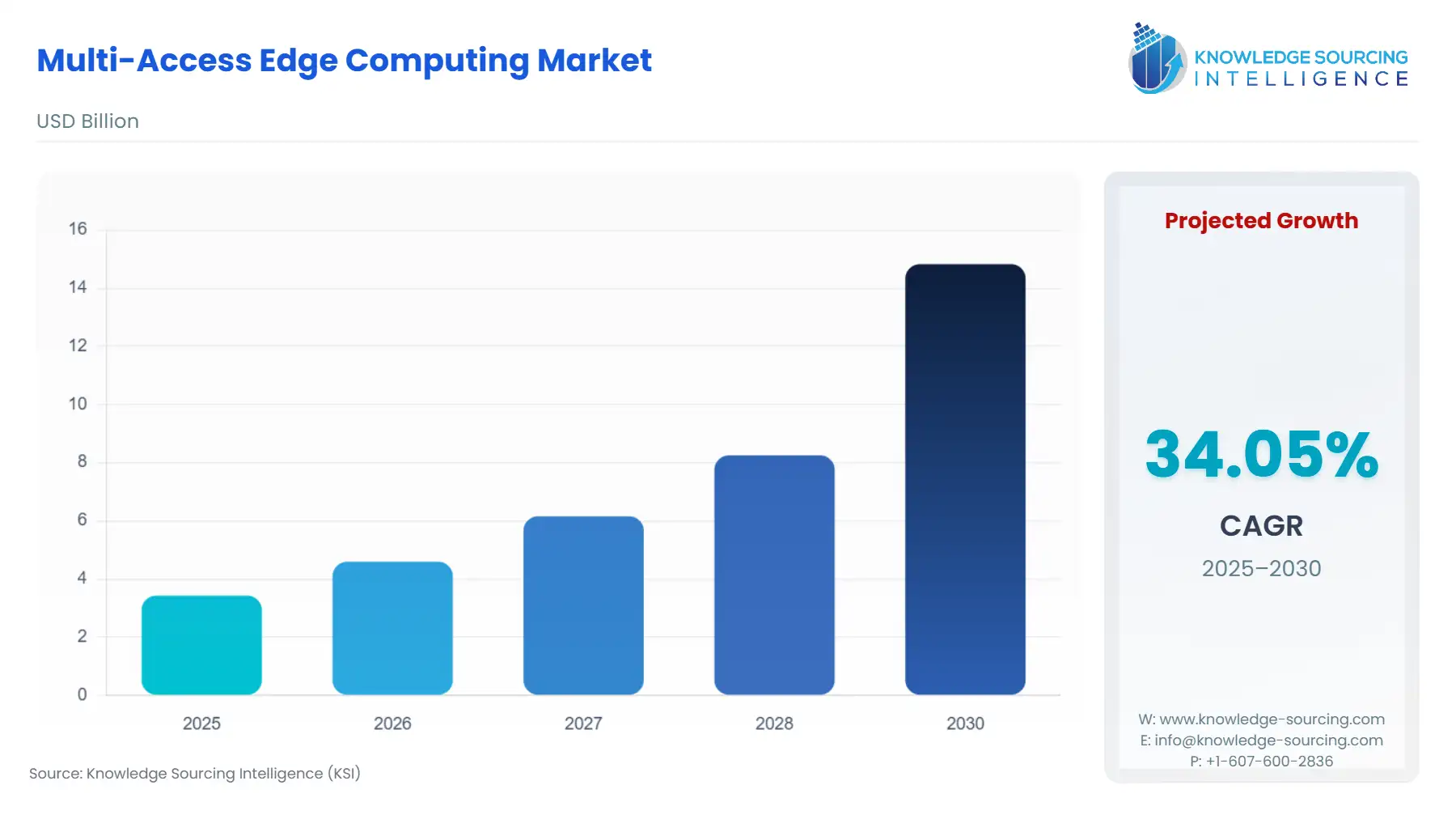

Multi-Access Edge Computing Market, sustaining a 33.03% CAGR, is anticipated to grow from USD 3.426 billion in 2025 to USD 18.987 billion in 2031.

Multi-Access Edge Computing Market Growth Drivers:

5G Adoption in MEC

The adoption of 5G multi-access edge computing (MEC) is experiencing rapid growth. Mobile edge computing, a crucial component of the evolving 5G network, offers optimization of mobile resources. The combination of 5G and Edge technology addresses critical network shortcomings, including the requirements for reduced latency, enhanced network resilience during outages, and heightened data security. This edge-driven transformation is a significant disruptor in the contemporary business landscape, with 5G MEC technology leading the way.

For instance:

In August 2021, Taqtile, an enterprise software provider, introduced an augmented reality (AR) solution that harnesses the power of 5G and MEC to assist frontline workers in sectors like manufacturing and field maintenance known as Manifest Connect, this solution equips and empowers frontline workers to efficiently and safely complete complex tasks with consistency.

In March 2022, Tata Consultancy Services (TCS) unveiled its Enterprise 5G Edge suite of solutions in collaboration with Microsoft Azure's private mobile edge computing (private MEC). This TCS suite offers a wide range of capabilities that assist enterprises in creating, incorporating, deploying, and managing an enterprise 5G edge ecosystem by leveraging the Azure private MEC solution. This enables businesses to harness the benefits of edge computing for their 5G applications.

Cloud RAN and MEC Co-Deployment

Cloud RAN (CRAN) and Mobile Edge Computing (MEC) are synergistic technologies that effectively support emerging services, particularly those demanding low latency and high bandwidth. However, implementing CRAN on a generic computing infrastructure instead of specialized RAN-optimized hardware represents a substantial investment for mobile network operators. Nonetheless, the CRAN approach enables quicker radio deployment, significantly reducing the time required compared to traditional deployment methods. This highlights the cost-efficiency and agility that CRAN brings to the telecommunications industry.

In March 2023, Google and Nokia made a significant announcement regarding their collaboration to advance cloud RAN technology. They successfully conducted the first end-to-end Level 3 (L3) data call, demonstrating the capability to run radio access network (RAN) functions as software on Google's Distributed Cloud Edge (GDC Edge) platform. This achievement, powered by Nokia's AirScale Cloud RAN solution and Nokia Cloud RAN SmartNIC, not only enables customers to realize their objectives but also ensures that feature parity is maintained between traditional and cloud RAN deployments.

In April 2023, Ericsson and Dell Technologies joined forces to improve the flexibility of Cloud RAN (Radio Access Network). Ericsson's Cloud RAN solution integrates Dell PowerEdge servers with Ericsson's cloud-native RAN compute software. This collaboration enables RAN and mobile edge computing tasks to operate seamlessly on Dell infrastructure within a distributed RAN architecture.

Rapid Proliferation Of 5G Network Deployment

According to TeleGeography and 5G Americas, it has been reported that the count of operational 5G networks worldwide has currently achieved a count of 267 million. This figure is projected to experience a notable rise, reaching 386 million by the conclusion of 2023 and subsequently escalating to 413 million by the close of 2025. These statistics underline the robust growth in 5G network investments across various global regions, highlighting the dynamic evolution of 5G technology.

Multi-Access Edge Computing Market Opportunities:

Artificial Intelligence at the Edge

The deployment of AI applications at the edge of the network, often referred to as Edge AI, shares common goals. These objectives include deploying AI applications in proximity to data sources, enabling real-time data processing, functioning independently without relying on network connectivity, minimizing power consumption, and optimizing limited computing resources. Edge AI facilitates quick decision-making by eliminating the need to shuttle data back and forth between the cloud and edge devices.

In February 2023, MemryX Inc. and Edge Impulse formed a partnership to facilitate the easy development and deployment of AI on MemryX Edge AI Processors. These edge AI chips find extensive use in various sectors, including transportation, IoT, robotics, industrial, and edge computing. Developers now have the opportunity to utilize Edge Impulse's platform to create, evaluate, and effortlessly deploy models and algorithms on MemryX edge AI processors.

In August 2023, Sidus Space, a satellite manufacturing and space services company, revealed its strategic acquisition of Exo-Space, an innovative California-based company specializing in Edge Artificial Intelligence (AI) software and hardware for space-related purposes. The incorporation of Exo-Space's EdgeAI technology into Sidus' sensors offers substantial value and has transformative potential across diverse sectors.

Multi-Access Edge Computing Market Geographical Outlook:

In November 2022, Vodafone inaugurated the United Kingdom's inaugural Edge Innovation Lab within Manchester's MediaCity. This lab, located at HOST, the Home of Skills & Technology, provides a platform for businesses, educational institutions, software developers, and public sector entities to explore and experiment with the potential of Multi-access Edge Compute (MEC), which represents the next evolution in network technology.

In April 2022, Hewlett Packard Enterprise partnered with Maxis to become Malaysia's inaugural provider of multi-access edge computing, offering a digital solution tailored for enterprises. This collaboration makes MEC especially appealing to businesses that rely on time-sensitive edge applications like data analytics, Artificial Intelligence (AI), automation, and machine learning.

List of Top Multi-Access Edge Computing Companies:

Some of the leading players in the market include Hewlett Packard Enterprise, Intel, and Verizon among others. The product offerings of the major corporations include the following:

COMPANY NAME |

PRODUCT NAME |

DESCRIPTION |

Hewlett Packard Enterprise | HPE GreenLake | HPE GreenLake 5G portfolio is a collection of cloud and as-a-service solutions designed to streamline and expedite your business operations. It provides a cloud-like experience regardless of where your applications and data are located, whether it's at the edge, in a data center, within colocation facilities, or in public clouds. |

Intel | Smart Edge | The Intel® Smart Edge Node Software is a 5G emerging technology, enables enterprises to implement private network solutions at enterprise or customer premises, such as industrial sites, retail stores, warehouses, ports, hospitals, venues, and street infrastructure, to fulfill the needs of Multi-access Edge Computing (MEC). It ensures security, local data access, and rapid response times with low latency. |

Verizon | Verizon 5G edge | Verizon 5G Edge combines two essential components of multi-access edge computing: infrastructure and software development, enabling developers to create applications for wireless edge devices and significantly reducing latency. |

Multi-Access Edge Computing Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Multi-Access Edge Computing Market Size in 2025 | USD 3.426 billion |

Multi-Access Edge Computing Market Size in 2030 | USD 14.830 billion |

Growth Rate | CAGR of 34.05% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Multi-Access Edge Computing Market |

|

Customization Scope | Free report customization with purchase |

Multi-Access Edge Computing Market Segmentation

By Type

Public MEC

Private MEC

By Application

Data & Video Analytics

IoT Devices

Augemented & Virtual Reality

Others

By End-User

Manufacturing

Healthcare

IT & Telecommunication

Energy & Utilities

Retail

Others

By Geography

Americas

United States

Others

Europe Middle East and Africa

United Kingdom

Germany

Others

Asia Pacific

China

Japan

India

South Korea

Others