Report Overview

5G System Integration Market Highlights

5G System Integration Market Size:

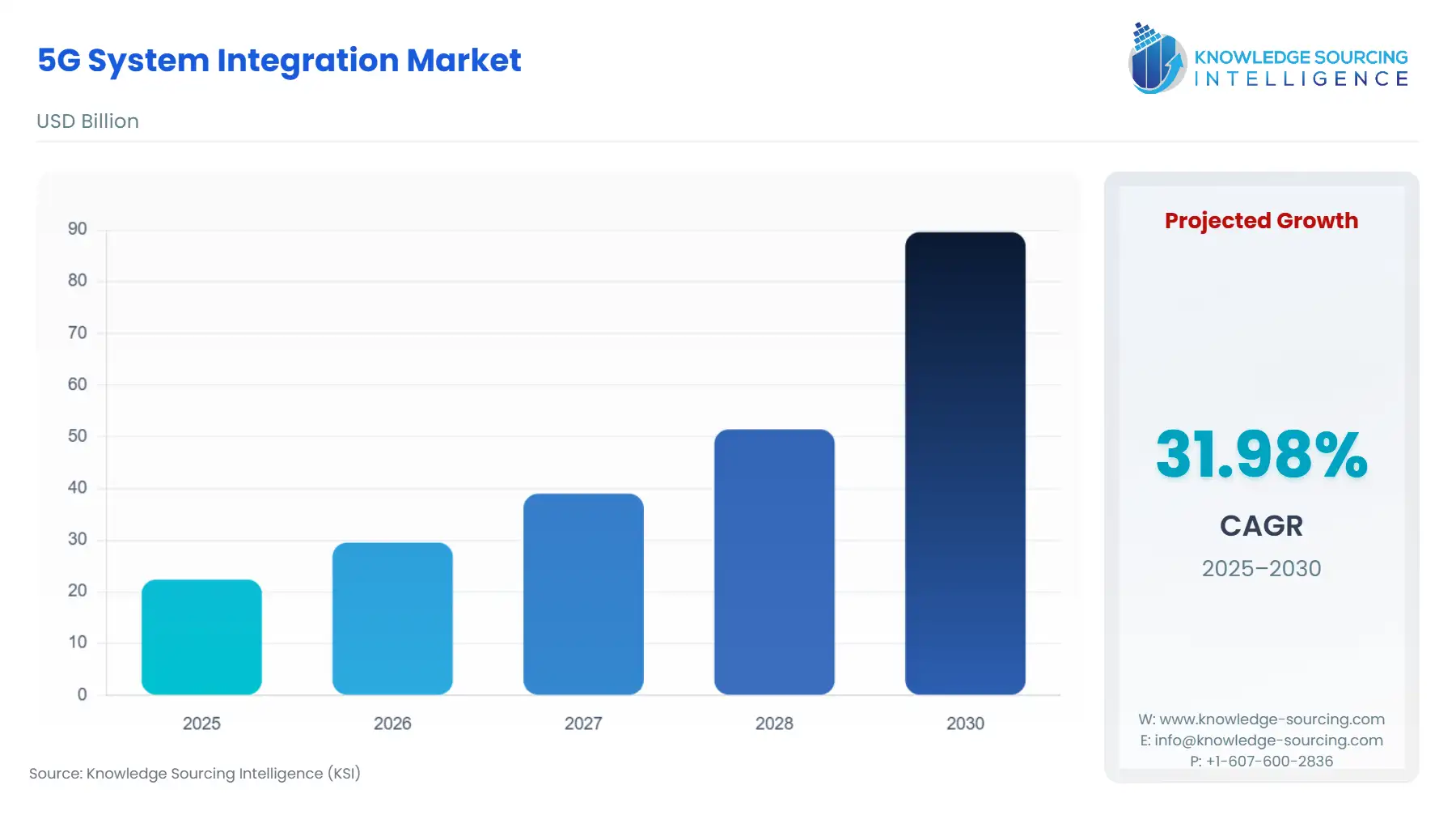

The global 5G system integration market will grow from USD 22.384 billion in 2025 to USD 89.624 billion in 2030 at a CAGR of 31.98%.

5G System Integration Market Growth Drivers:

- 5G network impact on IoT

The deployment of 5G networks is anticipated to have a significant impact on the development of IoT services. 5G networks offer notably swifter data transfer rates, reduced latency, and increased capacity compared to preceding mobile network generations. This translates to quicker data transmission for IoT devices, enabling more effective real-time data processing and analysis. This heightened responsiveness opens doors for novel applications demanding instantaneous data processing, like remote surgery, autonomous vehicles, and industrial automation. Furthermore, the enhanced security features of 5G networks will also shape the evolution of IoT services, with provisions like network slicing permitting isolated virtual networks for distinct IoT applications.

The increasing adoption of Network Function Virtualization (NFV) and Software-Defined Networking (SDN) among businesses is anticipated to significantly boost the market for 5G system integration. NFV enables organizations to implement multiple virtual machines and firewalls, fostering a more efficient economy of scale. Meanwhile, SDN offers an intelligent network architecture designed to alleviate hardware limitations within company facilities.

Major global players are seeking opportunities to speed up their operations and take advantage of the rising 5G technology. Additionally, the fourth industrial revolution, which is industry 4.0, big data analysis, internet of Things (IoT), is expected to boost the market for 5G system integration in the projected period. In January 2022, Verizon Business and Atos collaborated to provide powerful intelligent IoT solutions, with a 5G multi-access edge for business, government, and communities for people worldwide. The partnership aims to provide predictive analysis by providing a 5G edge solution. Hence, with the increasing 5G technologies, the market for 5G system integration is expected to grow in the projected period.

For instance:

- According to the latest mobility report from Ericsson, the foremost category within the worldwide 5G Internet of Things (IoT) endpoint market is expected to be connected vehicles. This segment is predicted to attain a substantial share of the installed base market, accounting for 39 percent by 2023, equivalent to around 19 million endpoints.

- In September 2023, Sateliot, a Spanish nanosatellite constellation operator in low-Earth orbit (LEO), utilizes the 5G IoT standard to offer coverage extension to mobile network operators (MNOs) and mobile virtual network operators (MVNOs) through standard roaming agreements. Through its Smallsat System, Sateliot can swiftly introduce its 2GHz MSS/IoT services, facilitating partner MNOs to integrate NB-IoT-NTN applications and broaden their geographical coverage without the need for additional infrastructure investment.

Rising Trend of Network Function Virtualization (NFV) and Software-Defined Networking (SDN)

The revolution of 5G services through Network Function Virtualization (NFV) has induced a profound shift, impacting Physical Network Functions (PNF), Virtual Network Functions (VNF), hardware, software, orchestration, and network operations. 5G architecture integrates NFV and cloud deployment for enhanced network and service efficiency. The adoption of SDN and NFV principles carries implications for synchronization network architecture and operations, while cloud and distributed applications also pose potential relevance from a synchronization perspective.

- In December 2022, Nokia and NBN Co revealed the deployment of Nokia's advanced broadband platform and the Altiplano Access Controller to enhance the NBN® network, representing the first Lightspan MF-14 deployment in the Southern Hemisphere. Nokia's Altiplano Access Controller, utilizing software-defined networking (SDN) and network function virtualization (NFV), introduces increased automation and virtualization via an open API for innovative network management.

A remarkable increase in IoT devices

According to the Ericsson mobility report data and forecasts from 2022 to 2028, the Internet of Things (IoT) is projected to grow remarkably across categories: the wide-area and cellular IoT segments display notable expansion of Wide-area IoT by 13%, Cellular IoT by 12%, and Short-range IoT by an impressive 19% The short-range IoT category stands out with the highest projected growth. The total IoT market is set to expand by 18% annually, reflecting substantial growth in various IoT sectors. The IoT market is expected to experience significant growth, reflecting a dynamic and evolving technological landscape.

5G System Integration Market Emerging Opportunities:

- Systems Integration Services

System integration involves developing intricate information systems that could encompass crafting specialized architectures or applications, combining them with current or new hardware, pre-packaged and tailor-made software, and communication components. Huawei's electric power broadband operations solution extends consulting, planning, and system integration services to power sector clients. Through strategic business and service design, this solution facilitates cost-effective network establishment and service advancement by leveraging excess power grid resources.

Manufacturers must integrate next-generation networks to offer unified communication for 5G technologies, thereby minimizing operational downtime and costs by ensuring continuous connectivity and remote monitoring. Consequently, the strong deployment of the Industrial Internet of Things (IIoT), coupled with the rising demand for 5G services to provide unified connectivity, is projected to drive the demand for 5G system integration services throughout the forecast period.

In February 2023, HCL launched a suite of technology solutions for 5G and beyond. HCL, which is one of the leading providers of technology, launched a range of innovative technologies for the 5G ecosystem at the World Mobile Congress 2023. HCLTech’s 5G system integration will enable public and private 5G operators to deploy and integrate critical components for future networks seamlessly.

List of Top 5G System Integration Companies:

Some of the leading players in the market include Ericsson and Huawei Technologies Ltd., among others. The major corporations provide a range of products that include the following:

|

COMPANY NAME |

PRODUCT NAME |

DESCRIPTION |

|

NEC Corporation |

Open RAN Center of Excellence (CoE) |

The NEC 5G Open RAN Center of Excellence (CoE) offers top-tier integration and interoperability testing, along with comprehensive end-to-end quality assurance proficiency. Additionally, the NEC Open RAN CoE establishes a collaborative space for the Open RAN community to jointly develop, implement, and validate inventive solutions for evolving and future requirements. |

|

Amantya |

ONAP integration |

ONAP integration services encompass integration with ONAP to manage the 5G SA Core, an Adaptation Layer to call ONAP APIs, and Closed Loop Automation Implementation. |

|

Wave In |

B5G |

Wave-In, with its B5G (Private 5G+Satellite Communication) network expertise, delivers comprehensive end-to-end solutions and firsthand guidance on system integration, ensuring a seamless implementation of your 5G private network. |

5G System Integration Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Market Size Value in 2025 | US$22.384 billion |

| Market Size Value in 2030 | US$89.624 billion |

| Growth Rate | CAGR of 31.98% from 2025 to 2030 |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segments Covered |

|

| Companies Covered |

|

| Regions Covered | Americas, Europe, Middle East and Africa, Asia Pacific |

| Customization Scope | Free report customization with purchase |

5G System Integration Market Segmentation:

- By Solution Offering

- Consulting

- Infrastructure Integration

- Application Integration

- By Technology

- Communication Technology (CT)

- Operational Technology (OT)

- Information Technology (IT)

- By Integration Model

- Vertical Integration

- Horizontal Integration

- Star Integration

- Common Data Format

- By Enterprise Size

- Small and Medium

- Large

- By Industry vertical

- Automotive

- Manufacturing

- Energy

- Logistics

- Healthcare

- Others

- By Geography

- Americas

- United States

- Others

- Europe, Middle East, and Africa

- Germany

- UK

- Others

- Asia Pacific

- China

- Japan

- South Korea

- Others

- Americas