Report Overview

Artificial Intelligence (AI) In Highlights

AI in Defense Market Size:

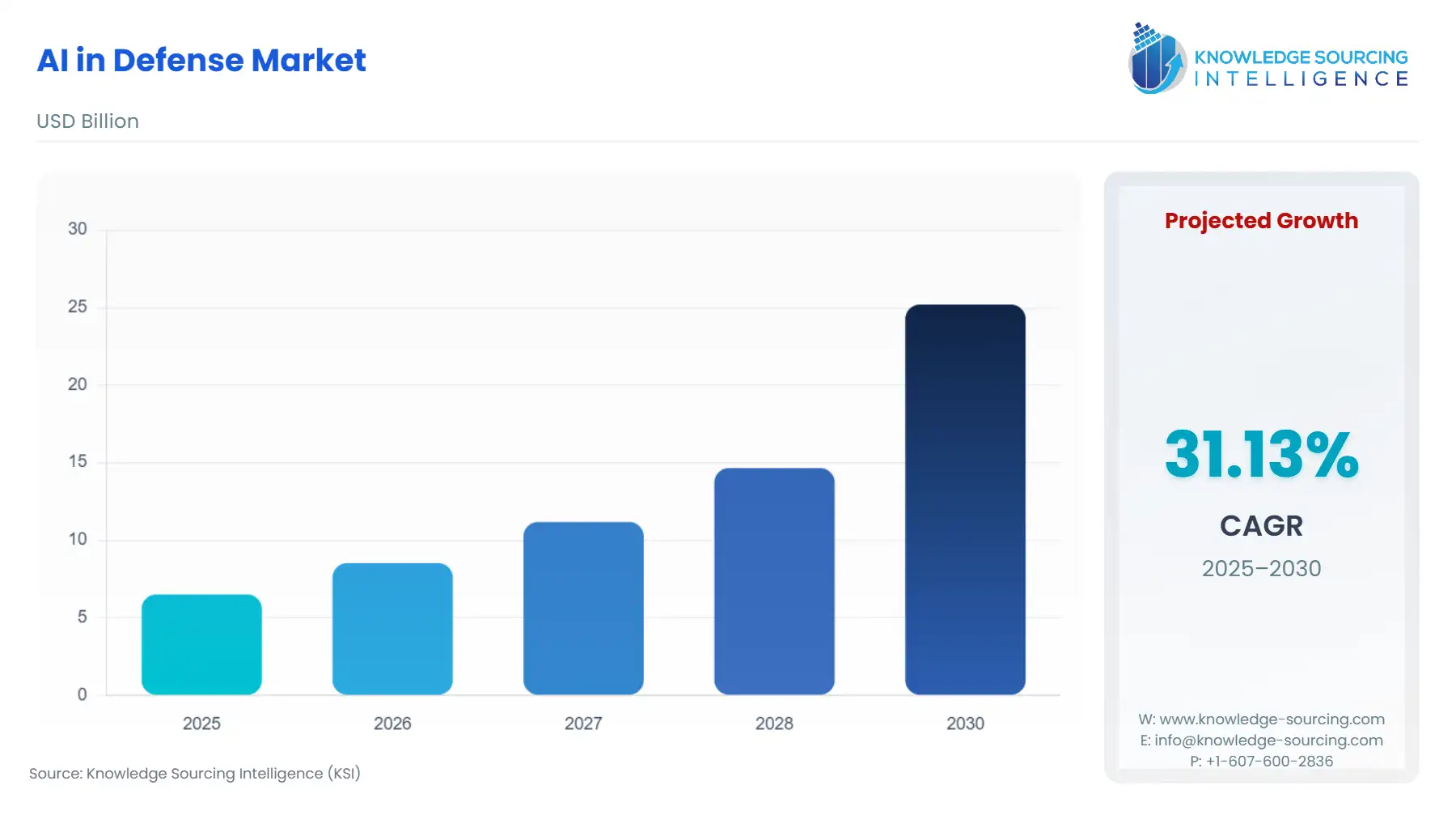

The AI in Defense Market is estimated to expand at a growth rate of 31.13% CAGR during the projected period to account for US$25.200 billion by 2030, up from US$6.500 billion in 2025.

The AI in the defense market is revolutionizing military capabilities within the broader defense tech market. The military AI market leverages defense artificial intelligence to enhance decision-making, situational awareness, and operational efficiency. AI in warfare supports autonomous systems, predictive analytics, and cyber defense, driving military modernization. AI in national security enables real-time threat detection and response, strengthening global defense frameworks. Defense innovation is fueled by advancements in machine learning, sensor integration, and data processing, positioning AI as a cornerstone of modern warfare. This market is critical for nations seeking strategic advantages through cutting-edge, technology-driven defense solutions.

AI in Defense Market Trends:

The AI in defense market is evolving with a focus on ethical and advanced applications. Responsible AI in defense and AI ethics in the military prioritize transparency and accountability in AI deployment. AI-powered autonomous systems enhance unmanned operations, while multi-domain operations (MDO) AI integrates air, land, sea, space, and cyber domains for cohesive strategies. AI swarm intelligence enables coordinated drone and robot missions, improving tactical efficiency. Digital twin defense models simulate assets for real-time optimization. AI for wargaming refines strategic planning through predictive simulations. These trends highlight the industry’s commitment to ethical, integrated, and innovative defense solutions.

The military and defense are vast industries where AI plays a significant role. Progress in AI enables new opportunities for developing defense technologies. In addition to the aforementioned increase in the effectiveness of military forces, using AI in military operations is also more likely to result in a victory in war. Globally, many nations employ AI to improve their military operations and increase their forces' productivity.

Defense objectives will hold a significant share as the government continues spending more of its national budget on defense. As such, qualified engineers and researchers working on defense-purpose technologies are the major market drivers. For deep learning computers, AI allows for creating neural networks and artificial neural networks using big data. Moreover, AI-powered robots can enhance the precision and efficacy of military judgments made by humans, facilitating machine-human combat of all kinds between manned and unmanned systems.

Additionally, AI cannot move forward without relevant data gathered by different defense ships, aircraft, and vehicles on everyday duty. The military collects the data using war games, digital simulations, and physical defense exercises, which train the AI. In the coming years, increasing defense spending is likely to lead to a wider application of AI for designing defensive programs, which will drive the overall AI in the defense market.

AI in Defense Market Overview:

The market is driven by the increase in governments worldwide investing and providing funding allocations in AI technology, which is fuelling the AI deployment in military operations to monitor strategic superiority and advance their battlefield capacity. There are diverse applications of AI in the military and defense sector worldwide for enhancing the military security of their country's borders, personnel, and armed forces.

Moreover, the increase in cyber threats is also increasingly focusing on the government defense sector for the allocation of AI-driven cybersecurity solutions, like intrusion detection and securing the data. For instance, in June 2025, the National Terrorism Advisory System (NTAS) bulletin highlighted the growing cyber and terror threat to the country’s landscape, aligning with critical infrastructure, from the Iran conflict and its linked hackers. This leads to growing demand for AI for cybersecurity in defense, such as Booz Allen Hamilton, which offers expertise in AI-driven cybersecurity solutions to its customers, ensuring the system's resilience with peak performance.

AI is witnessing a growing application in multiple military branches and operations, driven by a shifting approach to defense, warfare, and border security through the adoption of these technologies. AI offers increased precision, analysis, and efficiency through data-driven decision making, leading to advancements in defense equipment and machines and promoting cyber defense solutions in high-security and remote environments.

Additionally, AI technologies are an essential tool for advancing the anomaly detection system, assisting in the identification of security threats and analysis of network traffic, which is demonstrative of cyber threats and border security, further fueling market expansion. The adoption of AI in the military is also expanding with the rise in funding. Furthermore, AI-powered robots can enhance the precision and efficacy of military judgments made by humans, assisting in machine-human combat of all types between manned and unmanned systems.

In addition, governments are increasingly investing in developing and deploying AI technologies for defense against growing digital threats. For instance, in December 2025, the US Department of Defense (DoD) reported the introduction of a series of latest initiatives by the government for the acceleration in the adoption of advanced AI capacities in the defense sector of the USA. Under these, the AI RCC projects focus on organizations' necessity to use the emerging technology for management and cybersecurity, while also offering the troops these advanced AI capacities.

For instance, according to the Ministry of Defence data of March 2025, the Indian defense budget has grown by 2.6x from 2.53 lakh crore in 2013014 to 6.81 lakh crore in 2025-26. Moreover, the government recently launched the ADITI scheme in the country for focusing on the allocation of strategic technologies, including AI in their defense system, which granted up to 25 crore to innovators working for the advancement of these technologies.

Moreover, the market players are focusing on the development of new product innovations and strategic collaboration for advertising their AI in defense products and solutions for ensuring the security and defense across land, air, sea, and space. For instance, in February 2025, Raytheon, an RTX business, announced the completion of flight testing of the first-ever AI/ML-powered Radar Warning Receiver (RWR) system, developed for their fourth-generation aircraft. The company’s solution, WR systems for AI/ML processing at the sensor, is enabled to integrate with the AI models with the assistance of the Cognitive Algorithm Deployment System (CADS), which is extensively utilized in AI in defense solutions.

Furthermore, the rising advancements in machine learning, natural learning processing, robotics, and computer vision, and their growing integration into enhancing military operations as surveillance tools, and addressing complex mission-related concerns in real time, are also driving factors for the market expansion. AI can decipher a large volume of data and offer predictive analysis by identifying data patterns, which is an essential component in modern defense strategies.

AI in Defense Market Growth Drivers:

Government Investment in Defense Technologies:

The market for AI in defense is expanding rapidly, largely due to government funding and strategic defense initiatives. This is because countries worldwide are realizing that AI is a game-changing technology that has the potential to completely change how war, intelligence gathering, and national security are conducted in the future. Defense departments are increasing their investments in AI technology to improve their military capabilities, preserve strategic superiority, and better address new problems in the face of changing threats, asymmetric warfare, and geopolitical tensions. This investment in research and development, talent acquisition, niche hardware, and infrastructure has been further stimulated by world applications of interest to national security. These applications include surveillance, target identification, semi-autonomous vehicles/drones, eventually driverless cars, and cybersecurity. Moreover, AI also provides automotive sensors for military surveillance equipment such as satellites and night vision devices, as well as missile targeting systems.

Leading nations in this trend include the US, China, Russia, India, the UK, France, and Israel. They have implemented extensive national AI policies with a focus on military applications. For example, the Joint Artificial Intelligence Center (JAIC), established by the U.S. Department of Defense (DoD), serves as a focal point for integrating AI across the military's many branches and focuses on autonomous systems, logistics optimization, predictive maintenance, and AI-enabled decision-making. Additionally, through programs like Project Maven and the Defense Advanced Research Projects Agency (DARPA), which are devoted to accelerating the deployment of AI in combat and intelligence situations, the U.S. government has contributed billions of dollars to AI-focused R&D.

In addition, more funding can bring in the best AI talent working on defense-related projects, speed up innovation, and help build high-performance computing clusters. Improvements in machine learning, natural language processing, and computer vision will be its eventual outcome. For instance, in May 2024, through the European Defence Fund, the European Commission invested €1,031 million in 54 joint European defense research and development projects. It is set to facilitate the development of dozens of technologies spanning multiple critical innovation focus areas such as cyber, land, air, sea, and space-based asset protection, including Chemical, Biological, Radiological, and Nuclear (CBRN) defense.

As part of its New Generation Warfare doctrine, Russia is also working to automate and weaponize AI in combat. Meanwhile, India has set up a Defence AI Council and Defence AI Project Agency (DAIPA) within its Ministry of Defence to guide the use of AI in threat detection, autonomous combat, and surveillance. The EU has a long way to go when compared to major world powers in terms of defense innovation spending, especially in AI. The United States spends €130 billion a year on military research and development, which is ten times more than the €14.4 billion that the EU and its member states spend on the same.

These strategic defense efforts encompass more than just purchasing technology; they also involve developing regulatory frameworks, collaborating internationally on AI standards, developing talent, and establishing moral criteria for the application of AI in military contexts. Defense ministries are creating dynamic ecosystems to guarantee ongoing innovation and quick adoption of AI technology through multilateral programs, government funding, public-private partnerships, and cooperation with academics and the commercial sector.

Naval Operations Research

The increasing research in Naval operations is anticipated to drive AI in the defense market expansion. In recent years, AI, which presents the potential to maintain control over ever-increasing areas against increasingly robust adversaries, has been garnering recognition within naval research. The Navy is also working to improve the range of autonomy for unmanned systems with AI. Some use cases for the military could be unmanned aircraft, unmanned surface vessels, and drones. AI can gather all the data observed from several sensors and satellites with the Air Force, among other defense forces. This could also lead to the defense staff being more confident in taking authority in deciding a suitable course of action. In the end, AI can make a drone take off and land, and even finish doing it alone.

In addition, as AI is further developed, advancements can be made in submersible boats and other craft to have mine-detecting abilities while on land. Examining the object and identifying it leads to making an appropriate decision that leads to quick action in mine detection. Some have built-in military hardware that can operate autonomously while keeping human lives out of harm's way.

AI in Defense Market Segmentation Analysis:

The AI in the defense market is segmented into various segments, components, technologies, military branches, applications, and geography. By component, the market is divided into three categories: hardware, software, and services. The software segment holds a major market share as it consists of AI algorithm-driven platforms and data analytics tools that are critical in defense applications. Software provides major functionality to the defense sectors, especially real-time data processing, data-driven decision making, and predictive analytics for security, which is maintaining the segment's leading position.

By technology, the market is segmented into machine learning, computer vision, natural language processing, and others. Machine learning dominates the technology segment’s market share, driven by its diverse utilization in defense functions such as predictive analytics, cybersecurity, ISR systems for threat detection, and autonomous navigation of defense vehicles and drones.

By military branch, the AI in the defense market is categorised into the army, navy, and air force. The air force segment will hold the largest market share, while the navy segment is growing rapidly. The air force military branch is extensively utilizing AI technologies in diverse AI operations and platforms, such as aircraft, in unmanned aerial vehicles, and for surveillance. AI is increasingly adopted in the air force segment for enhancing navigation, collision avoidance, and real-time data analysis for missions.

Based on application, the market is segmented into intelligence, surveillance & reconnaissance (ISR), cyber security, combat training, and others. The ISR segment is dominating the application segment due to a rise in its integration in sensors, drones, and satellites for processing a large amount of data for real-time threat detection, situational awareness, and target recognition. The market companies are also increasingly developing these solutions for increased utilization in defense services. For instance, in April 2025, the Lockheed Martin Skunk Works collaborated with Arquimea to develop and demonstrate the AI-enabled ISR platforms for scaling the mission area and detection of any possible anomaly, enhancing the security, environmental monitoring, disaster response, and safety.

AI in Defense Market Geographical Outlook:

The Asia Pacific region is anticipated to hold a significant AI in Defense market.

Asia Pacific countries such as Japan, India, and China are witnessing rising AI markets because of major key players in AI and technical companies. Additionally, countries in the region are heavily investing in new AI and defense technologies. Therefore, the two merged fields have created a product in the form of AI in the defense market and are benefiting hugely from growing initiatives by governments and private enterprises to develop and deploy AI technologies further in defense.

For instance, in July 2022, India’s Defense Minister, Shri Rajnath Singh, launched 75 new AI products developed by the Indian private sector and start-ups, and product development companies at the first-ever 'AI in Defence' symposium, a two-day event held in New Delhi. Domains of products include AI Platform Automation, Autonomous/Unmanned/Robotics systems, Blockchain-based Automation, Command, Control, Communication & Computer & Intelligence and Surveillance & Reconnaissance (C4ISRs), Cyber Security, Human Behavioural Analysis, Intelligent Monitoring Systems, among others. These increasing government initiatives to advance AI in defense will contribute to the overall market expansion.

North America, particularly the USA, is also expected to hold a major market share.

Artificial Intelligence is gaining traction in the US market, with various industrial opportunities being explored. With the ongoing transition towards next-generation equipment and weaponry system adoption, the AI applicability in the country’s defense sector is also expected to rise. Additionally, the high defense spending in the USA is also establishing a framework for investments in AI technologies. According to the data provided by the Department of Defense (DoD), the requested defense budget for FY2024 was US$842.2 billion, a 2.6% growth over 2023’s defense spending.

Furthermore, the country harbors one of the highest numbers of companies, including start-ups operating in Artificial Intelligence, further driving market expansion. Additionally, the growing concern related to cyber threats has led the US government to bolster its defense infrastructure, which has provided new growth prospects for the adoption of defense-purpose technologies. Hence, favorable efforts to lead in global technological superiority have led the United States to implement necessary initiatives and policies. For instance, the “2023 Data, Analytics, and Artificial Intelligence Adoption Strategy” issued by the DoD aimed to bolster the development of defense-focused AI technology and integrate it in various operations.

Such favorable strategies, followed by ongoing transition towards driving automation and next-generation equipment development, have increased the overall AI adoption, with unclassified AI investment by the Department of Defense (DoD), rising from US$600 million in 2016 to US$1,800 million in 2024, with over 685 active AI projects. Likewise, the ongoing collaboration with defence companies with major market players such as Lockheed Martin Corporation and IBM Corporation has also elevated the possibilities for AI adoption.

Moreover, favorable program implementation, such as ‘Viper Experimentation and Next-Gen Operations Model (VENOM)' that marked a significant step towards the development of fighter aircraft featuring autonomous combat capabilities, is also paving the way for future market expansion.

AI in Defense Market Key Developments:

November 2025: Defense Innovation Unit (DIU) awards a contract of up to US$99 million to AI start-up Obviant for the development of advanced AI analytics applied to acquisition and defense spending data.

November 2025: OpenAI launches the “OpenAI for Government” initiative, offering its most capable models in secure, compliant environments for U.S. federal and defence use—including an initial pilot with the Chief Digital and Artificial Intelligence Office (CDAO) at the United States Department of Defense.

February 2025: Raytheon Technologies (RTX business) completes flight testing of its first AI/ML-powered Radar Warning Receiver system (CADS) designed for 4th-generation aircraft, enabling embedded GPU-driven real-time threat prioritization.

July 2024- The University of Maryland hosted the second annual AI Defense Technical Review to feature research from across the Department of Defense, organized by the Office of the Under Secretary of Defense for Research and Engineering. The session “Scalability and Federation of AI” discussed smart decision-making and strategic coordination over all the forces operating with the related forces. Nearly 300 people from the government, industry, and academia registered for the event, and there were presentations from Google, Microsoft, AWS, IBM, and CENTCOM.

List of Top AI in Defense Companies:

IBM Corporation

Booz Allen Hamilton Inc.

Qualetics Data Machines Inc.

Raytheon Technologies Corporation

Boeing

AI in Defense Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 6.500 billion |

| Total Market Size in 2030 | USD 25.200 billion |

| Forecast Unit | Billion |

| Growth Rate | 31.13% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Component, Technology, Military Branch, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

AI in Defense Market Segmentation:

By Component

Hardware

Software

Services

By Technology

Machine Learning

Computer Vision

Natural Language Processing

Others

By Military Branch

Army

Navy

Air Force

By Application

Intelligence, Surveillance & Reconnaissance (ISR)

Cyber Security

Combat Training

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

Japan

China

India

South Korea

Indonesia

Taiwan

Australia

Others