Report Overview

Antimony Processing By-Products Market Highlights

Antimony Processing By-Products Market Size:

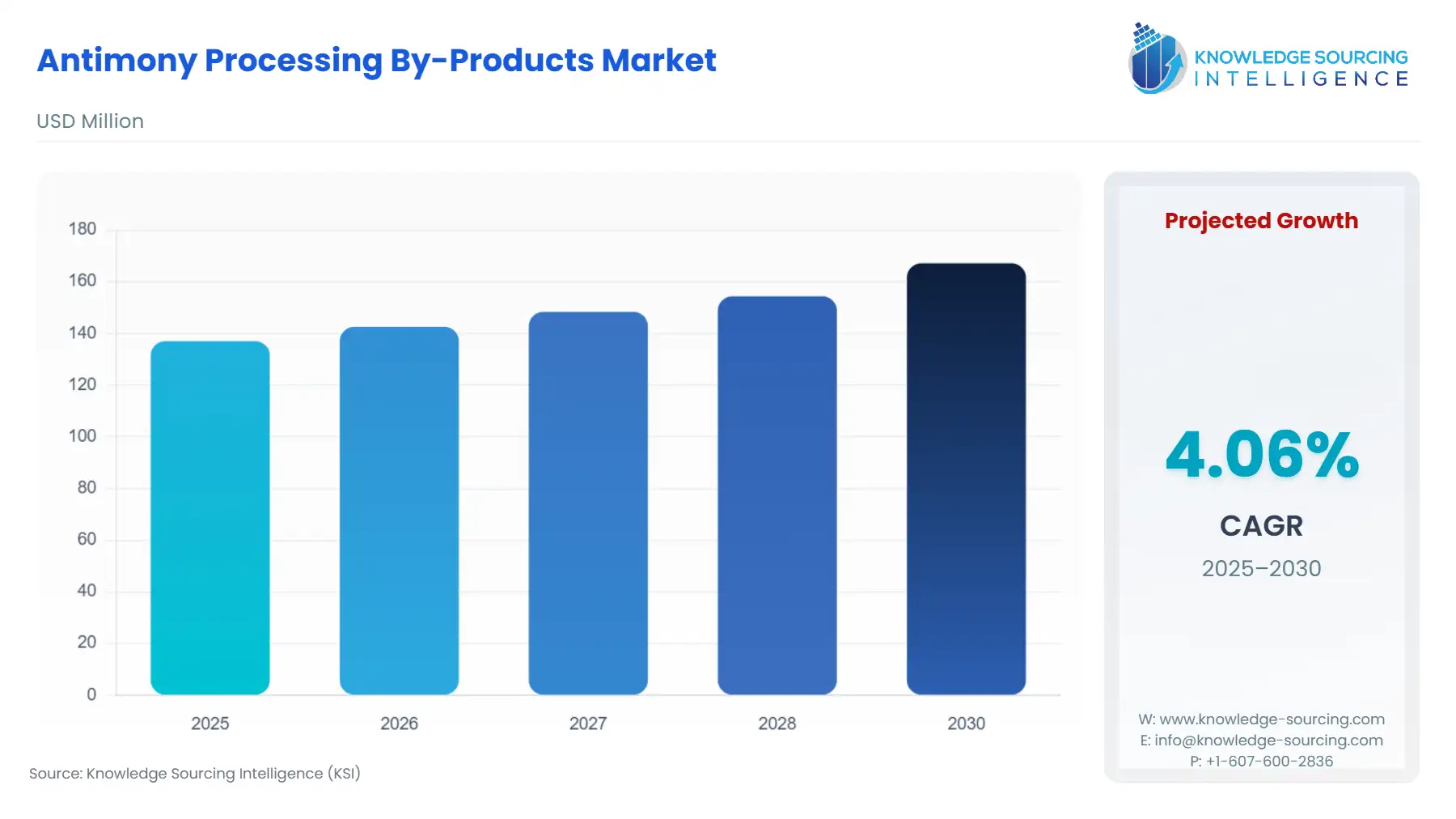

The Antimony Processing By-Products Market is expected to grow at a CAGR of 4.06%, rising from USD 137.036 million in 2025 to USD 167.184 million by 2030.

The antimony processing by-products market is growing as companies strive to achieve greater resource efficiency and minimise their environmental impacts. By-products like antimony trioxide, alloys and other residual materials can be recovered from antimony refining and processing, making them important feedstocks for flame retardant materials, batteries, catalysts and various industrial applications. Innovations in extraction and refining techniques are leading to improvements in the yield and purity of these by-products, making them more suitable for high performance applications.

Rising demand from the electronics, automotive, construction and chemical industries will further contribute to the expanding market. Furthermore, sustainable practices in mining and processing are encouraging companies to recover and reuse by-product substances, complying with regulations and achieving cost-benefit goals. While various industrial sectors continue to become stronger and regulation gets tighter, the antimony processing by-products market will enjoy steady growth. Recovery and use of these materials efficiently will create economic value, contribute to waste reductions, and foster the circular economy concept in the organic production of antimony.

Antimony Processing By-Products Market Overview & Scope:

The Antimony Processing By-Products Market is segmented by:

- Product type: The market is segmented into antimony metal, antimony oxide, antimony alloys and others. Antimony alloys account for the major portion of the market as they enhance the strength of solder, heat resistance and integrity of the bond. This enhances their applications in complex electronics and automobile assemblies.

- Application: Applications include flame retardants, batteries, alloys, catalysts, and other industrial uses. Flame retardants dominate owing to rising safety requirements in electronics, construction, and textiles. Antimony trioxide increases the fire resistance of polymers, paints, and coatings, making it indispensable for compliance with the worldwide fire safety regulations.

- End-User Industry: End-users consist of electronics and electricals, automotive, construction, chemical industry, and other industrial users. Electronics and electricals generate huge demand owing to antimony by-products in semiconductors, soldering materials, and flame-retardant components, which offer durability and safety to the devices.

- Region: Geographically, the market is expanding at varying rates depending on the location.

________________________________________

Top Trends Shaping the Antimony Processing By-Products Market:

1. Recovery and Recycling of By-Products

- Mining and processing companies are increasingly concentrating on the recovery of by-products of antimony to reduce waste and improve resource efficiency. Technologies for the refining and reprocessing of by-products with advanced technology facilitate the recovery of high-purity antimony trioxide and alloys from waste streams, and hence the Circular economy throughout this chain of supply of antimony.

2. Use in High-Performance Industrial Applications

- As the by-products of antimony are being applied more and more in flame retardants, batteries, catalysts, and alloys. In various electronic applications and in the automotive and construction markets, the demand is being extended because of their thermal stability, uniformity over temperature and resistance to corrosion from the normal corrosive conditions of industrial use, and because they satisfy the safety regulations imposed by various authorities.

________________________________________

Antimony Processing By-Products Market Growth Drivers vs. Challenges:

Drivers:

- Rising Industrial Demand: The growing applications of the by-products of antimony in the electronics, automotive and other industries such as the construction industry and the chemical industry cause a demand for the supplies of the by-products of antimony through recovery which is made possible by processing and recovery from the same and hence leads to a low cost and constant unit supply of them again in the high class industrial applications of it.

- Regulatory and Environmental Compliance: The increasing severity of environmental regulations has caused many companies to adopt methods of processing which are more acceptable in terms of recovery and recycling in everything which is done to lessen the adverse environmental damage which might take place and is in line with the ESG goals as well.

Challenges:

- High Processing and Recovery Costs: Implementing advanced recovery technologies requires significant capital investment, limiting adoption for smaller processing operations.

________________________________________

Antimony Processing By-Products Market Regional Analysis:

- Asia-Pacific: Asia-Pacific dominates the antimony by-products processing industry due to wide-scale antimony mining and refining activities, particularly in China, one of the leading producers of antimony in the world. With the availability of significant quantities of raw material, adequate processing infrastructure and prospects of developing consumption due to requirements in electronics, automotive and construction, etc., this market is progressing in a strong manner as recovery technologies are being developed for recovering antimony trioxide and alloys in pure form from the processing by-products. Strong, encouraging government policies for the implementation of resource efficiency initiatives and stringent environmental regulations are contributing to the market growth, as by-products are recycled or reused progressively. The market for antimony by-products processing has a strong presence in the Asia-Pacific, progressing due to rapid industrialisation and the establishment of production bases, thereby contributing a major share to the world market.

________________________________________

Antimony Processing By-Products Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 137.036 million |

| Total Market Size in 2031 | USD 167.184 million |

| Growth Rate | 4.06% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Product Type, Application, End-User Industry, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Antimony Processing By-Products Market Segmentation:

- By Product Type

- Antimony Metal

- Antimony Oxide

- Antimony Alloys

- Others

- By Application

- Flame Retardants

- Batteries

- Alloys

- Catalysts

- Other

- By End-User Industry

- Electronics and Electricals

- Automotive

- Construction

- Chemical Industry

- Other

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Others

- North America