Report Overview

Antimony Hydrometallurgy Market - Highlights

Antimony Hydrometallurgy Market Size:

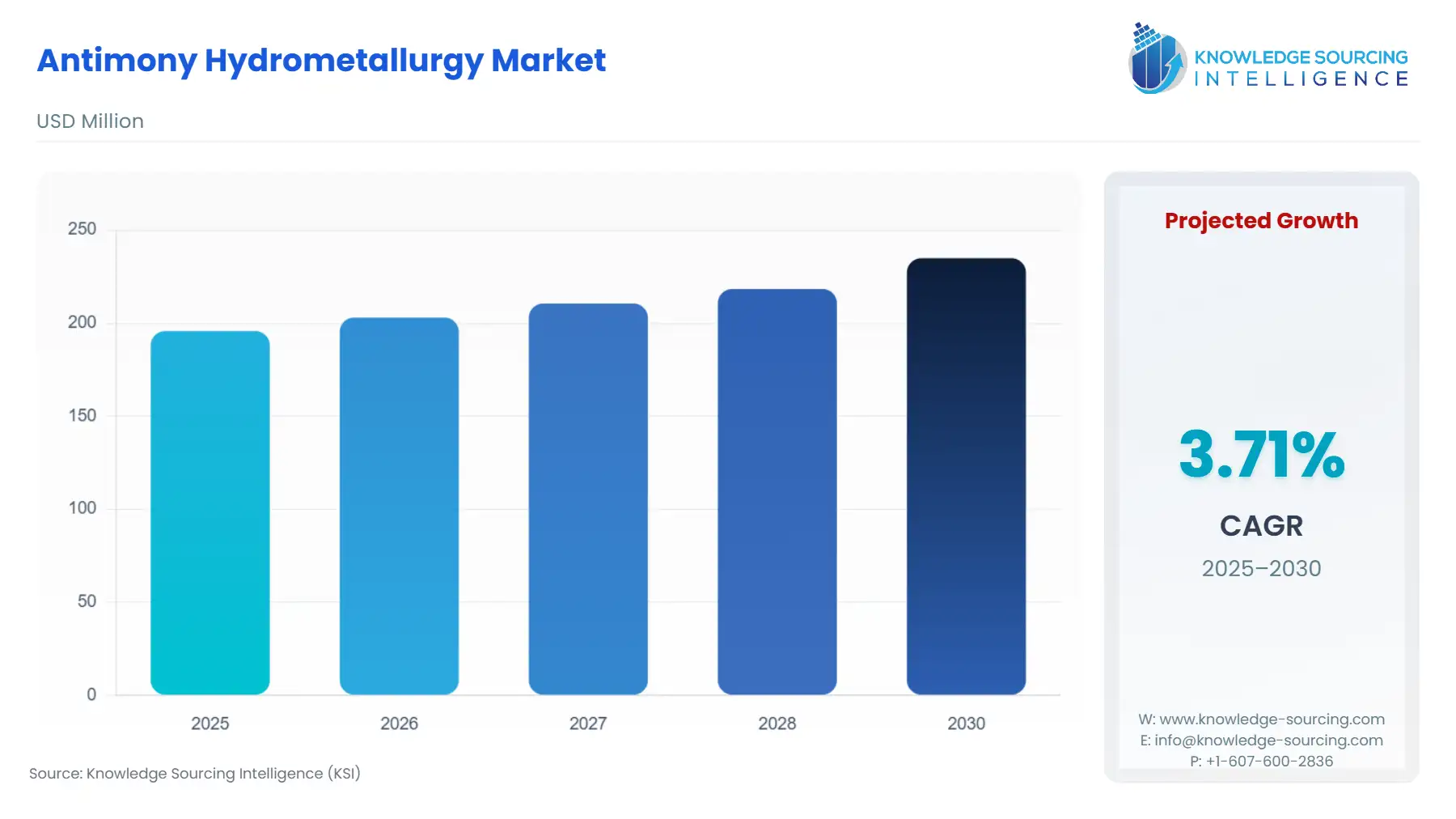

The Antimony Hydrometallurgy Market is expected to grow at a CAGR of 3.71%, rising from USD 195.766 million in 2025 to USD 234.919 million by 2030.

The antimony hydrometallurgy market has expanding interest due to a move toward cleaner and more efficient methods of extracting metals from ores. Hydrometallurgical methods, such as leaching, solvent extraction, and electro-winning are taking increasing place of pyrometallurgical methods due to lower environmental costs and higher recovery efficiency. The increased demand for high-purity antimony for flame retardants, batteries, and in alloys indicates active research in technological developments in refining processes. Research and explanation involving the leach ability of antimony, more selective leaching methods, less reagent consumption in leaching, and profitable economics are experiencing expansion. To encourage response in use of hydrometallurgical methods form can be made that sustainable use of resources encourages research in recycling and secondary recovery of antimony using hydrometallurgical methods. Partnerships in research in extraction methods can be found between the industrial and academic. The development of new extraction methods and efficient means of using less energy can also be a research goal. Explaining the increased concern of governments for environmental health and industrial change we can see that the hydrometallurgical method will be the technological base for new developments in technology in global antimony processing and refining.

Antimony Hydrometallurgy Market Overview & Scope:

The antimony hydrometallurgy market is segmented by:

- By Process Type: The market has been segmented based on process type into leaching, solvent extraction, electro-winning, and precipitation. Among these segments, the leaching process accounts for the major share, led by its better capacity of the dissolution of antimony compounds in controlled conditions. This process offers selective recovery of the metal in high purity with lower environmental impact, thus making it applicable in large-scale industrial processes.

- By Application: Based on applications, the market has been segmented into production of antimony trioxide, battery production, flame retardants, and alloy manufacturing. Antimony trioxide production holds the major share as it forms one of the most important intermediates for flame-retardants, plastics and the manufacturing of glass and its major applications are ascribed to the huge demand in construction, automotive, and electronics industry.

- By End Use: The market has been segmented into mining and metallurgical companies, the chemical processing industry, the battery manufacturing industry, and research institutions. The mining and metallurgical companies constitute the major share in this segment as they are the major users of hydrometallurgical processes for higher mineral recovery efficiency and lower operational costs.

- Region: Geographically, the market is expanding at varying rates depending on the location.

________________________________________

Top Trends Shaping the Antimony Hydrometallurgy Market:

1. Transition Toward Green Extraction Technologies

- The trend toward using hydrometallurgical processes that have lower carbon emissions and do not produce harmful by-products that result from smelting is gaining enormous ground. Extraction processes with water-borne leaching and solvent extraction systems using minimal waste and therefore with enhanced recyclability would comply with global sustainability directives.

2, Rising Focus on Secondary Antimony Recovery

- A major trend is the increased emphasis on recovering antimony from industrial waste and electronic scraps. Hydrometallurgy is well-positioned as the technology of choice, as valuable metals can be extracted from unwanted materials. This helps various industries in their effort to decrease their dependence on primary ores while at the same time enhancing initiatives for systematic recycling and diminished environmental waste.

________________________________________

Antimony Hydrometallurgy Market Growth Drivers vs. Challenges:

Drivers:

- Increasing Demand for High-Purity Antimony: Supplies of high-purity antimony are necessitated by expanding applications of antimony in flame-retardant materials, batteries and speciality alloys. Because this is so, manufacturers will have to resort to hydrometallurgical processes which ensure the constant purification, yields and efficiencies. In addition to this acquisition of metals using hydrometallurgy satisfies the essential need for both quantity and quality of these products required by industry, having electronic, automotive and military applications.

- Stringent Environmental Regulations: Legislators and environmentalists are creating stricter rules that eliminate smelting as a mainstream method of extraction and change it to one less harmful and more eco-smart. There is an effort by various governmental agencies towards hydrometallurgy as being less harmful, less wasteful and able to recover bodies of valuable metals from complex ores. This would assist in sustainable industrial growth.

Challenges:

- High Capital and Operational Costs: The establishments and equipment that are required for a successful hydrometallurgical plant require a vast financial outlay and reagents, equipment and waste disposal expenses. Smaller and mid-sized industries will face financial challenges in implementing such a skilled and high-tech program.

________________________________________

Antimony Hydrometallurgy Market Regional Analysis:

- Europe: Europe plays an important role in the antimony hydrometallurgy market due to its good environmental regulations and its focus on sustainable metal recovery. The region invests heavily in cleaner extraction technologies to reduce the ecological impact of raw materials and lessen reliance on imports. Leading countries such as Germany, Belgium and Great Britain are carrying out numerous investigations or pilot projects into the hydrometallurgical recycling of antimony from industrial waste and electronic scrap. The cooperation between universities and metallurgical enterprises encourages the development of selective leaching and solvent extraction methods. Furthermore, the EU policies that promote circular economy measures and security of critical minerals are a further important factor which accelerates the hydrometallurgical application of antimony and places the area in the vanguard of sustainable metal refining and resource efficiency.

________________________________________

Antimony Hydrometallurgy Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 195.766 million |

| Total Market Size in 2031 | USD 234.919 million |

| Growth Rate | 3.71% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Application, End-User Industry, Geography |

| Companies |

|

Antimony Hydrometallurgy Market Segmentation:

- By Type

- Leaching Process

- Solvent Extraction

- Electro-Winning

- Precipitation

- By Application

- Antimony Trioxide Production

- Battery Manufacturing

- Flame Retardants

- Alloy Production

- By End-User Industry

- Mining and Metallurgical Companies

- Chemical Processing Industries

- Battery Manufacturers

- Research and Development Institutions

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Others

- North America