Report Overview

Antimony Derivatives Market - Highlights

Antimony Derivatives Market Size:

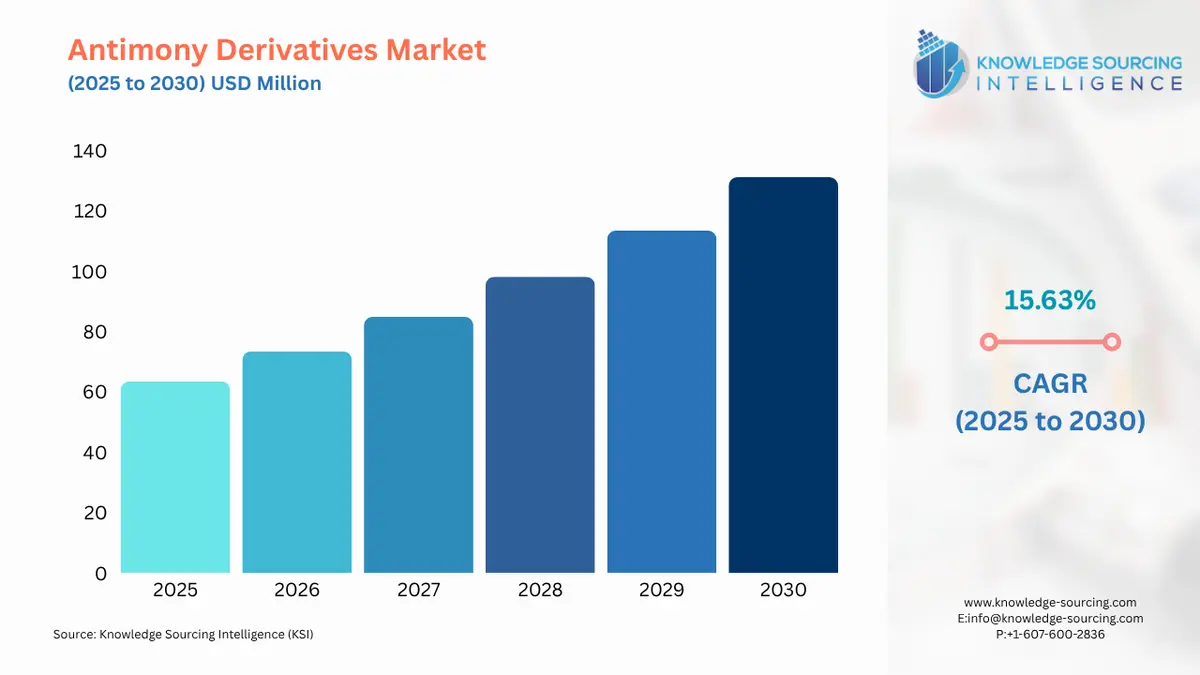

The Antimony Derivatives Market is expected to grow at a CAGR of 15.63%, reaching USD 131.180 million in 2030 from USD 63.476 million in 2025.

Antimony Derivatives Market Key Highlights:

- Powerful forces inherent in fire safety and environmental standards are propelling robust demand in construction, automotives, and electronics towards the use of antimony trioxide.

- Advanced batteries, flame-retardant plastics, and specialty catalysts have made antimony a leading industry worldwide.

Antimony derivatives are one of the more innovative spheres of the overall industrial environment. As the world shifts toward a new energy mix, antimony alloys are being understood as critical in next-generation rechargeable batteries and grid-scale energy storage systems. At the same time, interest in ceasing the use of safer, high-performance flame-retardants in buildings, electronics, and autos emphasizes how future-oriented and investment-worthy these chemicals are.

Antimony Derivatives Market Overview & Scope:

The Antimony Derivatives market is segmented by:

- Type: The antimony derivatives market is segregated into antimony trioxide, antimony pentoxide, antimony alloys, sodium antimonate, and others. Antimony trioxide (ATO) has the largest share in this category as it finds wide use as a synergist in flame retardants. TO is especially appreciated in plastics, textiles, and electronics as a means of improving the fire resistance of a material, and to do so without interfering with mechanical properties. Antimony pentoxide is increasingly being used in its application in specialty markets like advanced catalysts, lithium-ion and sodium-ion battery technology, and specialty glass. Antimony alloys, notably with lead, are also irreplaceable in grid storage batteries, automotive batteries, and industrial machinery, due to their hardening, corrosion protection, and strength. Sodium antimonate has uses in glass, ceramics, and flame-retardants, yet is still far less marketable than ATO. Together, these groups of products constitute the mainstay of various industries such as chemicals, automotive, and electronics, and guarantee a sustained increase in demand.

- Application: Various applications of antimony derivatives include flame retardants, lead-acid batteries, plastics, glass and ceramics, catalysts, and others. The largest segment is the flame retardants segment, which has a considerable percentage of the total demand worldwide. Increasing fire safety standards in terms of materials used in construction, electrical appliances, consumer products, and automotive interiors ensures a unified consumption of ATO. Another crucial product is the lead acid battery segment, since alloy antimony is commonly used in the grids of the battery to ensure service longevity and a high level of charge and discharge. Outside pressure from lithium-ion batteries, lead-acid batteries remain the mainstay of backup power systems, in automotive starting systems, and in industrial applications, hence maintaining demand. Other uses of antimony compounds are in plastics and textiles to satisfy regulatory limits regarding flammability. The glass and ceramics sector employs antimonate and pentoxide in decoloring glass and in optical clarity in high-value architecture and specialty classes. Catalysts and others are growing sectors, involving antimony derivatives in the support of advanced chemistry and new energy sources.

- Form: The market is further categorized by form into powder, ingot, and liquid derivative. Powder is the common name in the global market mainly because of the ease of its incorporation into flame-retardant materials, polymers, and coatings. It is cost-effective for mass production cases and dispenses evenly. An ingot form is normally used in the creation of alloys and in batteries, where the integrity of the structure is vital and where a defined composition is vital.

- End-Use Industry: The industries where the demand for antimony derivatives has been seen are chemicals, electrical and electronics, automotive, construction, textiles, and defence. The automobile industry is a particular sector where demand of lead-acid batteries is high. Although the introduction of EVs has challenged the use of lead-acid batteries, these batteries are still necessary in hybrid cars, auxiliary systems, and industrial equipment. Electronics manufacturers use large quantities of flame-retardant antimony compounds as circuit boards, casings, and insulation because of the requirements of fire safety on consumer electronics and industrial equipment. The construction sector is another major user, incorporating flame-retardant-treated plastics, insulation, and structural materials. The textiles sector requires ATO-treated fabrics to comply with stringent flammability standards, especially in upholstery, military uniforms, and industrial protective clothing. Meanwhile, the defense industry leverages antimony alloys for munitions and protective gear, highlighting its strategic significance.

- Region: The antimony derivatives market is composed of North America, South America, Europe, the Middle East & Africa, and Asia Pacific. Asia Pacific is the leading producer and consumer, and China is the leader in terms of global supply chains. Europe and North America are the more advanced markets with high regulatory norms, but South America and MEA are new markets where industrial demand is rising and there is a lack of domestic industrial capacity.

Top Trends Shaping the Antimony Derivatives Market:

- Rising Demand for Flame Retardants

The global growth in demand for flame-retardant materials is one of the most noticeable trends in the antimony derivatives market. Regulatory bodies around the globe are increasing fire standards on buildings, vehicles, aerospace, and consumer products, making the usage of antimony trioxide as a synergistic additive in these industries. As an example, the construction materials (insulation, wiring, and composite panels) have to adhere to strict flammability standards in Europe, North and Asia. Additionally, rapid development in the third-world economies has contributed to the increase of the necessity of fire-safe structure materials and products of consumption. Growing demand in the electronics industry is also strengthened by the rise of smaller, high-heat devices such as smartphones and EV batteries, in which thermal stability and fire safety are critical. This regulatory-based demand situation also holds up the long-term dominance of flame retardants in the use of antimony derivatives. - Shift Towards Energy Storage and Battery Applications

The world is in the process of electrification and integration of renewable energy, which has shifted attention to batteries in their industrial innovations. Antimony is an important constituent in lead-acid battery capabilities that continue to dominate use as automotive starters, back-up energy stores, and industry applications. Improves the strength and durability, and electrochemical performance of battery grids, thereby providing a long life cycle even under high usage. Although the lithium-ion batteries are on the rise, lead-acid batteries remain commonly manufactured because of the low cost, recyclability, and existing infrastructure.

Antimony Derivatives Market Growth Drivers vs. Challenges:

Drivers:

- Stringent Fire Safety Regulations: The biggest contributing factor to the growth of the antimony derivatives is the stringent fire safety regulations being initiated across the globe. Strict regulations in Europe have been introduced to adhere to the set standard of flame-retardant-treated material, such as in European REACH standards, in North America, its building codes, and in Asia, the urban fire protection codes. The need in the long term is achieved by such regulatory motivation of antimony trioxide demand.

- Automotive Battery Demand: The strength of the chemical bonds that form the composition of lead-acid batteries and their alloys, such as the use of antimony-based alloys, makes the batteries relevant to non-automotive applications even in the era of EV adoption. The high-end commercial vehicles, military devices, as well as renewable power grids also utilize these batteries, hence increasing consumption.

Challenges:

- Supply Concentration & Price Volatility: China controls a significant supply of the world's production and exports. This kind of dependence puts the world markets at risk of future supply chain challenges, geopolitical shocks, and price volatility.

- Health & Environmental Concerns: Antimony has also been found to pose toxicological threats to the health of humans and other components of the ecosystem. Consequently, such stricter environmental analysis as raised by the regulatory agencies requires industries to seek other options for flame retardants and alloying materials.

Antimony Derivatives Market Regional Analysis:

- Asia-Pacific: Asia Pacific antimony derivatives market is anticipated to be lead . China is the biggest producer and exporter of antimony and its derivatives, providing substantial world demand. The growth of the region is supported by the development of the automotive, construction, and electronics industries, as well as the significant investments of the government in infrastructure development and manufacturing. Strict fire-safety standards, even in the developed world, and the growing population to serve in the big cities, as well as the rising use of lead-acid batteries in burgeoning economies such as India and Southeast Asia, add additional spikes to market opportunities.

- Europe: Europe has been typified by regulated control and highly developed industrial uses. High regulation on fire safety and green sustainability standards lead to strong demand for flame retardants in buildings and consumer products. The automotive and renewable energy sectors also contribute significantly, as Europe pushes for cleaner energy adoption and sustainable manufacturing practices. Research into advanced battery chemistries in Germany, France, and the UK could open new opportunities for antimony pentoxide and alloys. However, environmental scrutiny on chemical safety could also restrain growth if substitutes gain traction.

Antimony Derivatives Market Competitive Landscape:

The market is fragmented, with many notable players:

- Company Initiatives: In August 2025, Alkane Resources and Mandalay Resources completed a merger of equals to create a combined company with producing assets in Australia and Sweden. Continuing under the name “Alkane Resources”, the combined company remains listed on the Australian Securities Exchange and listed on the Toronto Stock Exchange.

Antimony Derivatives Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 63.476 million |

| Total Market Size in 2031 | USD 131.180 million |

| Growth Rate | 15.63% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Application, Form, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Antimony Derivatives Market Segmentation:

- By Type

- Antimony Trioxide

- Antimony Pentoxide

- Antimony Alloys

- Sodium Antimonate

- Others

- By Application

- By Form

- Powder

- Ingot

- Liquid

- By End-Use Industry

- Chemicals

- Electrical & Electronics

- Automotive

- Construction

- Textiles

- Defense

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Others

- North America