Report Overview

Argentina Advanced Battery Market Highlights

Argentina Advanced Battery Market Size:

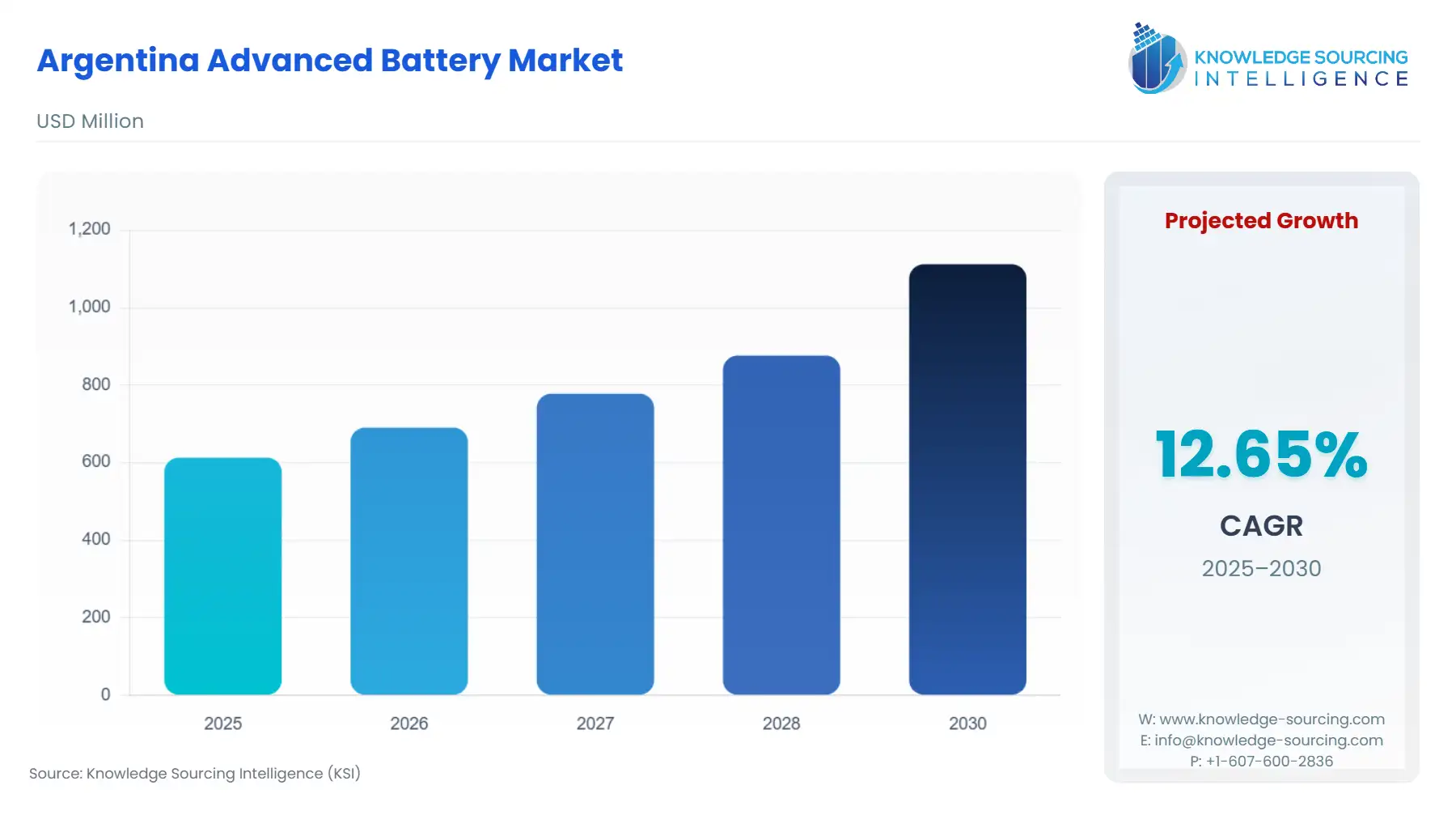

The Argentina Advanced Battery Market is forecast to rise at a CAGR of 12.65%, attaining USD 1.112 billion in 2030 from USD 0.613 billion in 2025.

The Argentine Advanced Battery Market is experiencing a fundamental shift, moving beyond its traditional role as a key raw lithium supplier to actively pursue vertical integration and domestic value-added manufacturing. Supported by substantial mineral reserves and a growing government mandate for grid modernization and renewable energy integration, the market for advanced battery energy storage systems (BESS) is undergoing a significant expansion. International investment, particularly in the upstream lithium sector, reinforces the long-term supply stability necessary to support a nascent domestic cell manufacturing base. The primary market opportunity remains centered on leveraging lithium resources for export while simultaneously developing localized battery assembly and integration capabilities to address national energy infrastructure deficiencies and promote electric vehicle adoption.

Argentina Advanced Battery Market Analysis:

- Growth Drivers

The surge in lithium production directly fuels demand for both domestic and international advanced battery manufacturing. As Argentina had the world's third-largest lithium reserves in January 2021, the resource abundance de-risks the long-term supply chain for any local or regional battery cell initiative. This reliable raw material availability acts as a powerful pull factor, increasing the demand for localized cathode and anode material processing facilities. Separately, the government's decisive action on energy storage procurement significantly drives the need for BESS. The Alma-GBA program, which awarded 667 MW of battery storage capacity through a competitive tender, directly generates substantial, guaranteed demand for utility-scale batteries to reinforce the power grid, particularly in the Buenos Aires Metropolitan Area.

- Challenges and Opportunities

A primary challenge lies in bridging the gap between raw lithium extraction and large-scale battery cell manufacturing. While the nation excels in lithium carbonate production, the domestic manufacturing capacity for battery cells remains modest, with initial plants operating at a fraction of the scale required for global competitiveness. This capacity deficit acts as a constraint on high-capacity battery demand. Conversely, the opportunity rests in the strategic shift toward domestic value addition, led by initiatives like Y-TEC's cell production. By cultivating a local industrial base, Argentina can target regional electromobility and energy storage markets, securing a higher-margin position in the value chain and structurally increasing demand for local-content final battery products. Furthermore, the development of Direct Lithium Extraction (DLE) technologies, as planned by companies like Lithium Argentina in their joint venture with Ganfeng, offers an opportunity to optimize resource utilization, potentially lowering the cost of locally sourced lithium and subsequently increasing the demand for lithium-ion battery production.

- Raw Material and Pricing Analysis:

The advanced battery market, dominated by the Lithium-ion technology segment, is fundamentally tied to the price and availability of lithium carbonate. As a top-five global producer of lithium, Argentina is a critical price setter in the global supply chain. With a total LCE output capacity reaching 186,000 t/yr in 2025, and major producers continuing expansion efforts, the substantial domestic supply of lithium carbonate acts as a powerful anchor. The supply-side robustness helps mitigate geopolitical risk for international buyers and provides a cost-competitive advantage for nascent domestic battery manufacturers in the acquisition of primary raw material. Pricing dynamics are thus heavily influenced by global supply-demand imbalances, though the country's resource position provides a structural advantage.

Supply Chain Analysis:

The Argentine advanced battery supply chain is currently bimodal. The dominant segment is the upstream raw material extraction, centered on the Puna region's "Lithium Triangle," which includes the Salar De Olaroz and Salar del Hombre Muerto. This segment integrates globally, exporting lithium carbonate to key production hubs in Asia for final processing into cathode materials and cell production. The nascent second segment is mid-stream domestic manufacturing, which involves state-backed entities like Y-TEC working with locally sourced lithium carbonate to produce battery cells. Logistical complexity for advanced batteries is significant, constrained by the long-distance transport of high-capacity, high-value finished cells from international manufacturing centers to Argentina for integration into BESS or EV platforms. Dependence remains high on foreign technology and capital for scaling up domestic cell production beyond pilot capacity.

Government Regulations:

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| National/Provincial | Law 27.191 (National Promotion of the Use of Renewable Energy Sources) & Alma-GBA Program | The law established a 20% renewable energy target by 2025. This mandate, coupled with tenders like the 667 MW Alma-GBA BESS auction, directly creates immediate, project-based demand for utility-scale battery energy storage systems (BESS) necessary for grid stabilization and integration of intermittent renewable sources. |

| Provincial (e.g., Catamarca) | Environmental Impact Assessment (EIA) requirements for Mining Projects | Provincial approval of the EIA is mandatory to obtain an operating permit. This regulatory scrutiny on environmental and social impacts introduces procedural timelines and project risk, potentially moderating the speed of new lithium projects and affecting the long-term supply and cost stability of the essential battery raw material. |

| National | Regime for the Incentive of Large Investments (RIGI) | This incentive regime, which grants tax breaks and legal stability to major projects, is anticipated to attract substantial foreign direct investment into the high-capital lithium mining sector, accelerating raw material output and thereby increasing the primary supply of lithium carbonate for the advanced battery value chain. |

Argentina Advanced Battery Market Segment Analysis:

- By Technology – Lithium-ion Batteries: Lithium-ion (Li-ion) batteries are the primary technology driving advanced battery market expansion in Argentina. This is a direct consequence of the nation's immense lithium resource base, which provides a long-term supply guarantee for the core raw material. The local push toward vertical integration, exemplified by Y-TEC's establishment of a domestic cell production facility, is explicitly focused on Li-ion chemistry to link the upstream mining sector to mid-stream industrial capacity. This focus creates intrinsic demand for high-quality lithium carbonate, cathode materials, and anode materials. Furthermore, the global automotive and BESS industries universally prefer Li-ion for its energy density and cycle life, ensuring that projects like the $90 million investment by Stellantis, which secured an offtake agreement for up to 15,000 tonnes per annum of lithium, are focused on this chemistry. The market for Li-ion in Argentina is therefore fundamentally supply-driven, with domestic production efforts attempting to capture a greater share of the massive global demand for this technology.

- By Application – Energy Storage Systems (Utility-scale): The utility-scale energy storage system (ESS) segment is experiencing rapid demand acceleration, principally driven by the government's structured procurement programs aimed at grid modernization. The 667 MW awarded through the Alma-GBA tender demonstrates a firm, quantifiable demand for high-capacity battery installations to manage congestion and enhance reliability in critical areas like the Buenos Aires Metropolitan Area (AMBA). This government-backed demand de-risks investment in large ESS projects, directly attracting over $540 million in capital. Utility-scale batteries serve the crucial function of providing dispatch flexibility and stabilizing supply, which becomes increasingly imperative as more intermittent renewable energy sources, mandated by Law 27.191, integrate into the grid. The stability and predictability offered by these public tenders translate into robust, immediate demand for containerized BESS solutions from both domestic and international energy infrastructure developers.

Argentina Advanced Battery Market Competitive Environment and Analysis:

The competitive landscape in Argentina's advanced battery sector is bifurcated between upstream raw material producers and nascent domestic technology developers. Global mining and chemical giants dominate the lithium carbonate extraction space, while the domestic cell manufacturing is driven by a state-backed entity.

- Lithium Argentina: A major player in the upstream supply chain, this company, in partnership with Ganfeng, operates the Caucharí-Olaroz lithium brine operation. They achieved production of approximately 25,400 tonnes of lithium carbonate in 2024. Their strategic positioning is focused on expanding their resource base and output; in August 2025, they announced a new joint venture with Ganfeng to consolidate three projects in Salta Province, targeting a potential capacity of up to 150,000 tonnes per annum of lithium carbonate equivalent. This expansion directly reinforces the raw material supply for the global advanced battery market.

- Y-TEC (YPF-Tecnología): As the technology arm of the state-owned oil company YPF, Y-TEC is the primary vehicle for vertical integration and domestic value-add. The company established a battery cell production plant in La Plata, with the strategic goal of moving "from the salt flats to the batteries." This initiative positions them as a foundational player in domestic cell production for stationary energy storage and potential future electromobility applications, aiming to displace reliance on imported cells.

Argentina Advanced Battery Market Developments:

- August 2025: Lithium Argentina and Ganfeng announced a new joint venture to consolidate the Pozuelos and Pastos Grandes lithium brine projects in Salta Province. The joint venture aims for a phased production capacity of up to 150,000 tonnes per annum of lithium carbonate equivalent, utilizing a hybrid DLE and solar evaporation flow sheet. This development is a significant capacity addition in the upstream supply chain.

- September 2023: Argentina Lithium & Energy Corp. announced a definitive agreement for an investment of the ARS$ equivalent of US$90 million by Stellantis. The transaction grants Stellantis an irrevocable right to purchase up to 15,000 tonnes per annum of lithium product produced by Argentina Litio y Energia S.A. over seven years via an Offtake Agreement. This secures long-term commitment from a major automotive OEM to the Argentinian lithium supply chain.

Argentina Advanced Battery Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 0.613 billion |

| Total Market Size in 2031 | USD 1.112 billion |

| Growth Rate | 12.65% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Technology, Capacity, Material, Sales Channel |

| Companies |

|

Argentina Advanced Battery Market Segmentation:

- BY TECHNOLOGY

- Lithium-ion Batteries

- Lead-acid Batteries

- Solid-state Batteries

- Nickel-metal Hydride (NiMH) Batteries

- Flow Batteries

- Sodium-ion Batteries

- Others

- BY CAPACITY

- Low Capacity (<50 Ah)

- Medium Capacity (50-200 Ah)

- High Capacity (>200 Ah)

- BY MATERIAL

- Cathode Material

- Anode Material

- Others

- BY APPLICATION

- Automotive

- Electric Vehicles

- Hybrid Electric Vehicles

- Plug-in Hybrid Electric Vehicles

- Energy Storage Systems

- Residential

- Commercial & Industrial

- Utility-scale

- Consumer Electronics

- Industrial

- Motive Power

- Stationary

- Medical

- Aerospace & Defense

- Others

- Automotive

- BY SALES CHANNEL

- OEM

- Aftermarket