Report Overview

Argentina E-Hailing Market - Highlights

Argentina E-Hailing Market Size:

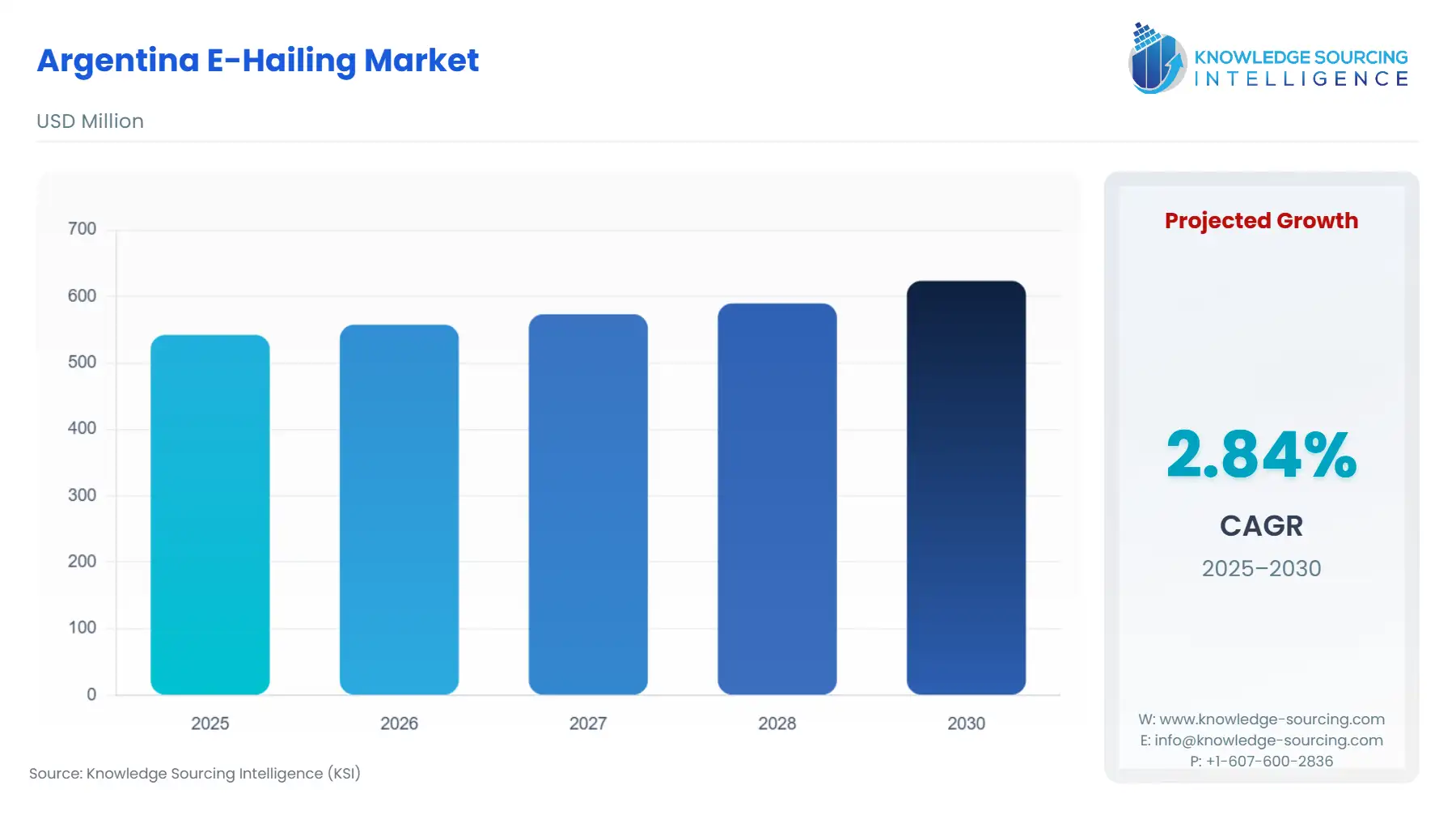

Argentina E-Hailing Market is expected to grow at a 2.84% CAGR, reaching USD 623.697 million by 2030 from USD 542.322 million in 2025.

Argentina's e-hailing market is e-buzzing, while urban commuters are swooping in on traditionally cheap access and affordable app-based rides with services like Uber, Cabify, inDrive and DiDI. Demand is growing as 92% of the Argentine population is urban, with limited rideshare options. There are apps like Uber's "Uber Taxi" which allow taxi drivers to join the platform, but have the user still use the app, while keeping linear pricing with meters. Mendoza has formally regulated ridesharing, giving some legal clarity for providers and bringing formal adoption and legitimacy throughout the province. An urban demand space, gaps and holes, regulatory shifts and questions, and more blurring and bending between taxis and ridesharing apps.

Argentina E-Hailing Market Overview & Scope

The Argentina E-Hailing Market is segmented by:

- By Service Type: The market is divided into segments by service type into ride sharing, ride hailing and others. Ride sharing offers the possibility for multiple group passengers travelling in the same direction to share a single ride and fare. It is also less harmful to the environment as it could help to reduce emissions and alleviate traffic congestion. Ride-hailing, on the other hand, gives one passenger access to a driver through an app, which gives a sense of privacy and provides a slightly faster ride than group travel. Others include peer-to-peer rentals and niche/unique mobility models, which are not classified within either of these two categories.

- By Device Type: The market is divided into segments by device type into smartphones, tablets and others. Smartphones are the primary device in this segment, and it can be argued that nearly all users utilise mobile apps to book, track and pay for rides. Smartphones are portable, and users generally have access to internet connectivity 24/7. Others include desktops or other types of in-car.

- By Vehicle Type: The market is divided into segments by vehicle type: two-wheeled vehicle, three-wheeled vehicle, and four-wheeled vehicle. Four-wheeled vehicles are further divided into sedans, SUVs and others. Two-wheeled vehicles such as scooters and motorcycles are quite popular modes of transportation in dense urban markets. They are affordable and can typically cut through traffic.

- By End-User Industry: The market is segmented into personal (B2C) and corporate (B2B). Personal users account for the largest share, as millions of individuals book rides for commuting, shopping, and leisure daily.

- By Region: Geographically, the market is expanding at varying rates depending on the location.

Top Trends Shaping the Argentina E-Hailing Market

- Argentina’s ultra-urbanized population:

- 92% of Argentina is an ultra-urbanised population and some sharp growth is anticipated, as ride-hailing sessions grew 36% year-over-year, and app downloads saw 28% growth in early 2024.

- Uber’s “Uber Taxi” feature is gaining traction:

- Uber's "Uber Taxi" feature is being leveraged, with Argentinian traditional taxi drivers, reacting to Argentina's hustled economy, now enrolling onto the app, to access more passengers and income.

Argentina E-Hailing Market Growth Drivers vs. Challenges

Drivers:

- Economic instability pushed many Argentines into ride-hailing: Economic instability has pushed many into ridesharing; for Uber drivers in Buenos Aires, 20% were unemployed before moving to ridesharing, showing the platform is now an alternative income.

- Integration of traditional taxis through Uber Taxi: Uber Taxi integration helps platforms grow fleet and brand, offering flexibility and resiliency through one more vehicle as the street-hailed taxi count shrinks.

Challenges:

- Regulatory uncertainty: Regulatory uncertainties, changing regulations, implementation, supporting opposition from taxi unions and others continue to lead to protests for platforms like Uber. Opposing actions create challenges in an already doubtful operational model, and work against their attempt to find and legitimise app-based services in Argentina.

Argentina E-Hailing Market Regional Analysis

- Argentina’s e-hailing market is concentrated in large metropolitan areas such as Buenos Aires, Córdoba, Rosario, and Mendoza, where demand for flexible urban transport is high and digital adoption is widespread.

Argentina E-Hailing Market Key Development

- The Superior Court of Justice of Argentina (TSJ) has welcomed Uber and DiDi to operate legally in Córdoba, effectively cancelling a ban which lasted for years. This was supposed to be positive progress for contemporary transport; however, it has inspired strong opposition from taxi unions, which host many protesters. The protesters claimed that this regulation would ruin their livelihoods, but they mentioned that Uber and DiDi should also be regulated. The backlash was amplified when the Córdoba City Council proposed tightly regulated quotas, capping the ride-hailing cars allowed to operate on the road and adding other licensing structures.

Argentina E-Hailing Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Argentina E-Hailing Market Size in 2025 | USD 542.322 million |

| Argentina E-Hailing Market Size in 2030 | USD 623.697 million |

| Growth Rate | CAGR of 2.84% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | Buenos Aires, Córdoba, Rosario, Mendoza, La Plata |

| List of Major Companies in the Argentina E-Hailing Market |

|

| Customization Scope | Free report customization with purchase |

Argentina E-Hailing Market Segmentation:

- By Service Type

- Ride Sharing

- Ride Hailing

- Others

- By Device Type

- Smartphones

- Tablets

- Others

- By Vehicle Type

- Two-Wheeler

- Three-Wheeler

- Four-Wheeler

- Sedans

- SUVs

- Others

- By End-User Industry

- Personal (B2C)

- Corporations (B2B)

- By City

- Buenos Aires

- Córdoba

- Rosario

- Mendoza

- La Plata

Our Best-Performing Industry Reports:

Navigation:

- Argentina E-Hailing Market Size:

- Argentina E-Hailing Market Key Highlights:

- Argentina E-Hailing Market Overview & Scope

- Top Trends Shaping the Argentina E-Hailing Market

- Argentina E-Hailing Market Growth Drivers vs. Challenges

- Argentina E-Hailing Market Regional Analysis

- Argentina E-Hailing Market Key Development

- Argentina E-Hailing Market Scope:

- Our Best-Performing Industry Reports: