Report Overview

Brazil E-Hailing Market - Highlights

Brazil E-Hailing Market Size:

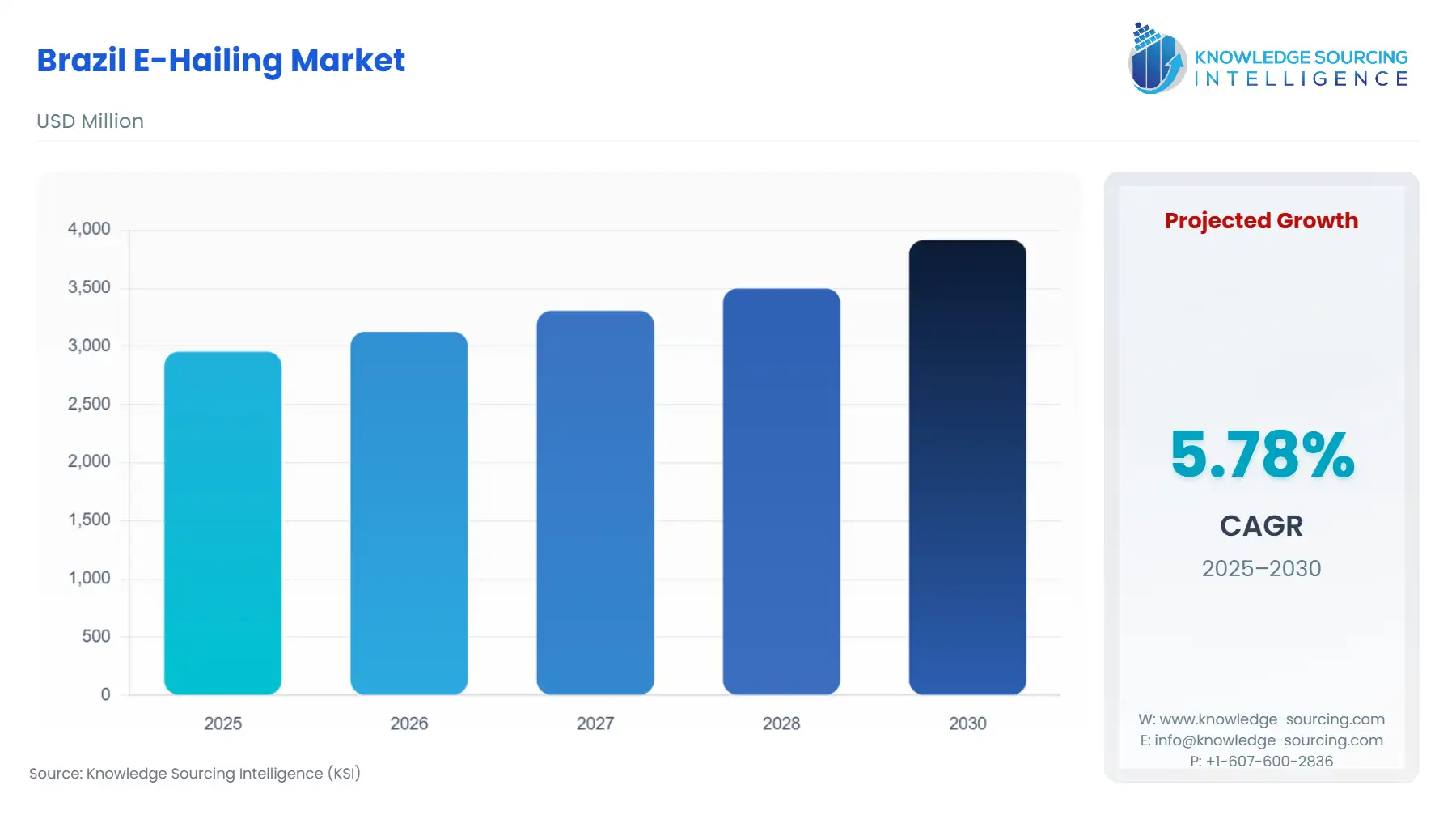

Brazil E-Hailing Market, sustaining a 5.78% CAGR, is anticipated to rise from USD 2.955 billion in 2025 to USD 3.914 billion by 2030.

Brazil's e-hailing market is growing steadily. Paddle through like Uber, 99, and inDrive make delivery integrated with mobility. Uber is further entrenching itself by partnering with food giant iFood, allowing users to book rides while ordering grocery or meal services from a single interface. In such a space, Uber Moto and 99 Moto have undoubtedly become flag-bearers of controversy by boldly operating in São Paulo without authorisation due to a ban, giving a clear aftermath on the tussle between governing authorities in sectors and these platforms. The market is built around convenience, legal complexity, and newer partnerships.

Brazil E-Hailing Market Overview & Scope

The Brazil E-Hailing Market is segmented by:

- By Service Type: The market is divided into segments by service type into ride sharing, ride hailing and others. Ride sharing offers the possibility for multiple group passengers travelling in the same direction to share a single ride and fare. It is also less harmful to the environment as it could help to reduce emissions and alleviate traffic congestion. Ride-hailing, on the other hand, gives one passenger access to a driver through an app, which gives a sense of privacy and provides a slightly faster ride than group travel. Others include peer-to-peer rentals and niche/unique mobility models, which are not classified within either of these two categories.

- By Device Type: The market is divided into segments by device type into smartphones, tablets and others. Smartphones are the primary device in this segment, and it can be argued that nearly all users utilise mobile apps to book, track and pay for rides. Smartphones are portable, and users generally have access to internet connectivity 24/7. Others include desktops or other types of in-car systems which serve an administrative function or other specialised accessibility needs.

- By Vehicle Type: The market is divided into segments by vehicle type: two-wheeled vehicle, three-wheeled vehicle, and four-wheeled vehicle. Four-wheeled vehicles are further divided into sedans, SUVs and others. Two-wheeled vehicles such as scooters and motorcycles are quite popular modes of transportation in dense urban markets. They are affordable and can typically cut through traffic.

- By End-User Industry: The market is segmented into personal (B2C) and corporate (B2B). Personal users account for the largest share, as millions of individuals book rides for commuting, shopping, and leisure daily.

- By Region: Geographically, the market is expanding at varying rates depending on the location.

Top Trends Shaping the Brazil E-Hailing Market

- Super-app integration:

- Uber and iFood have teamed up so users can book rides and order groceries or essentials all in one, simplifying mobility and delivery into a single tap.

- Payment innovation:

- InDrive has introduced fully embedded PIX payments through Open Finance, allowing customers the benefit of fast, secure, real-time account-to-account transactions in the app wallets, no cards, more freedom.

Brazil E-Hailing Market Growth Drivers vs. Challenges

Drivers:

- EV adoption is accelerating: EV adoption is kicking it into overdrive. App 99 is pushing sustainability by expanding its electric vehicle fleet and looking to double EVs within a year to appeal to eco-conscious riders and support Brazil’s green goals.

- Legal clarity on labour: Legal clarity around labour is finally taking shape. President Lula has introduced a bill that, once adopted, will stipulate a minimum wage, daily work hour limit, and social benefit entitlements for ride-hailing drivers, thus adding legitimacy and stability to the gig workforce.

Challenges:

- Driver dissatisfaction: Driver dissatisfaction over wages and benefits creates tension, threatening long-term workforce stability and service quality in Brazil’s e-hailing market.

Brazil E-Hailing Market Regional Analysis

The e-hailing market in Brazil is concentrated in urban states (e.g., São Paulo, Rio de Janeiro, and Minas Gerais), where high populations, traffic congestion, and increasing smartphone penetration among the citizens are driving demand for ride-hailing.

Brazil E-Hailing Market Key Development

- Uber and iFood have landed a strategic partnership in Brazil; beginning in the second half of 2025, iFood users can book an Uber ride from the iFood app, while Uber users can access iFood’s delivery services - from groceries to pharmacy items - through the Uber app. The integration represents a substantial evolution in consumer convenience and service bundling.

Brazil E-Hailing Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Brazil E-Hailing Market Size in 2025 | USD 2.955 billion |

| Brazil E-Hailing Market Size in 2030 | USD 3.914 billion |

| Growth Rate | CAGR of 5.78% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | São Paulo, Rio de Janeiro, Minas Gerais, Bahia, Paraná |

| List of Major Companies in the Brazil Arabia E-Hailing Market |

|

| Customization Scope | Free report customization with purchase |

Brazil E-Hailing Market Segmentation:

- By Service Type

- Ride Sharing

- Ride Hailing

- Others

- By Device Type

- Smartphones

- Tablets

- Others

- By Vehicle Type

- Two-Wheeler

- Three-Wheeler

- Four-Wheeler

- Sedans

- SUVs

- Others

- By End-User Industry

- Personal (B2C)

- Corporations (B2B)

- By City/ State

- São Paulo

- Rio de Janeiro

- Minas Gerais

- Bahia

- Paraná

Our Best-Performing Industry Reports:

Navigation:

- Brazil E-Hailing Market Size:

- Brazil E-Hailing Market Key Highlights:

- Brazil E-Hailing Market Overview & Scope

- Top Trends Shaping the Brazil E-Hailing Market

- Brazil E-Hailing Market Growth Drivers vs. Challenges

- Brazil E-Hailing Market Regional Analysis

- Brazil E-Hailing Market Key Development

- Brazil E-Hailing Market Scope:

- Our Best-Performing Industry Reports: