Report Overview

Asia-Pacific Antimony Market - Highlights

Asia-Pacific Antimony Market Size:

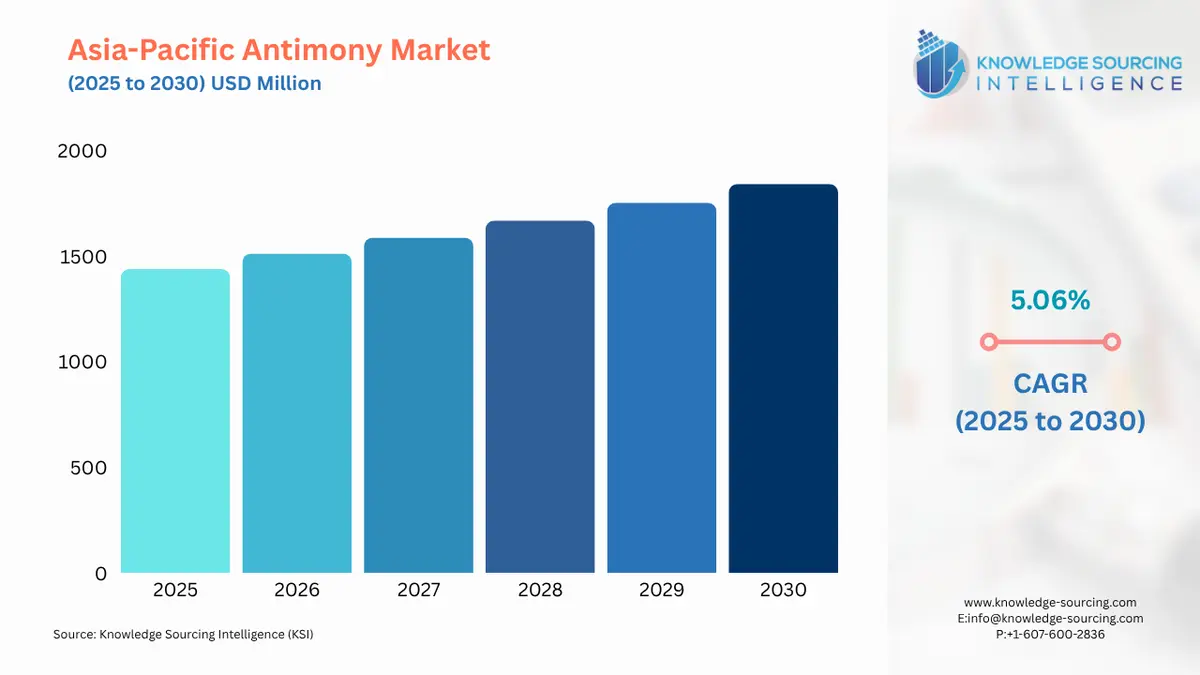

The Asia-Pacific Antimony Market is projected to expand at a CAGR of 5.06%, advancing from USD 1,438.694 million in 2025 to USD 1,841.431 million by 2030.

The Asia-Pacific antimony market is growing rapidly, supported by expanding demand in many sectors. The rise in the application of antimony in flame retardants, lead-acid batteries, and alloys primarily drove the growth. Antimony market challenges included supply chain interruptions and price volatility fueled by export policies. There is still a robust antimony market in the Asia-Pacific region, and the region continues to be a dominant player within the global supply chain, as China's dominance appears to be unchallenged.

Asia-Pacific Antimony Market Overview & Scope:

- Application: The market can be segmented by application into Flame Retardants, Lead-Acid Batteries, Alloys, Catalysts, and Others. Flame retardants account for the largest demand because antimony trioxide increases fire resistance in plastics, textiles, and electronics for both industrial and consumer applications to ensure safety and compliance with regulations.

- Form: The market can also be segmented by form, including Antimony Trioxide, Antimony Pentoxide, Alloys, and Others. Antimony trioxide is available in high purity and is cost-effective as a flame retardant. Usage of antimony trioxide is versatile as part of biocide and chemical production processes. As such, antimony trioxide is favoured as a multiple end-user industrial application for safer alternatives.

- End-User Industry: The market can also be segmented by end-user industry: Chemicals, Automotive, Electronics, Industrial Manufacturing, and Others. The automotive industry is the largest consumer using antimony in lead-acid batteries, as well as in alloys and components of engines to improve the durability, efficiency, and performance of vehicles.

- Region: Geographically, the market is expanding at varying rates depending on the location.

Top Trends Shaping the Asia-Pacific Antimony Market:

-

Growing Demand for Flame Retardants

- Elevated safety standards across electronics, textiles, and construction sectors are driving antimony trioxide consumption. Its utility in enhancing flame resistance concurrently with environmental regulations renders it a necessity for producers targeting regulatory compliance and consumer safety.

-

Expansion of Lead-Acid Battery Applications

- The automotive sector, more specifically electric vehicles, is stimulating the consumption of lead-acid batteries. Antimony enhances plate performance, corrosion resistance and overall lifetime; thus, it is important for automotive and industrial battery applications in the region

Asia-Pacific Antimony Market Growth Drivers vs. Challenges:

Drivers:

- Rapid Industrialisation and Urbanisation: Growth in antimony-based products, particularly flame retardants, alloys and catalysts, is driven by rapid industrial growth, urban expansion, and infrastructure development in the Asia Pacific. The increased benefit of flame retardants, alloys, and catalysts in construction, electronics or manufacturing sectors, as well as new investments in renewable energy, automotive production, and packaging, have further increased consumption of antimony products.

- Increasing Adoption in Automotive and Electronics Sectors: The growth of electric vehicles, general automotive production, and high-tech electronics is driving demand for antimony through various performance improvements. Antimony improves the overall performance of batteries, durability of alloys, and reliability of electronics. As countries like China, India, and Japan continue to expand industrial and economic markets, the demand for antimony increases, creating recurring opportunities.

Challenges:

- Supply Concentration and Price Volatility: Antimony production is concentrated within a few countries, which creates vulnerabilities, supply chain disruptions, and price volatility. This affects planning for manufacturers, and additional production costs may be incurred, which limits consistent availability of raw materials in industrial or commercial applications.

Asia-Pacific Antimony Market Regional Analysis:

- China: China is one of the chief suppliers of antimony in the Asia-Pacific markets, supplying domestic and export opportunities. High demand due to fire retardant materials, lead acid batteries, alloys, and production that is supported by government political strength and the use of more advanced and refined technologies has continued to support output and production.

List of Top Asia-Pacific Antimony Companies:

- Yunnan Tin Company

- China Northern Rare Earth Group High-Tech Co.

- Hunan Nonferrous Metals Corporation

- Huachang Antimony Industry

- Hsikwangshan Twinkling Star Co., Ltd.

Asia-Pacific Antimony Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 1,438.694 million |

| Total Market Size in 2031 | USD 1,841.431 million |

| Growth Rate | 5.06% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Application, Form, End-User Industry, Geography |

| Geographical Segmentation | Japan, China, India, South Korea, Taiwan, Others |

| Companies |

|

Asia-Pacific Antimony Market Segmentation:

By Application:

The market is analyzed by application into the following:

- Retardants

- Lead-Acid Batteries

- Alloys

- Catalysts

- Others

By Form:

The market is analyzed by form into the following:

- Antimony Trioxide

- Antimony Pentoxide

- Alloys

- Others

By End-User Industry:

The market is analyzed by end-user industry into the following:

- Chemicals

- Automotive

- Electronics

- Industrial Manufacturing

- Others

By Geography:

The study also analyzed the Asia-Pacific antimony market into the following regions, with country level forecasts and analysis as below:

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Others