Report Overview

Automotive Adhesive Tape Market Highlights

Automotive Adhesive Tape Market Size:

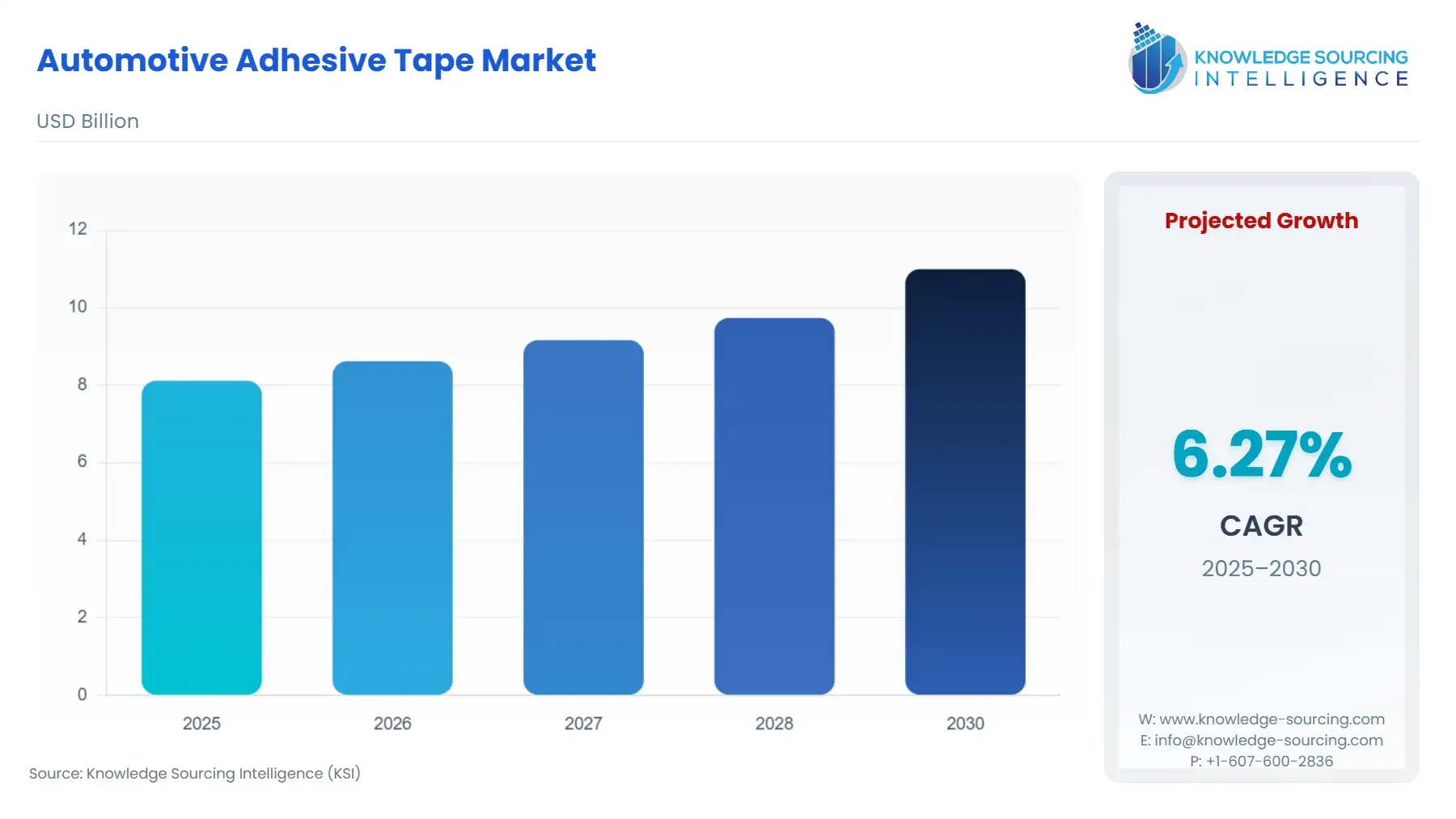

The Automotive Adhesive Tape Market will reach US$10.994 billion in 2030 from US$8.113 billion in 2025 at a CAGR of 6.27% during the forecast period.

The global automotive adhesive tape market is undergoing a profound structural transformation, transitioning from a primarily interior and trim-focused commodity market to a high-value, performance-critical component sector indispensable for the modern electric and autonomous vehicle architecture. This shift is not merely linear growth but a radical change in the function of adhesive tape, which has evolved from simple mounting to performing complex engineering roles—namely, thermal management, electromagnetic shielding, and NVH (Noise, Vibration, and Harshness) reduction. The market's current trajectory is inextricably linked to the pace of automotive electrification and the concurrent adoption of advanced manufacturing processes that prioritise weight reduction, material diversity, and enhanced in-cabin air quality. Manufacturers who successfully pivot their research and development toward high-performance, sustainable, and regulatory-compliant tape formulations are positioned to capture the accelerating demand curve for these sophisticated bonding solutions.

Automotive Adhesive Tape Market Analysis:

Growth Drivers

The market expansion is directly propelled by the imperative for vehicle lightweighting across all major automotive-producing regions. Global emission mandates compel OEMs to adopt mixed-material chassis constructions, utilising aluminium and composites, which are difficult to join using traditional welding or bolting. Adhesive tapes provide a high-performance, durable bond for dissimilar substrates, directly replacing heavier mechanical fasteners and thus decreasing the vehicle's curb weight. Concurrently, the proliferation of the Electric Vehicle (EV) segment amplifies demand for highly specialised tape solutions. The high-voltage battery system requires tapes for thermal management (thermally conductive tapes), electrical insulation (dielectric tapes), and cell-to-module securing, where their application ensures structural integrity and mitigates the risk of thermal runaway events, an application wholly absent in Internal Combustion Engine (ICE) vehicles. Furthermore, the US administration's move toward higher tariffs on imported speciality chemicals creates price volatility in the global supply chain, which, counterintuitively, forces domestic manufacturers in key markets to prioritise high-value, performance-based tape solutions with higher margin stability, channelling investment into the premium, EV-centric segments.

Challenges and Opportunities

The primary constraint facing the industry is the escalating regulatory pressure concerning Volatile Organic Compounds (VOCs) in vehicle interiors, which forces a costly reformulation and revalidation cycle for established solvent-based products. This directly suppresses demand for incumbent chemistries and necessitates significant capital expenditure in low-VOC manufacturing processes. However, this challenge simultaneously creates a massive opportunity: the accelerating market shift toward water-based and hot-melt (solvent-free) pressure-sensitive adhesives (PSAs). Manufacturers who successfully develop high-adhesion, low-VOC acrylic and synthetic rubber systems achieve a key competitive differentiator, particularly in Asia-Pacific and Europe, where regulatory enforcement is rigorous. A secondary opportunity lies in the burgeoning market for electromagnetic compatibility (EMC) shielding tapes and acoustic damping materials. The dense concentration of electronics and silent operation of EVs amplify the need for sophisticated shielding and Noise, Vibration, and Harshness (NVH) mitigation, generating new, high-margin revenue streams for performance-tape specialists.

Raw Material and Pricing Analysis

The Automotive Adhesive Tape market is acutely sensitive to pricing volatility in key petrochemical derivatives, as raw materials—primarily synthetic polymers for the backing and adhesive components—constitute a substantial portion of the total production cost. The dominant adhesive chemistries, including acrylics (for high-performance and weather resistance) and synthetic rubber (for initial tack and cost efficiency), are direct derivatives of crude oil and natural gas feedstock, linking their pricing dynamics to global energy markets. The supply of speciality resins, plasticisers, and release liners (silicone-coated films) is concentrated in specific industrial chemical hubs, making the supply chain vulnerable to geopolitical and logistical bottlenecks. Recent trade actions, such as the reciprocal increase of US tariffs on Chinese-sourced chemical inputs—including specific acrylic monomers—compress the operating margins of US and European tape converters who rely on these global supply flows. This disruption drives up material costs and pushes OEMs to qualify alternative, locally-sourced raw materials or adopt more efficient, thin-gauge film constructions to mitigate the inflationary pressures.

Supply Chain Analysis

The global supply chain for automotive adhesive tape is structured as a complex, multi-tiered network originating from commodity chemical producers and culminating at OEM assembly lines. The foundational raw materials—polymer films (PET, PVC, Polyimide), acrylic monomers, and synthetic rubbers—are globally sourced, with significant production concentration in Northeast Asia (China, Japan, South Korea) and Central Europe. Asia-Pacific serves as the critical production hub for both raw material intermediates and finished tape conversion, offering scale and cost advantages. Logistical complexity arises from the need to transport temperature-sensitive, high-precision coated jumbo rolls globally to regional slitting/die-cutting operations (Tier 2/Tier 3) before they reach the Tier 1 interior and exterior component suppliers. The sector's major dependency lies in the reliable, uninterrupted flow of specialised acrylic and rubber resin feedstocks; any interruption in maritime freight or imposition of trade duties directly translates to lead time extensions and cost escalations, forcing major Western converters to invest in regionalising production or establishing dual-sourcing strategies to de-risk key inputs.

Government Regulations

Key global governmental and quasi-governmental regulations directly influence the material composition and demand for automotive adhesive tapes, primarily by mandating environmental, health, and safety compliance.

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

China |

GB 33372-2020 (Limitation of Volatile Organic Compounds (VOCs) in Adhesives) |

Directly suppresses the demand for conventional solvent-based tapes and creates a massive, regulatory-driven demand shift toward compliant, low-VOC water-based and hot-melt adhesive tapes, particularly for interior applications like headliners and instrument panels. |

|

European Union |

REACH Regulation (Registration, Evaluation, Authorisation and Restriction of Chemicals) |

Mandates rigorous testing and phase-out of substances of very high concern (SVHCs), including certain plasticizers and solvents common in PVC and rubber-based tapes. This compels manufacturers to invest in new, compliant raw material substitutions, raising R&D costs but driving innovation in safer tape chemistries. |

|

United States |

FMVSS 302 (Flammability of Interior Materials) / NHTSA |

Critical for all interior tapes, especially as they relate to seat assemblies and acoustic dampeners. The rise of EV battery systems introduces further demand for specialized flame-retardant (FR) tapes with UL or similar ratings, which must perform dual roles of electrical insulation and fire safety. |

|

Global |

End-of-Life Vehicles (ELV) Directive |

Although European in origin, the principles drive global design for recyclability. This impacts tape formulation by requiring easy de-bond/separability from substrates, promoting the use of tapes that simplify vehicle dismantling and material recovery, thus altering adhesive chemistry selection. |

Automotive Adhesive Tape Market Segment Analysis:

By Application: Electronics Segment Demand Analysis

The Electronics segment, encompassing everything from advanced driver-assistance systems (ADAS) sensors to large-format cabin displays, is one of the most technologically demanding and rapidly growing application areas for automotive adhesive tapes. The demand driver is not merely volume but precision and functional performance. The proliferation of ADAS features—Lidar, Radar, and camera modules—requires specialised, thin-gauge, and optically clear adhesive (OCA) tapes for securely bonding lens elements and protecting sensitive electronic Printed Circuit Boards (PCBs) from moisture and thermal shock. This application requires extreme dimensional stability, as tape failure can directly compromise sensor accuracy and vehicle safety system integrity. Furthermore, the integration of large, curved, and flexible OLED/LCD touchscreens in vehicle interiors creates demand for thermally conductive tapes and electrically conductive (EMI/RFI shielding) tapes. These tapes manage the significant heat generated by high-power processors and protect sensitive electronics from electromagnetic interference produced by the vehicle’s high-voltage power system, especially in EVs. The increasing thermal and electrical density of automotive electronics mandates an adhesive tape solution that can perform insulation, bonding, and thermal management functions simultaneously, accelerating the shift away from generic mounting tapes toward multi-functional, engineered film-backed products.

By Backing Material: Polyvinyl Chloride (PVC) Segment Demand Analysis

The Polyvinyl Chloride (PVC) backing material segment holds a strong historical position, largely driven by its use in wire harnessing applications, where its unique combination of conformability, flame-retardant properties, and excellent abrasion resistance remains a critical demand driver. PVC tapes, particularly those with a plasticised formulation, conform easily to complex wire bundle shapes, offering superior mechanical protection and electrical insulation across the entire cable network of the vehicle. This application is foundational across ICE, Hybrid, and EV platforms. However, the future demand trajectory for traditional PVC tapes is bifurcated by two powerful opposing forces. On one hand, the escalating complexity of wiring in connected and autonomous vehicles—including higher data rates and greater cable length—maintains a high volume demand for harness wrapping. On the other hand, strict global regulations, such as the EU's REACH mandates, increasingly scrutinise the use of certain plasticisers in PVC, creating an inevitable, regulatory-induced headwind. This forces manufacturers to seek out innovative, non-phthalate plasticisers or pivot to alternative, high-performance backings like polyethene terephthalate (PET) film-based tapes that deliver equal or superior temperature and abrasion resistance without the regulatory compliance overhead. The market success of the PVC segment now hinges on the swift adoption of sustainable, compliant formulations.

Automotive Adhesive Tape Market Geographical Analysis:

US Market Analysis (North America)

Demand in the US market is predominantly driven by the rapid, federally-incentivised growth of Electric Vehicle (EV) production and a strong focus on advanced manufacturing for structural bonding. The increasing production capacity from established OEMs and new market entrants focused on battery electric trucks and SUVs has created a disproportionately high demand for high-performance, thick-gauge double-sided foam and acrylic tapes used in exterior panel attachment, battery pack sealing, and acoustic damping. The rigorous safety requirements of the National Highway Traffic Safety Administration (NHTSA) for crash protection and occupant safety drive the adoption of very high-bond (VHB) acrylic foam tapes that can replace welds and rivets in non-structural and semi-structural areas, distributing stress and enhancing energy absorption upon impact. Furthermore, a highly competitive automotive aftermarket maintains a steady demand for speciality body repair and customisation tapes, contributing to the overall market stability. The demand is highly concentrated in states with high manufacturing activity and major EV production hubs, where tape manufacturers are investing in localised technical support and supply to meet "Just-in-Time" OEM requirements.

Brazil Market Analysis (South America)

The Brazilian automotive adhesive tape market is primarily governed by the output of its established, domestically focused production base, dominated by manufacturers of flex-fuel and mid-range ICE vehicles. The core demand is rooted in high-volume, cost-competitive applications for interior assembly (headliners, trim, seat fastening) and general-purpose wiring harness wrapping. Demand growth is closely correlated with ANFAVEA's (Associacao Nacional dos Fabricantes de Veiculos Automotores) production and sales figures, which show resilience despite volatility, particularly in light commercial vehicles. Unlike North America and Europe, the regulatory push for lightweighting and EV adoption is nascent but accelerating, driven by government incentives for new energy vehicles. Consequently, the immediate demand for high-end, thermally-conductive tapes is limited, with the market favouring proven, cost-effective solutions such as mass-produced single-sided cloth and PVC tapes. The future growth trajectory relies heavily on the success of localised production mandates and the eventual large-scale transition of the domestic fleet to electric and hybrid technologies, which will fundamentally shift the application-mix toward high-performance materials.

Germany Market Analysis (Europe)

The German market, representing the epicentre of European premium and luxury automotive manufacturing, focuses demand on precision-engineered, high aesthetic, and acoustic-performance tapes. The German OEMs' traditional emphasis on NVH (Noise, Vibration, and Harshness) reduction is a core demand driver, leading to high consumption of advanced foam-based damping and acoustic sealing tapes for door panels, body cavities, and dashboards. The stringent emissions targets enforced by the European Union and the rapid ramp-up of luxury EV production necessitate a high volume of structural bonding tapes for the multi-material construction of lightweight chassis and high-voltage battery enclosures. Germany's adherence to the REACH regulation also imposes severe constraints on the supply side, creating a preference for fully compliant, low-emission tape systems. The market is characterised by a strong emphasis on automation; thus, demand prioritises die-cut, pre-cut, and automated application-ready tape solutions that seamlessly integrate into the highly mechanised production lines of major German automotive plants.

South Africa Market Analysis (Middle East & Africa)

The South African market serves as a crucial export-oriented manufacturing hub for global OEMs, primarily focusing on component manufacturing and assembly for light passenger vehicles. This market’s demand structure is unique: it is driven by international specifications and quality standards, not purely local consumption. As such, the demand profile is dual-layered, consisting of a stable base for traditional general-purpose masking and protection tapes used during the manufacturing and painting processes, coupled with a growing requirement for globally compliant performance tapes. The increasing export of vehicles to Europe, where low-VOC and ELV compliance is mandatory, is indirectly raising the local demand for sophisticated adhesives and tapes that meet these international standards, even if the domestic regulatory environment is less stringent. The overall market size is smaller than in the major regions, but its strategic importance in the export value chain ensures a sustained demand for tapes used in critical assemblies, such as sealing, trim attachment, and wire harnessing, compliant with global OEM specifications.

China Market Analysis (Asia-Pacific)

China is the single largest and fastest-growing market for automotive adhesive tape, driven by its unparalleled scale in both ICE and New Energy Vehicle (NEV) production. The demand curve is steepened by two primary factors: the sheer volume of vehicle output and the country's aggressive push for technological self-reliance in the NEV supply chain. The implementation of strict indoor air quality standards, such as the GB 33372-2020 for VOCs, is the most powerful demand-shifter, creating immediate obsolescence for non-compliant solvent-based tapes and mandating the wholesale adoption of high-performance water-based acrylics and low-VOC hot-melt systems for interior applications. Furthermore, the massive production of EV batteries generates exponential demand for high-temperature, flame-retardant Polyimide and PET-backed tapes for cell and module winding, insulation, and busbar protection. The local market is highly price-competitive, but the premium segment, serving high-end NEV and Autonomous Driving components, commands strong growth for highly technical, imported, or domestically-developed speciality tapes that meet stringent performance and reliability metrics.

Automotive Adhesive Tape Market Competitive Environment and Analysis:

The Automotive Adhesive Tape market is characterised by a high degree of integration, with a limited number of global chemical and materials giants controlling the core adhesive and film technologies. Competition hinges on R&D capacity, global manufacturing footprints, and the ability to rapidly formulate application-specific, regulatory-compliant products, particularly those tailored for EV and ADAS integration. Major competitive advantages are derived from backward integration into proprietary polymer and adhesive synthesis, allowing for cost control and customised formulation.

Henkel AG & Co. KGaA

Henkel is strategically positioned as a comprehensive materials solutions provider, leveraging its global footprint and deep expertise in structural adhesives to provide complementary high-performance tapes and thermal management films. The company's competitive advantage lies in its Loctite and Teroson brands, which deliver a cross-portfolio approach encompassing liquid adhesives, sealants, and functional tapes for complex EV battery and body-in-white applications. Henkel focuses on materials that address the most critical performance challenges of electrification: thermal runaway protection and lightweight bonding. Verifiable product focus includes high-performance acrylic foam tapes engineered for body panel attachment and specialised dielectric/thermal barrier tapes for module-to-module insulation within high-voltage battery packs, ensuring they meet the strictest automotive safety standards and thermal management requirements. Their strategy is to offer integrated system solutions that shorten OEM development cycles for new vehicle platforms.

Avery Dennison Corporation

Avery Dennison maintains a strong competitive position as a leading global manufacturer of pressure-sensitive materials, focusing heavily on its core expertise in speciality films and innovative adhesive coatings. The company strategically targets the high-growth, high-value segments of acoustic performance and interior aesthetics. A key verifiable focus is their portfolio of multifunctional automotive foam and fibre bonding tape solutions, launched in 2024, specifically developed to address the amplified Noise, Vibration, and Harshness (NVH) issues prevalent in silent EVs. These products utilise proprietary adhesive formulations to offer superior dampening and void-filling capabilities for interior assemblies (e.g., door panels, pillar trims) while complying with stringent interior air quality standards. Avery Dennison's primary strategic vector is innovation in sustainable and low-VOC chemistries, catering to OEM demand for environmentally responsible and occupant-health-conscious interior materials.

DIC Corporation

DIC Corporation is a formidable competitor, leveraging its comprehensive mastery of chemical synthesis and global production capabilities, particularly in the Asia-Pacific region. The company's competitive strength is rooted in its integrated supply chain, spanning from raw material resins to finished, die-cut products. DIC's DAITAC industrial adhesive tapes division actively focuses on speciality tapes for the electronics and automotive sectors. A verifiable product emphasis is placed on their Low VOC & Odour Double-coated Tape AD-140E and Waterproof Double-coated Tapes (#84 Series). This strategic focus directly addresses two of the market's most critical demand imperatives: meeting China's stringent VOC regulations for interior components and providing robust sealing and waterproofing solutions for demanding exterior and electronic assemblies, such as camera modules and exterior lighting units. DIC's strategy is to rapidly scale its compliant, high-performance product lines through its extensive network across Asia, capitalising on the region’s massive, accelerating volume growth in EV production.

Automotive Adhesive Tape Market Recent Developments:

April 2025: Henkel Announced New Mica Replacement Safety Coatings and Structural Adhesive Debonding Technologies

Henkel AG & Co. KGaA, through official corporate announcements, disclosed the launch of new, advanced material solutions specifically engineered for next-generation electric vehicle battery systems. The development includes Mica replacement safety coatings and innovative structural adhesive debonding technologies, which are offered in film and tape formats alongside liquid applications. This strategic move is a direct response to the urgent OEM demand for enhanced passive safety within battery packs, aiming to prevent thermal runaway propagation. The mica-replacement films provide superior thermal and dielectric barrier properties, while the debonding technologies facilitate the easier repair, recycling, and end-of-life separation of adhesively bonded battery components, positioning Henkel at the forefront of the circular economy mandate within the EV supply chain.

Automotive Adhesive Tape Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Automotive Adhesive Tape Market Size in 2025 | US$8.113 billion |

| Automotive Adhesive Tape Market Size in 2030 | US$10.994 billion |

| Growth Rate | CAGR of 6.27% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Automotive Adhesive Tape Market |

|

| Customization Scope | Free report customization with purchase |

Automotive Adhesive Tape Market Segmentation:

By Backing Material:

- Polyvinyl Chloride

- Polyethylene Terephthalate

- Polyamide

- Others (e.g., Cloth, Paper, Foam)

By Coating Technology:

- Solvent-based

- Hot-Melt based

- Water-based

- Others (e.g., UV-cured, Radiation-cured)

By Application:

- Electronics

- Exterior (e.g., Trim, Body Panel Attachment, Lighting)

- Interior (e.g., Headliners, Carpets, Seating, NVH)

- Others (e.g., Wire Harnessing, Temporary Protection)

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- The Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Japan

- Others