Report Overview

Automotive and Electronics Antimony Highlights

Automotive and Electronics Antimony Alloys Market Analysis:

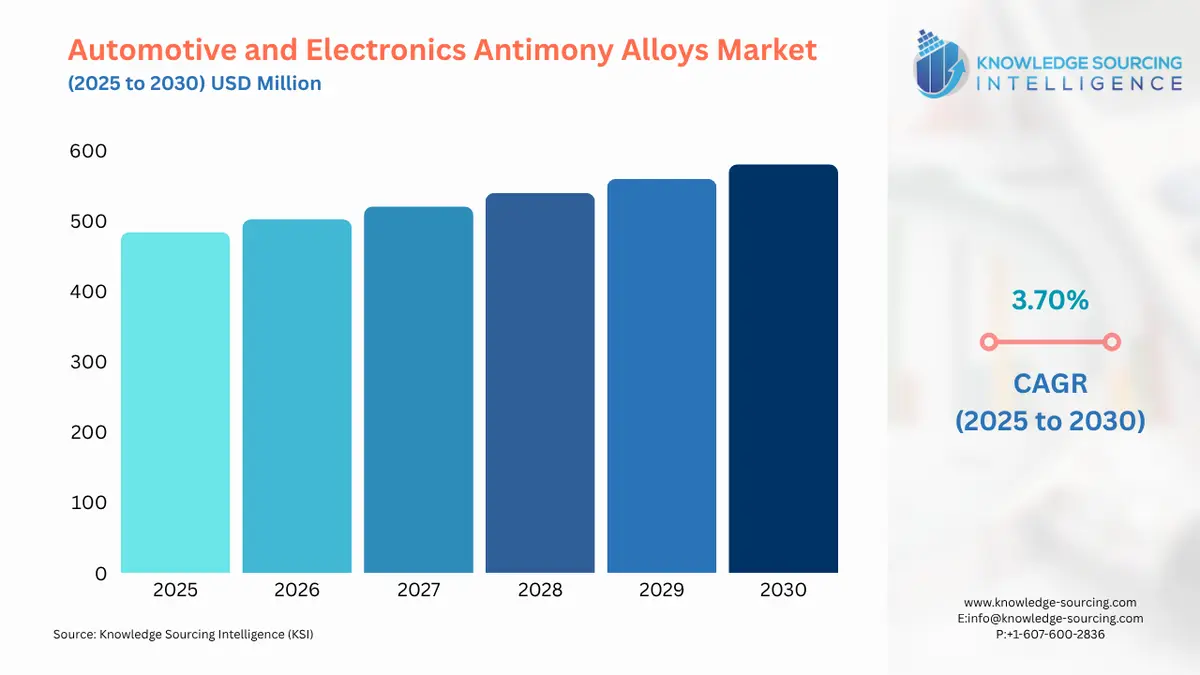

The Automotive and Electronics Antimony Alloys Market is expected to grow at a CAGR of 3.70%, reaching USD 580.627 million in 2030 from USD 484.176 million in 2025.

Automotive and Electronics Antimony Alloys Market Key Highlights:

- Increasing use of antimony alloys in automotive batteries and components is strengthening their role in both conventional and electric vehicles.

- Continuous innovation in alloy compositions is enhancing conductivity, durability, and thermal stability, expanding applications in advanced electronics and industrial equipment.

Antimony alloys are important materials for producing high-performance automotive batteries and electronic devices because of their hardness, corrosion resistance, and unique thermal and electrical conductivities. In automotive applications, antimony alloys are added to battery plates, bearings and other auto parts, leading to higher performance, improved durability, and overall longevity of the automotive components. In electronics, they are used in solders, connectors, and semiconductor devices for reliable performance. It is anticipated that the increase in usage from high-performance automotive batteries, electric vehicles, and electronics using antimony alloys will be significant. Antimony alloy technology is evolving with new alloy compositions and processing practices for potential applications across all sectors.

Automotive and Electronics Antimony Alloys Market Analysis Overview & Scope:

- Alloy Type: By alloy type, the market will be segmented as Lead-Antimony alloys, Tin-Antimony alloys, and Copper-Antimony alloys. Lead-antimony alloys are the largest volume because of their outstanding resistance to corrosion, mechanical strength, and conductivity properties. Lead-antimony alloys are particularly important in automotive applications such as lead-acid battery plates, as well as many other components in vehicles that require excellent durability in application to high stress (work).

- Application: By application, the market will be segmented as Automotive Components, Electronics & Electrical Equipment, and Machinery & Commercial Applications. Automotive Components is the top application market for antimony alloys because they improve the functionality of vehicle battery reliability, durability of engine and bearing parts, and long-term operational reliability of each vehicle over time, both for conventional power trains and electric power trains.

- End-User Industry: By end-user industry, the study will be segmented as Automotive, Electrical and Electronics, Industrial, and Other. The end-user industry with the largest usage is the Automotive industry, because antimony alloys are required for every vehicle or automotive battery, information, electronic, or electrical systems. The use of antimony alloys will ensure the safety of vehicle operation, longevity of the vehicle product, and the vehicle's performance under the various balance of operational use and environment in which the performance of the vehicle or product is performed.

- Region: Geographically, the market is expanding at varying rates depending on the location.

Top Trends Shaping the Automotive and Electronics Antimony Alloys Market Analysis:

-

Rise of Electric Vehicles (EVs)

- The increased use of electric vehicles has increased demand for high-performance lead-antimony alloys used in battery plates and components. Antimony alloys allow for better charge holding ability, life span and efficiency, and have become critical components in EV batteries and helping in the global transition towards more sustainable automotive technologies.

-

Miniaturisation and Advanced Electronics

- Electronics are getting smaller and have more power, which demands antimony alloys to exhibit better conductivity and thermal stability. Antimony alloys help manufacturers move more reliable parts to their consumers, including all types of connectors, thermal pads, semiconductors, and solder applications, while enabling innovation in making robust, energy-efficient devices.

Automotive and Electronics Antimony Alloys Market Analysis: Growth Drivers vs. Challenges:

Drivers:

- Expansion of Automotive Sector: As vehicle production increases, especially in emerging markets, consumption of antimony alloys continues to grow in battery plates, bearings, and engine components. With better durability, corrosion resistance, and mechanical strength, the antimony alloys have added additional importance for the automotive market for both conventional and electric vehicles.

- Growth in Consumer Electronics and Industrial Applications: As demand for smartphones, computers, and other industrial machinery grows, consumption of antimony alloys is expected to increase. Antimony alloys can provide electrical conductivity, thermal stability, and durability to ensure safe and reliable performance in high-stress environments, thus encouraging electronics and industrial manufacturers to use antimony alloys in their applications.

Challenges:

- Supply Concentration and Price Volatility: Antimony is garnered from only a few nations around the world, so demand volatility driven by geopolitical issues exporting countries place on their supply chains greatly impacts antimony's availability. Price volatility can increase manufacturing costs for end users, reduce market stability, and limit growth potential for end users that demand consistency of supply of lead-antimony alloys from manufacturers.

Automotive and Electronics Antimony Alloys Market Analysis: Regional Analysis:

- Asia-Pacific: Asia-Pacific leads the antimony alloys market due to high automotive production, rapid electronics manufacturing, and growing EV adoption. China dominates production and consumption, supplying both domestic and international demand. Investments in advanced battery technologies, industrial machinery, and electronic components drive continuous growth, while government initiatives promoting innovation and manufacturing infrastructure further strengthen the region’s position as a critical hub for antimony alloy supply and consumption.

Automotive and Electronics Antimony Alloys Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 484.176 million |

| Total Market Size in 2031 | USD 580.627 million |

| Growth Rate | 3.70% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Alloy Type, Application, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Automotive and Electronics Antimony Alloys Market Analysis Segmentation:

By Alloy Type:

The market is analyzed by alloy type into the following:

By Application:

The market is segmented by application into the following:

- Automotive Components

- Electronics & Electrical Equipment

- Industrial Machinery

By End-User Industry:

The market is segmented by end-user industry into the following:

- Automotive

- Electronics

- Industrial

- Others

By Geography:

The study also analyzed the automotive and electronics antimony alloys market into the following regions, with country-level forecasts and analysis as below:

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Others