Report Overview

Automotive Hydraulic System Market Highlights

Automotive Hydraulic System Market Size:

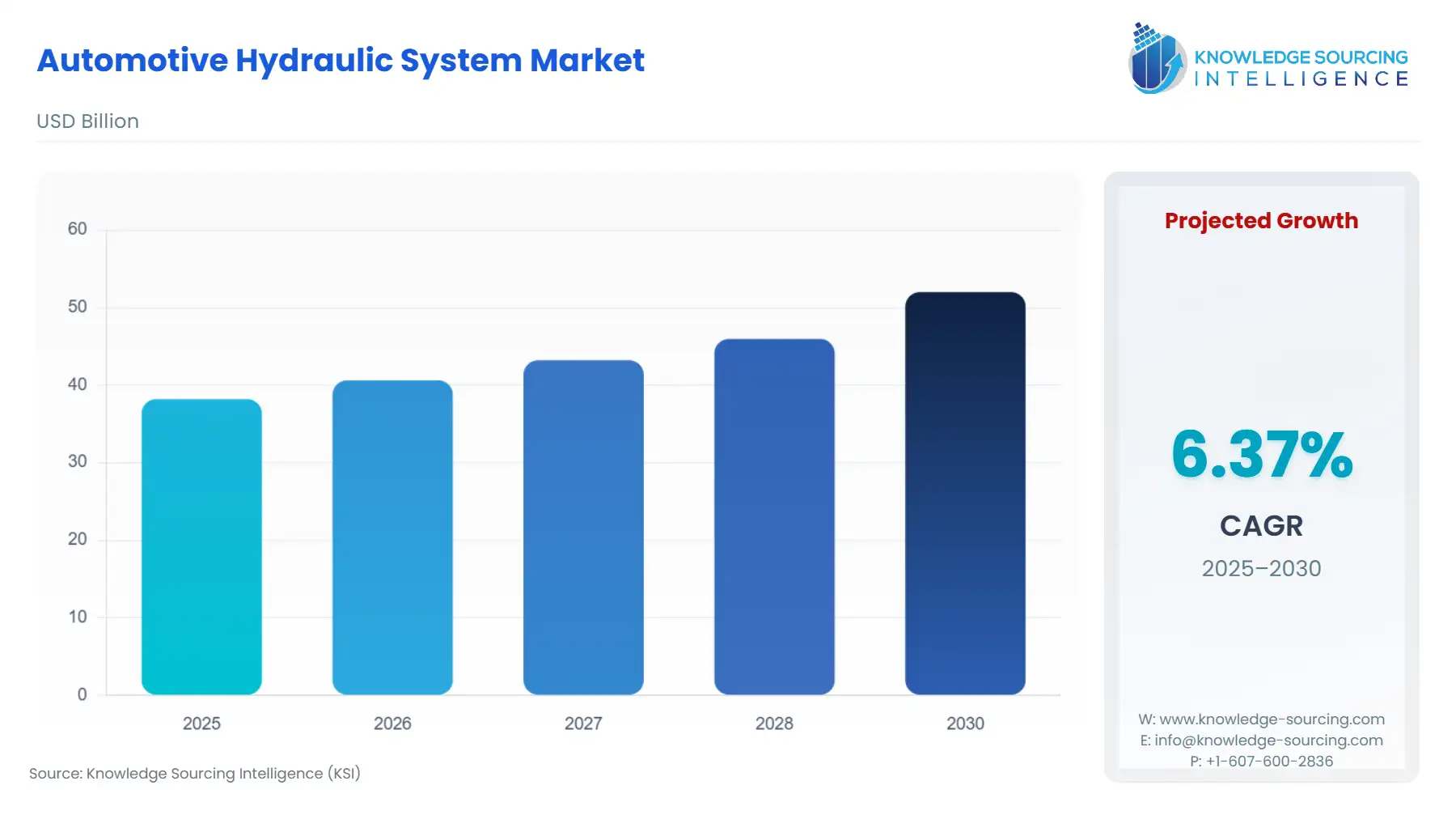

The automotive hydraulic system market is predicted to grow at a CAGR of 6.31%, reaching US$52.008 billion in 2030 from US$38.195 billion in 2025.

A hydraulic system uses fluid power to adjust speed and acceleration dynamically. It is mainly used in the automotive sector for various applications, such as steering, brakes, and active suspension. The ongoing adoption of modern technological approaches to enhance overall vehicle performance has provided a new scope for the hydraulic systems market.

Moreover, the growing prevalence of car accidents, followed by investments to bolster innovations in brakes and power steering, has further stimulated market growth. Major automotive manufacturers have formed strategic tie-ups with major players to bolster their vehicles' safety, energy efficiency, and performance, which has led to an upward market trajectory. However, despite their performance benefits, the high cost of production is expected to act as a major market restraint, hampering the overall expansion.

Automotive Hydraulic System Market Growth Drivers:

- Growing technological adoption to bolster vehicle performance has accelerated the market expansion.

Hydraulic systems have become a key aspect for automotives since they find usage in many systems, ranging from active suspension and brake-by-wire to power steering. The automotive sector's shift toward new technology to enhance vehicle performance and address current dynamics has opened up growth opportunities for hydraulic systems.

Various major companies are forming strategic collaborations to promote their hydraulic systems. For instance, in September 2023, Continental AG formed a strategic partnership with DeepDive to develop hydraulic drive and brake components that will be directly mounted on wheels. The partnership will have the technical expertise of both players in the brake system. Likewise, in May 2022, Nexteer Automotive and Continental expanded their CNXMotion’s “Brake-To-Steer” technology to improve safety redundancies across electric power steering applications.

- The growing prevalence of road accidents has bolstered the demand for automotive hydraulic systems.

Hydraulic systems assist in maintaining the vehicle’s stability by controlling the wheel’s vertical displacement through active suspensions. Moreover, they attain the desired vehicle speed by adjusting the brake pressure. Various technologies are currently being used in automobiles to improve comfort and security. With the growing prevalence of vehicle crashes and road accidents, the demand for such technologies, including hydraulic systems, is poised for a positive expansion.

According to the Ministry of Road Transport and Highways, in 2022, road accidents reached 4,61,312, representing an 11.9% growth in accidents. The same sources also specified that the number of injuries reached 4,43,366 and deaths at 1,68,491, which experienced an increase of 15.3% and 9.4%, respectively. Likewise, according to the Federal Statistical Office, in 2023, road accident fatalities reached 2,839, representing a 1.8% increase over the numbers reported in the preceding year.

Automotive Hydraulic System Market Segment Analysis:

- Brakes are expected to account for a considerable market share.

Application-wise, the automotive hydraulic system market is analyzed into brakes, steering, and shock absorbers. Brakes are expected to constitute a considerable market share since hydraulic brake systems have formed a cornerstone of modern vehicles. They generate forces that are higher than other braking systems and can easily decelerate vehicle speed without losing overall stability.

Likewise, steering is estimated to grow steadily, fueled by technical collaborations and ongoing investments to improve vehicle balance and control at different speed levels, especially at low speeds. Absorbers are also poised for positive expansion during the given timeframe.

- Passenger vehicles will hold a considerable market share.

Based on vehicle type, the automotive hydraulic system market is divided into passenger vehicles, light commercial vehicles, and medium & heavy commercial vehicles. Passenger vehicles are projected to account for a remarkable share, fueled by the growing demand for family-oriented vehicles.

Moreover, growing disposable income and rapid urbanization have increased the production and sales of such vehicle types. For instance, according to the International Organization of Motor Vehicle Manufacturers (OICA), in 2023, global passenger vehicle production stood at 68.020 million units, representing a 10.5% growth over the 2022 production volume. The same source also stated that passenger vehicle sales experienced a 12.3% growth in 2023.

Automotive Hydraulic System Market Geographical Outlook:

- Asia Pacific will show significant growth during the forecast period

Geography-wise, the automotive hydraulic system market is segmented into North America, South America, Europe, the Middle East and Africa, and the Asia Pacific. The APAC region is expected to account for a remarkable portion of the market as it houses major automotive manufacturing nations, namely China, Japan, India, and South Korea. These countries have experienced significant growth in production capacity over the past couple of years.

OICA data states that in 2023, automotive production in the Asia Pacific reached 55.11 million units, accounting for nearly 58% of the global production volume. Production in China reached 30.160 million units, showcasing an 11.6% growth, whereas production in India, Japan, and South Korea experienced growth of 7.3%, 14.8%, and 13.1%, respectively.

North America is estimated to show significant growth fueled by the establishment of hydraulic hose and brake production plants in regional economies, namely the United States and Mexico. Likewise, the European region is projected to show constant growth during the time frame.

Automotive Hydraulic System Market Key Development:

- In June 2024, Tenneco launched a highly tunable hydraulic rebound stop system, “Monroe® Ride Refine Advanced HRS,” for electronic dampers used in automotive applications. The product offers high damping force and noise performance, eliminating the risk of chassis reinforcement in heavy passenger vehicles.

- In January 2024, Continental AG announced the construction of a US$90 million hydraulic hose production plant in Mexico. The plant will bolster the company’s existing manufacturing capacity and expand its presence in the Americas.

- In March 2023, ZF Friedrichshafen AG showcased its new brake-by-wire electrohydraulic solution that adjusts brake pressure and controls deceleration through electric signals. It offers better motion control technology, increasing the overall safety of commercial and passenger vehicles.

- In April 2022, Cummins completed the acquisition of Jacobs Vehicle System, which specializes in cylinder deactivation and engine braking technologies. The JVS addition has enabled Cummins to explore new opportunities in engine retarding in commercial vehicles.

Automotive Hydraulic System Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

|

Automotive Hydraulic System Market Size in 2025 |

US$38.195 billion |

|

Automotive Hydraulic System Market Size in 2030 |

US$52.008 billion |

| Growth Rate | CAGR of 6.31% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

|

List of Major Companies in Automotive Hydraulic System Market |

|

| Customization Scope | Free report customization with purchase |

Automotive Hydraulic System Market Segmentation:

- By Application

- Brakes

- Steering

- Shock Absorbers

- By Component

- Master Cylinder

- Slave Cylinder

- Reservoir

- Hose

- By Vehicle Type

- Passenger Vehicles

- Light Commercial Vehicles

- Medium & Heavy Commercial Vehicles

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America