Report Overview

Automotive Power Electronics Market Highlights

Automotive Power Electronics Market:

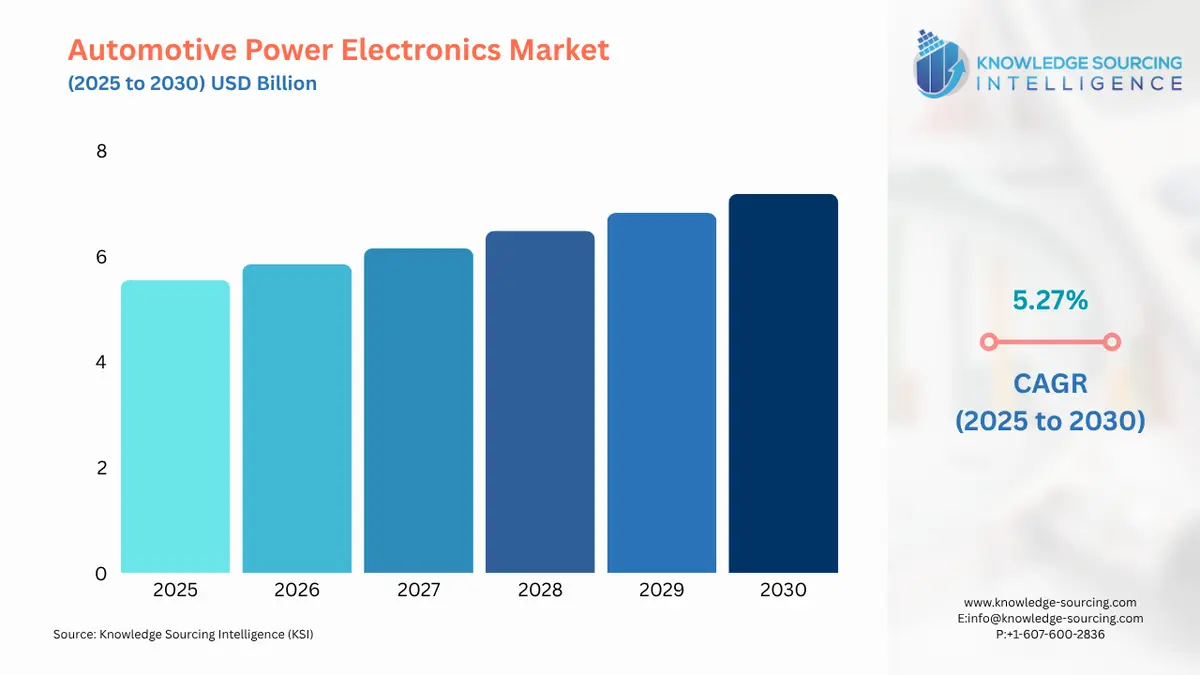

The Automotive Power Electronics Market is expected to grow at a CAGR of 5.27%, reaching USD 7.180 billion in 2030 from USD 5.554 billion in 2025.

The automotive power electronics market is at the core of the automotive industry's transformative shift toward electrification, enhanced safety, and greater connectivity. Power electronics, which include a range of components from discrete devices to integrated circuits and modules, are responsible for converting, controlling, and conditioning electrical power within a vehicle. This technology is fundamental to the operation of a variety of systems, including powertrains, advanced driver-assistance systems (ADAS), and infotainment. The market's growth is no longer a linear progression but a rapid acceleration propelled by a confluence of technological innovation and a global policy push for cleaner transportation.

Automotive Power Electronics Market Analysis:

- Growth Drivers

The most potent growth driver for the automotive power electronics market is the global shift toward vehicle electrification. As the industry transitions from internal combustion engine (ICE) vehicles to hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs), and battery electric vehicles (BEVs), the demand for power electronics per vehicle increases exponentially. In an ICE vehicle, power electronics content is limited to applications such as body electronics and infotainment. However, in an electric vehicle, power electronics are indispensable for the core functions of the vehicle. For example, inverters are required to convert the direct current (DC) from the battery into alternating current (AC) to drive the electric motor. The onboard charger converts AC from the grid into DC to recharge the battery. Furthermore, DC-DC converters are essential for stepping down the high-voltage battery power to supply the vehicle’s 12V auxiliary systems. The rapid increase in electric vehicle sales directly translates into a proportional rise in demand for these power electronics components.

Another critical driver is the imperative for enhanced energy efficiency. Automakers are under constant pressure from both regulations and consumer demand to improve fuel economy and battery range. This has propelled the adoption of wide-bandgap (WBG) power semiconductors, particularly Silicon Carbide (SiC) and Gallium Nitride (GaN), which offer superior performance characteristics compared to traditional silicon. SiC and GaN devices can operate at higher voltages and temperatures, with lower switching losses. This allows for the design of more compact and efficient power electronic systems, which reduces the overall weight and size of the vehicle's electrical components and extends the range of EVs. The performance advantages of these materials create a direct demand for advanced power modules and discrete devices that leverage this technology. Finally, the proliferation of advanced driver-assistance systems (ADAS) and autonomous driving features also fuels demand. These systems, which include features like adaptive cruise control, lane-keeping assist, and automated parking, require complex sensor fusion and data processing. Power electronics are essential for the efficient power management of the high-performance processors and sensors that enable these features, thereby creating a new demand vector in the safety and security segment of the market.

- Challenges and Opportunities

The automotive power electronics market faces several structural challenges. The complexity of design and integration for advanced applications is a significant hurdle. As vehicle systems become more interconnected and functionally integrated, a single power electronics component may need to manage multiple functionalities on a single chip. This requires sophisticated design processes and algorithms, which can affect the switching speed and overall performance of the control structure. Additionally, the high power density of modern components creates a thermal management challenge. Efficiently dissipating the heat generated by inverters and power modules is critical for the longevity, safety, and reliability of the vehicle. The necessity for robust cooling solutions can add complexity and cost to the overall system design.

However, these challenges are simultaneously creating substantial opportunities. The demand for higher efficiency and thermal performance has created a clear market opportunity for advanced semiconductor materials like SiC and GaN. Companies that can effectively scale the production of these WBG components and develop innovative packaging solutions for thermal management stand to gain a significant competitive advantage. The focus on miniaturization and component integration also presents a pathway for growth. By integrating multiple functionalities onto a single chip, manufacturers can reduce the bill of materials, decrease module size, and improve power efficiency. This shift from discrete components to integrated power modules is a major opportunity for companies that can deliver a complete and optimized system-in-package solution. Furthermore, the rising demand for vehicle-to-grid (V2G) technology, which allows EVs to send power back to the grid, is creating a new application for bi-directional power electronics. This emergent application presents a significant future opportunity for the market as the energy grid becomes more decentralized and integrated with electric vehicle charging infrastructure.

- Raw Material and Pricing Analysis

The cost structure of automotive power electronics is heavily influenced by the raw materials used in semiconductor manufacturing. The primary material is silicon, but the market is seeing a rapid shift toward wide-bandgap materials such as Silicon Carbide (SiC) and Gallium Nitride (GaN). SiC is produced from silicon and carbon, while GaN is a compound of gallium and nitrogen. The raw material cost for these WBG materials is higher than for traditional silicon, which contributes to the higher price of SiC and GaN-based power devices. The production of these materials requires specialized and capital-intensive manufacturing processes, which can limit supply and affect pricing.

The pricing dynamics are also tied to the overall semiconductor supply chain, which is subject to global demand, geopolitical factors, and production capacity. The cost of a power module is a function of not only the semiconductor dies but also the packaging materials, such as copper for busbars, ceramics for substrates, and thermal interface materials. The high material content in power electronics, particularly for components that handle high current and voltage, makes them susceptible to volatility in commodity prices. The transition to SiC and GaN, while offering long-term performance benefits, can initially result in higher system costs for automotive OEMs, though this is often offset by the ability to use a simpler thermal management system, smaller batteries, and lighter cables.

- Supply Chain Analysis

The supply chain for automotive power electronics is a multi-tiered, global network. It begins with the upstream producers of raw materials, such as silicon and SiC wafers. These wafers are then supplied to semiconductor manufacturers, who fabricate the power semiconductor dies. These dies are the core of power electronic components. The next tier in the supply chain consists of assembly and testing companies that package the dies into discrete devices, integrated circuits, or complete power modules. This is a critical step, as the packaging must be robust enough to withstand the harsh automotive environment, including extreme temperatures and vibrations.

The final tier consists of Tier 1 automotive suppliers who integrate these power electronic components into larger subsystems, such as inverters, onboard chargers, and battery management systems, before supplying them to the original equipment manufacturers (OEMs). The complexity of this supply chain makes it vulnerable to disruptions. The recent global semiconductor shortage underscored the dependencies within this network, as disruptions at the wafer fabrication or packaging stage led to production delays for automakers worldwide. This has prompted a strategic shift, with many OEMs and Tier 1 suppliers seeking to form direct partnerships with semiconductor manufacturers to secure supply and co-develop next-generation technologies. Key production hubs for semiconductors are concentrated in Asia, with companies in Taiwan, South Korea, and China playing a significant role in global manufacturing.

- Government Regulations

Government regulations are a foundational force shaping demand in the automotive power electronics market. These policies create a direct imperative for the development and adoption of electric and hybrid vehicles, which in turn fuels the need for the underlying power electronics. Regulations are not only about emissions but also about safety, which drives the demand for power management in ADAS and other critical systems.

- European Union: European Green Deal, Vehicle CO2 Emission Standards

The European Green Deal sets a clear trajectory for a zero-emissions economy, with specific mandates for CO2 reductions. These regulations have created a direct and non-negotiable demand for electric and hybrid vehicles, which are heavily reliant on power electronics. This regulatory pressure compels automakers to accelerate their electrification roadmaps, thereby stimulating the market for inverters, converters, and other power electronic components. - United States: Corporate Average Fuel Economy (CAFE) Standards, Inflation Reduction Act (IRA)

The CAFE standards enforce fleet-wide fuel efficiency targets, which have historically driven demand for powertrain efficiency technologies, including power electronics. More recently, the Inflation Reduction Act provides significant tax credits and incentives for the purchase of electric vehicles and for domestic manufacturing of EV components. This policy directly increases consumer demand for EVs and incentivizes companies to build power electronics manufacturing capacity within the US, creating a dual demand-side and supply-side catalyst. - China: New Energy Vehicle (NEV) Mandate, “Made in China 2025”

China’s NEV mandate requires automakers to produce a certain percentage of electric and plug-in hybrid vehicles or purchase credits. This policy has transformed China into the world's largest market for EVs, and by extension, for automotive power electronics. The "Made in China 2025" initiative has also prioritized domestic development and production of key technologies, including semiconductors and power electronics, which is bolstering local manufacturing and reducing reliance on foreign suppliers.

Automotive Power Electronics Market Segment Analysis:

- By Vehicle Type: Battery Electric Vehicle (BEV)

The Battery Electric Vehicle (BEV) segment is the most significant growth driver for the automotive power electronics market. Unlike traditional vehicles, BEVs are entirely dependent on electrical power for propulsion and all other vehicle functions, which necessitates a substantial amount of power electronics. A typical BEV requires a high-voltage battery pack and a sophisticated battery management system (BMS) to monitor and control cell health, temperature, and charging/discharging cycles. The demand for power electronics in a BEV is directly tied to the need for efficient power conversion. This includes a high-power inverter to convert the DC battery power into AC for the electric motor, a bi-directional DC-DC converter for power management between the high and low-voltage systems, and an onboard charger for converting AC grid power into DC for the battery. As battery technology and vehicle range improve, the power electronics must also become more efficient, leading to a direct demand for high-performance components based on wide-bandgap semiconductors like SiC and GaN. The growth of the BEV market is not only a result of consumer preference but also a direct consequence of global government policies mandating the transition away from fossil fuels.

- By Component: Power Modules

Power modules are at the forefront of the automotive power electronics market, driven by the imperative for higher power density, integration, and reliability. A power module is a pre-packaged assembly of multiple power semiconductor devices, such as IGBTs or MOSFETs, often with diodes and other passive components, into a single unit. This integration simplifies the design process for Tier 1 suppliers and OEMs, reduces the physical footprint, and improves thermal performance. The demand for power modules is a direct result of the high-power requirements of modern vehicle systems, particularly in electric and hybrid powertrains. For instance, the main traction inverter in an EV requires a power module capable of handling high voltages and currents with minimal power loss. The use of SiC-based power modules is a particularly strong growth catalyst, as they enable higher switching frequencies and can operate at higher temperatures, which allows for smaller and lighter cooling systems and further extends the vehicle's range. The shift toward higher voltage architectures (e.g., 800V) in EVs is also increasing the demand for advanced power modules that can efficiently manage these elevated power levels, making them a cornerstone of the future automotive electrical system.

Automotive Power Electronics Market Geographical Analysis:

- US Market Analysis: The US automotive power electronics market is characterized by a strong push toward vehicle electrification, driven by a combination of federal and state-level incentives and a growing consumer preference for electric vehicles. The need for power electronics is directly tied to the expansion of EV production by major domestic manufacturers like Ford and General Motors, alongside new entrants. Policies such as the Inflation Reduction Act have incentivized both the purchase of EVs and the development of a domestic supply chain for key components, including power electronics. This is creating a localized requirement for manufacturing and a push for greater vertical integration. The market also sees significant demand from the defense and aerospace sectors, which drive innovation in high-reliability power electronics. While the US is a major consumer and innovator, its semiconductor manufacturing capacity for automotive applications is still developing, creating a dependence on global supply chains that companies are actively working to mitigate.

- Brazil Market Analysis: Brazil's automotive power electronics market is still in its nascent stages compared to more developed economies. The market is currently focused on components for traditional ICE vehicles and mild hybrids, as the country's fleet electrification is proceeding at a slower pace. The need for power management in infotainment and body electronics primarily drives the market. However, there is a growing demand for power electronics in agricultural and commercial vehicles, where efficiency gains are critical for operational costs. The country’s policies and economic conditions, including fluctuating currency and import tariffs, directly impact the pricing and availability of components. The future demand for automotive power electronics in Brazil is contingent on the government's adoption of more aggressive electrification policies and the development of a local manufacturing ecosystem.

- Germany Market Analysis: Germany’s automotive power electronics market is a powerhouse in Europe, driven by its world-class automotive industry and a strong commitment to engineering excellence. The market is shaped by the transition of key German automakers, such as Volkswagen, BMW, and Mercedes-Benz, toward electrification and advanced autonomous features. These companies require high-performance, high-reliability power electronics for their premium electric and hybrid vehicles. The German government's stringent emission standards and robust R&D funding for advanced technologies are creating a consistent demand for SiC and GaN-based components. The market is also a hub for collaboration between semiconductor manufacturers and automotive OEMs, with a focus on co-developing solutions for next-generation vehicle architectures. The German market's expansion is characterized by a high-value, high-performance profile rather than a volume-driven approach.

- Saudi Arabia Market Analysis: The automotive power electronics market in Saudi Arabia is heavily influenced by the country's strategic economic diversification goals. While the market for passenger vehicles is still dominated by ICE, the government's Vision 2030 plan includes significant investments in a domestic automotive industry and renewable energy. This is creating a future demand pathway for power electronics, particularly in relation to the development of local EV manufacturing capabilities. As the country builds out its industrial base, there will be a growing need for power electronics for manufacturing automation and infrastructure development, which will precede the broad consumer adoption of EVs. The need for power electronics in the country is therefore more of a long-term strategic play, tied to the government's industrial and economic ambitions.

- Japan Market Analysis: Japan's automotive power electronics market is mature and technologically advanced, with a long history of innovation in hybrid vehicle technology. The market's growth is driven by the country's leading automakers, such as Toyota and Honda, who have perfected hybrid powertrains and are now transitioning to full EVs. The market profile is focused on reliability, miniaturization, and high efficiency, as these factors are critical for performance in the country's dense urban environments. Japanese companies are leaders in the development of power modules and passive components for high-voltage applications. Government policies, including incentives for the adoption of electric vehicles and hydrogen fuel cell vehicles, are shaping demand and encouraging a focus on sustainable and energy-efficient solutions. The market is also a hub for robotics and industrial automation, which drives a parallel demand for precision power electronics.

List of Top Automotive Power Electronics Companies:

The global automotive power electronics market is a concentrated and highly competitive landscape dominated by a few major semiconductor companies. These players are distinguished by their extensive R&D capabilities, manufacturing scale, and deep relationships with automotive OEMs and Tier 1 suppliers. Competition is based on technological superiority, reliability, and the ability to offer a comprehensive portfolio of products.

- Infineon Technologies AG: A global leader in automotive semiconductors, Infineon has a dominant position in the power electronics market. The company's strategic focus is on the electrification of vehicles, offering a comprehensive portfolio of SiC and IGBT-based power modules and discrete devices. The company's acquisition of Marvell's Automotive Ethernet business and its focus on software-defined vehicles position it to meet the evolving needs of the industry. Infineon's competitive edge is derived from its scale, its integrated device manufacturing model, and its ability to co-develop solutions with automakers from the early design stages.

- ON Semiconductor (onsemi): Onsemi has a strong strategic focus on power and sensing solutions for automotive applications. The company has made significant investments in Silicon Carbide (SiC) technology, positioning it as a key supplier for high-voltage applications in EVs. Its strategic partnerships with major automotive players and Tier 1 suppliers, such as its collaboration with Schaeffler on a new PHEV platform, underscore its commitment to the electrification segment. The company's competitive strategy centers on its ability to provide high-efficiency solutions that reduce energy consumption and total system cost, which is a critical value proposition for OEMs.

- STMicroelectronics: STMicroelectronics is a major player in the automotive market, with a strong focus on smart mobility and power and energy management solutions. The company's strategic positioning is rooted in its ability to offer a broad range of products, from discrete components to integrated solutions for powertrain, chassis, and body electronics. STMicroelectronics is also making strategic moves in the sensors market, as evidenced by its acquisition of NXP's MEMS sensors business. This move strengthens its portfolio for ADAS applications and other safety-critical systems, thereby expanding its demand footprint in the automotive sector.

Automotive Power Electronics Market Developments:

- December 2025: Wolfspeed announced its silicon carbide (SiC) MOSFETs will power onboard charger systems for Toyota’s next-generation Battery Electric Vehicle (BEV) platforms.

- December 2025: ROHM and Tata Electronics established a strategic partnership to manufacture power semiconductors in India, beginning with automotive-grade 100V, 300A silicon MOSFETs.

- October 2025: Infineon launched the CoolGaN™ Automotive Transistor 100 V G1 family, the first AEC-qualified GaN series designed for 48V zone control and DC-DC converters.

- September?2025: Infineon expanded its CoolSiC™ MOSFET portfolio with new 400?V and 440?V devices, enhancing thermal performance, system efficiency, and power density in high?power automotive and compute?intensive applications.

- August 2025: Infineon Technologies AG completed the acquisition of Marvell Technology, Inc.'s Automotive Ethernet business.

- July 2025: STMicroelectronics acquired NXP's MEMS sensors business. This acquisition strengthens STMicroelectronics' position in the automotive sensors market, particularly for safety and ADAS applications, by adding NXP's portfolio of pressure sensors, accelerometers, and gyroscopes.

- July 2025: ON Semiconductor and Schaeffler expanded their collaboration on a new Silicon Carbide (SiC)-based plug-in hybrid electric vehicle (PHEV) platform.

Automotive Power Electronics Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Automotive Power Electronics Market Size in 2025 | USD 5.554 billion |

| Automotive Power Electronics Market Size in 2030 | USD 7.180 billion |

| Growth Rate | 5.27% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Automotive Power Electronics Market |

|

| Customization Scope | Free report customization with purchase |

Automotive Power Electronics Market Segmentation:

- By Vehicle Type

- Internal Combustion Engine (ICE)

- Hybrid Electric Vehicle (HEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Battery Electric Vehicle (BEV)

- By Component

- Power Integrated Circuits (ICs)

- Power Discrete Devices

- Power Modules

- By Application

- Powertrain & Chassis

- Body Electronics

- Safety & Security

- Infotainment & Telematics

- By Geography

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa