Report Overview

Automotive Sunroof Market Report, Highlights

Automotive Sunroof Market Size:

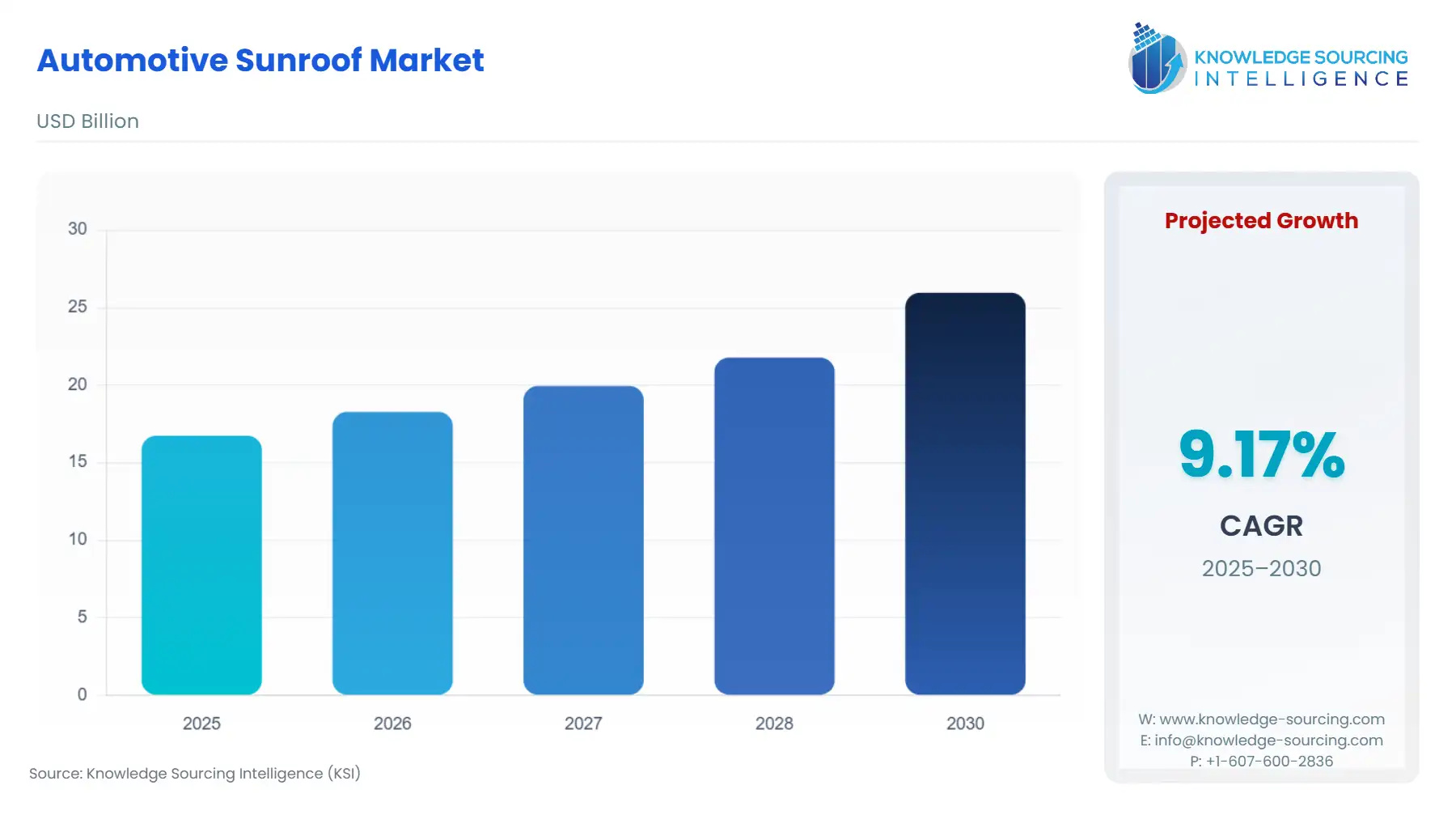

The automotive sunroof market is forecasted to rise at a 9.18% CAGR, reaching USD 25.962 billion by 2030 from USD 16.739 billion in 2025.

The automotive sunroof market is undergoing a profound transformation, moving beyond its traditional role as a simple comfort feature to become a crucial enabler of vehicle functionality, sustainability, and premium positioning. This structural change is dictated by the confluence of the automotive industry's twin imperatives: electrification and the integration of sophisticated digital technologies. Stakeholders must therefore shift their focus from mechanical complexity to the advanced material science and electronic integration inherent in next-generation roof systems. The market's future is intrinsically linked to material lightweighting and the seamless incorporation of smart glass and sensor technologies.

________________________________________

Automotive Sunroof Market Analysis

Growth Drivers

The surge in demand for the Automotive Sunroof Market is explicitly driven by specific industry trends, moving away from simple aesthetic preference toward functional necessity.

- Vehicle Electrification and Range Anxiety Mitigation: The proliferation of Electric Powered Vehicles (EPVs) creates a direct demand for Vehicle-Integrated Photovoltaic (VIPV) panoramic sunroofs. Traditional roofs consume power for interior functions, but VIPV glass, as introduced by companies like AGC Automotive, generates supplemental electricity. This feature directly addresses consumer range anxiety and reduces the thermal management load on the main battery by powering auxiliary systems, thereby increasing the effective range, a critical consumer metric for EV purchase decisions.

- The SUV Segment's Premiumization Imperative: The sustained global consumer shift toward Sports Utility Vehicles (SUVs) and Crossovers necessitates larger glass systems to maintain a spacious, airy cabin aesthetic. This trend directly compels OEMs to prioritize Panoramic Sunroof designs over conventional Pop-Up or Spoiler Sunroofs. The larger physical roof area on SUVs accommodates the extensive glass panels and complex mechanisms required for a full panoramic experience, accelerating the demand for this specific product type globally.

- Technological Convergence on the Roofline: The industry's push toward ADAS and autonomous driving systems mandates the elegant integration of roof sensor modules (RSM) housing LiDAR and camera technology. Sunroof systems are a primary vehicle for this integration, as demonstrated by concepts from Webasto, which showcase lidar and display elements integrated into the roof system. This functional integration transforms the sunroof module from a mechanical accessory into a high-value, electronic-centric component, directly increasing the value and demand for suppliers capable of system-level integration.

Challenges and Opportunities

The primary challenge facing the market is the weight-to-utility trade-off. Increasing the glass area, particularly with multi-layer laminated or tempered glass for safety and sound dampening, adds significant mass high up on the vehicle chassis. This raises the center of gravity and negatively impacts vehicle dynamics and energy efficiency—a critical constraint in the EV segment. This constraint, however, simultaneously generates the primary opportunity: the shift to lightweight materials. The necessity to shed mass drives demand for alternative substrates such as biomass-balanced polycarbonate and ultra-lightweight glass compositions, presenting a clear opportunity for material scientists and suppliers focusing on weight reduction technologies, such as the material innovation seen in Webasto's concepts.

Raw Material and Pricing Analysis

The Automotive Sunroof Market, being a physical product, is directly influenced by the dynamics of key raw materials: automotive-grade glass (primarily laminated and tempered) and aluminum alloys. Pricing for high-purity aluminum sheet has demonstrated significant volatility, evidenced by prices on major commodity exchanges. Fluctuations in the price of aluminum, a key component in the sunroof's frame, guides, and complex track mechanisms, directly impact the Bill of Materials (BOM) cost for manufacturers. Similarly, the increasing complexity of automotive laminated glass, required for enhanced safety, acoustics, and UV protection, drives up raw material costs due to multi-layer construction, including the specialized polyvinyl butyral (PVB) interlayer, impacting component pricing and OEM procurement strategies.

Supply Chain Analysis

The global supply chain for automotive sunroofs is a high-complexity, low-volume logistical challenge. Production is concentrated in specialized hubs across North America, Europe, and Asia-Pacific (e.g., manufacturing facilities in India, the Netherlands, and Germany) due to the necessity of proprietary, high-precision assembly equipment and specific material treatments. The logistical complexity stems from the large, fragile, and uniquely shaped final product—a glass module—which requires specialized transportation and handling to minimize in-transit damage.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| United States | National Highway Traffic Safety Administration (NHTSA) - FMVSS 226 (Ejection Mitigation) | Mandates measures to prevent occupant ejection in non-frontal crashes. This drives demand for laminated glass over tempered glass in the roof structure for better retention and fragmentation control, increasing the structural complexity and cost of the module. |

| European Union | United Nations Economic Commission for Europe (UNECE) Regulation No. 43 (Safety Glazing Materials) | Sets standards for the visible transmittance, optical quality, and mechanical properties of all glazing. Strictly governs the adoption of smart glass and tinted glass, requiring manufacturers to certify that new smart/switchable glass technologies maintain minimum transparency and impact resistance to meet safety and visibility norms. |

________________________________________

Automotive Sunroof Market In-Depth Segment Analysis

By Product Type: Panoramic Sunroof

The Panoramic Sunroof segment is the clear growth accelerator, fundamentally driven by the consumer's desire for a 'premium experience' and the inherent advantages for automotive design. This segment's demand is propelled by the structural adoption in SUV platforms, which now represent the highest-selling vehicle category globally. Unlike traditional sun/moonroofs, the panoramic version provides a near full-roof expanse of glass, substantially increasing perceived interior space and light. The direct demand driver is the OEM design imperative to differentiate a vehicle's interior experience. Furthermore, the large, fixed panel on many panoramic systems is the optimal platform for high-value technological integration, such as VIPV functionality for EVs or the installation of complex sensor arrays for ADAS/Lidar, as showcased by recent product concepts. This fusion of luxury aesthetics with functional technology cements the Panoramic Sunroof's role as an indispensable feature in the high-growth premium vehicle market.

By Vehicle Propulsion: Electric Powered Vehicles (EPV)

The EPV segment exerts a unique, critical demand pull on the sunroof market centered on efficiency and sustainability. The demand catalyst here is the direct link between roof system design and overall vehicle efficiency. EPV platforms drive explicit demand for ultra-lightweight and integrated solutions. Manufacturers are seeking roof systems that not only minimize mass to maximize battery range but also contribute to the energy grid of the vehicle. This means high demand for folding/ragtops and non-metallic glass options to reduce weight, and an accelerating demand for VIPV systems, which convert the roof's surface area into an energy collector. The demand is not for a 'hole in the roof' but for a 'functional energy/sensor platform.' This contrasts sharply with the ICE segment, where the sunroof remains largely a comfort feature, signaling a major future divergence in product design and material choice driven purely by propulsion type.

________________________________________

Automotive Sunroof Market Geographical Analysis

US Market Analysis (North America)

Demand in the US market is heavily skewed toward large-format and luxury-featured sunroofs, directly tied to the dominant market preference for large SUVs and pickup trucks. The primary demand driver is the consumer's high willingness to pay for optional comfort and aesthetic features, making the panoramic sunroof a critical revenue generator for OEMs. Regulatory compliance, particularly with evolving NHTSA standards regarding roof crush and ejection mitigation, mandates continuous engineering for structural integrity, often favoring solutions that incorporate safety-grade laminated glass and robust frame components.

Brazil Market Analysis (South America)

The Brazilian market exhibits a nascent but accelerating demand for sunroofs, primarily in the premium compact and entry-level SUV segments. The demand catalyst is the rising middle-class aspiration for globally recognized luxury features and the high-status association of sunroofs. A key local factor impacting demand is the high thermal load, which drives a preference for glass types with enhanced UV and thermal rejection coatings, ensuring the feature enhances cabin comfort without negatively affecting the air conditioning system's performance.

Germany Market Analysis (Europe)

Germany's market is characterized by a mature demand for high-speed performance and engineering excellence. The demand driver is not only luxury but also system reliability and acoustic performance. At high speeds typical of the German Autobahn, wind noise and vibration from an open or closed sunroof become critical differentiators. This compels a strong market preference for highly engineered systems (e.g., Spoiler Sunroofs and advanced Panoramic systems) that offer superior sealing, minimal air turbulence, and sophisticated noise-dampening materials.

Saudi Arabia Market Analysis (Middle East & Africa)

The Saudi Arabian market's demand is overwhelmingly driven by the climate imperative. The extreme ambient temperatures and high solar radiation directly necessitate sunroof glass with maximum thermal and UV rejection capabilities. Laminated glass with specialized solar control coatings is a non-negotiable feature. Demand focuses on electronically controlled smart glass to instantly manage light and heat, serving as a primary component in vehicle thermal management strategy.

China Market Analysis (Asia-Pacific)

China represents the highest volume growth segment, with demand driven by a combination of rapid premiumization and the importance of the rear passenger experience. Panoramic sunroofs are in high demand because they enhance the rear-seat passenger's perception of space and luxury, a critical factor given the prevalence of chauffeur-driven and large-family vehicles. Local factors, including high air quality concerns in metropolitan areas, also accelerate demand for complex sunroof systems with integrated high-efficiency cabin air filtration.

________________________________________

Automotive Sunroof Market Competitive Environment and Analysis

The automotive sunroof market is dominated by a few highly specialized Tier 1 suppliers that have achieved critical mass and technological depth. The competitive landscape is defined by the capacity for seamless global supply chain integration and a proven ability to co-develop technologically complex modules with Original Equipment Manufacturers (OEMs). Competition focuses on material innovation (lightweighting), sensor integration, and the commercialization of smart glass and VIPV technologies.

Automotive Sunroof Market Company Profiles

• Webasto SE: Webasto is a global systems partner positioned at the forefront of roof and thermal management technology. The company's strategic positioning is focused on leveraging its expertise in openable roof systems for the electrified and increasingly digitized vehicle environment.

• Inalfa Roof Systems: Inalfa Roof Systems maintains a robust global market position, underpinned by an expansive international manufacturing footprint and a focus on scalability in high-growth regions.

________________________________________

Automotive Sunroof Market Recent Development

• In March 2025, Argotec and Miru Smart Technologies unveiled the largest electrochromic sunroof window prototype in the automotive sector (measuring ~1.5 m × 1.6 m). Their design combines Miru's dynamic electrochromic glazing ("eWindows") with Argotec's advanced TPU interlayer films, aiming to enable scalable, energy-efficient smart glazing solutions for panoramic sunroofs and large curved windows in vehicles.

• In December 2024, Inalfa Gabriel Sunroof Systems (IGSS), a joint venture between Inalfa Roof Systems and Gabriel India, announced that its Chennai facility is nearing full capacity, having produced 130,000 sunroofs in 11 months of 2024. To meet rising demand and better serve key OEM customers like Hyundai and Kia, IGSS plans to expand into the western and northern automotive hubs in India.

________________________________________

Automotive Sunroof Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 16.739 billion |

| Total Market Size in 2031 | USD 25.962 billion |

| Growth Rate | 9.18% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Product Type, Vehicle Type, Glass Type, Vehicle Propulsion |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Automotive Sunroof Market Segmentation

- By Product Type

- Pop-Up Sunroof

- Panoramic Sunroof

- Foldings/Ragtops Sunroof

- Spoiler Sunroof

- Others

- By Vehicle Type

- Hatchback

- Sedan

- Others

- By Glass Type

- Tempered Glass

- UV Protection Glass

- Laminated Glass

- By Vehicle Propulsion

- ICE Powered Vehicles

- Electric Powered Vehicles

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America