Report Overview

Automotive Coatings Market Report, Highlights

Automotive Coatings Market Size:

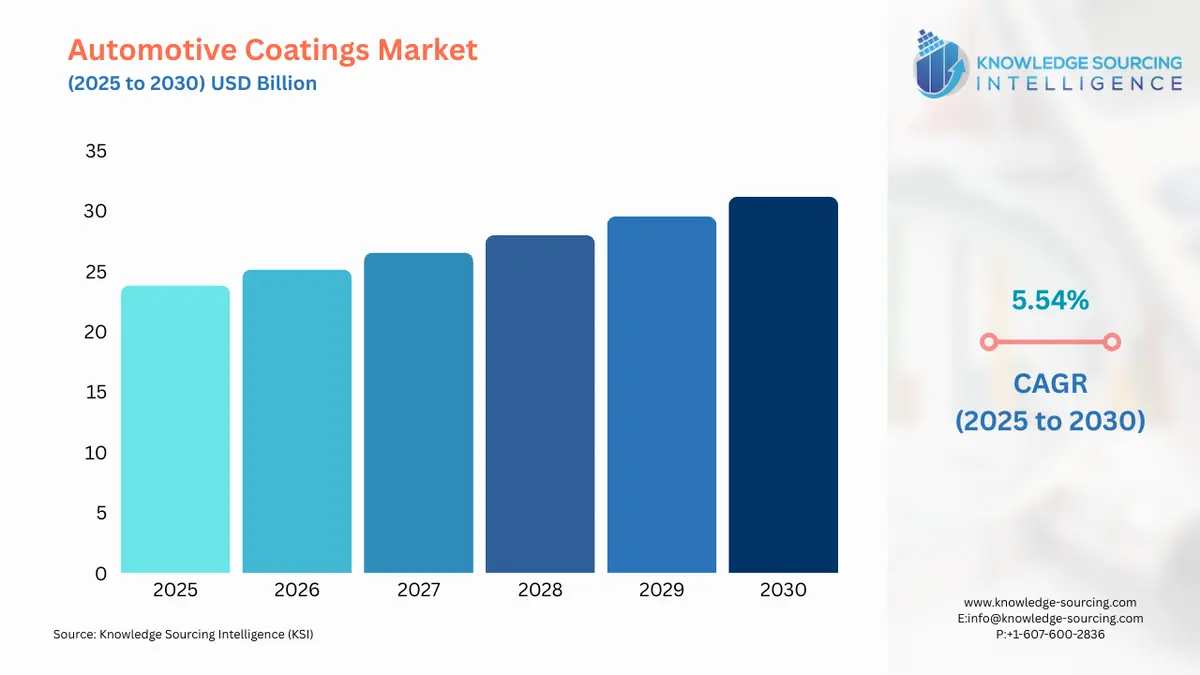

The automotive coatings market was valued at USD 23.820 billion in 2025 and is projected to expand at a CAGR of 5.54% over the forecast period to reach USD 31.184 billion by 2030.

The automotive coating market is a dynamic sector pivotal to vehicle aesthetics and durability. The rising demand for automotive paint drives innovation in high-performance coatings, enhancing vehicle surface protection against environmental stressors. The car coatings, particularly, are evolving with advanced OEM coatings, tailored for precision and longevity in manufacturing. Meanwhile, the automotive refinish market addresses repair and customization demands, offering specialized solutions for aesthetic and functional restoration. Transportation coatings, encompassing diverse vehicle types, are crucial for corrosion resistance and durability. Market players need to leverage these segments to produce cutting-edge formulations, meeting stringent performance and sustainability standards in the global market.

Automotive Coatings Market Trends:

The automotive coating market is rapidly evolving, driven by emerging trends shaping industry standards. EV coating requirements emphasize thermal management and corrosion resistance for electric vehicle components. Lightweight vehicle coatings support fuel efficiency and performance in next-generation designs. Automotive sustainability trends ensure eco-friendly formulations, reducing VOC emissions and waste. Custom vehicle aesthetics are gaining traction, with demand for unique finishes in the automotive aftermarket coatings sector. The automotive production outlook highlights increased adoption of advanced coatings to meet stringent durability and aesthetic standards. Industry players must innovate to align with these trends, balancing performance, sustainability, and customization in a competitive market.

The growth is driven by the rapid adoption of electric EVs and the expanding automotive refinish sector. Automotive coatings enhance vehicle aesthetics, durability, and protection, offering corrosion resistance, UV protection, scratch resistance, and visual appeal. These coatings are applied across original equipment manufacturers (OEMs), commercial vehicles, and the refinish sector, utilizing technologies such as waterborne, solvent-borne, powder, and UV-cured coatings.

The automotive coatings market is evolving rapidly, driven by technological advancements, environmental priorities, and changing consumer preferences. Key trends include:

-

Eco-Friendly Coatings: Waterborne coatings and powder coatings are gaining traction due to their low volatile organic compound (VOC) emissions, aligning with global sustainability goals. Innovations like bio-based coatings and recyclable coatings are emerging to reduce environmental impact.

-

EV-Specific Solutions: The rise of EVs necessitates coatings for lightweight composites, carbon fiber, and battery components, enhancing durability and thermal efficiency. For instance, coatings with electromagnetic shielding properties support EV and autonomous vehicle (AV) sensor functionality.

-

Advanced Technologies: Nanocoatings, self-healing coatings, and smart coatings are revolutionizing the market by offering superior scratch resistance, hydrophobic properties, and self-cleaning capabilities. AI-driven coating formulation and robotic application systems improve precision and reduce material waste.

-

Customization and Aesthetics: Consumer demand for metallic, pearlescent, and matte finishes is driving innovation in basecoats and clearcoats, particularly in the luxury and premium vehicle segments.

-

Digitalization: Digital color-matching and automated application systems enhance efficiency in OEM and refinish processes, reducing costs and improving quality.

Automotive Coatings Market Growth Drivers:

- Rising Automotive Production and EV Adoption: Global vehicle production growth and the shift to EVs drive demand for lightweight, durable coatings. EVs require specialized coatings to protect battery enclosures and enhance thermal management, with BloombergNEF projecting a 35% EV market share by 2030.

- Sustainability Regulations: Stringent VOC and environmental regulations, such as EU REACH, push the adoption of waterborne and powder coatings, reducing emissions and aligning with global sustainability goals.

- Consumer Demand for Aesthetics: Increasing consumer preference for customized vehicle appearances fuels innovation in basecoats and clearcoats, particularly in premium and luxury segments.

- Urbanization and Refinish Demand: Urban population growth (World Bank: 68% by 2050) boosts vehicle ownership and accident repair rates, driving refinish coating demand.

- Technological Advancements: Advancements in nanotechnology, AI, and ML are enhancing coating performance. Nanocoatings improve scratch resistance and durability, while AI-driven formulation optimizes resin chemistry and color accuracy. Robotic application systems ensure consistent coating quality, reducing waste and improving efficiency in OEM and refinish applications.

Automotive Coatings Market Restraints:

- Raw Material Price Volatility: Fluctuations in prices of resins, pigments, and additives, such as the 15% rise in titanium dioxide costs in 2021–2022, challenge profitability.

- High Transition Costs: Shifting to eco-friendly coating technologies requires significant capital investment, limiting adoption among smaller manufacturers in emerging markets.

- Complex Application Processes: Advanced coatings, such as nanocoatings and UV-cured coatings, require precise application techniques and specialized equipment, increasing operational complexity and costs for manufacturers and repair shops.

Automotive Coatings Market Geographical Outlook:

North America holds a significant share, led by the United States, which produced 10.6 million vehicles in 2023 (OICA, 2023).

High vehicle production and EV growth drive demand for eco-friendly coatings that comply with EPA standards. Companies like PPG Industries and Axalta Coating Systems invest in sustainable solutions, such as low-VOC coatings, to meet environmental regulations. Canada benefits from cross-border automotive trade, boosting coating demand, while Mexico, a manufacturing hub, sees steady growth, though cost sensitivity limits advanced coating adoption.

Asia-Pacific is the fastest-growing region, led by China, the world’s largest vehicle producer with 27.8 million units in 2023 (OICA, 2023). Urbanization, EV adoption, and infrastructure development fuel demand for OEM coatings and refinish coatings. Japan emphasizes high-quality coatings for premium vehicles, while India’s rising vehicle ownership and automotive manufacturing create opportunities, despite infrastructure challenges. Government initiatives, like India’s Make in India, support market expansion.

Europe commands a substantial share, driven by its established automotive industry and stringent environmental regulations. Germany, France, and the UK lead in vehicle manufacturing and customization, increasing demand for eco-friendly coatings. The European Commission’s Horizon Europe program allocated over €400 million for R&D in low-VOC coatings and bio-based coatings (European Commission, 2023). Companies like BASF and AkzoNobel innovate with waterborne basecoats, self-healing coatings, and nanotechnology, aligning with REACH standards to enhance durability and sustainability.

South America, the Middle East and Africa are emerging markets, driven by urbanization and automotive growth. Challenges like high production costs persist, but technological advancements and sustainable practices mitigate these issues. The automotive coatings market thrives on EV trends, environmental compliance, and regional innovation, with North America, Asia-Pacific, and Europe leading the charge.

Automotive Coatings Market Segment Analysis:

- By Technology: Waterborne Coating

Waterborne coatings are gaining dominance due to their low VOC emissions and compliance with global environmental regulations. They offer high durability and aesthetic quality, making them ideal for OEM and refinish applications. BASF’s Glasurit Eco Balance, launched in 2022, exemplifies the segment’s growth, reducing emissions by up to 50%. The segment is driven by regulatory pressures and consumer demand for sustainable solutions.

- By End-User: Automotive Refinish

The refinish segment is expanding due to rising vehicle ownership and accident repair rates, particularly in urban areas. The World Bank’s urbanization projection (68% by 2050) underscores the segment’s growth potential. Refinish coatings require high-performance clearcoats and basecoats for aesthetic restoration, with companies like Axalta offering fast-drying solutions to meet repair shop demands.

List of Top Automotive Coatings Companies:

- PPG Industries, Inc.: A global leader in coatings, PPG offers a comprehensive portfolio of waterborne, powder, and UV-cured coatings for OEM and refinish applications. Its 2024 launch of coatings for EV battery packs and the new waterborne plant in Thailand (March 2025) highlight its focus on sustainability and EV markets.

- Axalta Coating Systems: Known for its waterborne and powder coatings, Axalta serves major OEMs and refinishers. Its Fast Cure Low Energy (FCLE) System (April 2025) enhances refinish efficiency, while partnerships with BMW Group ensure high-quality, sustainable solutions.

- BASF SE: A pioneer in eco-friendly coatings, BASF offers waterborne and low-VOC solutions like Glasurit Eco Balance. Its 2024 partnership with INEOS Automotive for global body and paint programs emphasizes sustainability and innovation.

- AkzoNobel N.V.: AkzoNobel provides waterborne basecoats like Sikkens Autowave Optima (March 2025), offering faster processing and reduced emissions. Its acquisition of Lankwitzer Lackfabrik’s aluminum wheel coatings business strengthens its portfolio.

- Sherwin-Williams Company: A key player in automotive refinish, Sherwin-Williams offers low-VOC and waterborne coatings. Its partnership with Mercedes-AMG PETRONAS Formula One Team (2023) highlights its expertise in high-performance coatings.

Automotive Coatings Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Automotive Coatings Market Size in 2025 | USD 23.820 billion |

| Automotive Coatings Market Size in 2030 | USD 31.184 billion |

| Growth Rate | CAGR of 5.54% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Automotive Coatings Market |

|

| Customization Scope | Free report customization with purchase |

Automotive Coatings Market Segmentation:

- By Product

- Primer

- Electrocoat

- Clearcoat

- Base coat

- By Technology

- Waterborne Coating

- Solvent-borne Coating

- Powder Coating

- UV-cured coating

- By End-User

- Light Vehicle OEM

- Commercial Vehicle OEM

- Automotive Refinish

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- The Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America