Report Overview

Beta-Carotene Colorant Market Report, Highlights

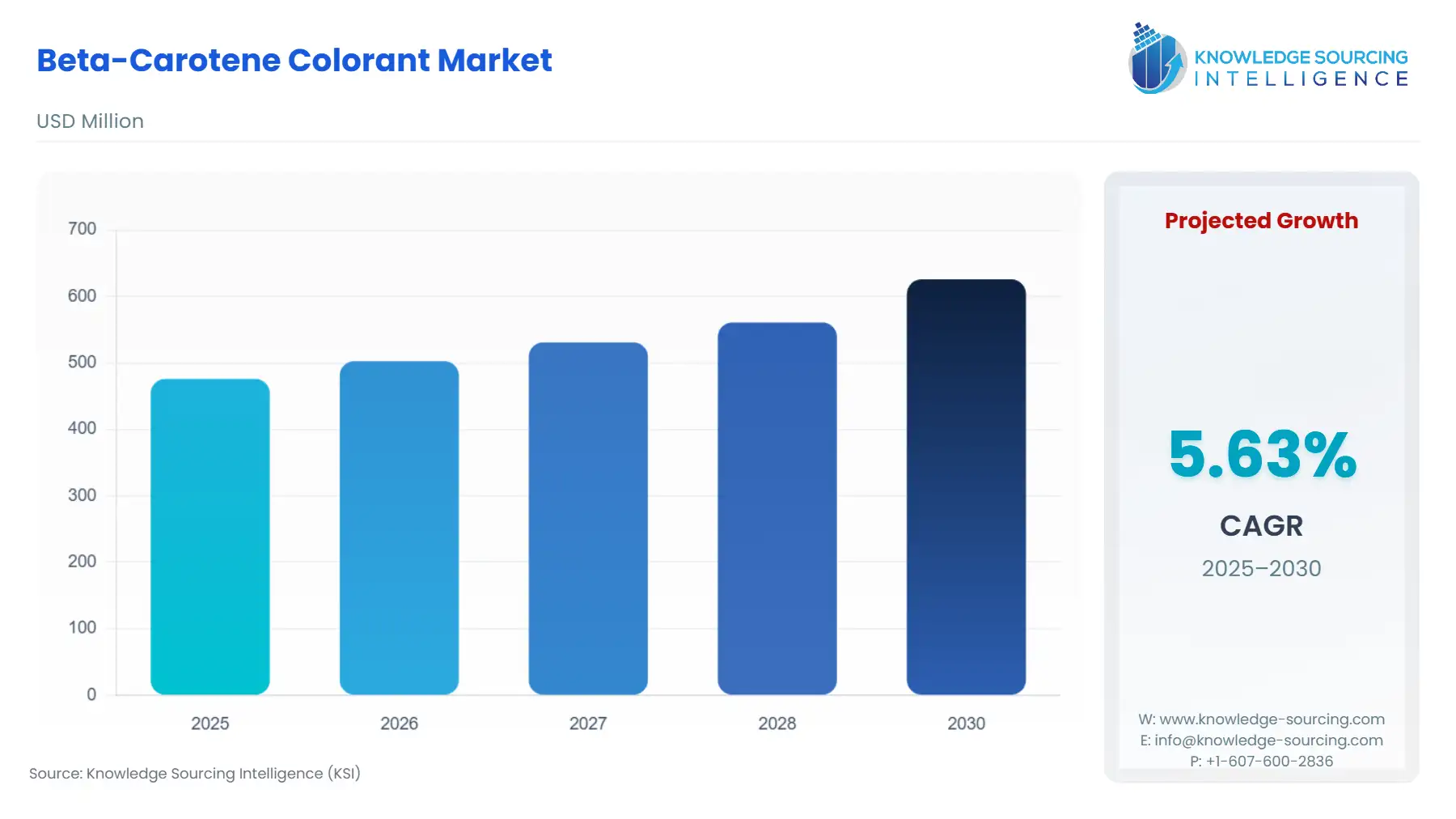

Beta-Carotene Colorant Market Size:

The Beta-Carotene Colorant market will grow at a CAGR of 5.63% from USD 475.71 million in 2025 to USD 625.58 million in 2030.

Beta-carotene colorant is a red-orange pigment found in high concentrations in fruits and vegetables. It gives plants their reddish-yellow color. Besides occurring in natural sources, beta-carotene colorant is also extracted from its synthetic sources.

Beta-Carotene Colorant Market Trends:

The ever-growing food and beverage industry is the largest market for beta-carotene colorants. This pigment is widely used in beverages, confectionaries, packed food, etc., as a colorant and to feed the ever-increasing population; its application is expected to increase further. Besides that, Beta-carotene is highly rich in Vitamin A and has antioxidant properties, which are expected to act as a booster for the market, especially in the pharmaceutical and dietary sectors. A shift in living standards has increased the consumption of organic goods, and as an organic pigment, the beta-carotene market can take advantage of favorable prospects. High intake of beta colorant is linked with side effects like loose stool, allergies, skin discoloration, etc., which is expected to hinder its market growth.

Beta-Carotene Colorant Market Growth Drivers:

- Growing food and beverage industry.

According to the United Nations[1], the world population is expected to reach 9.7 billion by 2050. With the ever-increasing demand for food and beverages accompanied by factors like rising population and growing disposable income, the beta-carotene colorant market is expected to grow significantly. This is because the beta colorant is an organic and intensely colored pigment, which makes it a preferable colorant choice in food and beverages. Its naturally or synthetically derived red, yellow, and orange color is widely used in dressings, confectionaries, baked products, etc. With the growth in the food and beverage industry, significant growth of beta-carotene colorants is also expected.

- Rich in vitamin A and antioxidants.

Beta-carotene is a rich source of Vitamin A, vital for good vision, eye health, a strong digestive system, mucous membranes, and healthy skin. These health properties associated with the product are expected to drive its market, especially in the pharmaceutical and dietary sectors. Although big doses of Vitamin A can be harmful, various research has shown that Beta-carotene contains a safe amount of Vitamin A. According to UNICEF Data, deficiency of Vitamin A is the leading cause of preventable childhood blindness, and in 2020, only 2 out of 5 children received life-saving benefits from Vitamin A supplementation. With these concerns, the intake of Vitamin A becomes necessary and is expected to drive the beta colorant market.

Besides that, the beta colorant is an antioxidant that protects the body from damaging molecules called free radicals. If not treated, free radicals can damage the cells, cause some severe illnesses, and increase the chances of heart disease and cancer. With the advised high intake of antioxidants, the beta-carotene colorant market stands in a favorable position.

Beta-Carotene Colorant Market Restraints:

- Side Effects and Overuse.

Research over time has proved that a high intake of beta-carotene colorants and their overuse can cause side effects like allergies, loose stool, bruising, skin discoloration, joint pain, etc. Also, certain studies have found that a high intake of beta-carotene supplements by smokers or by people exposed to asbestos can increase the chances of lung cancer in them. These factors can hinder its market growth in the future.

Beta-Carotene Colorant Market Geographical Outlook:

- The North American beta-carotene colorant market is anticipated to grow significantly.

It is projected that the beta-carotene colorant market in North America will develop significantly due to several factors. One major motivator is the growing health consciousness among consumers who understand the compound's advantages as a precursor to vitamin A, which is crucial for immune system support and eye health. Another aspect that contributes to this is the growing demand in the food and beverage sector, where beta-carotene is widely utilized as a natural colorant to fortify vitamin A. The demand for natural components in food items is predicted to drive future growth in the beta-carotene market.

Beta-Carotene Colorant Market Key Developments:

- In December 2023, in response to the increased demand from the beauty industry for naturally derived colorants for use in cosmetic and personal care products, Sun Chemical extended its SunPURO® Naturals product range. The source of farmed beta carotene, SunPURO® Natural Carotene O N70-2317, is dunaliella salina algae.

- In November 2023, Divi's is pioneering the use of beta-carotene, which imparts a stunning red hue to applications. In addition, Divi's is expanding its already impressive line of premium beta-carotene forms by adding yet another product to its lineup.

Beta-Carotene Colorant Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Beta-Carotene Colorant Market Size in 2025 | US$475.71 million |

| Beta-Carotene Colorant Market Size in 2030 | US$625.58 million |

| Growth Rate | CAGR of 5.63% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Beta-Carotene Colorant Market |

|

| Customization Scope | Free report customization with purchase |

Beta-Carotene Colorant Market Segmentations:

- By Product Type

- Natural

- Synthetic

- By Form

- Powder

- Liquid

- By Source

- Fruits & Vegetables

- Algae and Fungi

- Synthetic

- Other

- By End-User

- Food and Beverages

- Cosmetic Industry

- Pharmaceutical

- Dietary Supplements

- Animal Feed

- By Geography

- North America

- USA

- Canada

- México

- South America

- Brazil

- Argentina

- Others

- Europe

- U.K.

- Germany

- France

- Others

- Middle East and Africa

- UAE

- South Africa

- Israel

- Saudi Arabia

- Others

- Asia-Pacific

- China

- Japan

- India

- Australia

- Taiwan

- South Korea

- Others

- North America